The end of the fiscal year marks a pivotal checkpoint for businesses—a time to organize finances, tie up any loose ends, and prepare for a fresh start in the upcoming year.

Did you know that missing year-end deadlines can result in penalties and disrupt your financial planning?

Don’t let the chaos overwhelm you—this year-end accounting checklist will make the process seamless. Let’s see how!

Review Financial Records

Before you can declare your financial year closed, take a deep dive into your records:

- Reconcile Bank Accounts: Ensure that your bank statements align with your books. Unreconciled accounts can lead to discrepancies.

- Accounts Payable and Receivable: Confirm that all invoices have been sent and received. Follow up on pending payments.

- Inventory Check: Verify your inventory records and make necessary adjustments for shrinkage or overages.

| Checklist Item | Status |

|---|---|

| Bank accounts reconciled | ☑️ |

| Invoices sent and received | ☑️ |

| Inventory adjusted | ⬜ |

Example: Suppose you notice an outstanding invoice from three months ago. Following up promptly can improve your cash flow and reduce write-offs.

Evaluate Fixed Assets

Fixed assets like machinery, vehicles, or office equipment should be reviewed:

- Depreciation: Calculate and record depreciation for the fiscal year.

- Disposals and Acquisitions: Document any assets purchased or sold during the year.

Pro Tip: Use an asset management tool to track depreciation and simplify reporting. Software like Asset Panda can automate asset tracking and depreciation schedules.

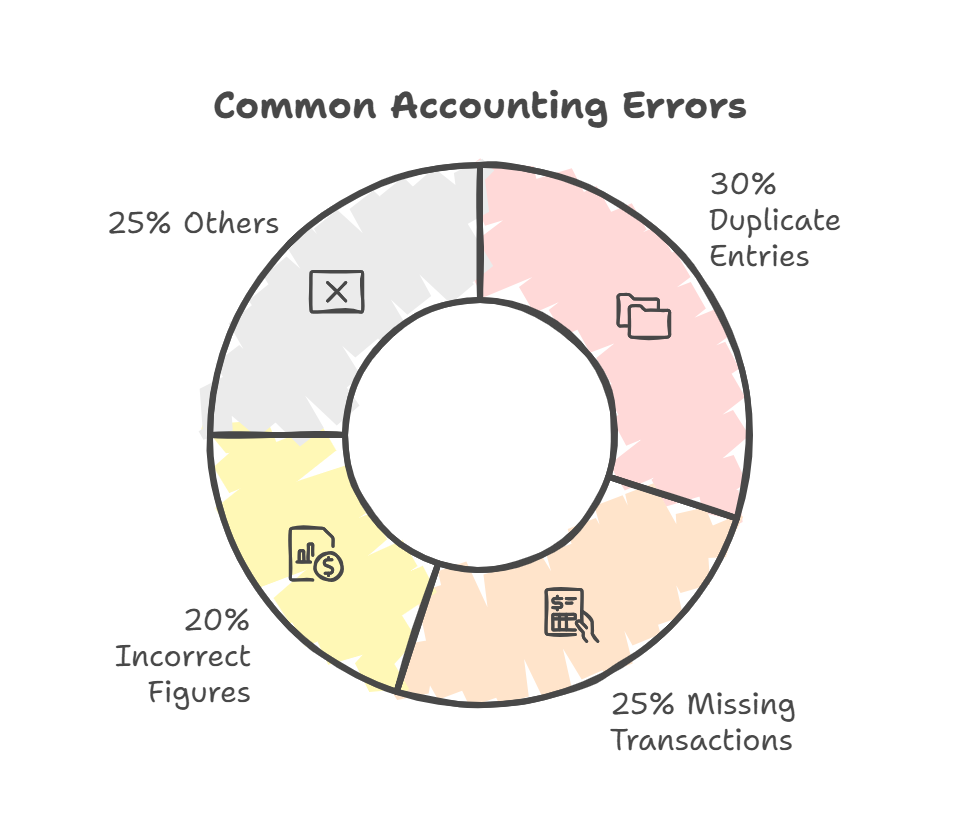

Audit and Reconcile Accounts

Conduct a thorough internal audit to ensure accuracy and compliance:

- Spot Errors: Look for duplicate entries, mismatched figures, or missing transactions.

