Important Notice: This blog post is intended solely to provide informational content on how to search PAN card details using a name. Suvit specializes in accounting automation software and does not offer services related to PAN card searches or support. For official assistance regarding PAN cards, please refer to the Income Tax Department of India.

Permanent Account Number (PAN) is a unique 10-digit alphanumeric code issued by the Income Tax Department of India to individuals, companies, and other entities. It is used as an identification number for tax purposes and is mandatory for financial transactions such as opening a bank account, filing income tax returns, and more.

Let’s see how to search for a name by PAN number!

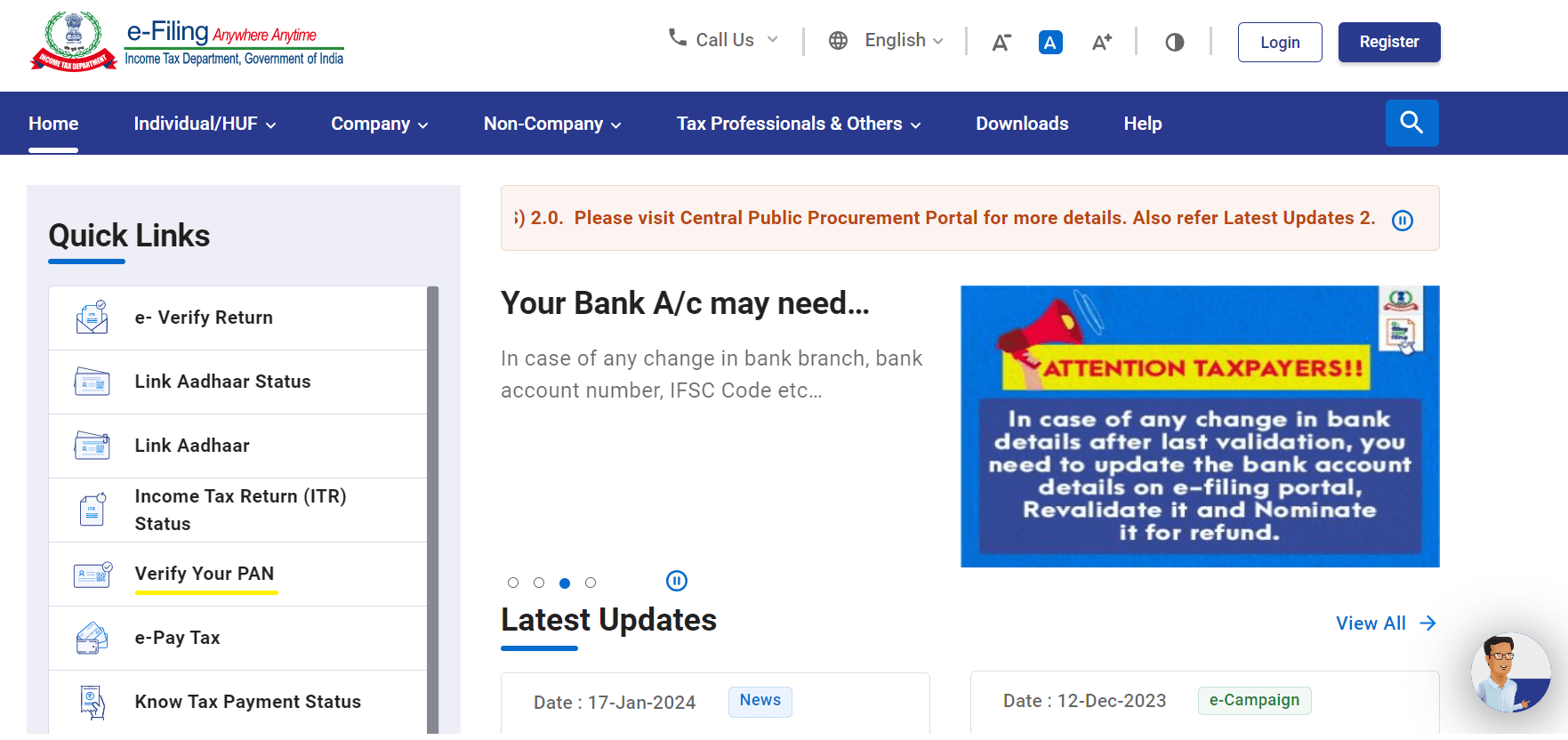

Find Name Using the Income Tax Department’s website

The Income Tax Department of India provides an online facility to verify the name of a person through his PAN. Here are the steps to follow:

