Vyapar TaxOne’s Banking Module is a powerful tool designed to enhance the management of bank statements and streamline financial workflows. This guide provides an in-depth look at its features, functionalities, and benefits to help you maximize its potential.

Importing Bank Statements with Ease

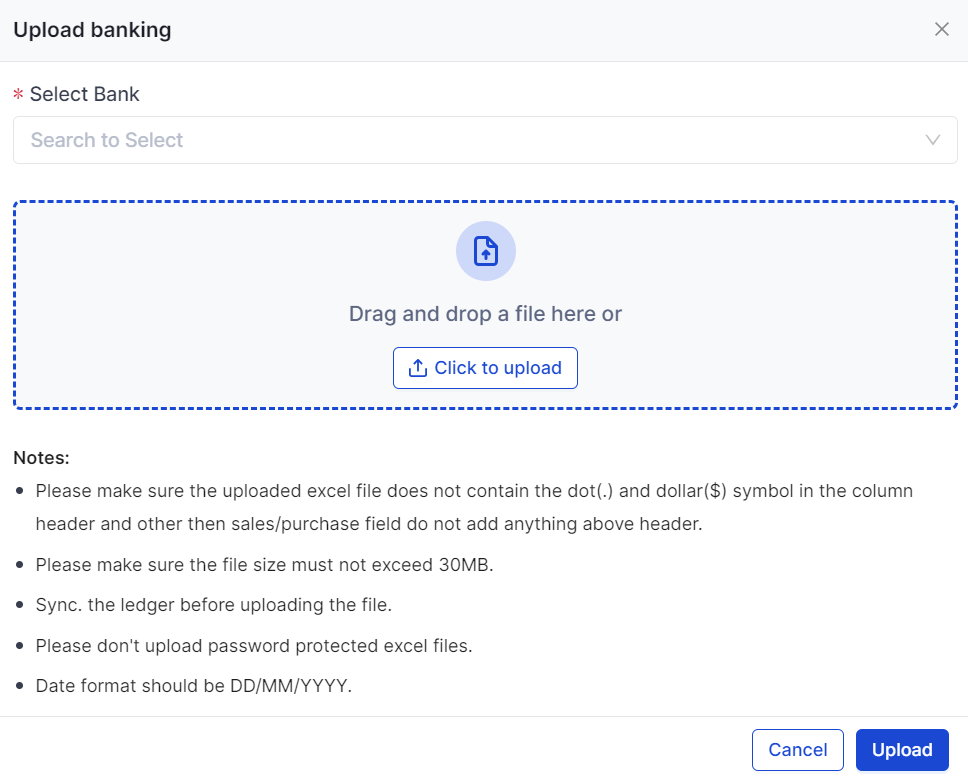

The first step in using Vyapar TaxOne's Banking Module is importing bank statements. Users can upload various file formats, including original PDFs, scanned PDFs, and Excel sheets.

Once uploaded, the system assigns a "Processing" status to the statement, indicating that the data is being analyzed. Vyapar TaxOne's robust AI-powered system efficiently handles this task, saving valuable time.

Common Scenarios:

- Duplicate Documents: Vyapar TaxOne identifies and flags duplicate bank statements, preventing redundancy.

- Password-Protected PDFs: If a document is password-protected, users are prompted to enter the password to proceed.

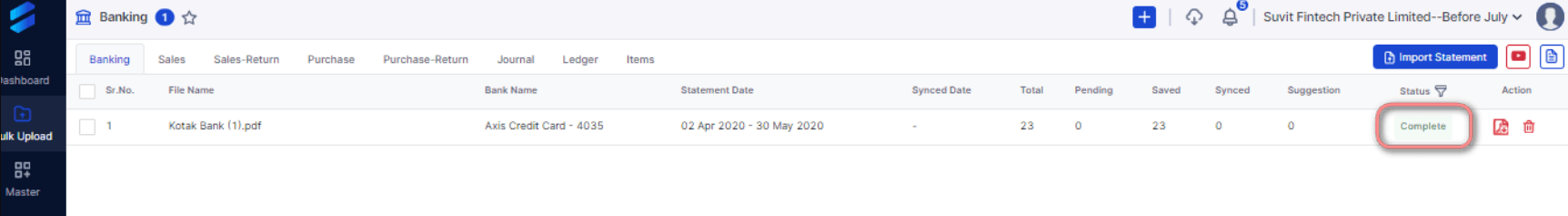

Understanding Processing Statuses: Complete and Failed

After the import, the bank statement is either marked as "Complete" or "Failed":

- Complete Status: Indicates that the statement has been successfully processed. Users can now proceed to ledger selection and other actions.

