Imagine running a business where your financial data is updated in real-time, errors are minimized, and decision-making becomes faster and smarter.

This is not just a vision; it is the reality of progressive accounting.

Traditional accounting methods have served businesses for decades, but they come with limitations. They often involve manual data entry, delayed financial reports, and rigid processes that slow down operations.

In this digital world, businesses need a more dynamic approach to financial management. This is where progressive accounting comes in.

What is progressive accounting? It is a modern approach that leverages technology, automation, and real-time data analytics to improve financial management. It eliminates inefficiencies and helps businesses make data-driven decisions.

In this blog, we will explore how progressive accounting works, its benefits, and how businesses can implement it for better financial outcomes.

Understanding Progressive Accounting

To put it simply, progressive accounting is an advanced form of financial management that uses modern technology to optimize accounting processes.

Unlike traditional accounting, which relies heavily on manual bookkeeping, progressive accounting integrates automation, artificial intelligence (AI), and cloud computing to streamline financial tasks.

How Is Progressive Accounting Different from Traditional Accounting?

Traditional accounting methods require accountants to record transactions manually, generate financial reports at scheduled intervals, and reconcile accounts through time-consuming processes.

Progressive accounting, on the other hand, automates these tasks, providing businesses with real-time insights, seamless integrations, and better accuracy.

Key Principles of Progressive Accounting:

-

Automation: Reducing manual work through AI-powered accounting tools.

-

Cloud-Based Solutions: Ensuring financial data is accessible from anywhere.

-

Real-Time Insights: Providing up-to-date financial reports for better decision-making.

-

Data Integration: Connecting accounting software with other business tools.

-

Compliance & Security: Automating tax calculations and financial regulations.

Core Components of Progressive Accounting

1. Automation in Accounting

Automation is at the heart of progressive accounting. AI-powered tools can handle data entry, transaction categorization, invoice processing, and bank reconciliations without human intervention. This not only saves important time but also lowers errors.

2. Cloud-Based Solutions

Businesses can access their financial data from anywhere at any time with cloud accounting software. This improves collaboration among teams and ensures that financial records are always up to date.

