Do you know services like Netflix, Spotify, or online gaming platforms have to pay taxes in India?

Yes, they do!

The answer lies in OIDAR GST Registration. OIDAR, short for Online Information Database Access and Retrieval, includes a broad spectrum of digital services provided with minimal human involvement.

Foreign companies offering OIDAR services to Indian consumers must comply with GST regulations.

If you're one of such service providers, this guide is your go-to resource for understanding OIDAR under GST, its registration process, and compliance obligations.

What are OIDAR Services?

Let’s first break down what OIDAR services mean under GST.

OIDAR refers to services delivered digitally over the internet with minimal human intervention.

Such services are highly relevant in today's tech-driven economy, especially as Indian consumers increasingly rely on digital platforms.

Examples of OIDAR Services

- Streaming platforms: Netflix, Amazon Prime, Spotify

- E-learning: Coursera, Udemy, Khan Academy

- Cloud storage: Google Drive, iCloud, Dropbox

- Online advertising services: Google Ads, Facebook Ads

- Gaming platforms: Xbox Live, PlayStation Network

- Downloadable Software and Applications: Adobe Creative Cloud, Microsoft Office 365, Antivirus Programs like Norton or McAfee, Mobile Apps

- Web Hosting and Maintenance: GoDaddy, Bluehost, AWS

- Services for Electronic Data Interchange (EDI): SAP EDI Solutions, TrueCommerce, IBM Sterling

- Search Engine Services: Google, Bing, SEMrush

GST compliance is required if your company serves Indian clients and fits into any of these categories.

Who Needs OIDAR GST Registration?

GST registration is not required for all OIDAR service providers. Let’s clarify the scenarios where registration is mandatory.

1. B2C Transactions (Business to Consumer)

If you're a foreign service provider delivering services directly to Indian consumers (individuals who are not registered under GST), you must register under GST. For example:

A US-based e-learning platform selling courses to Indian students. A global video-streaming platform offering subscriptions to Indian viewers.

GST is applicable, and as a foreign supplier, you are required to collect and remit GST to Indian authorities.

2. B2B Transactions (Business to Business)

When OIDAR services are provided to a GST-registered business in India, GST registration is not mandatory for the foreign service provider. Instead, the Indian business is responsible for paying GST under the reverse charge mechanism (RCM).

Documents Required for OIDAR GST Registration

To register under GST as a foreign service provider, you’ll need:

- Business Incorporation Certificate: Proof of the company's establishment in its home country.

- Tax Identification Number (TIN): Equivalent to an Indian PAN for foreign entities.

- Authorized Signatory’s Passport: A scanned copy of the passport.

- Bank Account Details: Valid international bank account details for transactions.

- Business Address Proof: Official proof of the company's business address.

Tip: Make sure all documents are scanned clearly and uploaded in the correct format to avoid processing delays.

