As a tax professional, you’ve likely experienced this: racing against a tax filing deadline, surrounded by stacks of invoices and endless spreadsheets.

The pressure to ensure every entry is accurate and every GST detail reconciled is immense. Sound familiar? This is the daily grind for many tax professionals.

But what if there was a way to simplify this process, reduce errors, and save time?

Give a high five to Suvit, the AI-powered accounting automation software transforming how tax professionals handle data entry and GST reconciliation.

Trusted by over 5,000 professionals, Suvit is setting new benchmarks in efficiency and accuracy. Let’s explore what makes it the go-to solution.

The Challenges of Manual Data Entry and GST Reconciliation

Manual data entry is one of the most tedious aspects of accounting. It’s not just time-consuming—it’s error-prone.

Even a small mistake in an invoice or tax calculation can lead to financial losses, penalties, or strained client relationships.

Here are some of the most common challenges:

1. Repetitive and Monotonous Tasks

Entering the same data across multiple platforms drains productivity and leaves little time for strategic tasks.

2. High Risk of Errors

Human errors, such as incorrect GSTINs or mismatched invoice details, can snowball into compliance issues.

3. Time Constraints

With tax deadlines looming, professionals often find themselves working overtime to reconcile GST data and prepare returns.

Suvit’s Key Features That Tax Professionals Rely On

Suvit steps in to address these pain points, offering tools designed to make the life of a tax professional easier:

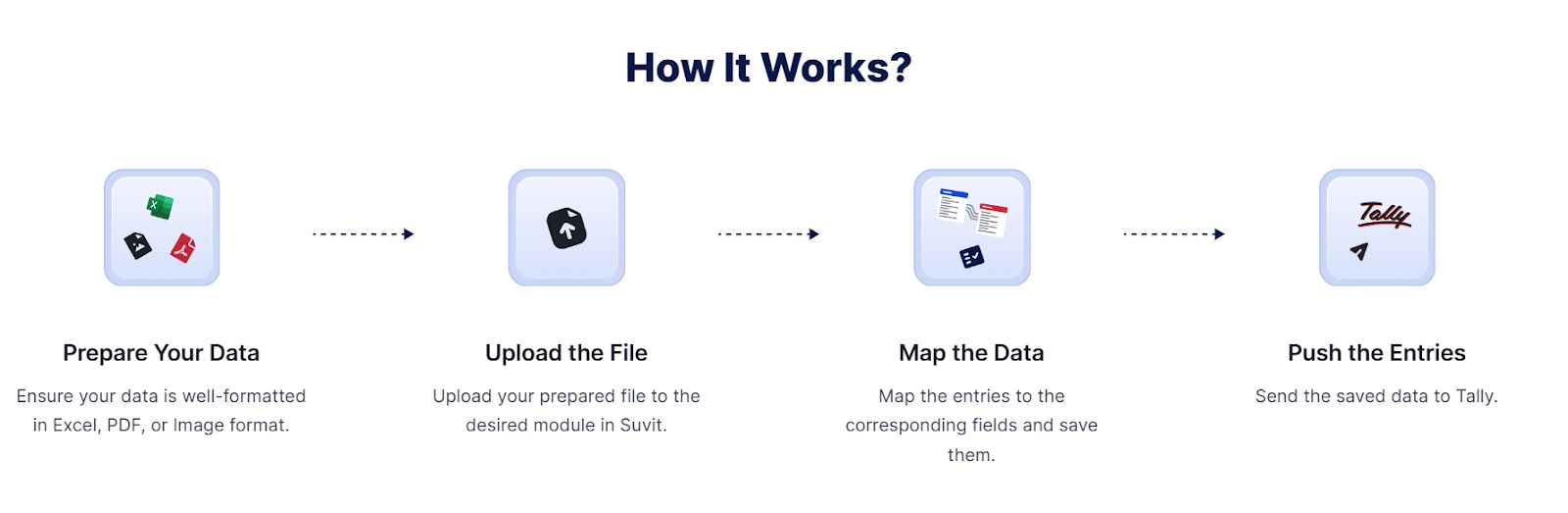

1. Accurate Data Entry

Suvit uses AI-powered automation to extract data from various sources like PDFs, Excel sheets, and even scanned documents.

