Welcome to our in-depth guide to various types of accounting software. If you have ever wondered how different businesses keep their numbers in check, this guide is for you.

Here, we explore software solutions designed for every business size—from small startups to large corporations.

Let’s see how the right accounting software can streamline your financial operations.

Understanding Accounting Software

What Is Accounting Software?

Accounting software is a tool that helps businesses record, manage, and analyze financial data. It simplifies tasks such as invoicing, payroll, tax calculations, and budgeting. In this digital world, various types of accounting software are tailored to meet specific business needs.

Key Benefits

Using various types of accounting software has many advantages:

- Accuracy: Automated calculations reduce human error.

- Efficiency: Fast processing saves time.

- Real-Time Reporting: Up-to-date insights help make informed decisions.

- Scalability: Software solutions grow with your business.

These benefits make accounting software a must-have for any business aiming to improve its financial management.

Classification of Accounting Software

By Deployment Model

Various types of accounting software can be classified based on how they are deployed:

- Cloud-Based: Accessible online, offering real-time updates and remote access.

- On-Premise: Hosted on local servers, offering complete control over data management.

- Hybrid Solutions: Combine cloud and on-premise features for flexibility.

By Business Size and Complexity

Different businesses have different needs. Here’s how various types of accounting software are categorized by business size:

- Small Business Solutions: Focus on simplicity and affordability.

- Medium Enterprise Software: Offer scalability with integration options.

- Enterprise-Level Systems: Provide complex, customizable features for large organizations.

In-Depth Analysis by Enterprise Size

Small Enterprises

Small businesses often have simple financial needs. They require accounting software that is:

- User-Friendly: Easy for non-accountants to navigate.

- Affordable: Budget-friendly pricing models.

- Essential Features: Basic bookkeeping, invoicing, and reporting.

For instance, software like Vyapar and Xero are popular choices among small businesses. They offer straightforward interfaces and essential functions without overwhelming the user.

Medium Enterprises

Medium-sized businesses require a balance between functionality and cost. Accounting software for medium enterprises typically includes:

- Scalable Modules: As your business grows, the software can expand its capabilities.

- Integration Capabilities: Easily connect with other business tools like CRM and ERP systems.

- Advanced Reporting: Detailed insights that support strategic decision-making.

Solutions such as Sage Intacct and FreshBooks cater to these needs, ensuring medium enterprises can manage finances efficiently while planning for growth.

Large Enterprises

Large corporations need robust and comprehensive systems. Various types of accounting software for large enterprises are designed to handle:

- Complex Workflows: Multi-department and multi-location operations.

- Customization: Tailored features to meet specific industry requirements.

- Integration with ERP Systems: Seamless connectivity with broader enterprise systems.

- High Security & Compliance: Strict standards to meet legal and regulatory requirements.

Software like Oracle NetSuite and SAP are favored in this space, offering a level of sophistication that large businesses demand.

Comparison Table: Accounting Software by Business Size

Below is a comparison table that summarizes key features of various types of accounting software based on business size:

| Business Size | Essential Features | Example Software | Pros | Cons | | --- | --- | --- | | Small Enterprises | Basic bookkeeping, invoicing, simple reporting | Vyapar, Xero | Easy to use, cost-effective | Limited advanced features | | Medium Enterprises | Scalable modules, integration capabilities, advanced reporting | Sage Intacct, FreshBooks | Scalable, flexible, mid-range pricing | Can become complex as needs grow | | Large Enterprises | Comprehensive modules, ERP integration, high security | Oracle NetSuite, SAP ERP | Highly customizable, robust compliance | Higher cost, longer implementation time |

This table makes it easier to compare the various types of accounting software available, so you can choose one that best fits your business needs.

