Have you ever wondered how businesses keep track of every penny coming in and going out? The secret lies in meticulous record-keeping, and at the heart of it all is the humble yet powerful voucher.

While vouchers may sound like a relic from the past, they remain a cornerstone of accurate accounting practices.

In this blog, we'll break down everything you need to know about different types of vouchers and how they can help you stay on top of your business finances.

Whether you're a seasoned accountant or just starting your financial journey, this guide will empower you to handle voucher recording with confidence. Ready? Let’s conquer those papers without the tears!

What Are Vouchers and Why Are They Important?

Vouchers are official documents that record and verify financial transactions within a business. They provide a clear audit trail, ensuring accountability and transparency.

From making payments to receiving income, vouchers capture every financial activity, making them essential for:

- Maintaining accurate financial records

- Simplifying audits and tax filings

- Preventing errors and fraud

Now, let’s explore the four main types of vouchers and their roles in your financial processes.

Demystifying Voucher Types

A. Debit Voucher (Payment Voucher)

Purpose: A debit voucher records every cash or bank payment made by a business. It serves as formal proof of the transaction and ensures accurate accounting.

Key Components:

- Date: The payment date.

- Voucher Number: A unique identifier for tracking.

- Payee: The recipient’s name (e.g., supplier, vendor, employee).

- Particulars: A brief description of the payment purpose.

- Amount: The exact sum paid.

- Account Debited: The expense or asset account affected.

- Authorized Signature: Approval from an authorized personnel.

Example Scenario:

Your company, XYZ Clothing, pays office rent of ₹10,000. The debit voucher includes:

- Date: Payment date

- Voucher Number: Unique identifier

- Payee: Landlord’s name

- Particulars: Rent for [Month]

- Amount: ₹10,000

- Account Debited: Rent Expense

- Authorized Signature: Manager’s signature

This voucher documents the payment and updates the "Rent Expense" account in your books.

B. Credit Voucher (Receipt Voucher)

Purpose: A credit voucher records incoming funds received by the business, providing a clear trail for every receipt.

Key Components:

- Date: The receipt date.

- Voucher Number: Unique identifier for tracking.

- Payer: The party making the payment (e.g., customer, client).

- Particulars: A brief description of the receipt purpose.

- Amount: The sum received.

- Account Credited: The income or asset account affected.

- Authorized Signature: Acknowledgement from an authorized personnel.

Example Scenario: XYZ Clothing sells a shirt for ₹500. The credit voucher includes:

- Date: Receipt date

- Voucher Number: Unique identifier

- Payer: Customer’s name

- Particulars: Sale of Shirt

- Amount: ₹500

- Account Credited: Sales

- Authorized Signature: Sales representative’s signature

This voucher records the sale and updates the "Sales" account in your records.

C. Supporting Voucher

Purpose: Supporting vouchers provide additional evidence for transactions recorded in debit or credit vouchers, ensuring legitimacy and accuracy.

Examples:

- Invoices: Details of purchased goods or services.

- Bills: Charges for utilities or rent.

- Receipts: Proof of payment received.

How It Works: Supporting vouchers are linked to primary vouchers using reference numbers. For instance, an invoice for office supplies might be attached to the corresponding debit voucher, enabling easy verification during audits.

D. Non-Cash Voucher (Journal Voucher)

Purpose: Non-cash vouchers record transactions that don’t involve immediate cash flow, such as credit purchases or internal transfers.

Key Components:

- Date: Transaction date.

- Voucher Number: Unique identifier.

- Accounts Involved: Debited and credited accounts.

- Amount: Monetary value of the transaction.

- Description: Explanation of the activity.

Example Scenario: XYZ Clothing purchases inventory worth ₹20,000 on credit. The non-cash voucher includes:

- Date: Transaction date

- Voucher Number: Unique identifier

- Accounts Involved: “Inventory” (debited) and “Accounts Payable” (credited)

- Amount: ₹20,000

- Description: Purchase of inventory on credit

This voucher updates the "Inventory" and "Accounts Payable" accounts without involving cash.

Deep Dive: Components of a Voucher

Standardization for Accuracy:

Maintaining standardized voucher formats across your business transactions is crucial for ensuring accurate and efficient record-keeping. Consistency allows for easier data entry, minimizes errors, and facilitates smooth financial reporting.

Imagine a scenario where vouchers come in various layouts and lack essential information. This can lead to confusion, wasted time deciphering details, and potential mistakes in recording transactions.