Step-by-Step OIDAR GST Registration Process

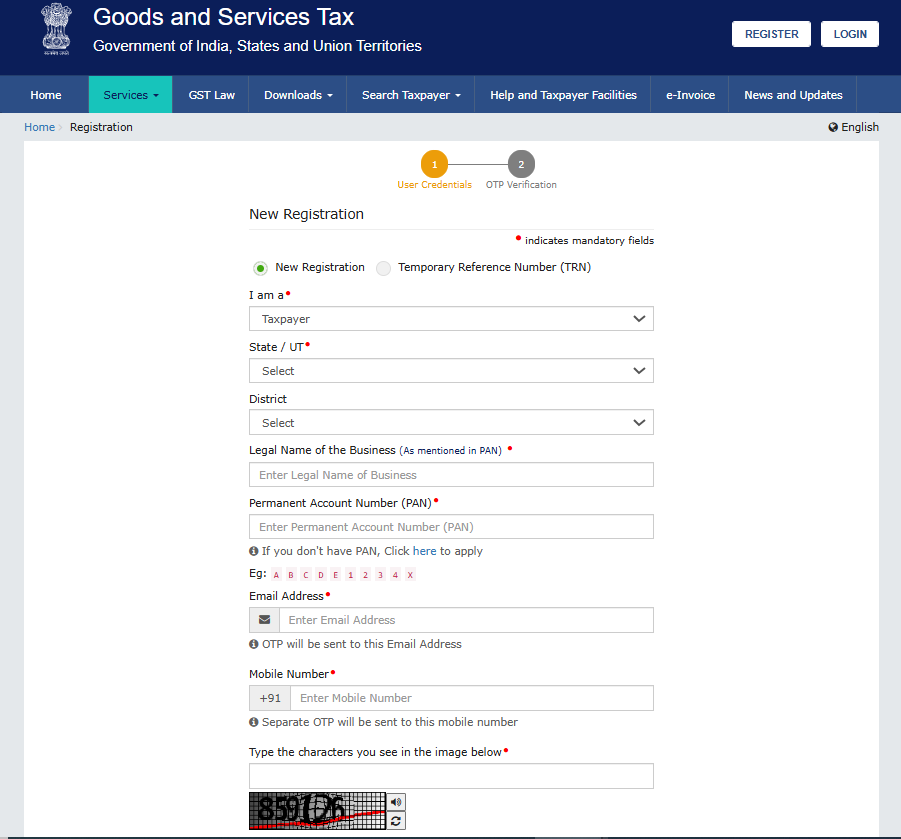

Step-1: Visit the official GST portal (www.gst.gov.in) and navigate to the registration section from the ‘Services’ on top menu.

Step-2: After selecting "New Registration," select "Taxpayer."

Step-3: Enter your basic details. Provide your legal name, PAN, email address, and mobile number. Enter OTP for confirmation, enter CAPTCHA, and then click the PROCEED button.

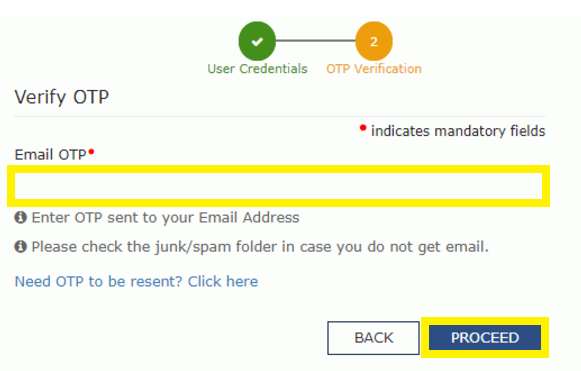

Step-4: After that, an OTP will be sent to your email and mobile device. Enter the OTP for verification of the details you provide.

Step-5: After verification, you’ll get an Application Reference Number (ARN) on your email and mobile. Click the "ARN" option to continue. Once validated, you’ll reach the OTP page.

Enter the OTPs sent to your phone and email. A 15-digit Temporary Reference Number (TRN) will then appear on the screen.

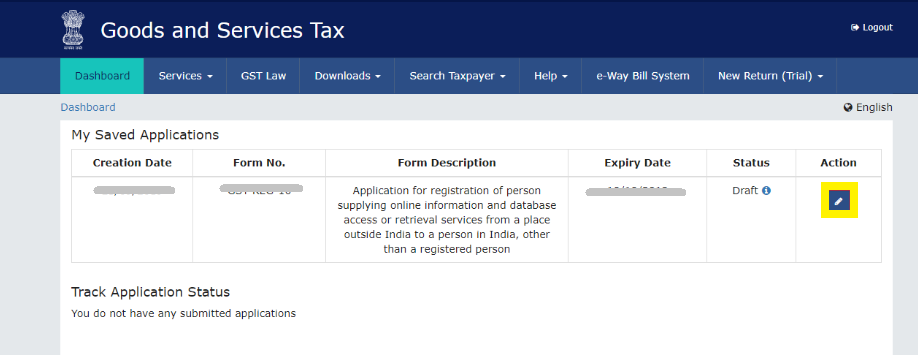

Step-6: Click "PROCEED" or log in using the Temporary Reference Number (TRN). Go to Services > Registration > New Registration, select the TRN option, and enter the number along with the captcha.

On the Verify OTP page, enter the OTP sent to your email and phone. You’ll see the "My Saved Application" page. Click the Edit icon under the Action column to continue.