- Reconcile Intercompany Accounts: If your business operates across multiple entities, reconcile intercompany accounts.

Practical Tip: Consider hiring an external auditor for an unbiased review, especially if your company is subject to regulatory requirements.

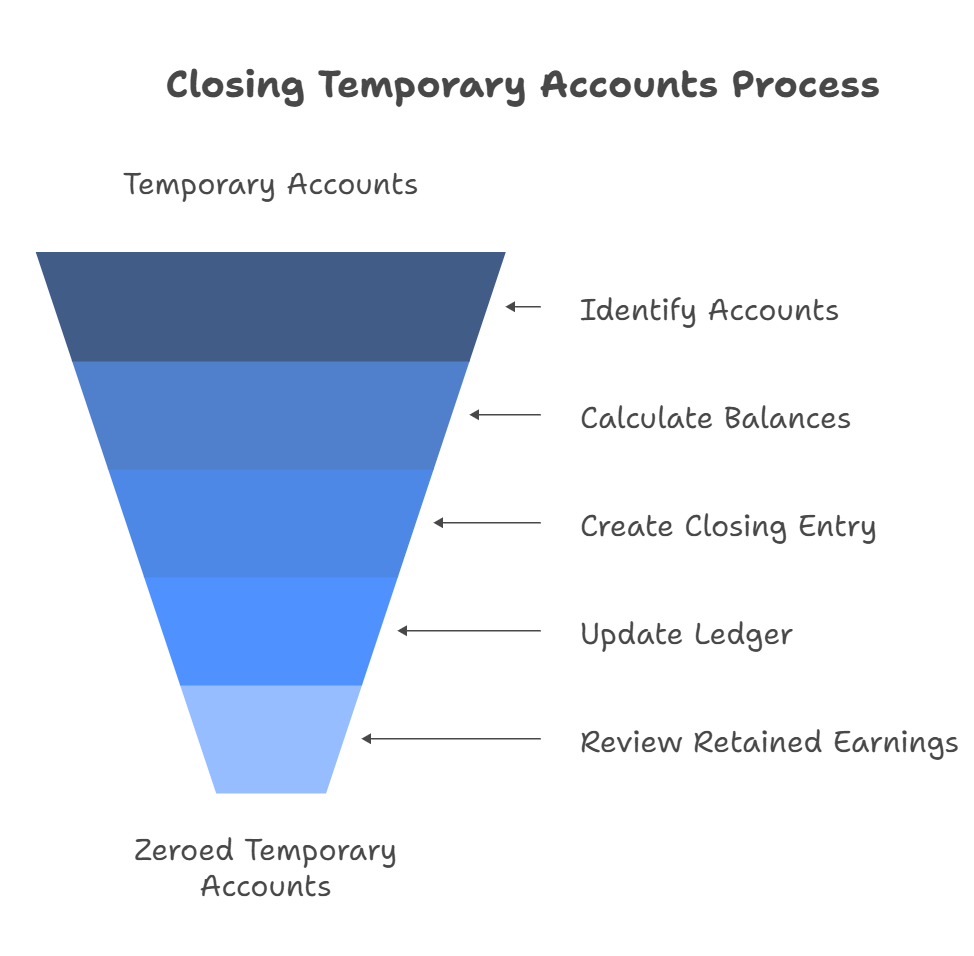

Close Temporary Accounts

It is necessary to close temporary accounts, such as revenue and expense accounts:

- Transfer balances to the appropriate permanent accounts.

- Update retained earnings.

Step 1: Identify Temporary Accounts: List all revenue and expense accounts.

Step 2: Calculate Balances: Total up the credit balances (e.g., revenue) and debit balances (e.g., expenses).

Step 3: Create a Closing Entry: Record an entry to transfer the net profit or loss to retained earnings.

Step 4: Update the General Ledger: Post the closing entries, ensuring all temporary accounts show a zero balance.

Step 5: Review Retained Earnings: Confirm the updated retained earnings reflect the year's net profit or loss.

Why This Matters: Closing these accounts ensures accurate reporting of profit or loss for the fiscal year.