By implementing a standardized voucher format, you ensure all necessary information is captured consistently. This includes elements like:

- Date: The date of the transaction.

- Voucher Number: A unique identifier is assigned to each voucher for easy tracking and reference.

- Payee/Payer: The name of the party receiving or making the payment.

- Particulars: A brief description of the reason for the transaction.

- Amount: The monetary value involved in the transaction.

- Debit/Credit Accounts: The specific accounts in the general ledger are affected by the transaction (debited for expenses and asset increases, credited for income and asset decreases).

- Authorized Signature: The signature of a designated person who approves the transaction.

These standardized components ensure clear and concise communication of all vital details related to a financial transaction.

Benefits of Pre-Numbered Vouchers:

Taking standardization a step further, consider using pre-numbered vouchers. This adds another layer of internal control to your financial system. Here's how:

- Prevents Duplication: Pre-numbered vouchers eliminate the risk of creating duplicate vouchers for the same transaction, which could lead to inaccurate accounting records.

- Enhanced Tracking: Each unique number allows for easier tracking and retrieval of specific vouchers when needed for audits or reference purposes.

- Reduced Fraud Risk: Pre-numbered vouchers make it more difficult to introduce fraudulent transactions into the system, as any missing or unaccounted-for numbers would raise red flags.

Implementing standardized and pre-numbered vouchers fosters a more organized and secure financial management system for your business.

The Power of Proper Voucher Recording

Meticulous voucher recording is the backbone of creating robust and reliable financial statements. These statements, which summarize your business's financial health, are crucial for various stakeholders, including investors, creditors, and tax authorities.

When voucher recording is done accurately and consistently, it translates into several-

Significant Benefits:

-

Improved Financial Control: Proper voucher recording provides a clear and detailed picture of all your financial transactions. This empowers you to make informed financial decisions, track expenses effectively, and identify areas for potential cost savings.

-

Streamlined Audits: Audits are a necessary process to ensure the accuracy of your financial statements. Having a well-organized voucher system with complete and accurate records makes the audit process smoother and less time-consuming. Auditors can easily trace transactions and verify their legitimacy.

-

Easier Tax Filing: Accurate voucher records simplify tax preparation and filing. Vouchers serve as documented proof of income and expenses, allowing you to claim legitimate deductions and avoid potential tax errors or penalties.

The Flip Side: Consequences of Improper Recording

On the other hand, neglecting proper voucher recording can lead to a cascade of negative consequences:

-

Errors and Discrepancies: Inaccurate or incomplete voucher records can introduce errors and inconsistencies in your financial statements. This can paint a distorted picture of your business's financial performance and mislead stakeholders.

-

Increased Risk of Fraud: Careless voucher recording creates an environment where fraudulent activities can go undetected. Without proper documentation, tracing unauthorized transactions becomes difficult.

-

Penalties and Fines: Inaccuracies in financial statements due to improper voucher recording can trigger penalties and fines from tax authorities. Auditors may also flag discrepancies, leading to additional costs and delays.

By prioritizing accurate voucher recording, you safeguard your business from these pitfalls and ensure a strong foundation for informed decision-making and financial stability.

Streamlining Voucher Creation for Payment, Receipt and Contra Transaction with Suvit

We've covered the importance of vouchers and their components, but creating them doesn't have to be a chore. Suvit takes the complexity out of voucher recording with its intuitive and user-friendly interface.

