Does this happen to you: Most days, you’re drowning in piles of invoices, receipts, and financial documents.

It’s the end of the month, and you’re spending countless hours manually entering data into spreadsheets—only to realize some errors will take even longer to fix. Frustrating, isn’t it?

This is where Accounting Data Entry Software comes to the rescue, offering an efficient, error-free, and automated approach to financial data management.

In this blog, we’ll explore the top features you should look for when selecting the right accounting data entry software for your business.

Whether a small business owner or a seasoned accountant, these features can transform how you handle financial data.

1. User-Friendly Interface

The first thing you’ll notice about excellent software is its simplicity. A user-friendly interface ensures that even non-technical users can navigate the tool effortlessly. Look for features like:

- Drag-and-Drop Functionality: Quickly upload files like invoices or receipts.

- Customizable Dashboards: Tailor the view to focus on what matters most—whether it’s expense tracking or revenue reports.

- Clean Navigation: Intuitive menus that reduce learning curves.

Pro Tip: Software with an easy onboarding process saves you time and gets your team productive faster.

2. Data Automation Capabilities

Say goodbye to manual data entry! Automation is the backbone of modern accounting software.

- Auto-Capture Data: Tools like OCR (Optical Character Recognition) extract information from receipts, invoices, and PDFs.

- Auto-Mapping: Automatically match data to predefined categories or ledgers.

- AI-Powered Predictions: Some tools predict and suggest entries based on historical data.

Example Use Case: A small business owner can scan receipts, and the software will automatically categorize them as travel, meals, or office expenses.

3. Integration with Other Tools

Seamless integration with other platforms can simplify your workflow.

Look for software that integrates with:

| Accounting Software | Banking Tools | Govt. Portal | | --- | --- | | Tally, Zoho Books | Online Banking | Income Tax | | Suvit | Payment Gateways | GSTIN |

With integration, data flows effortlessly between systems, reducing duplication and errors.

4. Multi-Format Support

Your business may deal with various data formats. The software should support:

- Excel Spreadsheets

- PDFs and Scanned Documents

- Email Attachments

Look for OCR capabilities that digitize paper documents and enable text recognition from images. This adds flexibility and ensures you can handle data from multiple sources.

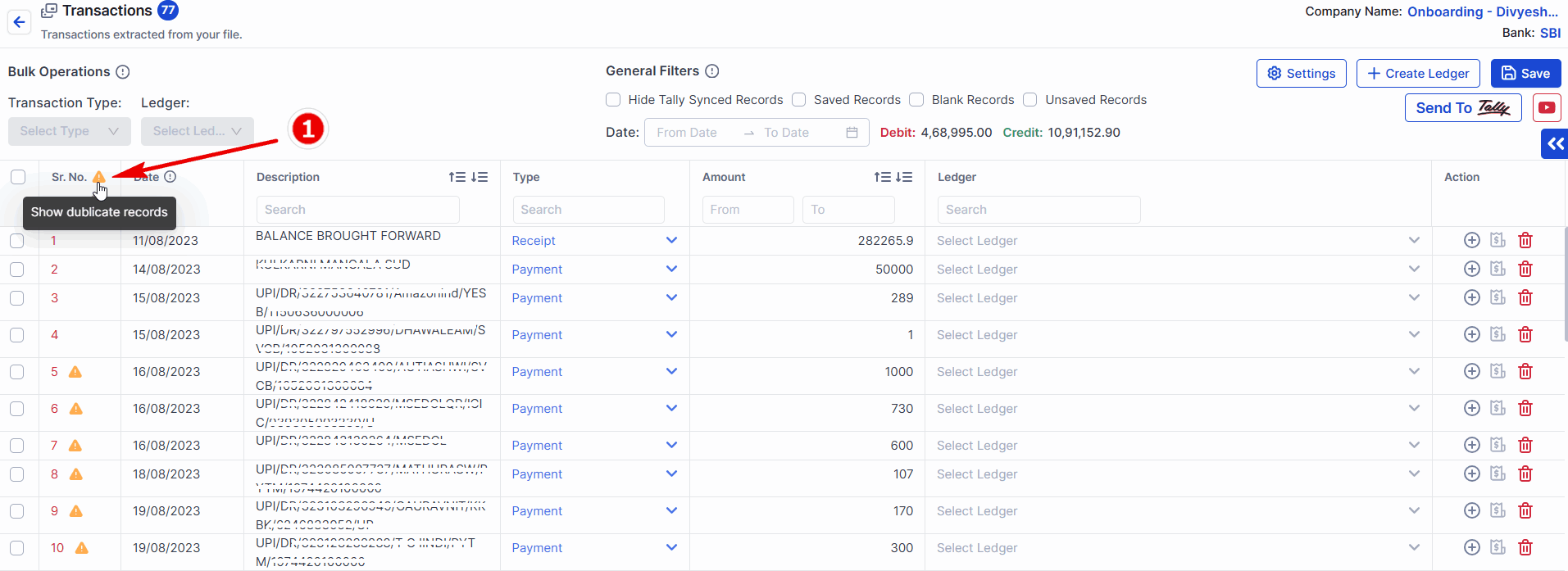

5. Accuracy and Error-Detection Features

Accuracy is essential in accounting.

Software with robust error-detection features can prevent costly mistakes. Features to look for include:

- Duplicate Entry Alerts: Warns you if data is entered twice.

- Validation Tools: Verifies data against predefined rules.

- Error Highlighting: Flags anomalies for review.

6. Customization and Scalability

Every business is unique, and your accounting software should adapt to your needs.

- Custom Templates: Create invoices, reports, or forms tailored to your brand.

- Flexible Workflows: Adjust workflows for specific industries or processes.

- Scalability: Ensure the software can grow with your business as data volumes increase.