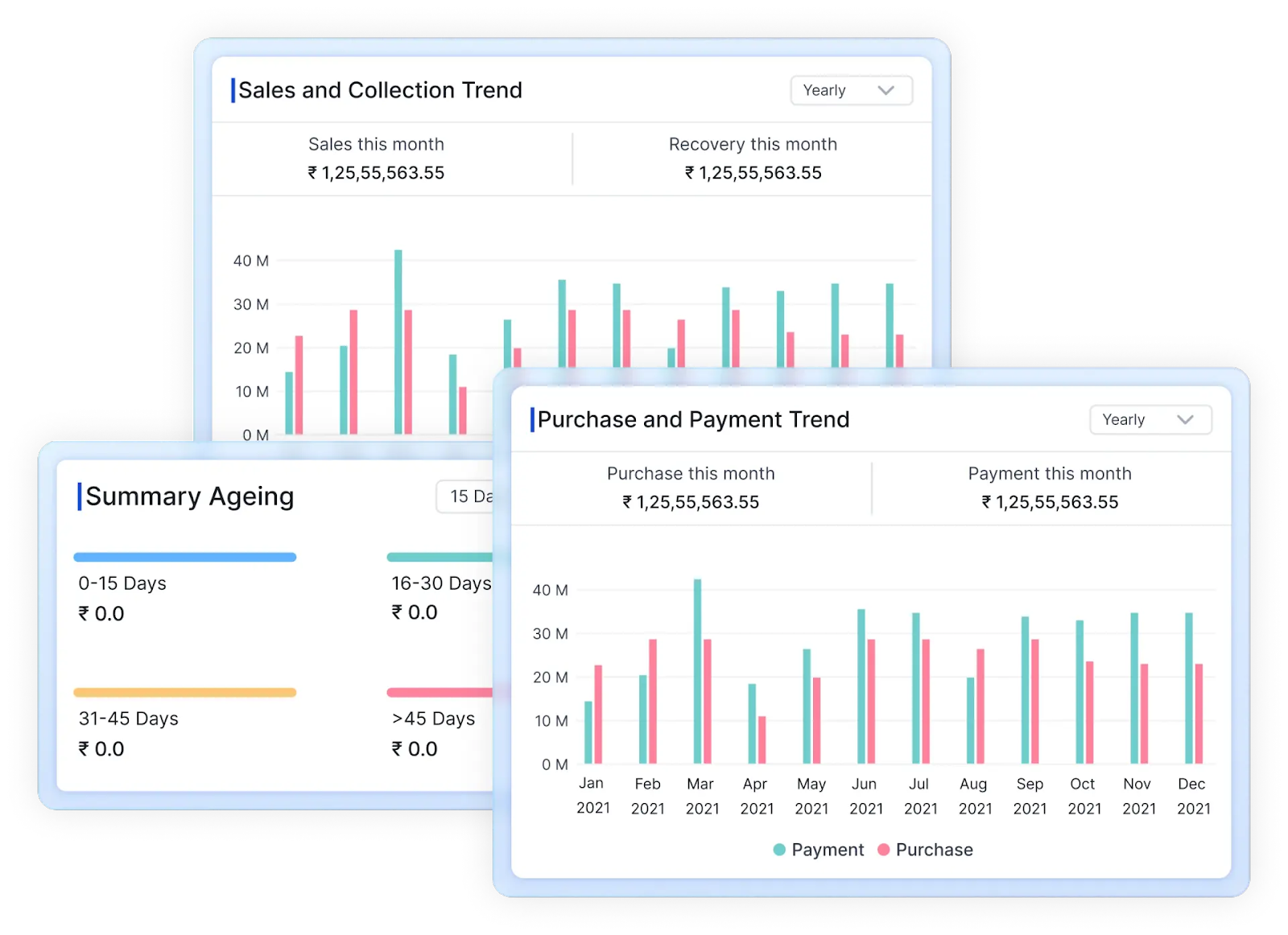

3. Real-Time Financial Reporting

Gone are the days when businesses had to wait until the end of the month to review their financial health. Progressive accounting provides real-time financial reports, helping business owners make informed decisions instantly.

4. Data-Driven Decision-Making

With progressive accounting, businesses can analyze financial data and gain insights into cash flow, profitability, and expenses. Predictive analytics tools help forecast future financial trends, allowing proactive decision-making.

5. Integration with Other Business Tools

Modern businesses use various software solutions, from CRM to inventory management. Progressive accounting ensures seamless integration with these tools, creating a centralized financial ecosystem.

Benefits of Progressive Accounting

-

Increased Efficiency – Automation eliminates repetitive tasks, allowing accountants to focus on strategic financial planning.

-

Cost Savings – Businesses save money by reducing the need for extensive manual bookkeeping.

-

Enhanced Accuracy – Automated data processing reduces human errors.

-

Improved Compliance – Automatic tax calculations ensure businesses stay compliant with regulations.

-

Scalability – Progressive accounting grows with the business, making it suitable for startups and enterprises alike.

-

Better Decision-Making – Real-time data enables business owners to make quick, informed decisions.

Progressive Accounting vs. Traditional Accounting

| Feature | Progressive Accounting | Traditional Accounting |

|---|---|---|

| Data Processing | Automated & AI-driven | Manual & labor-intensive |

| Accessibility | Cloud-based & remote access | On-premises, limited access |

| Decision-Making | Real-time insights | Delayed reporting |

| Scalability | Easily scalable | Requires manual adjustments |

| Compliance | Automated tax & audit compliance | Prone to errors & delays |

Implementing Progressive Accounting in Your Business

Transitioning from traditional to progressive accounting requires a strategic approach.

Here are some steps to make the shift:

-

Evaluate Your Current Accounting Processes – Identify inefficiencies and areas for improvement.

-

Choose the Right Accounting Software – Select a cloud-based, automation-driven platform that suits your business needs.