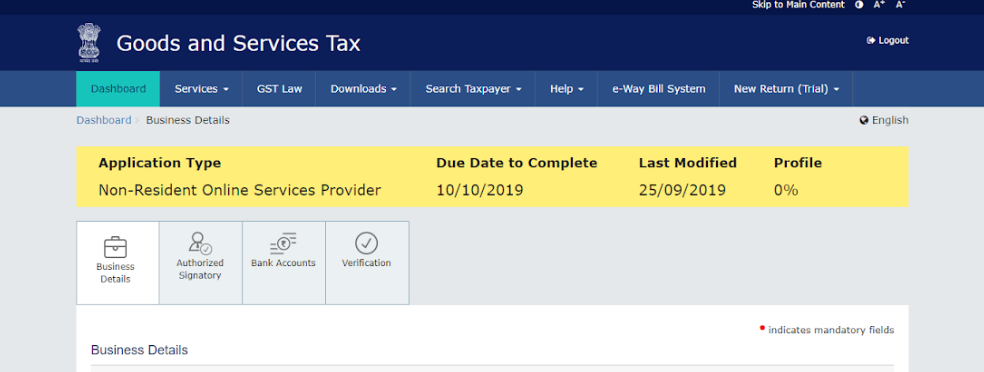

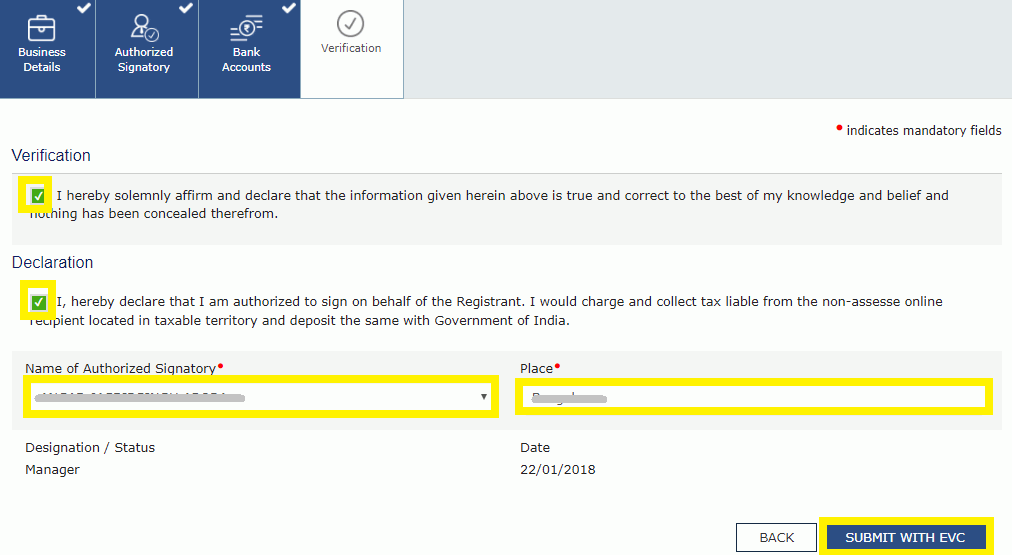

Step 7: Complete the GST registration form by entering your company's information, bank account information, and authorized signatory information.

Upload the necessary files, including proof of address, Aadhaar, and PAN.

You will receive a confirmation of successful submission as soon as the form and supporting documentation are turned in.

The GST department will process your application, and upon approval of your registration, you will be notified via email and SMS.

Note: Additional information such as the Type of Service and Place of Supply (PoS) must be provided during the registration process for OIDAR services. Make sure you have all the necessary documents and information before starting the registration process.

Practical Advice: Foreign service providers should hire a GST consultant for smooth navigation of Indian tax laws.

B2B vs. B2C Transactions in OIDAR Services

Understanding the difference between B2B and B2C transactions is important for compliance under** GST on OIDAR services.**

1. B2B Transactions

- Example: A foreign software company selling licenses to an Indian IT company.

- GST Implication: The Indian company (buyer) pays GST under the reverse charge mechanism.

- Service Provider’s Role: No GST registration is needed for foreign entities in this case.

2. B2C Transactions

- Example: A foreign gaming platform offering subscriptions directly to Indian gamers.

- GST Implication: The foreign service provider collects and remits GST.

- Service Provider’s Role: GST registration is mandatory.

Compliance Requirements & Return Filing After Registration

Once registered, here are your key compliance obligations:

1. Filing GST Returns

- Submit monthly GSTR-5 returns to report sales and tax collected.

- Filing is mandatory even if no transactions occur in a particular month.

2. Paying GST

- Deposit the GST collected to Indian authorities.

- Ensure timely payments to avoid penalties.

3. Record Maintenance

- Maintain detailed records of:

- Customer invoices

- Tax collected

- Transactions by location

Pro Tip: Using automated tools like Suvit can simplify return filing and record-keeping.

Consequences of Non-Compliance

Failure to follow GST regulations can have serious consequences:

- Penalties: Late registration or non-payment can attract heavy fines.

- Legal Actions: Persistent non-compliance may lead to business restrictions.

OIDAR GST Registration is a necessary step for foreign service providers catering to Indian customers. Compliance assures smooth operations, prevents penalties, and improves your credibility in the Indian market.

Managing GST can be complex, but AI-powered accounting tools like Suvit simplify the process. From automated GST reconciliation and return filing to GST health data and eligible ITC, Suvit saves you time and effort.

Make your OIDAR GST compliance stress-free with Suvit!