7. Security and Compliance

Handling sensitive financial data requires top-notch security. Look for:

- Encryption: Protects data during storage and transfer.

- Role-Based Access: Limits access based on user roles.

- Compliance Features: Ensure adherence to local accounting laws and data privacy regulations.

Pro Tip: Check for certifications like ISO 27001 or GDPR compliance if your business handles international transactions.

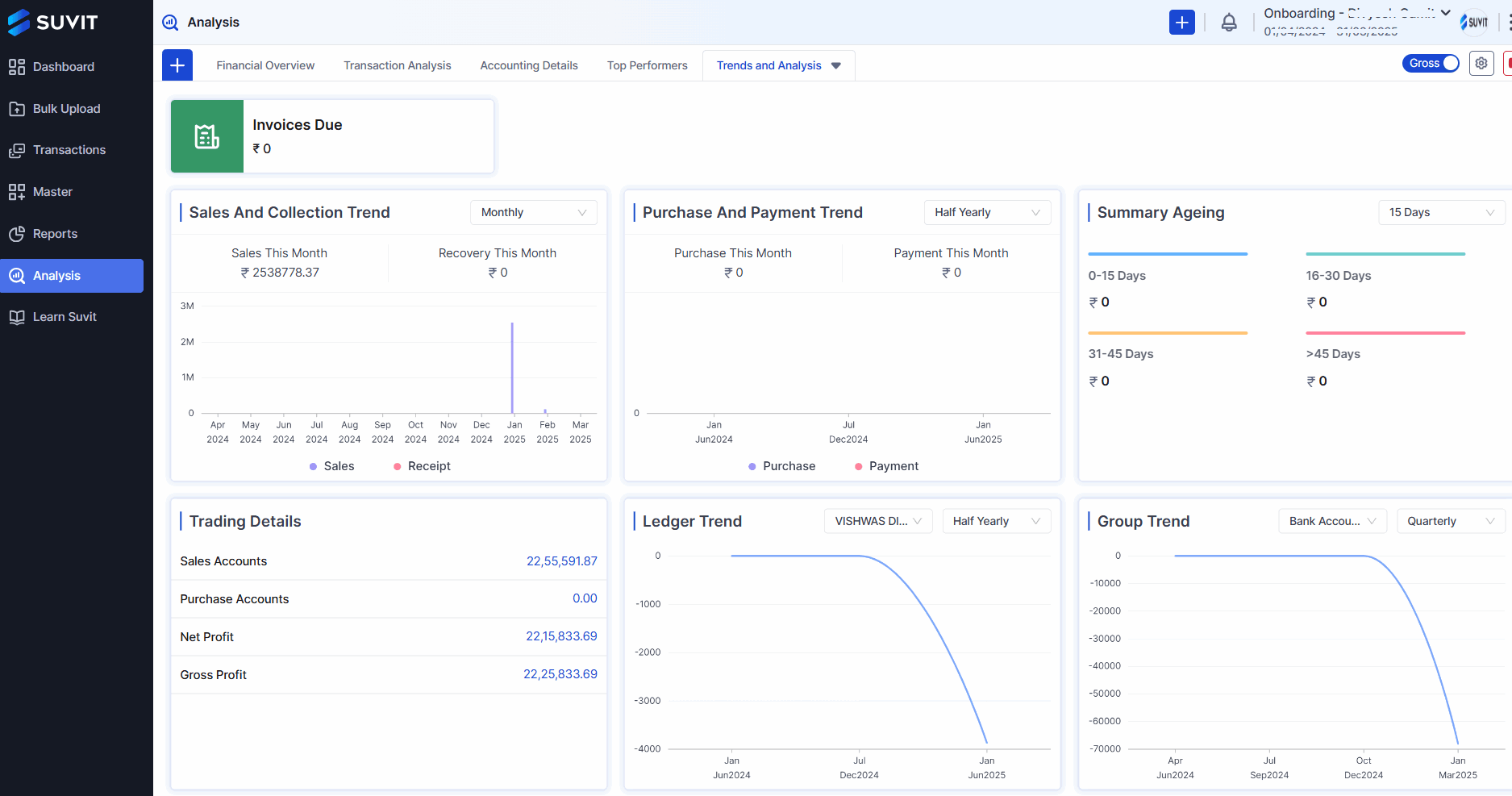

8. Real-Time Reporting and Analytics

Access to real-time insights can empower better decision-making.

- Dashboards: Get a snapshot of cash flow, revenue, and expenses.

- Custom Reports: Generate P&L statements, tax summaries, or performance analyses instantly.

- Forecasting Tools: Use historical data to predict trends.

9. Mobile and Cloud Access

Data accessibility while on the go is highly valuable.

Cloud-based software offers:

- Anywhere Access: Use mobile apps or web platforms to manage data remotely.

- Device Syncing: Ensure updates reflect across all devices instantly.

- Offline Mode: Work without an internet connection, syncing when online.

10. Customer Support and Training

Good software comes with great support. Look for:

- Customer Support: Ensure help is available when you need it.

- Training Resources: Tutorials, webinars, and user manuals to get started.

- Community Forums: Platforms where users share tips and solutions.

Fun Fact: Companies that invest in training see a 60% faster software adoption rate.

Start with Free Accounting Data Entry Software

The right Accounting Data Entry Software can save time, reduce errors, and provide actionable insights to grow your business. By focusing on features like automation, integration, and security, you can select software that aligns with your needs and future goals.

Suvit is a useful option to consider—it offers an intuitive platform with powerful automation features to streamline your accounting tasks. Plus, you can start with a free trial of Suvit to explore how it can simplify your financial management before committing.

Ready to simplify your accounting processes? Start exploring your options with Suvit and discover how our tools can transform your financial management today.