Prepare Financial Statements

Your year-end isn’t complete without accurate financial statements:

- Balance Sheet: Reflect on your company’s financial position.

- Income Statement: Summarize revenues and expenses.

- Cash Flow Statement: Track cash inflows and outflows.

| Statement | Purpose |

|---|---|

| Balance Sheet | Snapshot of financial position |

| Income Statement | Overview of profitability |

| Cash Flow Statement | Tracks liquidity and cash movement |

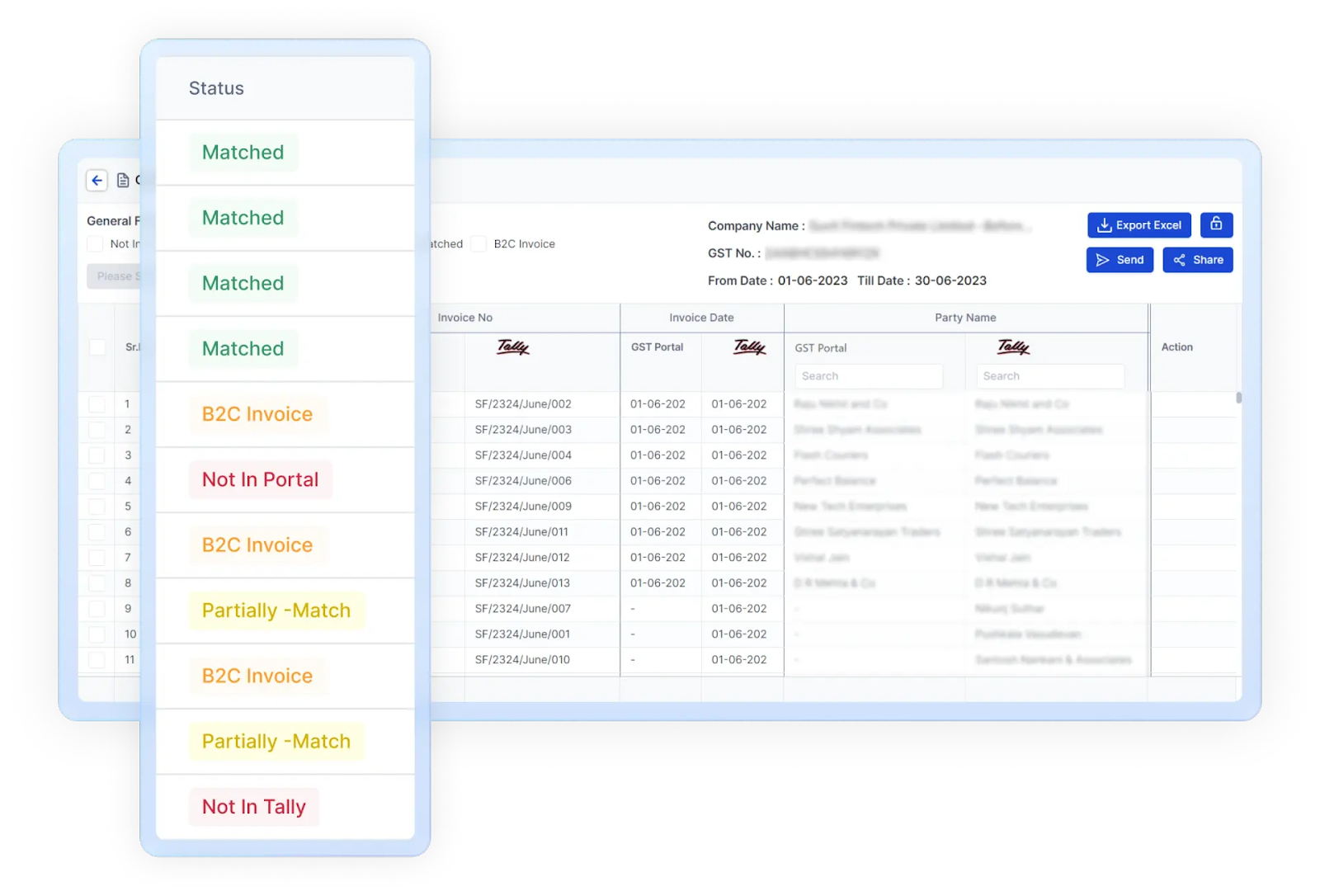

Review Tax Obligations

Taxes are non-negotiable:

- Calculate your income tax, GST, and other applicable taxes.

