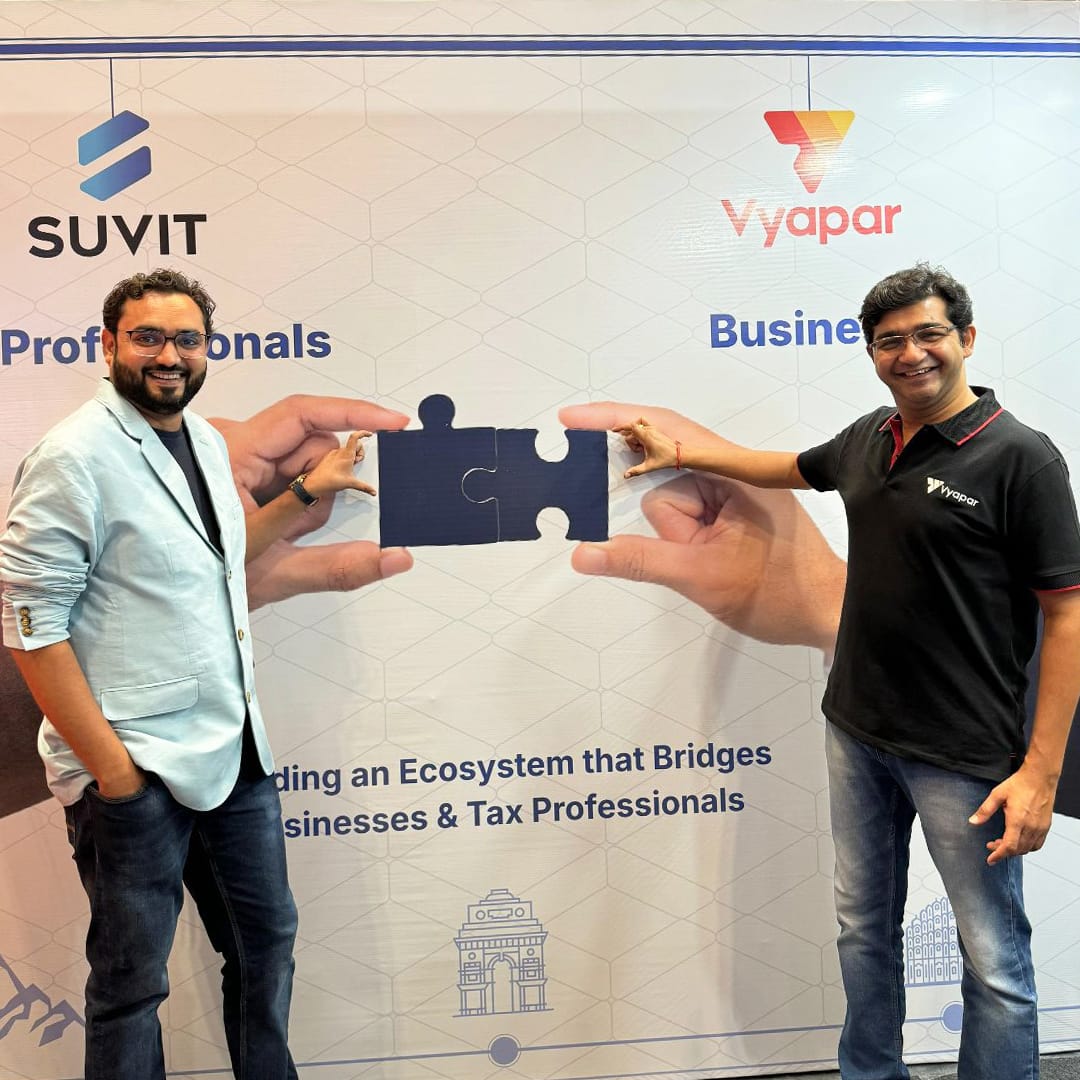

Exciting news for the B2B FinTech space—Vyapar and Suvit are teaming up to bring some much-needed change to India’s MSMEs and tax professionals!

We all know how vital India’s MSME sector is to our economy, but let’s face it, these businesses have their fair share of challenges. From juggling complex tax rules to handling everyday financial tasks, they often have a lot on their plate.