- Failed Status: Indicates issues such as unsupported formats, missing headers, or poor scan quality. Vyapar TaxOne provides detailed feedback, allowing users to rectify the problem and re-upload the statement.

Handling Errors:

- Review Vyapar TaxOne’s feedback on why the statement failed.

- Correct the document based on the given suggestions and re-upload it.

Efficient Ledger Selection and Customization

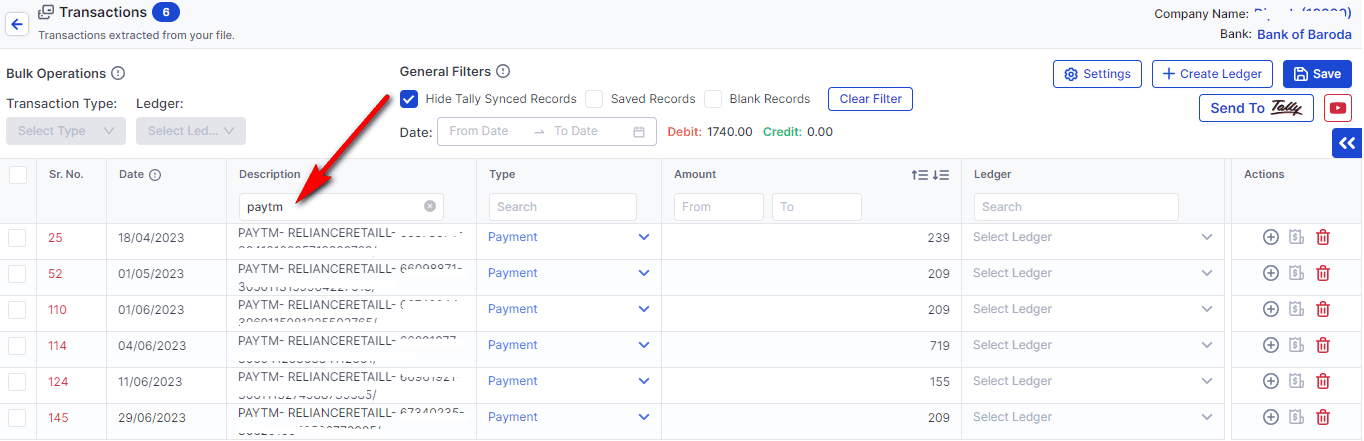

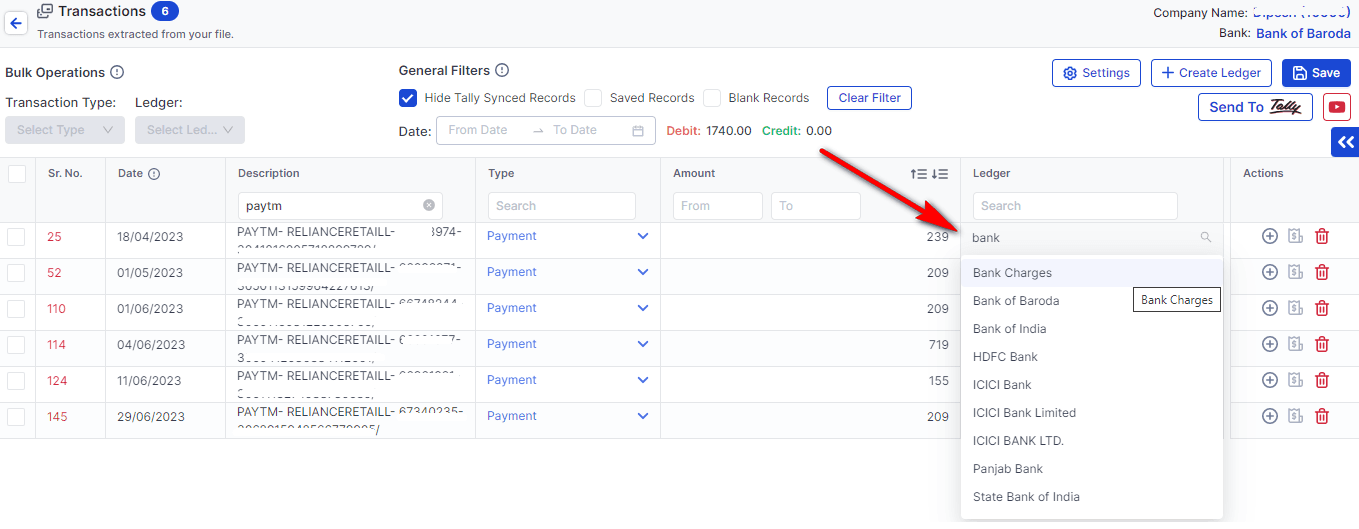

Ledger selection is a crucial step in the accounting process, and Vyapar TaxOne makes this easy with both bulk and individual options:

- Bulk Selection: Use filters like date range, narration, transaction type, or amount to select multiple ledgers at once quickly. This feature is ideal for handling large volumes of transactions efficiently.

- Individual Selection: For more control, users can select ledgers one at a time, ensuring precise categorization.

Customization Options:

- Convert transactions into different types, such as contra vouchers.

- Create new ledgers directly in Vyapar TaxOne, ensuring all financial records are accurately maintained.