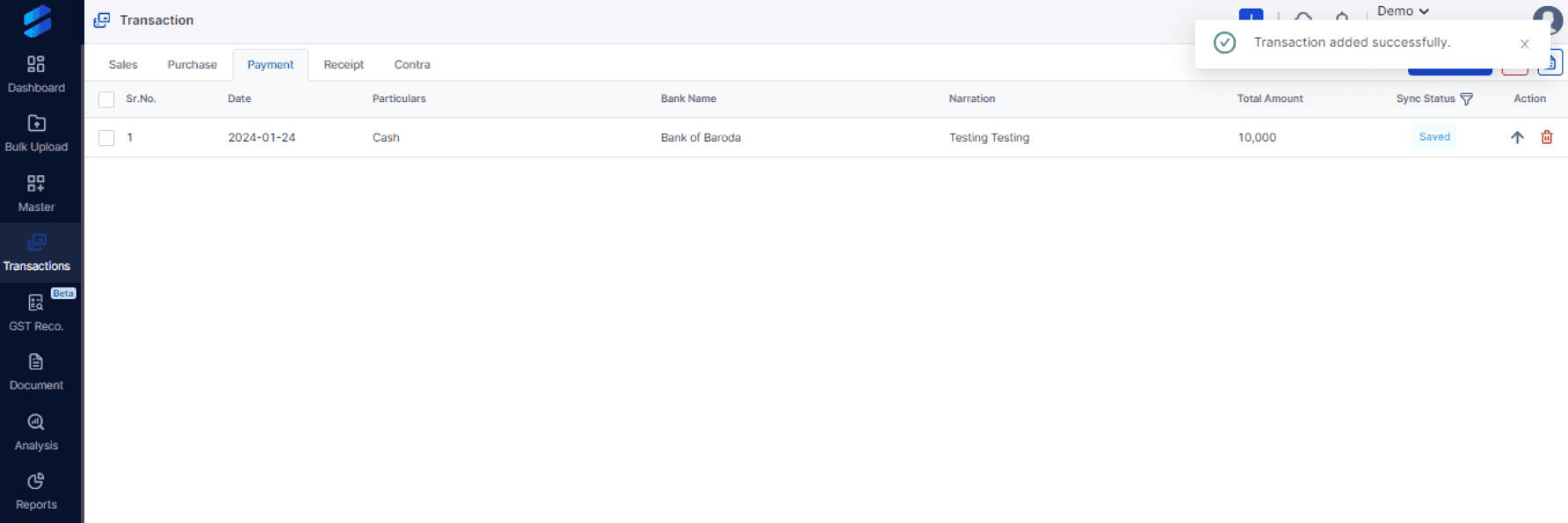

Suvit offers modules specifically designed for manual voucher creation, making the process as simple as 1-2-3. Here's a quick walkthrough:

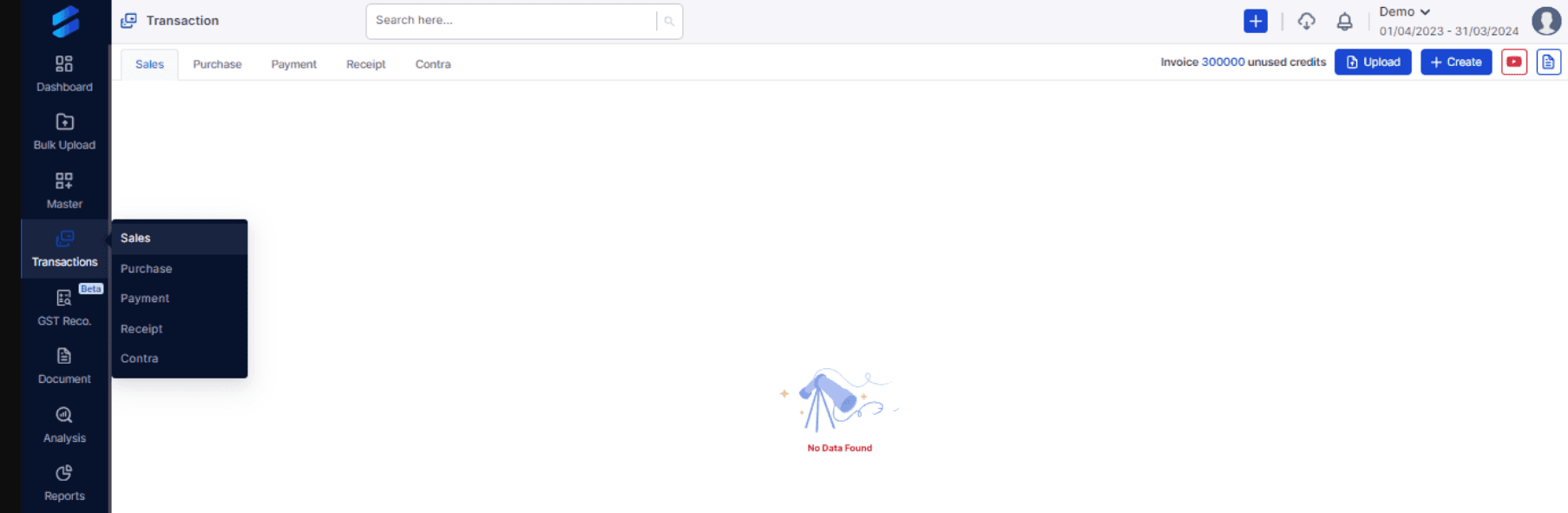

- Locate the "Transaction" section. Within this section, you'll find modules dedicated to creating various vouchers manually.