That’s where Vyapar and Suvit come in. This partnership is set to make life a whole lot easier for MSMEs, offering tools that simplify financial management and make tax compliance a breeze.

Why This Partnership Matters for MSMEs

Vyapar and Suvit teaming up isn’t just another business deal—it’s exactly what small businesses across India have been waiting for.

Let’s be real: MSMEs often find themselves strapped for resources, making advanced financial tools feel like a distant dream. That’s where Vyapar has already made a big impact with its user-friendly business management software, helping these businesses stay on top of things.

Then there’s Suvit, leading the charge in making pre-accounting tasks a breeze with its tech-driven platform.

Now, with these two joining forces, we’re about to roll out an integrated solution that’s not just powerful but also super easy to use.

Let's Get to Know Vyapar's Role

Vyapar has earned the trust of Indian MSMEs for a good reason—it’s all about keeping things simple and affordable. Whether it’s billing, invoicing, inventory tracking, or expense management, Vyapar got it covered with its all-in-one platform.

But what really makes Vyapar stand out is how well it understands the unique hurdles small businesses in India face. The software isn’t just a generic tool; it’s designed with these specific challenges in mind. With features like GST-compliant invoicing and automated tax filing, Vyapar takes a lot of the pressure off business owners, making their lives a whole lot easier.

What Makes Suvit Stand Out

Suvit’s superpower is turning time-consuming tasks into quick and easy ones with its AI-driven technology. Already recognized by ICAI, Suvit automates things like GST reconciliation and manual data entries and even provides custom analytics—everything an MSME needs to stay on top of those tricky regulatory requirements.

Now, by teaming up with Vyapar, Suvit is ready to take its game to the next level, reaching even more businesses with its powerful solutions.

What This Partnership Means for MSMEs

The Vyapar-Suvit partnership is poised to deliver a unified platform where MSMEs can manage both their financial operations and tax compliance seamlessly. Integrating Vyapar’s business management tools with Suvit’s tax compliance solutions means that small businesses no longer have to juggle multiple platforms.

This not only saves time but also reduces the likelihood of errors—something that can be costly for businesses operating on thin margins.

Here’s what MSMEs can look forward to:

- Ease of Use: A single platform that covers all your financial and compliance needs.

- Cost Efficiency: An affordable solution that still packs all the essential features.

- Peace of Mind: Automated tax compliance to keep your business on the right track.

How This Partnership is a Win for Tax Professionals

Tax professionals stand to gain significantly from the Vyapar-Suvit partnership as well. The integrated platform allows them to manage multiple clients with greater efficiency, thanks to automation and streamlined processes.

This is particularly important in a country like India, where tax regulations are constantly evolving. By reducing the time spent on routine tasks, tax professionals can focus on offering more value-added services to their clients, such as strategic financial advice and planning.

How the Founders See the Future

Sumit Agrawal, Founder and CEO of Vyapar, shares his excitement: “Together we aim to unite taxation experts and taxpayers on a single platform, bridging the gap between the two financial powerhouses and enhancing efficiency. By integrating with Suvit, we can automate data sharing with CAs and tax professionals, significantly reducing the time and effort required for compliance tasks.”

Ankit Virani, Founder of Suvit, adds: “Suvit helps tax professionals save up to 10x time by automating transaction entries and GST processes, allowing them to focus on more strategic activities. This integration will enable them to access real-time data from their MSME clients, file returns on time, and avoid penalties.”

The Impact of Vyapar’s Investment in Suvit

Vyapar’s investment in Suvit is set to create a powerful unified platform for MSMEs and tax professionals. This collaboration will streamline processes, enabling Vyapar users to easily share accounting data with their tax professionals, improving overall efficiency from billing to tax filing.

Suvit’s Strategic Plans

With Vyapar's support, Suvit plans to boost its engineering and sales capabilities. The investment will accelerate development and introduce new features, including:

- GST Automation: Simplifying GST compliance.

- Advanced Analytics: Providing deeper business insights.

- Practice Management: Enhancing tools for tax professionals.

These advancements will drive efficiency and growth, setting a new standard in the B2B FinTech space.

Read more about our founder’s journey here!