This eliminates manual errors and ensures accurate data entry every single time.

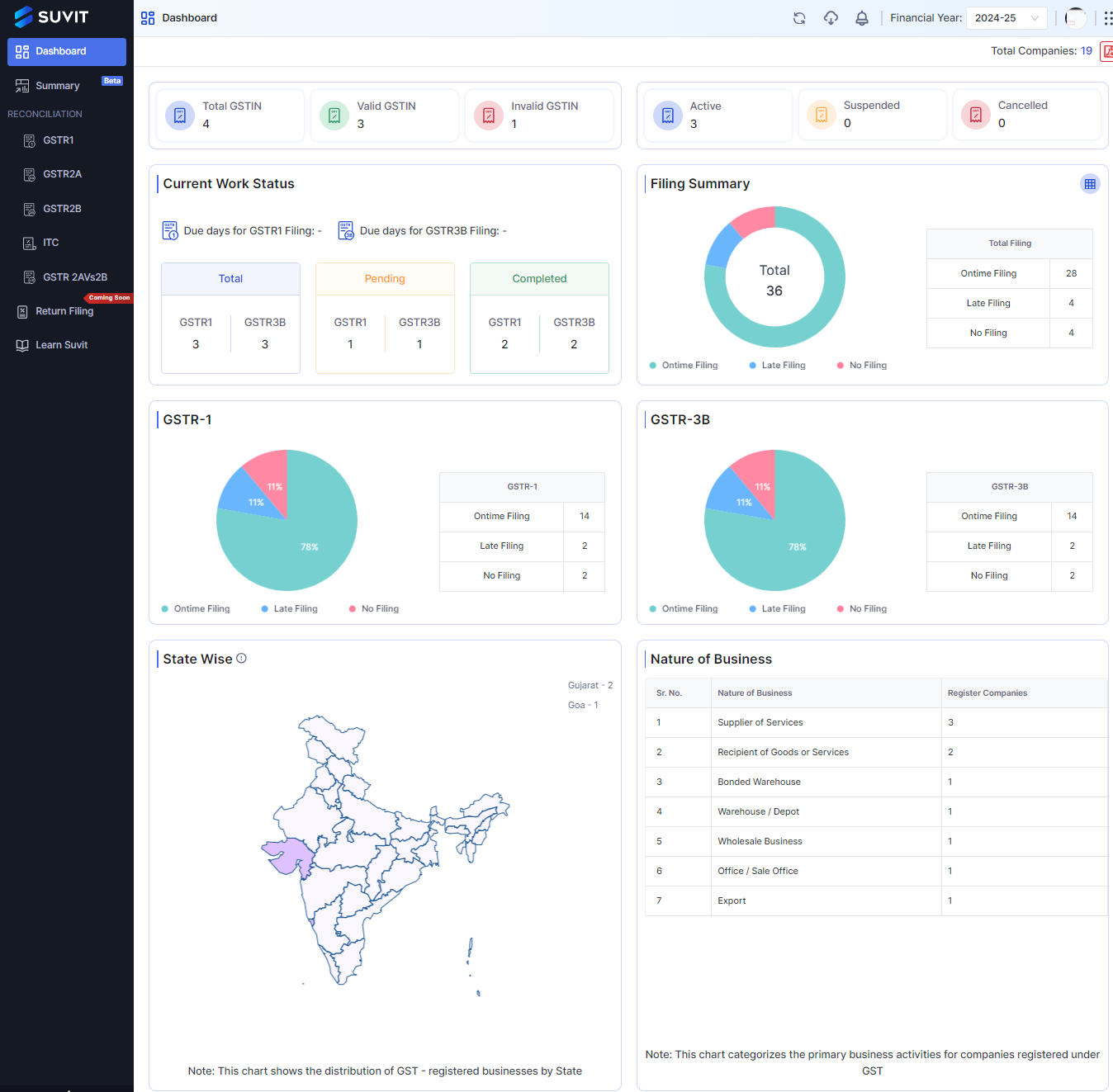

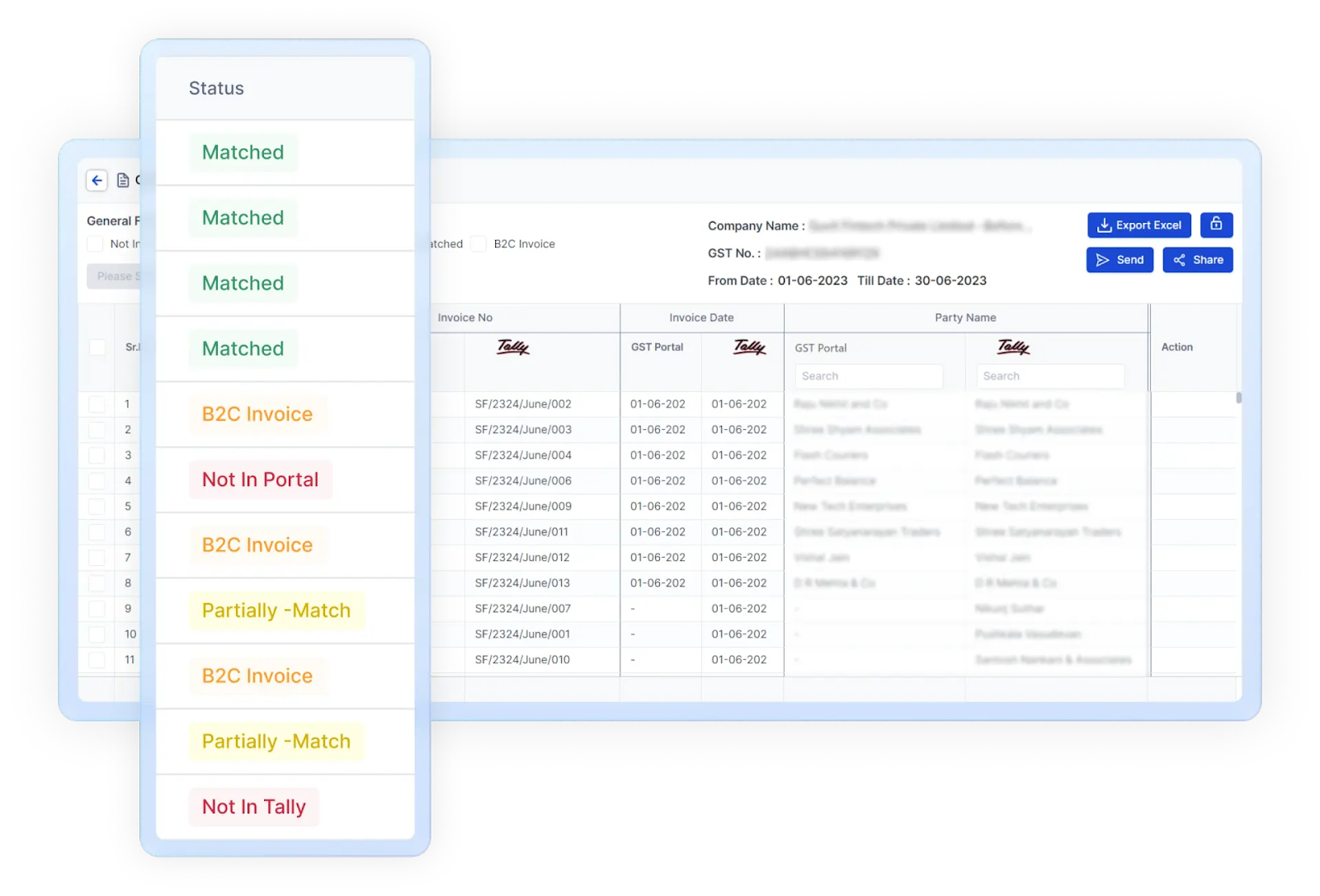

2. GST Reconciliation

GST reconciliation can be a nightmare when dealing