Efficiency and accuracy are the cornerstones of a successful accounting practice at any given point in time.

Chartered Accountants (CAs) are under increasing pressure to meet deadlines, stay updated with tax regulations, and provide their clients with timely and error-free financial information.

The good news is that accounting automation tools, like Suvit, are remaking how CAs work. These tools save time, reduce human error, and enhance the client experience.

In this blog, we’ll explore five compelling reasons every CA needs Suvit and how it can revolutionize managing accounting tasks.

1. High Efficiency and Time-Saving

In accounting, efficiency is everything. CAs constantly manage multiple clients, tight deadlines, and intricate financial data. Manual data entry, reconciliation, and report generation can consume much time, leaving little space for strategic thinking or client interaction. That’s where Suvit comes in.

How Suvit Helps:

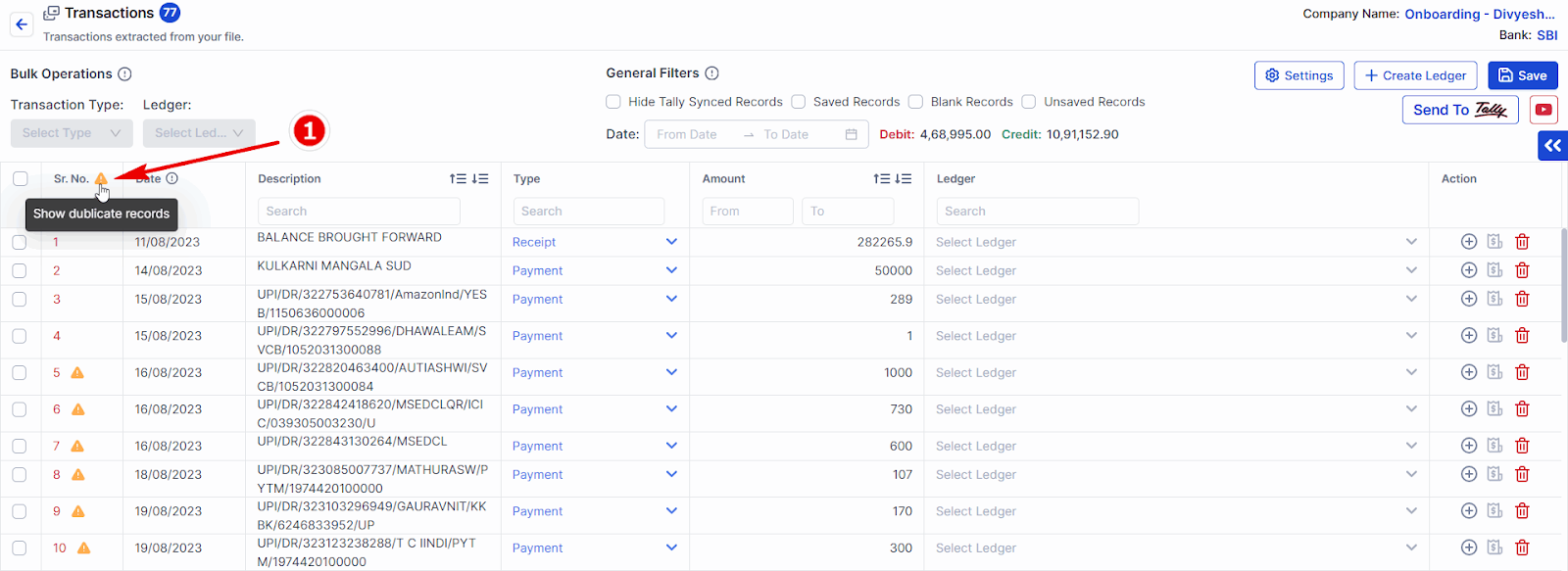

- Automates routine tasks: Suvit automates tasks like data entry, invoice generation, and report preparation. This significantly reduces the time spent on these repetitive activities, allowing CAs to focus on more value-driven aspects of their work.

- Real-time data processing: Suvit processes financial data in real-time, ensuring that CAs have the most up-to-date information. This helps save time and cuts down on the risk of errors.

Key Benefits:

- Faster task completion: By automating daily processes, CAs can complete tasks more quickly and efficiently.

- Time for strategic planning: With automation handling mundane tasks, CAs can focus on client consultations, financial analysis, and long-term planning.

Suvit’s automation streamlines operations and allows CAs to optimize their time, ultimately improving their productivity and client satisfaction.

2. Enhanced Accuracy and Reduced Errors

Manual accounting tasks come with the risk of human errors, which can have significant consequences for clients and their financial health. Whether it’s data entry mistakes, incorrect tax calculations, or missed invoices, these errors can lead to compliance issues, penalties, and a loss of trust.

How Suvit Helps:

- Data accuracy: Suvit’s automation tools are designed to ensure 100% accuracy in financial calculations and reporting. Eliminating the need for manual data entry significantly reduces the likelihood of errors.

- Real-time error detection: Suvit instantly flags data discrepancies, allowing CAs to rectify issues before they escalate. This feature improves accuracy in financial reporting and tax filings, which are critical for client satisfaction and compliance.

Key Benefits:

- Reduced risk of penalties: Suvit helps CAs avoid costly errors and issues by ensuring accurate and compliant financial reports.

- Boosted reputation: Clients trust your expertise more when you consistently provide error-free reports and financial advice.

With Suvit, CAs can be confident that their accounting processes are precise and reliable, allowing them to focus on higher-value tasks.

3. Improved Client Services

In a highly competitive market, providing excellent client service is essential for retaining and gaining new clients. By using an accounting automation tool like Suvit, CAs can enhance the quality of their services and exceed client expectations.

How Suvit Helps:

- Instant financial reports: With automated report generation, CAs can provide clients with up-to-the-minute financial statements, helping them make better-informed decisions in real-time.

- Personalized services: Suvit allows CAs to customize reports based on the client’s unique financial situation, providing them with tailored insights and actionable advice.

Key Benefits:

- Faster response times: Automation reduces the time spent preparing reports, enabling CAs to respond to client inquiries more quickly.

- Transparency and trust: Clients appreciate transparency. With Suvit, you can provide clear and understandable financial reports that help build trust and loyalty.

Offering streamlined & professional service helps CAs retain their clients and attract new ones through word-of-mouth and reputation.

4. Compliance and Taxation Benefits

Staying compliant with ever-evolving tax laws is one of the most challenging aspects of accounting. CAs must keep up with tax regulations, file returns on time, and ensure their clients always comply with local laws. Failing to do so can result in penalties, audits, and reputational damage.

How Suvit Helps:

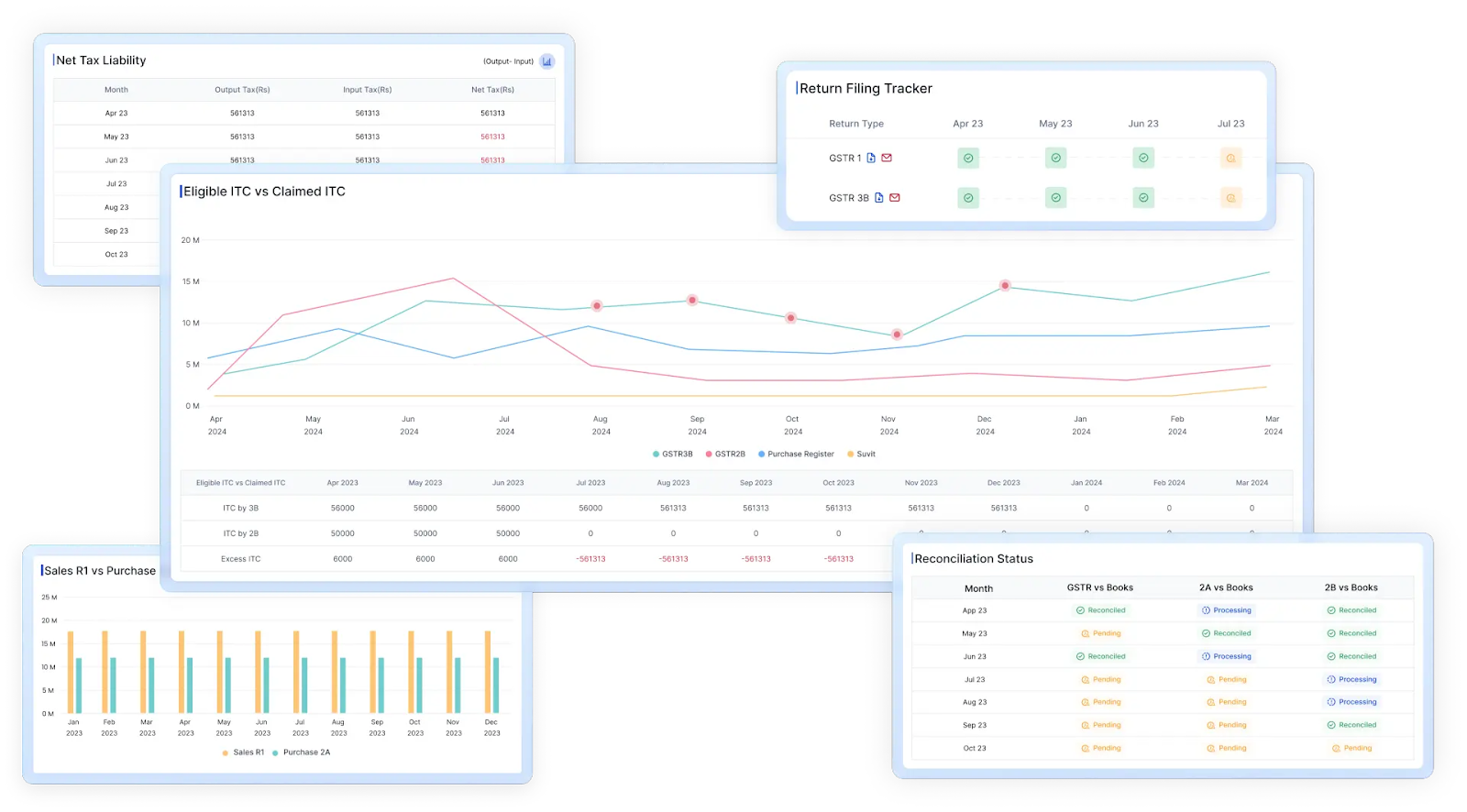

- Tax updates: Suvit ensures that your tax calculations and filings are always up to date with the latest regulations. It also writes regularly about updates on tax rates and other accounting industry information, helping CAs stay compliant.

- Effortless GST filings: Suvit automates GST reconciliations, ensuring accurate and timely submissions. It also enables you to track GST filing dates.

Key Benefits:

- No missed deadlines: Suvit’s automated system ensures that CAs never miss essential GST deadlines, reducing the risk of penalties.

- Simplified GST management: The software simplifies the complex task of GST compliance, making it easy for CAs to handle multiple clients with different GST rate needs.

By reducing the burden of tax filings and regulatory compliance, Suvit allows CAs to focus on providing better financial advice and services to their clients.

5. Cost Savings for Chartered Accountants and Their Clients

While investing in an accounting automation tool like Suvit requires an initial outlay, the long-term cost savings far outweigh the expense. The tool’s automation features help streamline operations, saving CAs time and money. These savings can be passed on to clients, creating a win-win situation.

How Suvit Helps:

- Reduces operational costs: By automating routine tasks, Suvit helps CAs lessen the need for extra work hours to handle data entry and manual calculations.

- Scalable solution: With Suvit, CAs can manage more clients with existing staff. This scalability leads to cost efficiency.

- ICAI Recognised Tool: Suvit is recognised under CMP Benefits, so you can avail special deals!

Key Benefits:

- Less reliance: With automation, CAs can minimize the need for extra staff in tax season, cutting overhead costs.

- Faster client onboarding: Suvit’s speed and efficiency enable CAs to take on more clients without increasing costs, making the practice more scalable and profitable.

Clients benefit from faster, more accurate services, and CAs can run a leaner operation, keeping costs under control.

Suvit = Chartered Accountants BFF

Incorporating an accounting automation tool like Suvit into your practice is no longer optional—it’s a necessity. From improving efficiency and accuracy to offering better client services and ensuring tax compliance, Suvit provides Chartered Accountants with the tools they need to succeed in a fast-paced, competitive environment.

Why Every CA Needs Suvit:

- Save time: Automate routine tasks and focus on higher-value work.

- Increase accuracy: Eliminate errors and ensure flawless financial reporting.

- Enhance client relationships: Provide real-time, personalized financial services.

- Stay compliant: Keep up with the latest tax laws and regulations.

- Cut costs: Streamline operations and reduce overhead.

The future of accounting is automated, and with Suvit, CAs can lead the way in offering smarter, faster, and more reliable services. So, if you want to transform your accounting practice, it’s time to explore Suvit and see how it can elevate your work to new heights.

To explore how Suvit can help you work smarter, not harder, and take your accounting services to the next level, try Suvit for free for a week!