-

Train Your Team – Ensure that your employees understand how to use modern accounting tools.

-

Integrate with Other Systems – Connect your accounting software with payroll, CRM, and other financial tools.

-

Monitor and Optimize – Regularly review financial reports and optimize processes based on real-time data.

The Role of Suvit in Progressive Accounting

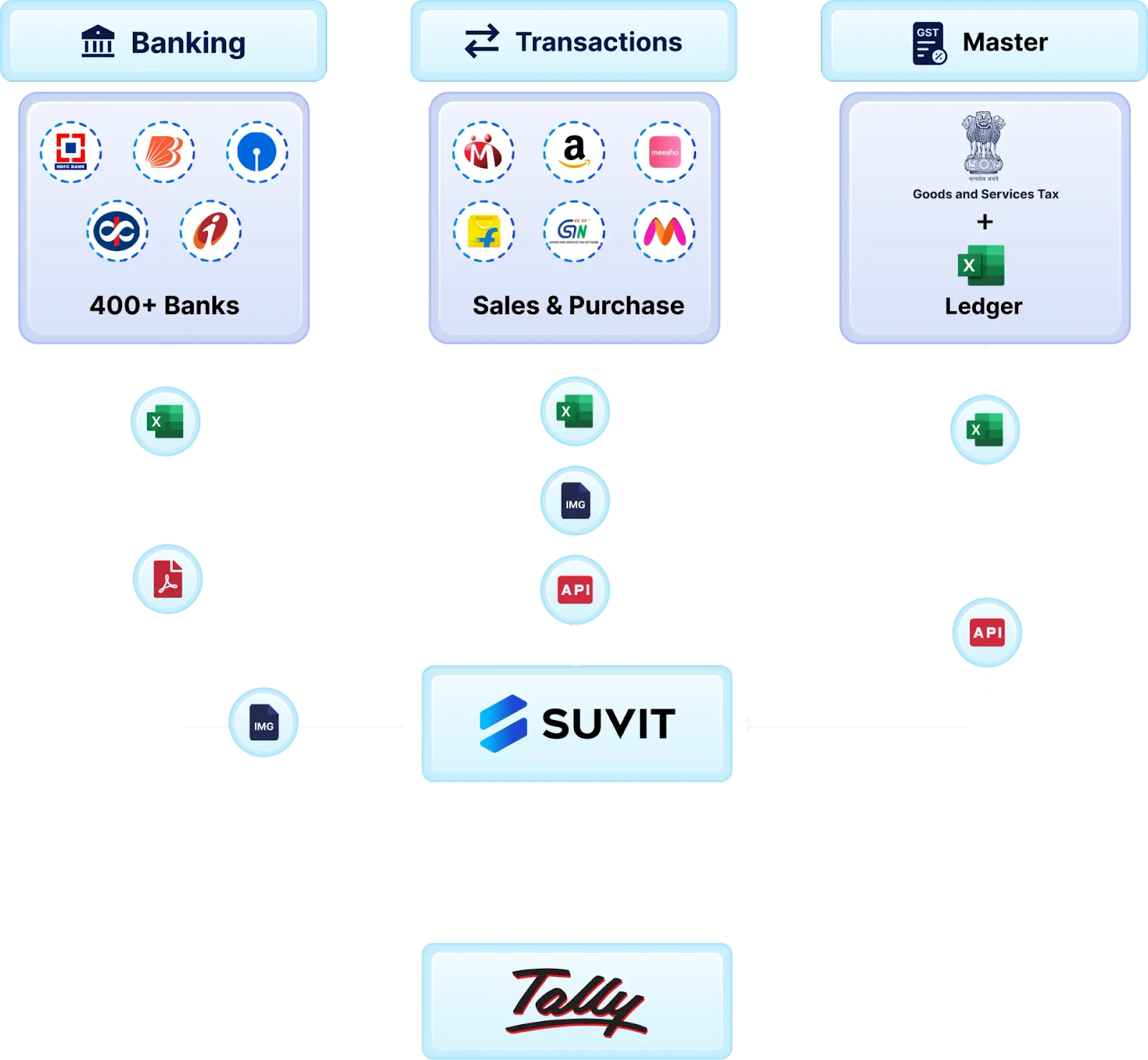

Suvit is at the forefront of progressive accounting, offering advanced automation and cloud-based solutions for businesses. Here’s how Suvit helps businesses embrace progressive accounting:

Automated Data Entry

Suvit reduces manual work by automating data extraction from invoices, bank statements, and financial documents. This ensures businesses save time while maintaining high accuracy levels.