with hundreds of invoices. Suvit automates the entire process, allowing professionals to:

- Match GSTR1, GSTR 2A, and GSTR 2B effortlessly.

- Detects discrepancies in GST data.

- Generate error-free reports in just a few clicks.

You can check this video out to see how easy it is to do GST Reconciliation with Suvit:

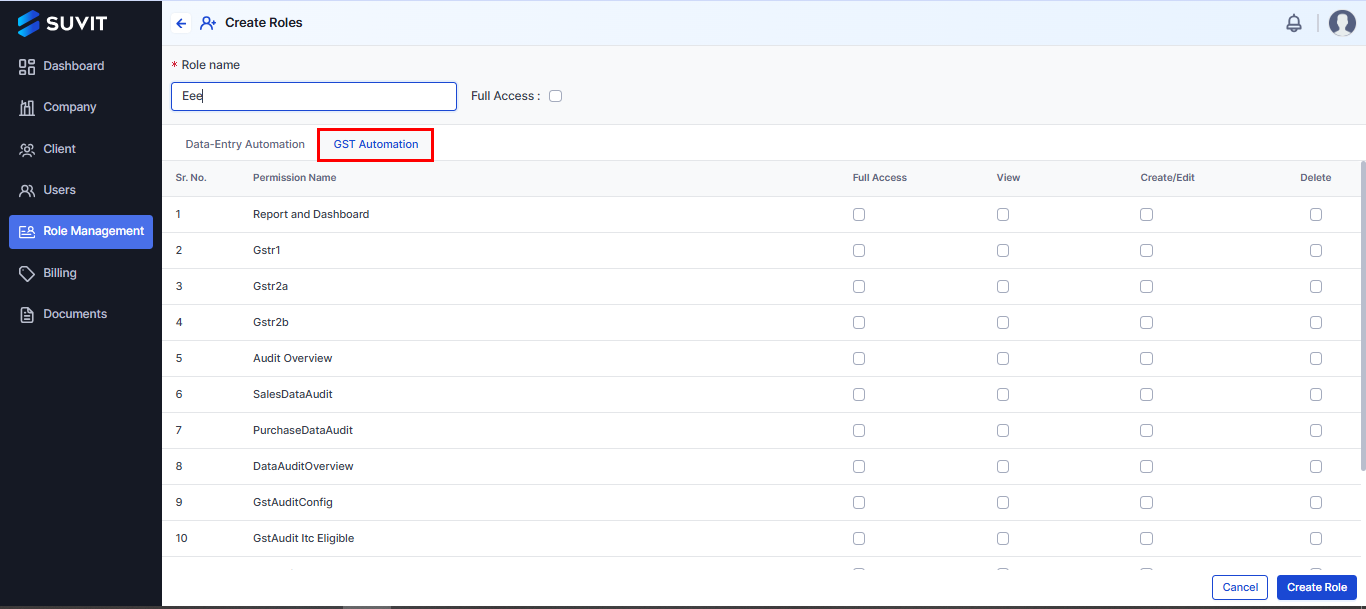

3. Document Management

Suvit offers a centralized platform to organize and store client documents securely.