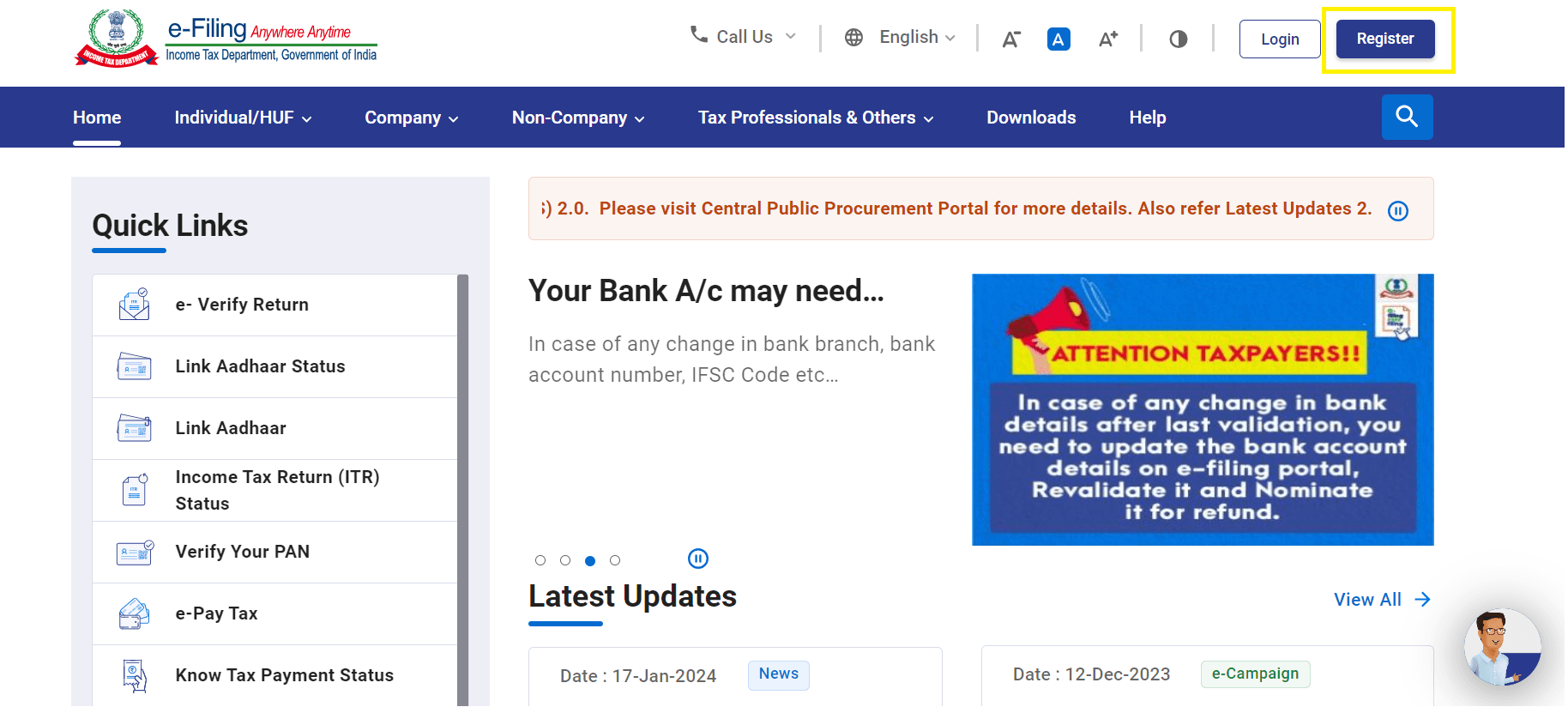

Step 1: Visit the Income Tax Department’s website at www.incometax.gov.in

Step 2: Click on the ‘Register’ option located in the top right corner.

