At Suvit, we’re always thinking of ways to make accounting easier for small practices. Recently, many clients have asked us how AI can help save costs in Accounts Payable (AP) and Accounts Receivable (AR). To answer this, we’re writing today’s blog. If you’re running a small accounting practice and wondering if AI is worth the investment, this blog is for you.

We’ll take a deep dive into how AI can save up to 80% of your AP/AR costs, and why it’s a game-changer for your firm.

Let’s explore what AI can do for your AP/AR process.

What are AP and AR, and Why Are They Important?

Accounts Payable (AP) and Accounts Receivable (AR) are essential processes in any business. AP is about managing payments your company owes to suppliers, while AR tracks what customers owe to your company. These two areas form the core of cash flow, and proper management is crucial for a business to thrive.

But for small accounting practices, managing AP and AR can be time-consuming, prone to errors, and costly. This is where automation, particularly AI-powered solutions, steps in to provide relief.

How AI Slashes AP/AR Costs by 80% (Yes, Really!)

Now, let’s talk about the big numbers. AI can save up to 80% of your AP/AR costs. But how?

-

Faster Processing Time: AI systems can process invoices and payments faster than humans. Instead of spending hours on manual data entry or verification, AI scans and inputs information in seconds. By reducing processing time, you cut down on labor costs and speed up the entire payment cycle.

-

Fewer Errors: Manual data entry can lead to mistakes, which can be costly. AI reduces errors by automating repetitive tasks. For example, it can automatically match invoices with purchase orders and flag discrepancies. This not only prevents errors but also saves time and money on corrections.

-

Streamlined Workflows: AI doesn’t just automate individual tasks; it optimizes entire workflows. Imagine having a system that automatically routes invoices to the right people for approval or sends payment reminders to clients. By streamlining the workflow, you reduce administrative costs and increase efficiency.

-

Better Cash Flow Management: AI tools can predict cash flow by analyzing patterns in your AP and AR. With better forecasting, you can avoid late payments, improve cash flow, and prevent unnecessary borrowing. This improved cash flow management is another way AI saves money for accounting practices.

-

Automated Fraud Detection: Fraud in AP/AR can be expensive. AI can detect unusual patterns that might indicate fraud, such as duplicate payments or suspicious vendor activity. By catching these issues early, you avoid losses and costly legal battles.

Also Read: How to do AP Automation with Accounting Automation

Let’s Talk Numbers: How the 80% Cost Savings Add Up

You might wonder how these changes translate into such significant savings. Let’s break it down:

-

Labor Costs: Reducing manual tasks like data entry, invoice approvals, and payment tracking can save up to 50-60% on labor alone.

-

Error Reduction: Minimizing errors and the time spent fixing them can cut costs by an additional 10-20%.

-

Fraud Prevention: AI's ability to detect fraud early can save 5-10% of potential losses.

When combined, these factors make it easy to see how AI can cut up to 80% of your AP/AR costs.

Why AI is a Game-Changer for Indian Accounting Firms

In India, small and mid-sized accounting practices often face tight budgets and growing workloads. The traditional way of handling AP and AR is manual, which means more time, more people, and more room for error. But with AI automation, Indian accounting firms can manage more clients without increasing costs.

The beauty of AI is that it’s scalable. Whether you have 10 clients or 100, AI can handle the load with ease. This is especially important in India’s fast-paced business environment, where clients expect quick turnaround times. AI tools can help meet these expectations by speeding up processes and reducing costs.

How Suvit Makes AP/AR Automation Simple and Effective

At Suvit, we’re dedicated to making life easier for accounting professionals. Our AI-powered solutions are designed to simplify AP/AR processes. With Suvit, you can automate:

- Sales/Purchase Entries

- Sales/Purchase Return Entries

- Banking Entries

- Journal Entries

- Ledger Allotment

- Documents Handling/Storage

- GST Reconciliation

- Cash flow predictions

By using Suvit’s AI tool, you can reduce your AP/AR costs significantly and improve efficiency across your practice.

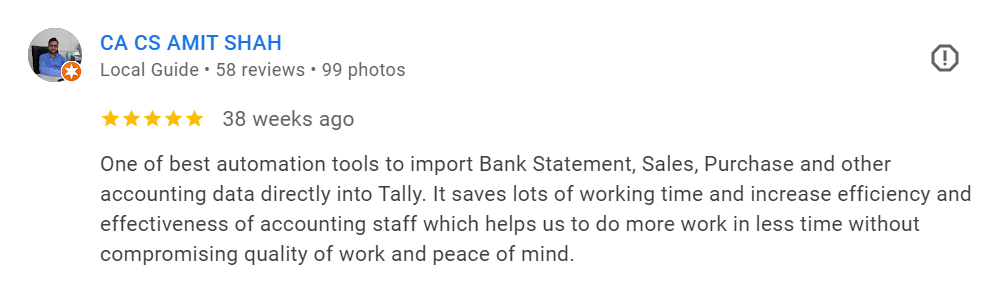

We’ve seen firsthand how our clients have benefited from automation. You can check this review from one of our clients.

Facing AI Challenges? Here’s How Being Accounting Firms You Can Overcome Them

While AI offers significant benefits, it’s important to acknowledge the challenges that come with adopting new technology, especially for smaller accounting practices. The good news is that these challenges are manageable:

-

Initial Investment Costs: AI tools might seem expensive at first, but the long-term savings make it worthwhile. Think of it as an investment that will pay off through reduced operational costs.

-

Training Staff: You’ll need to train your team to use AI tools. However, most AI systems, including Suvit’s, are designed to be user-friendly. With a little training, your team will be up and running in no time.

-

Data Security Concerns: Many firms worry about data security when using AI. Suvit understands this and ensures that all our AI systems meet the highest security standards. We prioritize your clients' data protection, so you can automate with peace of mind.

What’s Next? The Future of AP/AR for Indian Accountants

AI is more than just a trend; it’s the future of accounting. As the business landscape becomes more competitive, firms that adopt AI will have a clear advantage. By automating AP and AR processes, Indian accounting practices can save money, reduce errors, and scale their operations.

If your firm hasn’t yet explored AI automation, now is the time. The savings and efficiency gains are too significant to ignore.

Also Read: Work Smarter, Not Harder: Invoice Automation with Suvit

Save Time and Money with AI in AP/AR

In summary, AI can reduce AP/AR costs by up to 80% by speeding up processes, reducing errors, preventing fraud, and streamlining workflows. For Indian accounting firms, the benefits of AI are clear—lower costs, better cash flow management, and the ability to handle more clients with ease.

At Suvit, we’re committed to helping small accounting practices embrace AI and realize these savings. If you’re ready to take the next step in automating your AP/AR processes, reach out to us today. Or else you can start with a 7-day free trial!