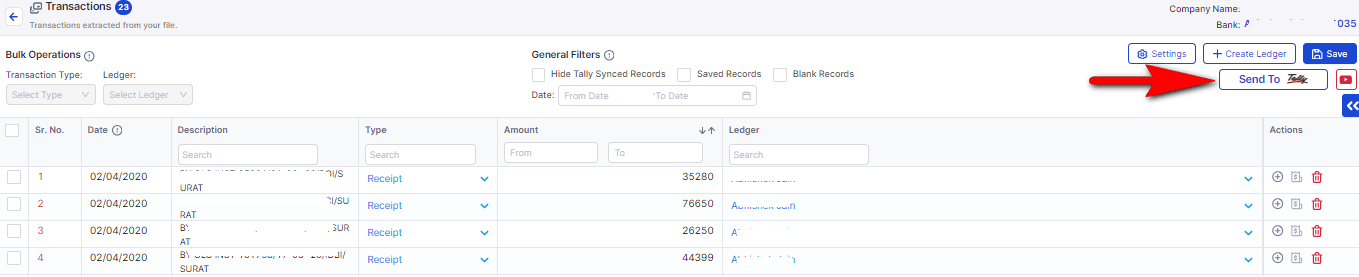

Leveraging General Filters for Streamlined Workflow

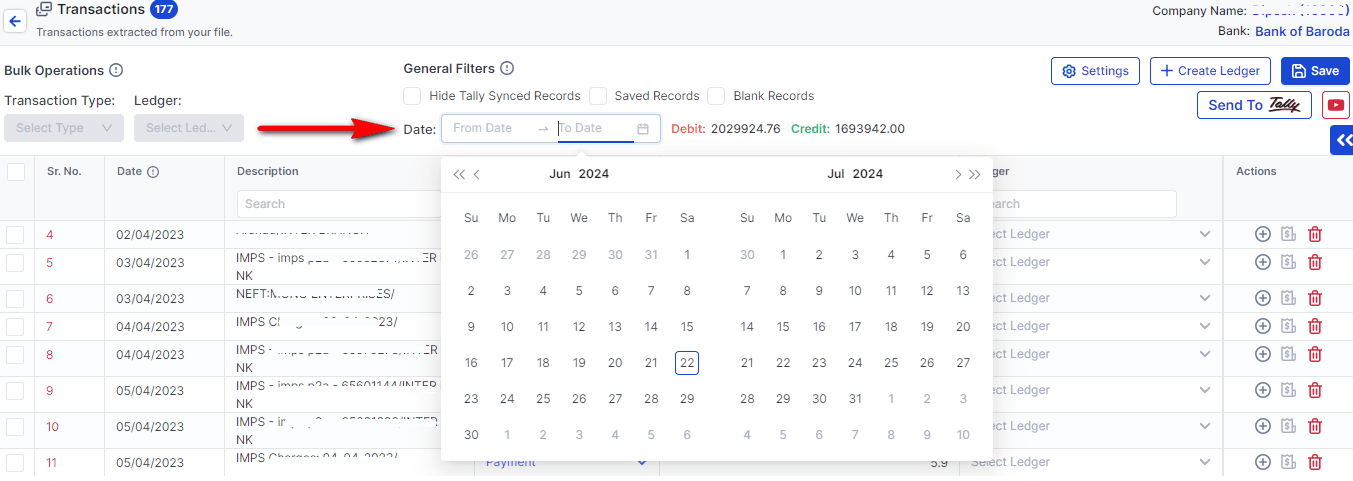

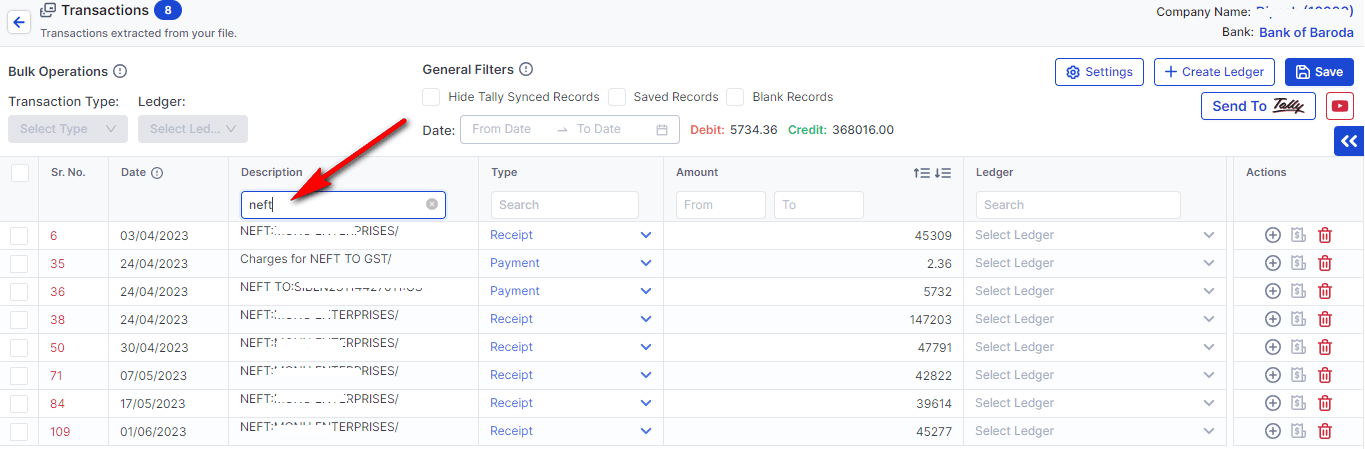

Filters are a powerful tool within Vyapar TaxOne's Banking Module. They help users quickly locate specific transactions or groups of transactions, making the workflow more efficient:

- Filter Types: Date range, narration, transaction type, amount range, and more.

- Use Cases: Find all transactions from a particular vendor, locate large deposits, or review all entries for a specific period.

Benefits of Using Filters:

- Saves time by narrowing down the list of transactions.

- Enhances accuracy by focusing on relevant data.