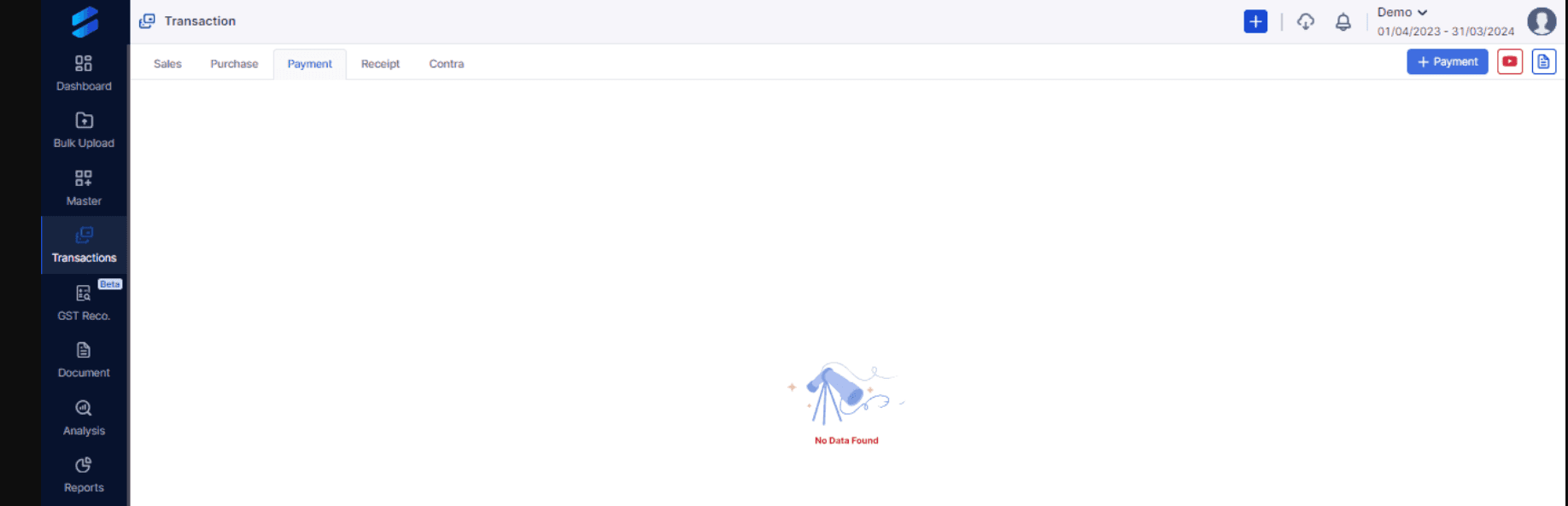

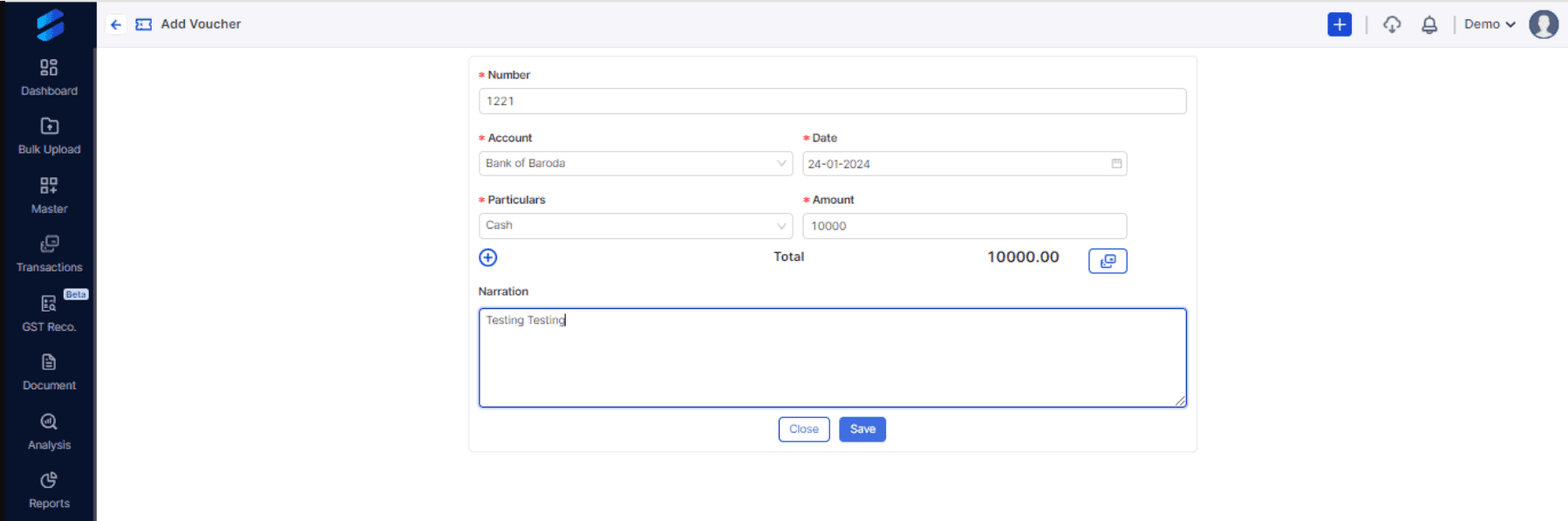

- Find the appropriate voucher type (e.g., "Payment") and start filling in the required data fields. These fields include the date, payee information, amount, account details, a brief description of the transaction, etc.

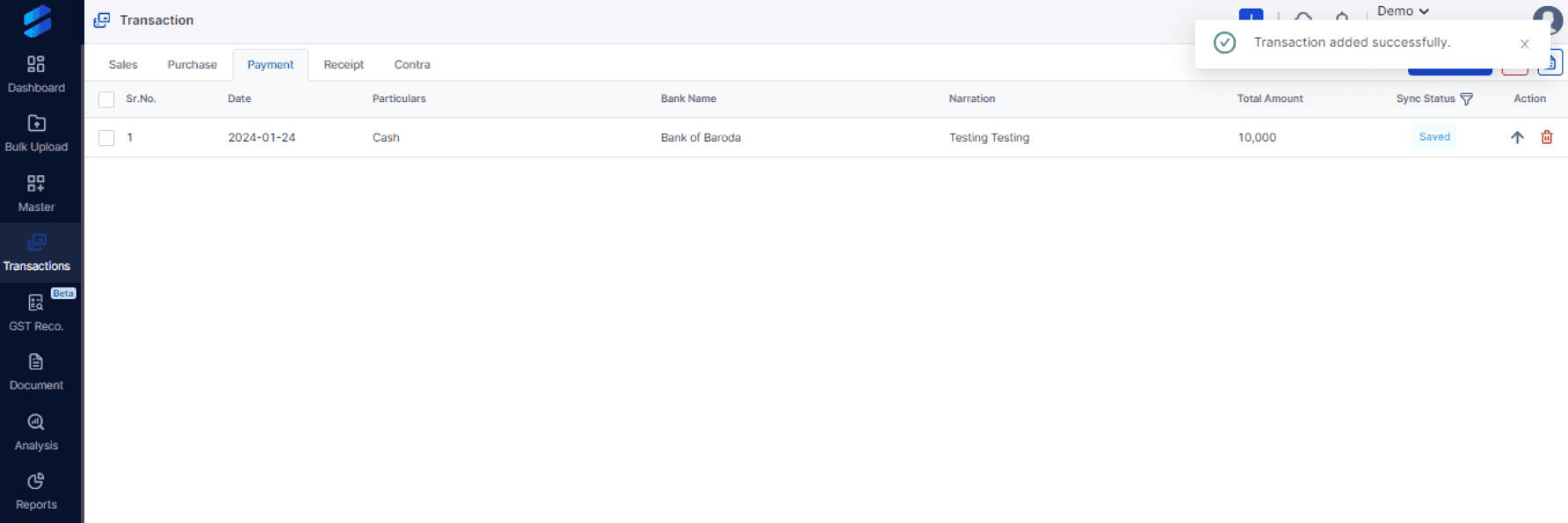

- Once you've entered all the necessary details, hit the "Save" button. This will store your voucher entry within Suvit.

- After saving, your voucher will be displayed as "Verified," indicating it's ready for synchronization with Tally.

- Ready to integrate your voucher into your accounting system? Simply click the handy "arrow button" displayed next to the voucher. This will seamlessly send the voucher entry to your Tally software.

Also Check:

Suvit's user-friendly interface makes manual voucher creation a breeze. No more wrestling with complex formats or struggling to remember obscure codes. With Suvit, voucher recording becomes an efficient and error-free task!