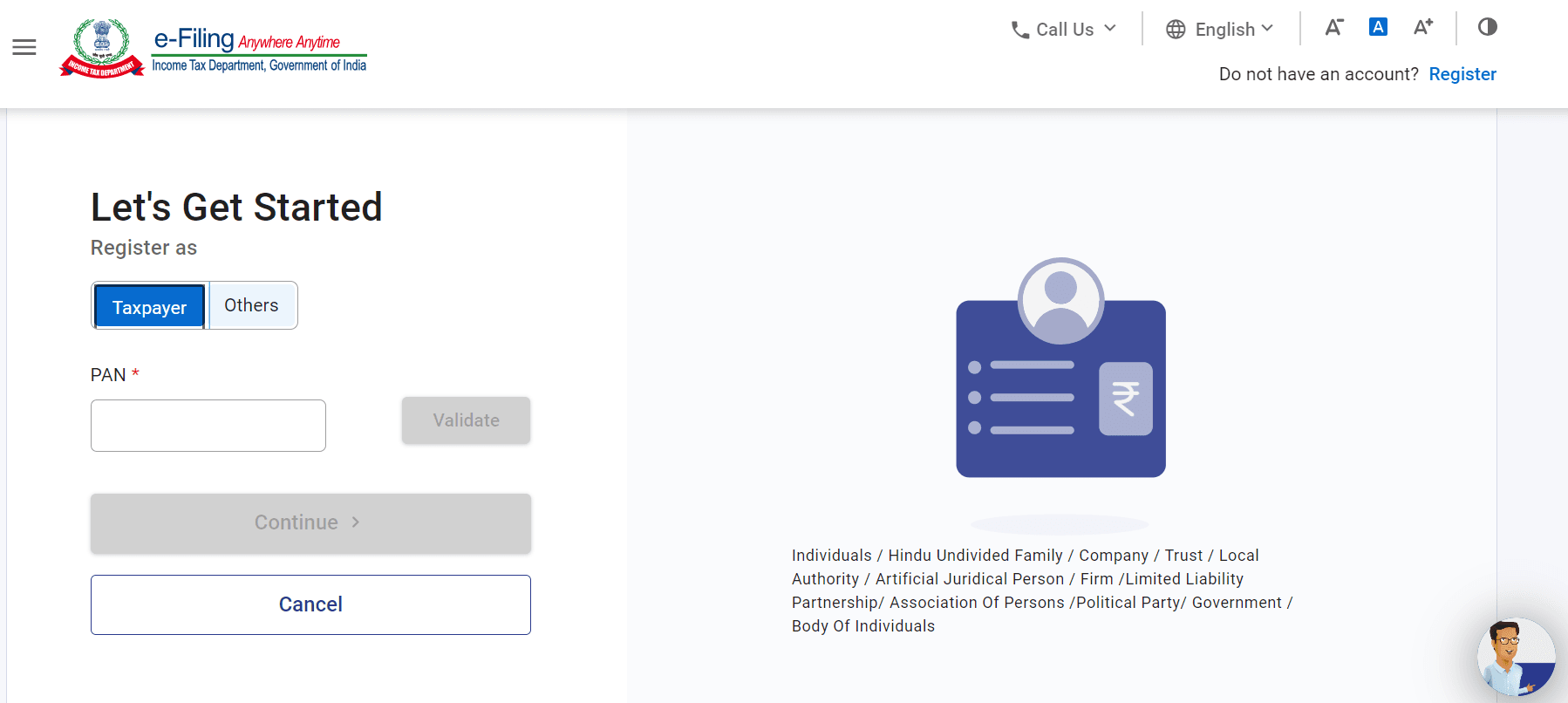

Step 3: Enter the PAN number and other details in the required field.

Step 4: An activation link for your account will be sent to your email address.