- File pending returns and clear outstanding payments.

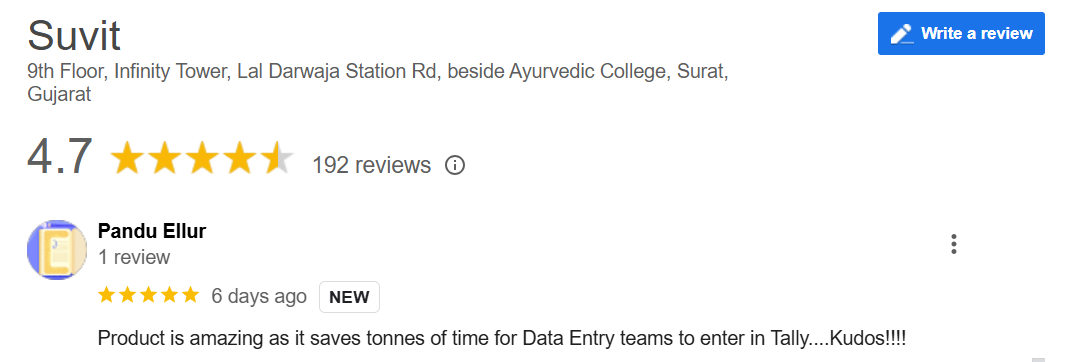

Example: A small business owner can save hours by automating GST reconciliation through tools like Suvit.