Core Features and Functionalities Across the Board

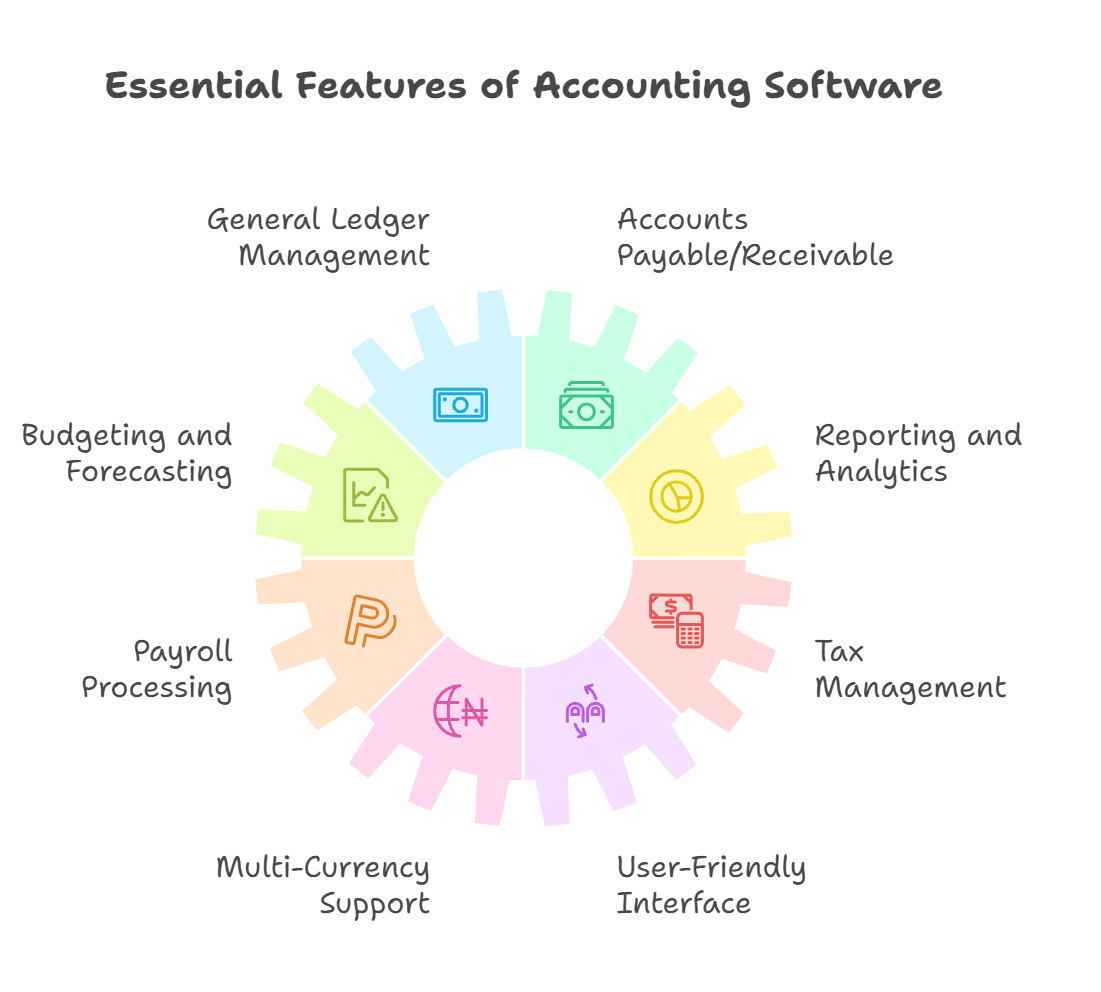

No matter the size of your business, many accounting software generally offer the following core features:

- General Ledger Management: The backbone of your financial system.

- Accounts Payable/Receivable: Manage bills and incoming payments.

- Budgeting and Forecasting: Plan your financial future.

- Reporting and Analytics: Gain insights through detailed reports.

- Payroll Processing: Automate employee payments.

- Tax Management: Simplify tax calculations and compliance.

- Multi-Currency Support: Essential for global businesses.

- User-Friendly Interface: Ensure ease of use for all employees.

Key Considerations When Choosing Accounting Software

When selecting from various types of accounting software, keep these points in mind:

- Cost vs. Benefit: Analyze your budget and the software’s ROI.

- Ease of Use: Choose software with an intuitive interface that needs little to no training.

- Integration: Ensure it works well with other tools you use.

- Scalability: Opt for software that expands alongside your business.

- Customer Support: Reliable support is essential for smooth operations.

- Security & Compliance: Confirm that the software meets industry standards and legal requirements.

These considerations will help you narrow down the options and choose the best solution for your enterprise.