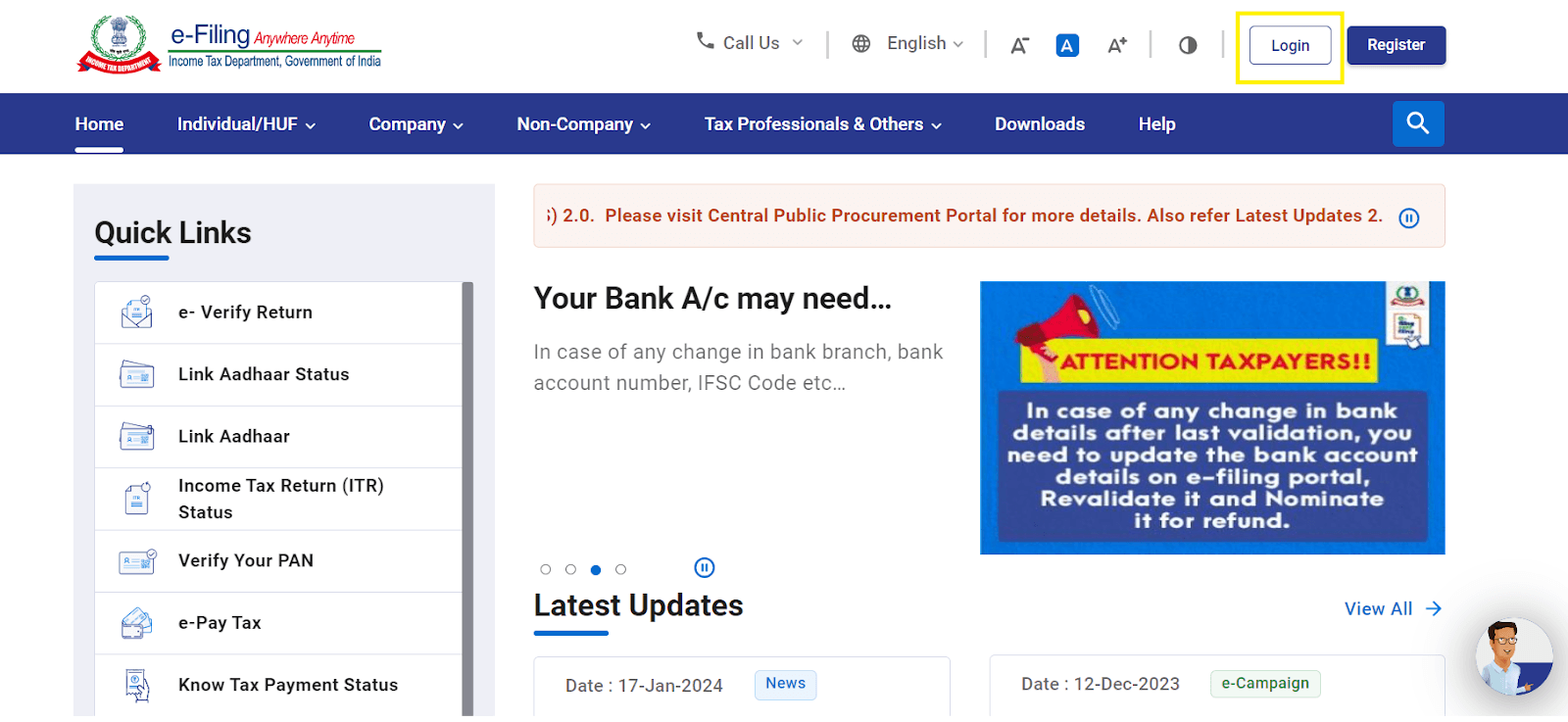

Step 5: Return to the official website of the Income Tax Department and select "Login."