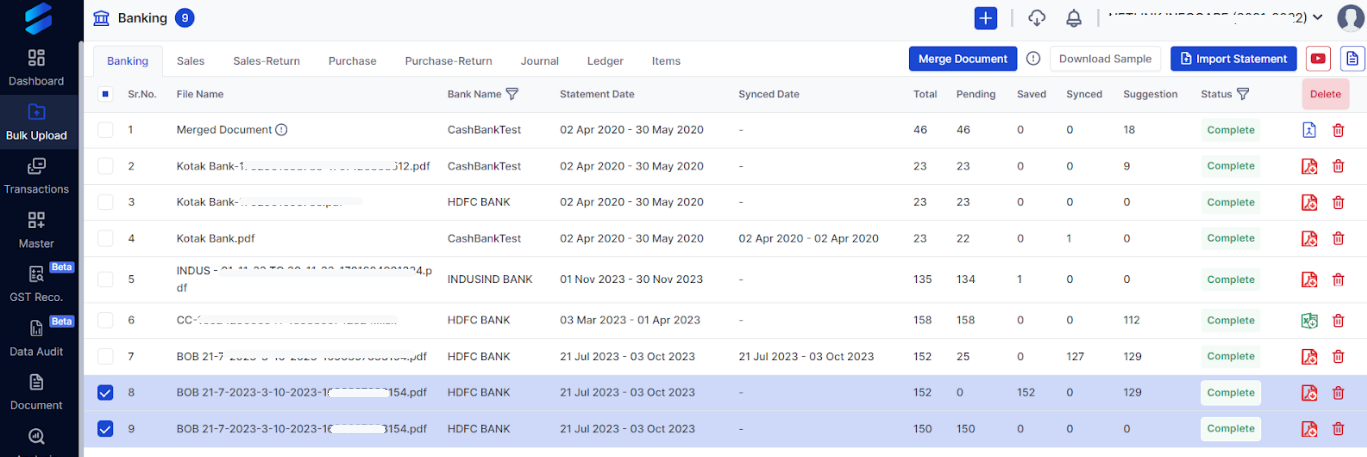

Document Merge Functionality: Simplifying Data Management

Vyapar TaxOne’s document merge functionality allows users to combine multiple bank statements from the same bank into a single document. This feature is especially useful when managing high volumes of transactions across different statement files.

Key Benefits:

- Consolidation: Merge various document types and formats seamlessly.

- Duplicate Removal: Automatically removes duplicate transactions, ensuring clean data.

Steps to Merge Documents:

- Select the documents you wish to merge.

- Click the merge button to combine them into a single file.

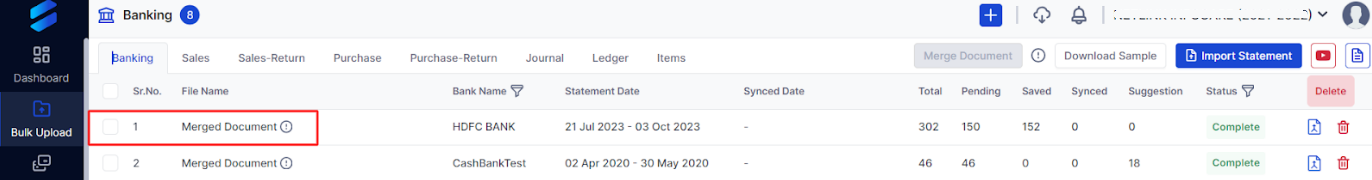

- After the document is merged, it will appear like the picture below. The file name is visible on the 'i’ icon.

- Download the merged documents in a zip format for easy storage and reference.

Requirements for the merged PDF;

(a) The uploaded PDF bank must match; (b) The total transaction amount after merging must equal 30,000 (for instance, we may have 10,000 transactions in the first PDF and 20,000 transactions in the second; after merging the PDFs, our total transaction amount will be 30,000, which is supported).

Ensuring Data Accuracy and Seamless Integration with Tally

After all transactions are processed and ledgers selected, the final step is exporting the data to Tally. Vyapar TaxOne ensures that this process is smooth and error-free, integrating seamlessly with your existing accounting workflows.

How It Works:

- Direct Integration: Vyapar TaxOne’s module directly exports the selected transactions to Tally, ensuring that all financial data is up-to-date.

- Error Checks: Before exporting, Vyapar TaxOne runs a final check to ensure all data is accurate and complete.

Advantages of Integration:

- Reduces manual data entry, minimizing errors.

- Saves time and enhances overall efficiency in financial management.

Also Read: [Work Smarter, Not Harder: Invoice Automation with Vyapar TaxOne](https://taxone.vyapar.com/post/invoice-automation-with-Vyapar TaxOne)

Want to Try Vyapar TaxOne for FREE !

Vyapar TaxOne’s Banking Module is a comprehensive solution designed to simplify the management of bank statements and optimize the accounting process.

From importing bank statements to selecting ledgers and merging documents, every feature is crafted to save time and enhance accuracy.

By leveraging these tools, accountants and businesses can ensure a more efficient and streamlined financial workflow.