Managing finances can be overwhelming for small business owners, but accounting software has emerged as a game-changer.

Whether it’s tracking expenses, sending invoices, or staying tax-compliant, accounting software simplifies your financial management processes and helps maximize your return on investment (ROI). Let’s see how it works and why it’s worth considering.

What Is Accounting Software?

Accounting software is a tool designed to help businesses manage their financial transactions and records efficiently. It handles a range of tasks, including:

- Tracking income and expenses.

- Creating and sending invoices.

- Automating tax calculations and filings.

- Generating detailed financial reports.

- Streamlining accounting workflows.

For small businesses, this tool is not just about managing finances; it’s about driving growth and maximizing ROI. But how exactly does it achieve that?

1. Improving Efficiency and Accuracy of Accounting Tasks

Accounting software can reduce manual errors and improve data quality, which can lead to better financial performance and reporting. Accounting software can also automate and streamline accounting tasks, such as reconciling bank accounts, sending reminders, and updating records, which can save time and resources for the business.

2. Enhancing Cash Flow Management and Decision-making

Accounting software can provide real-time and accurate information on the business’s financial situation, such as cash flow, profitability, and liquidity. This can help business owners and managers make informed and timely decisions, such as budgeting, forecasting, investing, and pricing. Accounting software can also help the business optimize its cash flow by facilitating faster and easier invoicing and payment collection, as well as managing expenses and bills.

3. Simplifying Tax Compliance and Preparation

Accounting software can help the business comply with the tax laws and regulations of their country, state, or region. Accounting software can calculate and file taxes automatically, as well as generate tax reports and statements. Accounting software can also keep track of tax deductions and credits, as well as tax changes and updates, which can help the business save money and avoid penalties.

Also Read: GST Rules for Small Businesses and Start-ups in India

4. Saving Time and Money on Accounting Costs

Accounting software can reduce the need for hiring more resources, which can be expensive and time-consuming. Accounting software can also lower the business operational costs, such as paper, printing, storage, and postage. Accounting software can also offer flexible and affordable pricing plans, as well as free trials and demos, which can suit the needs and budget of the small business.

5. Integrating with Other Business Tools and Systems

Accounting software can integrate with other software and systems that the business uses, such as CRM, ERP, POS, e-commerce, inventory, payroll, and banking. This can create a seamless and unified workflow for the business, as well as improve data sharing and collaboration. Accounting software can also sync with cloud-based platforms and mobile devices, which can enable businesses to access and manage their finances anytime and anywhere.

Also Read: 11 Small Business Accounting Tips and Tricks

How Suvit Can Help Your Small Business in Maintaining ROI

Suvit is more than just accounting software; it’s a complete automation tool tailored for small businesses. Here’s how Suvit can support your financial goals:

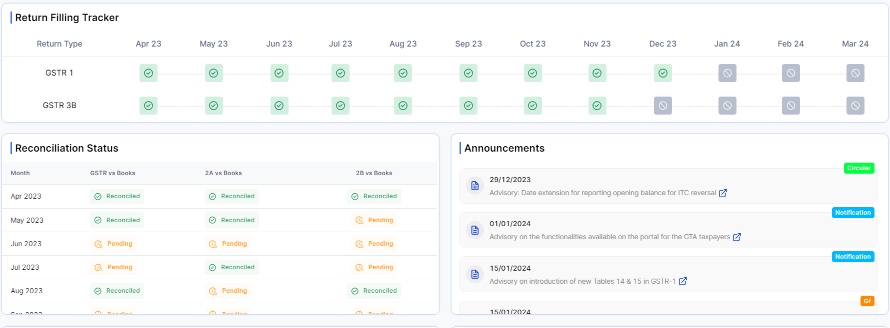

- Automated GST Filing: Simplify your returns and stay compliant with Suvit’s automated processes.

- GST Reconciliation: Generate a comprehensive GST Health Report to identify discrepancies.

- Reports and Analytics: Gain valuable insights into sales, purchases, and top-selling products.

- Mobile Accessibility: Access all your financial data on the go with Suvit’s mobile app.

With Suvit, small businesses can reduce manual work, improve financial accuracy, and make data-driven decisions to grow their ROI. Plus, you can start with a 7-day free trial to experience the benefits firsthand!

Accounting software isn’t just an expense; it’s an investment in your business’s future. From improving efficiency to enhancing cash flow and tax compliance, the right software can make a significant difference.

Tools like Suvit take it a step further by automating key processes and providing actionable insights. Ready to maximize your ROI? Give Suvit a try today and see the difference it makes for your small business.