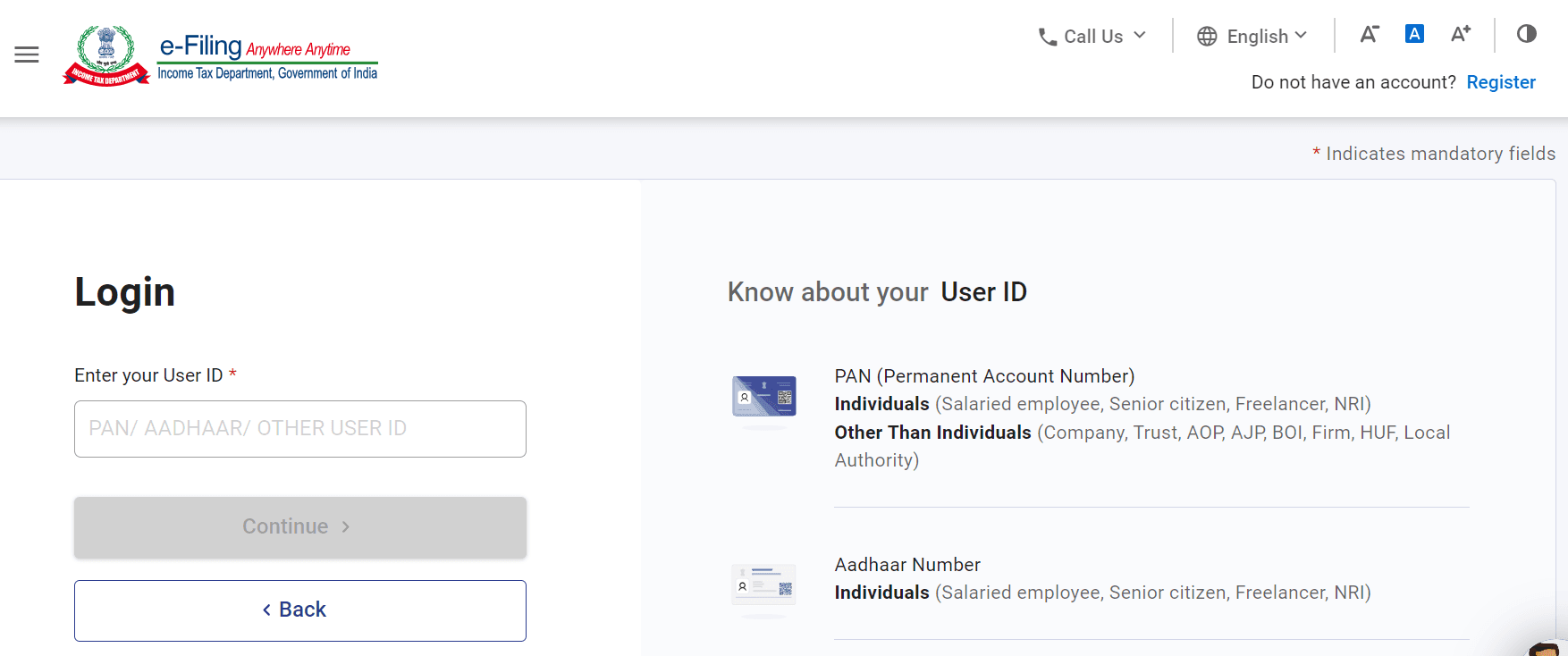

Step 6: Fill up the required Login details to continue.

Step 7: After login, navigate to the "Profile Settings" section and choose "PAN Details."

Step 8: View all the details related to your PAN card on the screen, including your name, address, area code, jurisdiction, and other relevant information.

