If someone told you a decade ago that artificial intelligence (AI) would soon handle accounting tasks like invoicing, reconciling, and financial forecasting, would you have believed them?

Well, here we are in 2024, and AI is no longer a term—it’s a necessity.

As accounting firms and professionals adapt to an increasingly tech-driven world, “Accountants & AI” is becoming the most discussed pairing in the industry.

Accounting firms are already leveraging AI for process automation and the number is only growing.

But why should you care about AI, and more importantly, why should you adopt it today? Let’s understand!

1. Maximize Your Time: Why Efficiency Matters Now More Than Ever

Think about the hours spent on repetitive tasks—data entry, bank reconciliations, invoice processing—and imagine if that time could be better utilized.

AI-powered tools make this possible by automating mundane processes. With AI, you can eliminate manual work and focus on more strategic areas like advisory services or financial planning.

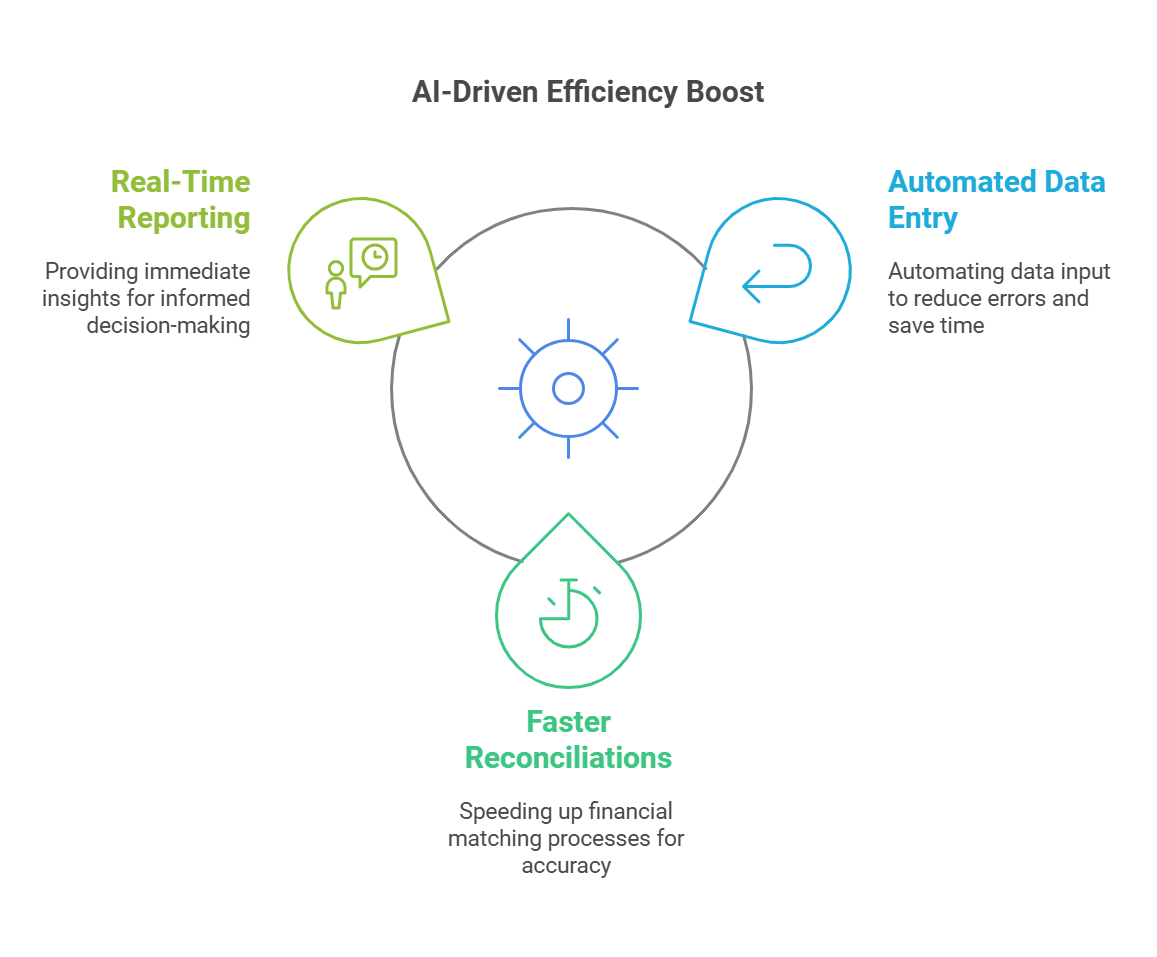

Here are some specific ways AI boosts efficiency:

- Automated Data Entry: AI systems can extract and process data from invoices, receipts, and bank statements without manual intervention.

- Faster Reconciliations: Tools like AI-driven reconciliation software can match transactions and flag discrepancies in seconds.

- Real-Time Reporting: AI generates up-to-date financial reports, enabling accountants to make timely decisions.

For example, AI can automatically categorize transactions, flag inconsistencies, and even generate detailed insights into spending patterns.

This isn’t just about convenience; it’s about optimizing workflows and making time for what truly matters: serving your clients better.

By adopting AI, accountants can handle higher volumes of work without compromising quality, ensuring they meet deadlines and deliver results efficiently.

2. Precision Redefined: The Case for Reducing Errors Today

Human errors happen—misplaced decimals, overlooked deductions, or misclassified expenses. But in accounting, even small mistakes can have significant consequences.

AI minimizes these risks by performing tasks with precision and consistency.