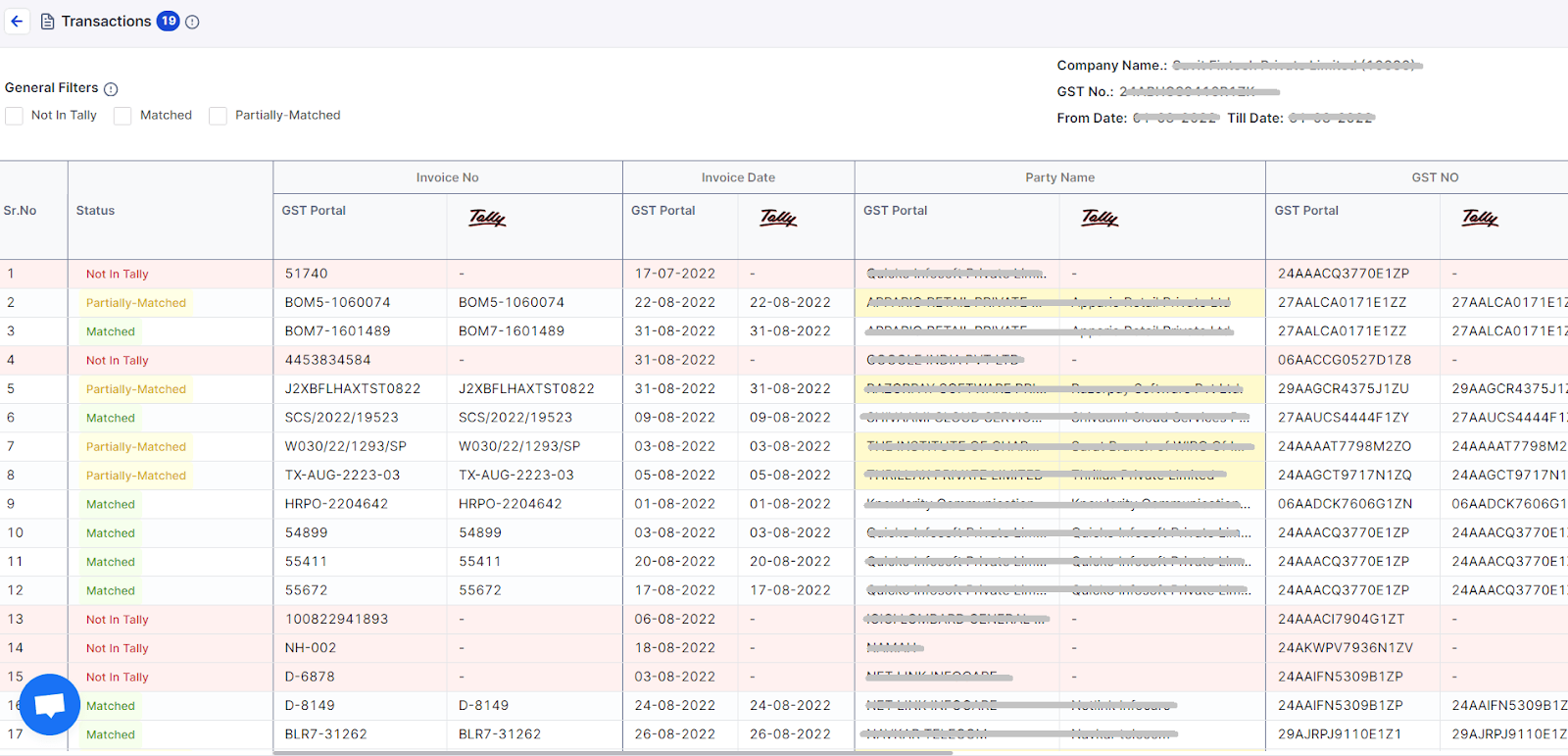

Real-Time GST Reconciliation

Suvit simplifies GST calculations and reconciliations, ensuring compliance with tax regulations. The automated reconciliation feature eliminates the need for manual cross-verification, reducing the risk of errors.

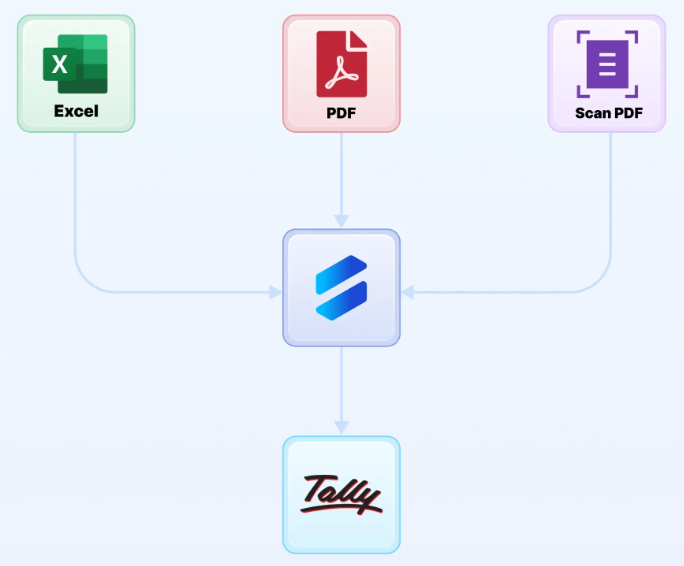

Multi-Format Data Processing

Unlike traditional accounting tools, Suvit is capable of processing multiple file formats, including Excel files, PDFs, and scanned documents. This flexibility makes it easier for businesses to handle diverse financial records efficiently.

Cloud-Based Access

Businesses can access financial data anytime, anywhere. This improves collaboration among finance teams and ensures up-to-date recordkeeping, which is important for financial planning.

See here how to configure Suvit with Tally cloud.

Seamless Integration with Accounting Software

Suvit integrates with leading accounting software(Tally), ensuring that businesses can transition smoothly from traditional accounting to a progressive, automated system.

Check this to know how to Connect Suvit with Tally.

Advanced Analytics and Insights

Suvit provides businesses with valuable insights into financial trends, cash flow patterns, and compliance status, enabling better decision-making.

Security and Compliance

With Suvit, businesses don’t have to worry about security risks. The platform ensures encrypted data storage, automatic backup, and compliance with financial regulations.

By leveraging Suvit, businesses can improve efficiency, reduce errors, and optimize financial management.

Whether you are a small business looking to streamline operations or a growing enterprise aiming for scalability, Suvit provides the right tools for a smooth transition to progressive accounting.

Try Suvit for free for a week!

Think Progressive Accounting, Think Automation

Progressive accounting is not just a trend; it is the future of financial management. By integrating automation, real-time data, and cloud-based solutions, businesses can achieve greater efficiency, accuracy, and scalability.

If you are still relying on traditional accounting methods, now is the time to make the shift. Adopting progressive accounting will give your business a competitive edge, ensuring smarter decision-making and better financial outcomes.

Ready to transform your accounting processes? Start implementing progressive accounting today with advanced solutions like Suvit!

Also Read:

- How GST Return Filing Software Can Save You Time and Effort

- Why Tally Accounting Software India is the Go-To Choice for Businesses

- How to Import XML Data to Excel for Accounting and Financial Analysis

- Capital in Accounting: Types & Their Importance for Business

- How OCR is Changing the Way We Work: Guide to OCR Technology