Features like role-based access and client-specific folders make document management seamless.

| Aspect | Without Document Management (Suvit) | With Document Management (Suvit) |

|---|---|---|

| Handling Documents | It's a mess without a proper system, making things confusing. | Suvit makes it easy - all your documents neatly sorted and easy to find. |

| Organization | Things are all over the place, and it's hard to keep track. | Suvit keeps everything organized so you can find what you need without stress. |

| Mistakes and Confusion | More chances of mistakes because everything is manual. | Suvit helps you avoid mistakes by keeping things in order and easy to manage. |

| Finding Stuff | Trying to find a specific document feels like a treasure hunt. | With Suvit, finding documents is a breeze - just a few clicks away. |

| Time Crunch | Wasting time searching for stuff instead of getting things done. | Suvit saves you time, so you can focus on what really matters. |

| Happy Clients | Clients might get frustrated if things are not in order. | Suvit keeps your clients happy by making everything smooth and quick. |

| Workflow | Things don't run as smoothly as they could. | Suvit makes your work life easier and more enjoyable. |

| User-Friendly Feel | It's a bit of a headache trying to get things done. | Suvit feels friendly and easy, like having a helpful assistant at your fingertips. |

4. Client Communication Tools

Professionals can create customized roles for clients, making it easier to collect and exchange documents.

This improves transparency and reduces back-and-forth communication.