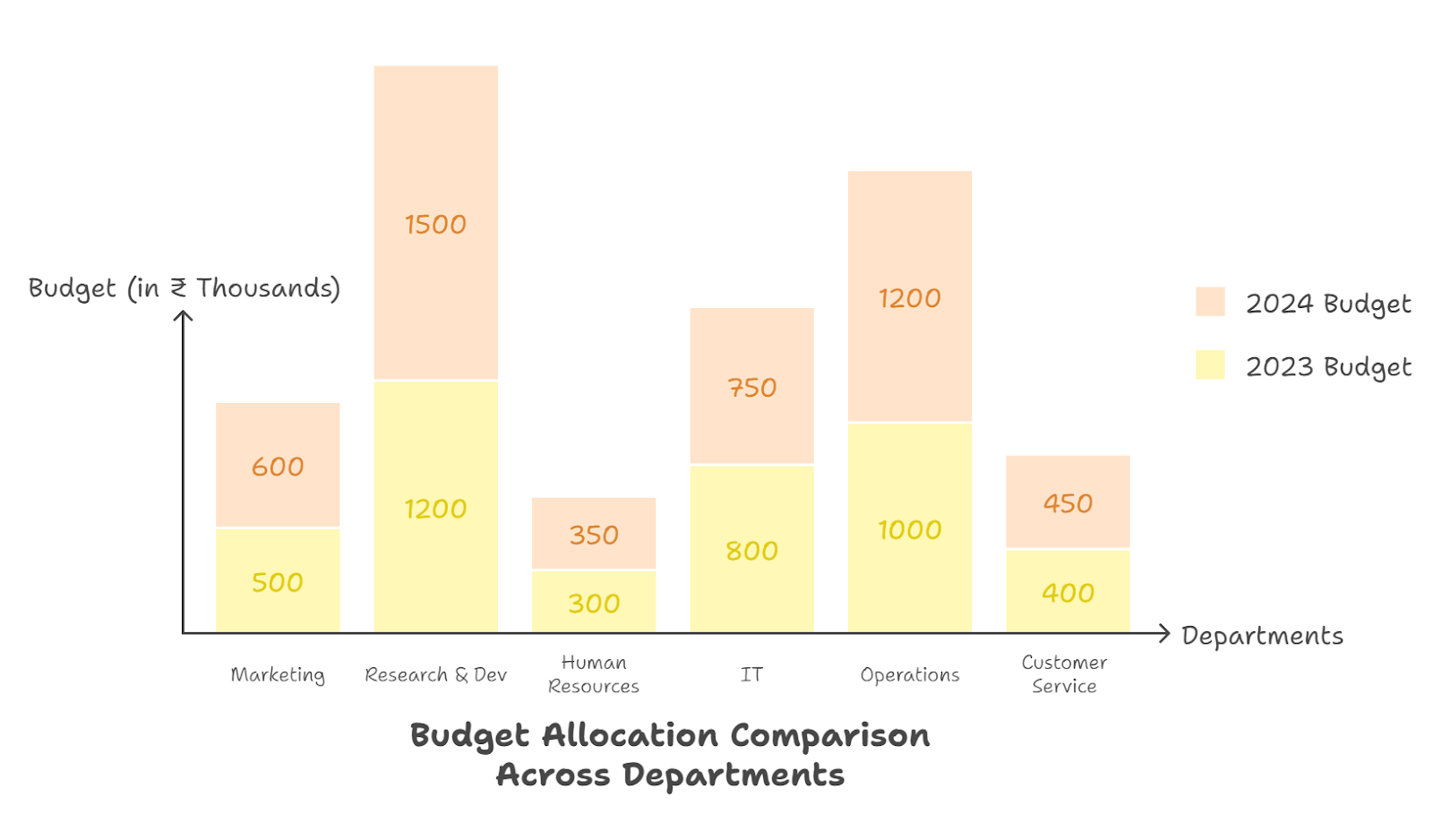

Set Up Next Year’s Budget

Use this year’s data to:

- Forecast revenue and expenses.

- Allocate resources for growth and sustainability.

Long-Term Tip: Regularly review and adjust the budget throughout the year to adapt to market changes.

Communicate with Stakeholders

- Share year-end financial summaries with stakeholders.

- Hold meetings with employees to discuss key takeaways and goals for the next fiscal year.

Example: Presenting a clear, concise financial summary can build trust with investors and motivate employees by showing the company’s achievements.

Embrace Technology

Automation tools and accounting software have the potential of changing the industry. Features of these tools like reconciliation, reporting, and forecasting simplify year-end processes.

| Tool | Feature |

|---|---|

| Suvit | Automated reconciliation, Financial Reports |

| Vyapar | Biling, Inventory, Accounting |

| Zoho Books | Budgeting and forecasting |

The purpose of technology is to save time, not to take your place!

Final Checklist

Here’s a quick checklist to ensure you’ve covered everything:

| Year-End Accounting Checklist | ||

|---|---|---|

| Task Category | Specific Tasks | Status |

| Bank Reconciliation | Ensure all bank accounts are reconciled. | |

| Match bank statements with ledger entries. | ||

| Accounts Payable & Receivable | Confirm all invoices are sent and received. | |

| Follow up on overdue payments. | ||

| Inventory Management | Conduct a physical inventory count. | |

| Adjust records for discrepancies. | ||

| Fixed Assets | Record new purchases or disposals. | |

| Update depreciation schedules. | ||

| Internal Audit | Identify and correct duplicate or missing entries. | |

| Reconcile intercompany accounts if applicable. | ||

| Closing Temporary Accounts | Transfer balances from revenue and expense accounts to retained earnings. | |

| Financial Statements | Finalize the balance sheet. | |

| Prepare the income statement. | ||

| Compile the cash flow statement. | ||

| Tax Compliance | Calculate taxes (e.g., GST, income tax) owed. | |

| File returns and clear outstanding dues. | ||

| Budget Preparation | Share year-end summaries with stakeholders. | |

| Organize meetings to align on next year’s goals. | ||

| Technology Review | Evaluate accounting tools for efficiency. | |

| Train staff on updated tools and processes. | ||

| Final Approvals | Obtain management sign-off on all reports. | |

| Archive all relevant documents for compliance. | ||

Prepare, Close, and Move Forward

Closing the fiscal year doesn’t have to be overwhelming.

With this year-end accounting checklist, you’ll not only ensure compliance but also set your business up for success.

Need help simplifying your accounting tasks? Tools like Suvit are just a click away. Here’s to a smooth year-end closure and a profitable new year!