The GST system in India is like a car engine – every part has its role to play, and state codes are the pistons that keep the engine running smoothly.

If you’ve ever filed a GST return or created an invoice, you’ve already met these unsung heroes: GST state codes. But are you sure you’re using the right ones? With the 2025 updates in place, let’s make sure you’re up to speed.

In this blog, we’ll explore the GST state code list for 2025, understand its importance, and touch on GST jurisdictions.

What are GST State Codes?

GST state codes are two-digit numerical identifiers assigned to every Indian state and union territory under the Goods and Services Tax system.

These codes simplify tax processes by providing a standard reference for inter-state transactions and GST compliance.

They are part of the 15-digit GSTIN. The GSTIN's first two digits show the state in which the company is registered, followed by the 10-digit PAN number, one digit that indicates the number of registrations, and two digits that contain default and checksum values.

For instance, Maharashtra’s state code is 27, while Delhi’s is 07. Simple, right? But their utility goes beyond just numbers – they ensure that taxes are allocated to the correct state.

Complete GST State Code List (2025)

Below is the updated GST state code list for 2025:

| State | State code list under GST |

|---|---|

| Andaman & Nicobar Islands | 35 |

| Andhra Pradesh | 37 |

| Andhra Pradesh (Old) | 28 |

| Arunachal Pradesh | 12 |

| Assam | 18 |

| Bihar | 10 |

| Chandigarh | 4 |

| Chhattisgarh | 22 |

| Dadra And Nagar Haveli & Daman And Diu (Newly Merged UT) | 26* |

| Delhi | 7 |

| Goa | 30 |

| Gujarat | 24 |

| Haryana | 6 |

| Himachal Pradesh | 2 |

| Jammu & Kashmir | 1 |

| Jharkhand | 20 |

| Karnataka | 29 |

| Kerala | 32 |

| Ladakh | 38 |

| Lakshadweep | 31 |

| Madhya Pradesh | 23 |

| Maharashtra | 27 |

| Manipur | 14 |

| Meghalaya | 17 |

| Mizoram | 15 |

| Nagaland | 13 |

| Odisha | 21 |

| Puducherry | 34 |

| Punjab | 3 |

| Rajasthan | 8 |

| Sikkim | 11 |

| Tamil Nadu | 33 |

| Telangana | 36 |

| Tripura | 16 |

| Uttar Pradesh | 9 |

| Uttarakhand | 5 |

| West Bengal | 19 |

| Other Territory | 97 |

| Centre Jurisdiction | 99 |

| Other Country | 96 |

*Before January 26, 2020, the former UT of Daman and Diu's GST state code was 25.

Tip: Always double-check your state code during invoicing to avoid compliance headaches.

How are GST State Codes Used?

GST state codes play a vital role in several key activities:

-

GST Registration: When applying for GST, the correct state code ensures accurate recording of your business's location and district.

-

Invoice Generation: These codes are used to calculate the applicable tax liability for invoices.

-

Filing GST Returns: The state code in your GSTIN indicates where your business needs to file returns, simplifying the compliance process.

What is the Importance of GST State Codes

-

Accurate Tax Allocation: When you record a transaction, the GST state code ensures taxes go to the right state or union territory.

-

Hassle-Free Compliance: Proper state codes reduce errors in GST returns.

-

Ease in Cross-Border Transactions: For inter-state supplies, these codes are mandatory.

What is the GST Jurisdiction?

GST jurisdiction defines which tax authority – Central or State – manages your GST compliance. Each jurisdiction is divided into:

- Central GST (CGST) authorities.

- State GST (SGST) authorities.

Why is GST Jurisdiction Significant?

Understanding your GST jurisdiction is important for several reasons:

-

Compliance: It ensures adherence to local tax regulations. For example, a business in Gujarat that isn’t aware of its jurisdiction may miss important compliance deadlines.

-

Tax Assessment: Tax rules and rates can vary by region. Misapplying rates from the wrong state can lead to penalties.

-

Communication: Knowing your jurisdiction helps you connect with the appropriate tax authorities for assistance or queries.

-

Filing Returns: GST returns must align with your jurisdiction's specific guidelines to prevent errors or delays.

-

Dispute Resolution: In the event of tax disputes, identifying the correct jurisdiction ensures you approach the right authorities for resolution.

How is GST Jurisdiction Categorized?

GST jurisdiction is divided into two primary types:

-

Central Jurisdiction: Transactions between various states or union territories fall under this jurisdiction. For instance, if a manufacturer in Gujarat sells goods to a vendor in Madhya Pradesh, the transaction would fall under Central Jurisdiction and be subject to Integrated GST (IGST).

-

State Jurisdiction: This pertains to transactions conducted within the same state. For example, an eatery in Delhi catering only to local customers would fall under State Jurisdiction and be liable for State GST (SGST), dealing with Delhi's tax authorities.