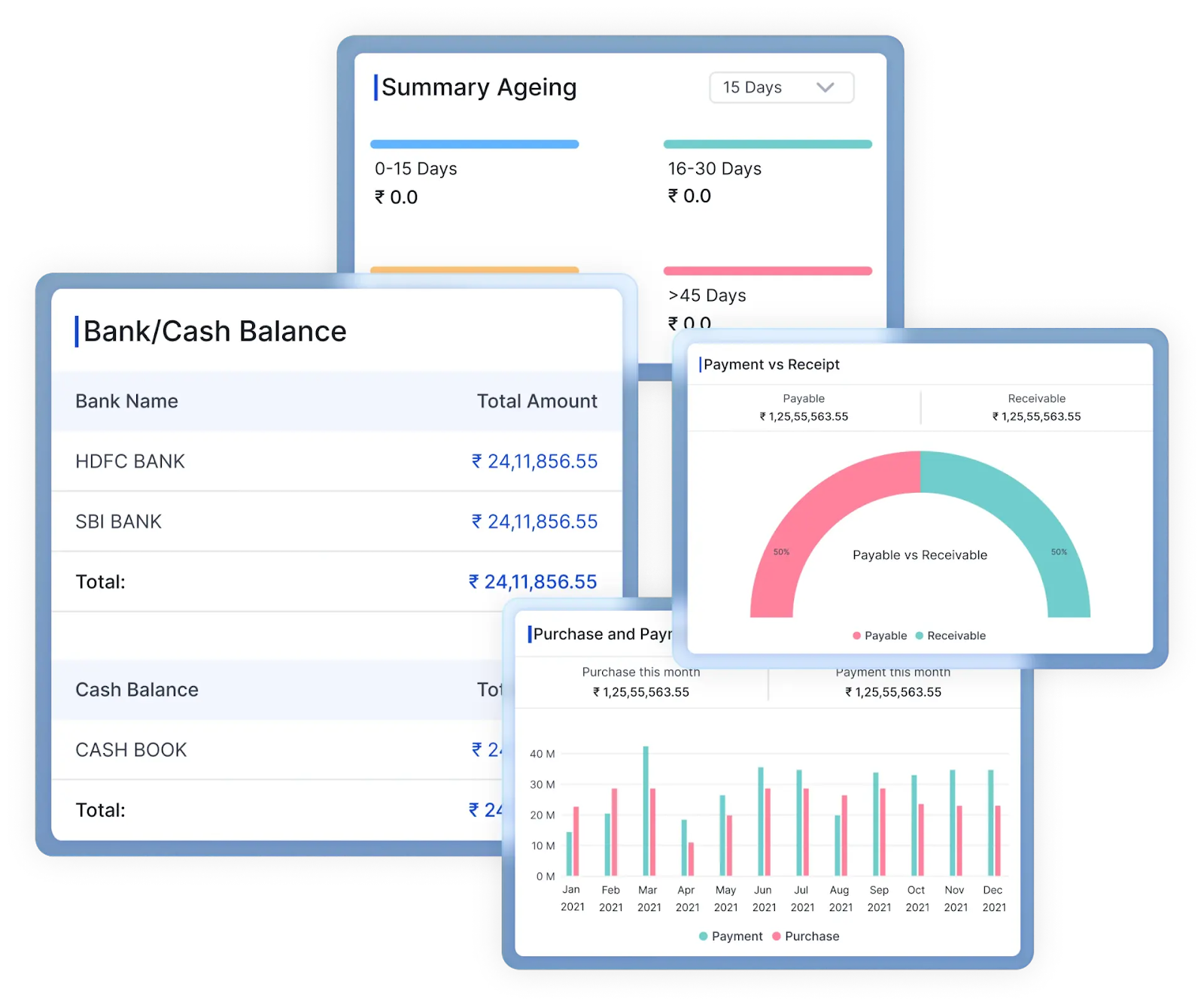

5. Customizable Reporting

With Suvit, you can create real-time reports tailored to specific needs, making financial analysis and audits much easier.

How Suvit Saves Time and Improves Productivity

Consider the case of a mid-sized accounting firm managing over 200 clients. Before adopting Suvit, they spent approximately 50 hours per week on manual data entry and reconciliation.

After integrating Suvit into their workflow:

- Data entry time reduced by 80%: Automated extraction eliminated the need for repetitive tasks.

- Errors dropped significantly: The AI system flagged inconsistencies before finalizing reports.

- Capacity doubled: The firm could handle more clients with the existing team size.

We are not just saying it, checkout these reviews:

Time Savings with Suvit

| Task | Traditional Method | Suvit Automation | Time Saved |

|---|---|---|---|

| Data Entry | 30 hours/week | 5 hours/week | 25 hours |

| GST Reconciliation | 20 hours/week | 3 hours/week | 17 hours |

Enhanced Compliance with Suvit

Staying compliant with GST regulations is no small feat. Suvit ensures that professionals are always a step ahead by:

- Flagging Errors Automatically: The system identifies mismatched data, reducing the risk of penalties.

- Providing Audit Trails: Detailed logs of all activities make audits hassle-free.

- Staying Updated: Suvit regularly updates its features to align with the latest tax regulations.

Why Over 5,000 Professionals Trust Suvit

Suvit’s reputation as a reliable tool is backed by numbers. Over 5,000 tax professionals use it daily to handle data entry and GST reconciliation. The software has processed more than 11 crore transactions, helping its users save thousands of hours.

But it’s not just about the numbers. Here’s what professionals love about Suvit:

- User-Friendly Interface: No technical expertise required.

- Exceptional Support: Dedicated customer service to resolve queries promptly.

- Scalability: Suvit grows with your business, handling increasing data volumes effortlessly.

Getting Started with Suvit

Ready to take the leap? Here’s how you can get started:

- Sign Up for a Free Trial: Explore all features for seven days without any commitment.

- Onboard Your Team: Suvit’s intuitive interface ensures a smooth transition for your staff.

- Automate Your Workflow: Leverage Suvit’s tools to save time, reduce errors, and improve productivity.

Visit Suvit.io to book a demo or to start your free trial today.

Ready to Join 5000+ Tax Professionals?

In today’s AI world, tax professionals can no longer afford to rely solely on manual processes. Suvit is not just a tool—it’s a must-have for those looking to optimize their workflows, ensure compliance, and deliver impeccable service to their clients.

Join the growing community of professionals who trust Suvit for accurate data entry and seamless GST reconciliation. Why work harder when you can work smarter with Suvit?😉

Also Read: 3 Ways Suvit Can Help You Rotate Accounting Duties Among Your Team