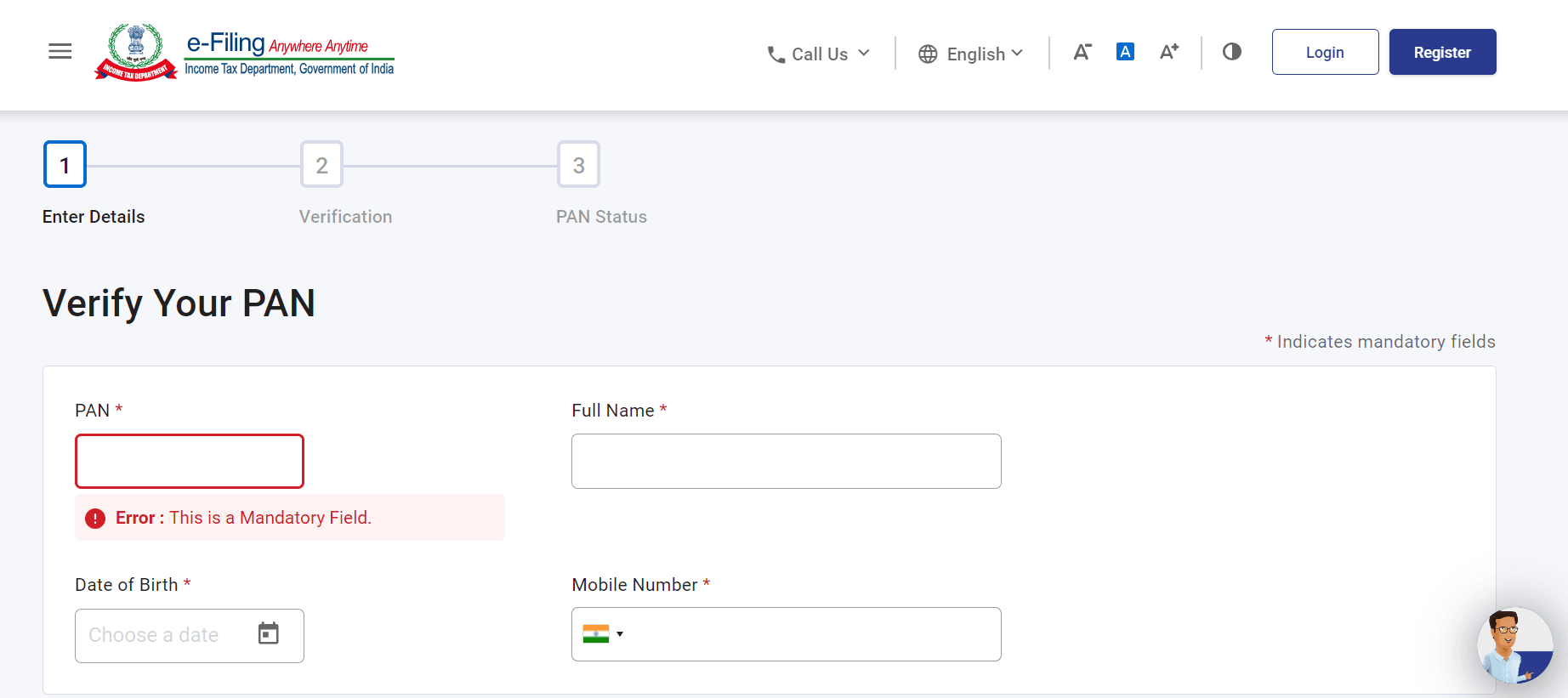

How to Check PAN Card Details using Name and Date of Birth:

Step 1: Go to the Income Tax E-Filing page.

Step 2: Click on "Verify your PAN" in the "Quick Links" section.

Step 3: Provide your PAN, full name, Date of Birth, and mobile number.

Step 4: Enter the OTP sent to your mobile and click "Validate."

Step 5: You'll be taken to a new page, confirming your "PAN is active and details match the PAN."

Read Also: 3 Easy And Simple Ways On How To Download E-Pan Card Through NSDL, UTIITSL, And E-Filing Website

Search PAN Card Details Using the Challan 280 Payment Option

The Challan 280 payment option is another way to find the name of a person through his PAN. Here are the steps to follow:

Step 1: Visit the NSDL website at https://www.tin-nsdl.com/.

Step 2: Click on the ‘Services’ option and select ‘PAN’.

Step 3: Click on the ‘Challan 280’ option.

Step 4: Fill in the required details such as PAN number, name, and address.

Step 5: Click on the ‘Submit’ button.

Step 6: The name of the PAN holder will be displayed on the screen.

Why is Having a PAN Card Important?

1. ID Proof: Your PAN card is like a super ID card. It proves who you are and even has your picture. You need it for things like getting a gas connection or opening a bank account.

2. Employment: Most employers want to know your PAN card details for paying your salary and taxes. You also need it when you file your tax return.

3. Banking: If you want to open a bank account or do anything important with your money, you must have a PAN card. It's to stop wrong things like cheating or hiding money. Even putting more than Rs. 50,000 in your bank needs your PAN card info. The same goes for fixed deposits.

4. Post Office Deals: If you're putting more than Rs. 50,000 in a post office account, you need your PAN details.

5. Digital Money: Using digital wallets for payments? If you spend more than Rs. 20,000 in a month, they'll want your PAN card details.

6. Cards, Loans, and Score: Applying for a credit or debit card? They'll ask for your PAN details. Not giving them might harm your credit score. Need a loan? PAN details are a must.

Read Also: UAN: Portal Registration, Activating Your Universal Account Number, And Linking It To Aadhar

7. Buying/Selling Property: If you're dealing with property worth more than Rs. 5 lakh, both the buyer and seller need PAN cards. The same goes for buying jewelry over Rs. 5 lakh.

8. Vehicle Buying: Except for two-wheelers, all vehicle purchases need PAN card details.

9. Share Market: If you're into buying and selling shares, the people handling your accounts need your PAN card details.

10. Investments: Putting money in bonds, debentures, or mutual funds? PAN card details are part of the deal.

11. Insurance: If your insurance payments go over Rs. 50,000 in a year, they want your PAN details.

12. Foreign Money: Changing your money to another country's money? PAN card details are needed for that too.

There are several ways to find the name of a person through his PAN. The Income Tax Department’s website, NSDL website, TIN website, and Challan 280 payment option are some of the methods that can be used. It is important to note that PAN verification is a crucial step in financial transactions and should be done with utmost care. We hope this blog has been informative and helpful.

Disclaimer: We hope you found this information helpful. Please be reminded that Suvit is an accounting automation platform and does not handle PAN card queries or services. For any issues or questions regarding your PAN card, please visit the official Income Tax Department website.