Emerging Trends and Future Directions

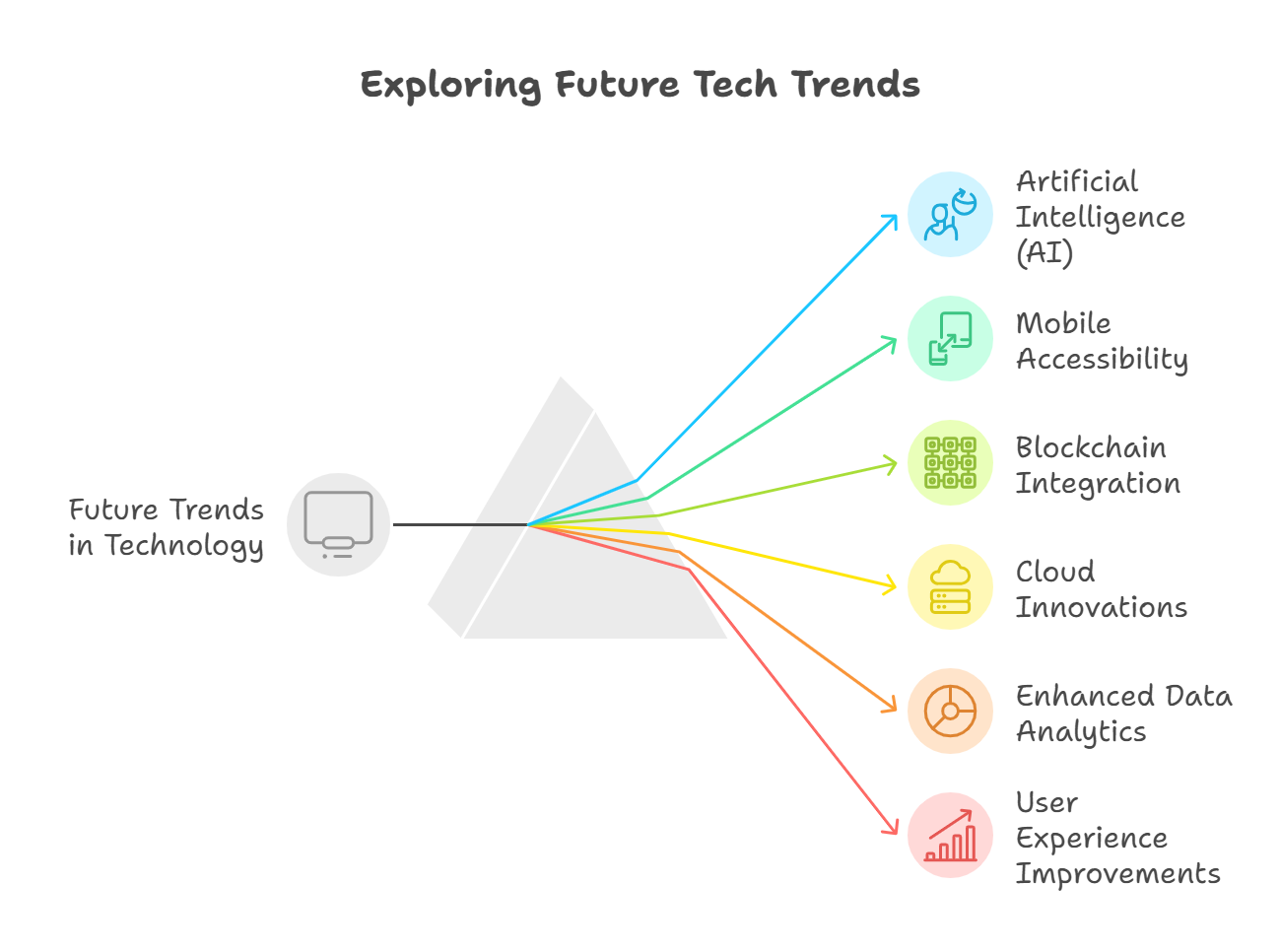

The landscape for types of accounting software is constantly growing. Here are some trends to watch:

- Artificial Intelligence (AI): AI-powered features for predictive analytics and automated data entry.

- Mobile Accessibility: More solutions are optimized for smartphones and tablets.

- Blockchain Integration: Enhances security and transparency in transactions.

- Cloud Innovations: Even more powerful and flexible cloud-based solutions.

- Enhanced Data Analytics: Advanced tools for better financial insights.

- User Experience Improvements: Simplified designs to make navigation even easier.

These trends suggest that the future of accounting software will be more intuitive, secure, and integrated with other business systems.

Case Studies and Examples

To illustrate the impact of various types of accounting software, let’s consider a few examples:

Small Enterprise Success

A small retail business adopted a simple cloud-based accounting solution. The software streamlined daily transactions and reduced errors. The owner saved time and could focus on growth rather than manual bookkeeping.

Medium Enterprise Transformation

A medium-sized manufacturing company switched to an accounting system with scalable modules. The software was integrated with their existing ERP and CRM systems to improve data accuracy and provide real-time financial insights, aiding in better decision-making.

Large Enterprise Efficiency

A large multinational corporation implemented an enterprise-level accounting system. The comprehensive solution manages complex workflows across multiple countries. With enhanced security and custom reporting, the company achieved greater regulatory compliance and operational efficiency.

These case studies show how various types of accounting software can be tailored to meet the diverse needs of businesses.

Accounting But With Automation

Experience the future of financial management with Suvit. Suvit is an accounting automation tool that easily integrates with Tally.

Its automation stands out by streamlining transaction processing, document management, client management, and delivering real-time insights—all tailored for businesses of any size.

Why Choose Suvit?

- Automated Processes: Minimize manual work and reduce errors.

- Real-Time Reporting: Stay updated with instant financial insights.

- Custom Dashboards: Personalize your view to track what matters most.

- Seamless Integration: Easily connect with your existing systems.

Ready to revolutionize your accounting? Try Suvit for free for a week and see the impact for yourself!