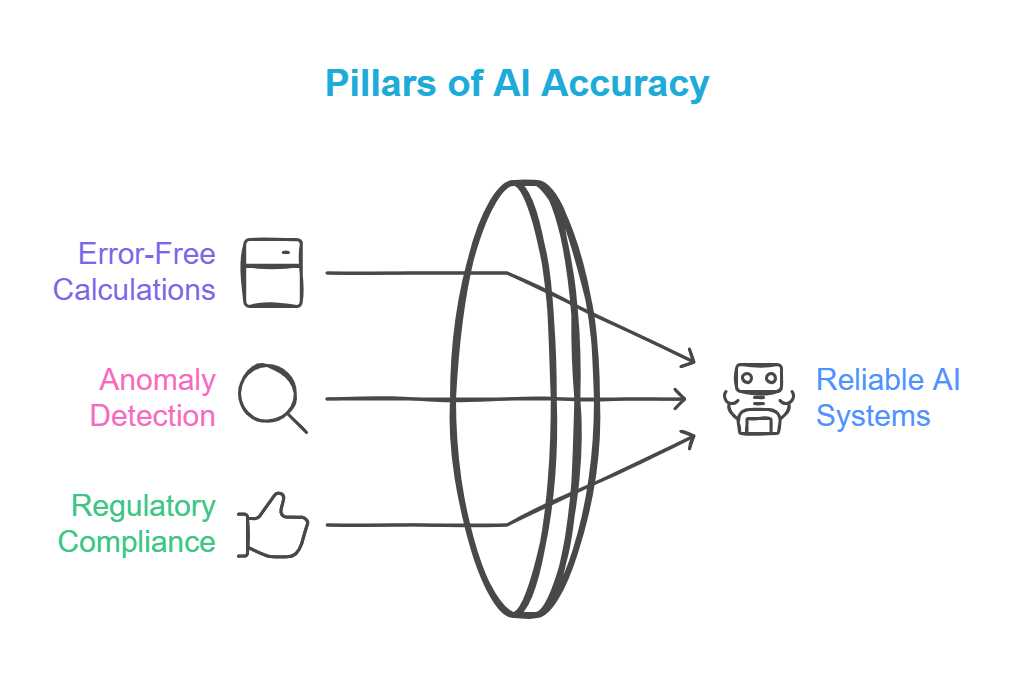

Here’s why AI’s accuracy matters:

- Error-Free Calculations: AI ensures that financial calculations are accurate every time.

- Anomaly Detection: AI algorithms can analyze large datasets and highlight unusual patterns or transactions, preventing fraud or non-compliance.

- Regulatory Compliance: AI keeps up with ever-changing tax laws and accounting standards, ensuring your reports meet legal requirements.

For instance, tools powered by machine learning continuously improve their accuracy as they process more data. This level of precision not only builds trust with clients but also safeguards your practice from potential audits and penalties.

Consider this: A report by PwC highlighted that AI could reduce accounting errors by up to 70%. That’s a game-changer, especially in an industry where accuracy is non-negotiable.

3. Stay Competitive: Why Accountants Must Lead with AI

The accounting industry isn’t immune to change. Clients now expect faster turnaround times, data-driven insights, and tech-savvy accountants who can deliver all this seamlessly.

Adopting AI is a strategic move to stay competitive in such an evolving landscape.

Here’s how AI helps accountants stay ahead:

- Value-Added Services: AI enables accountants to offer services like predictive analytics and business consulting.

- Improved Client Experience: Faster and more accurate deliverables lead to higher client satisfaction.

- Future-Ready Skills: By adopting AI, accountants can position themselves as forward-thinking professionals.

On the flip side, accountants who resist AI risk being seen as outdated. Clients increasingly prefer firms that embrace technology, and non-adoption could mean losing out on lucrative opportunities.

Imagine competing with a firm that delivers real-time insights while you’re still manually reconciling accounts. It’s clear which firm a client would choose.

Overcoming Common Hesitations

It's normal to worry about implementing new technology. Will it be too expensive? Is it complicated to use? And what about job security?

These are valid questions, but the reality is that AI tools are becoming more accessible, user-friendly, and affordable than ever before.

Let’s address some of the most common concerns and dispel a few myths surrounding AI adoption in accounting. A widespread misconception is that AI will replace accountants altogether.

In reality, AI serves as a tool to augment human capabilities, not replace them. While AI excels at automating repetitive tasks and analyzing vast datasets, it lacks the judgment and subtle understanding that accountants bring to strategic decision-making and client interactions.

- Cost: Many AI solutions offer tiered pricing plans, making them suitable for firms of all sizes. The initial investment is frequently outweighed by the long-term cost savings.

- Complexity: Modern AI tools are designed with user-friendly interfaces and robust customer support, ensuring a smooth learning curve.

- Job Security: AI isn’t here to replace accountants; it’s here to empower them. By automating repetitive tasks, AI frees up time for accountants to focus on complex decision-making and client interaction—areas where human expertise remains irreplaceable.

Moreover, the integration process has become simpler. Many AI tools seamlessly integrate with existing accounting software, reducing the need for significant operational changes.

Also Read: Cyber Hygiene for CAs: Protect Data with AI-Powered Security

So Are You Up For the Collaboration With AI?

The accounting profession is evolving, and so should its practitioners. By adopting AI, accountants can:

- Save time and increase efficiency.

- Reduce errors and improve accuracy.

- Stay competitive in a rapidly changing industry.

The numbers speak for themselves: Firms that adopt AI report higher client retention rates, better work-life balance for employees, and improved profitability.

As AI continues to reshape the way we work, early adopters will have the advantage. Don’t wait for your competitors to gain the upper hand. Start exploring AI-powered tools today and future-proof your career.

Have you started using AI in your accounting practice? Or are you still weighing the pros and cons?

If you are still somewhere in between, then try AI-powered Accounting Automation tool ‘Suvit’!

Suvit automates the manual work and saves you valuable ‘me-time’. Try Suvit free for a week!

Let’s navigate the future of “Accountants & AI” together!