Follow these Steps to Find Your GST Jurisdiction

Follow these steps to identify your GST jurisdiction:

-

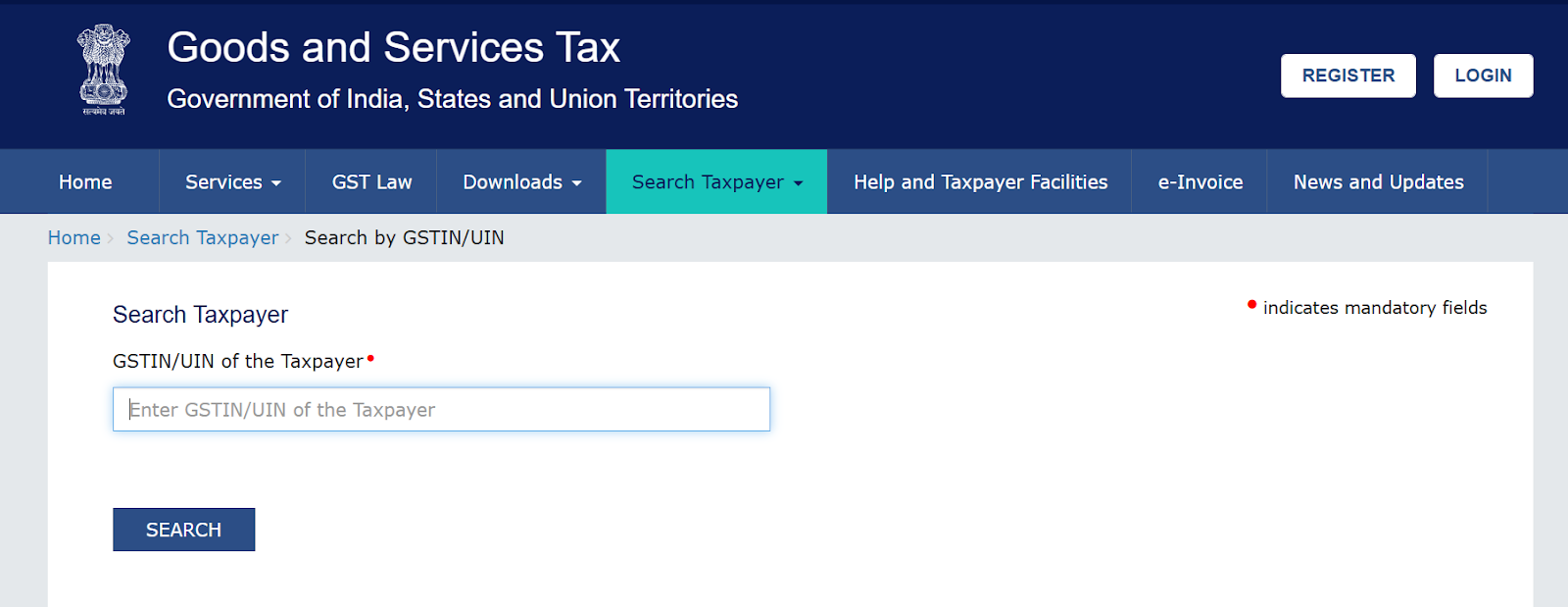

Go to the GST Portal: Visit www.gst.gov.in to access the official GST portal.

-

Navigate to 'Search Taxpayer': On the portal’s homepage, click on the "Search Taxpayer" option.

3. Search Using GSTIN or UIN: Enter your GSTIN (Goods and Services Tax Identification Number) or UIN (Unique Identification Number) in the search bar.

3. Search Using GSTIN or UIN: Enter your GSTIN (Goods and Services Tax Identification Number) or UIN (Unique Identification Number) in the search bar.

- Check Assigned Jurisdiction: The portal will display details of both your Central and State jurisdiction based on your registration details.

Pro Tip: Always verify your jurisdiction when updating your GST details or expanding your business to a new location.

Common Issues Related to GST State Codes and Jurisdictions

- Incorrect State Codes: Leads to tax misallocations and potential penalties.

- Jurisdictional Mismatches: Filing under the wrong jurisdiction can delay refunds.

Solution: Always validate your GST details before submitting returns.

FAQs on GST State Codes and Jurisdiction

Q1: What happens if the wrong state code is entered in GST returns?

Incorrect state codes can result in tax mismatches, leading to notices from tax authorities.

Q2: Can GST jurisdiction change for a business?

Yes, if your business address changes across states or zones, your jurisdiction will update accordingly.

Q3: How to update GST jurisdiction details?

Log in to the GST portal and file an amendment application under the ‘Core Fields’ section.

Work Within India’s Tax System

GST compliance can feel like a maze, but with the right tools and updated knowledge, it’s a manageable task. The GST state code list and jurisdiction details play a significant role in smooth tax operations.

Always stay updated and double-check your codes to avoid errors.

Bonus Tip: Consider using Suvit’s automated GST tools to simplify your invoicing, reconciliation, and reporting tasks.

Ready to simplify GST? Share this blog with your network to keep everyone updated!

Also Read: