The Goods and Services Tax (GST) is a comprehensive indirect tax reform introduced in India on July 1, 2017. It has revolutionized the way taxes are levied and collected in India, and it has had a significant impact on businesses of all sizes.

GST software is a valuable tool for businesses of all sizes to comply with GST regulations and streamline their tax operations. It can help businesses with tasks such as:

- Generating GST invoices and returns

- Calculating GST liability

- Tracking GST payments

- Filing GST returns on time

In this blog post, we will discuss the role of GST software for your business. We will also cover the different types of GST software available, the benefits of using GST software, and how to choose the right GST software for your business.

Whether you are a small business owner or a large enterprise, GST software can help you save time and money, and reduce the risk of tax compliance errors.

So, let’s get started!

What is GST Software?

GST software is a computer application that helps businesses comply with the Goods and Services Tax (GST) regulations in India. It automates many of the tasks involved in GST compliance, such as:

- Generating GST invoices and returns

- Calculating GST liability

- Tracking GST payments

- Filing GST returns on time

GST software can also help businesses with other tasks such as:

- Managing inventory

- Tracking sales and expenses

- Generating reports

GST software is available in a variety of forms, from simple cloud-based applications to more complex enterprise solutions. The right GST software for a business will depend on its size, industry, and needs.

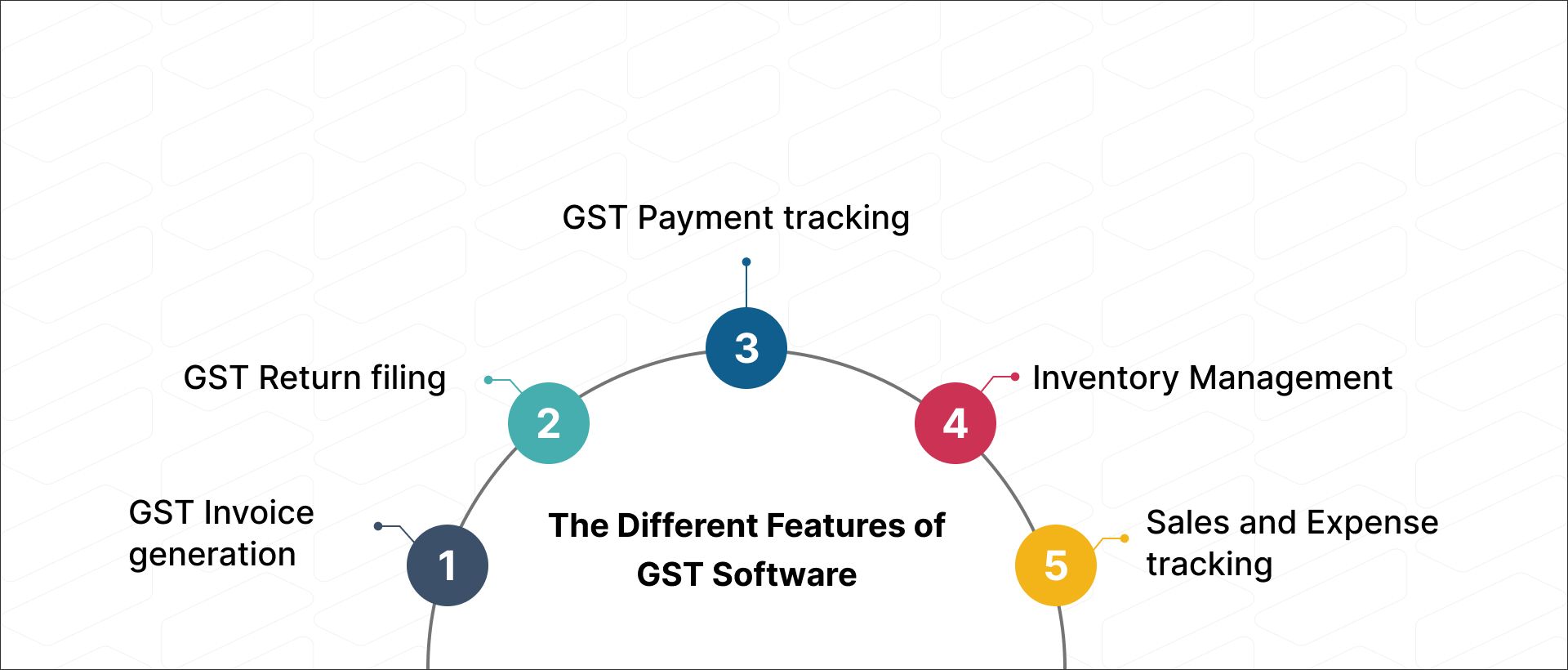

The Different Features of GST Software

GST software typically includes the following features:

- GST invoice generation: GST software can help businesses generate GST invoices in compliance with GST regulations. It can also help businesses manage their GST invoices and track their GST liability.

- GST return filing: GST software can help businesses file their GST returns on time and accurately. It can also help businesses track their GST compliance status.

- GST payment tracking: GST software can help businesses track their GST payments and ensure that they are paid on time.

- Inventory management: GST software can help businesses manage their inventory levels and track their GST liability on inventory.

- Sales and expense tracking: GST software can help businesses track their sales and expenses and generate reports for GST compliance purposes.

How GST Software Can Help Businesses Comply with GST Regulations

GST software can help businesses comply with GST regulations in a number of ways. For example, it can help businesses:

- Generate GST invoices in compliance with GST regulations.

- Calculate their GST liability accurately.

- Track their GST payments and ensure that they are paid on time.

- File their GST returns on time and accurately.

- Track their GST compliance status.

The Role of Taxes in the Indian Economy

Taxes play a vital role in the Indian economy. They provide the government with the revenue it needs to fund essential services such as:

- Education

- Healthcare

- Infrastructure

- Defence

- Social welfare programs

Taxes also help to regulate the economy and promote economic growth. For example, the government uses taxes to discourage consumption of harmful goods and services, and to encourage investment in productive activities.

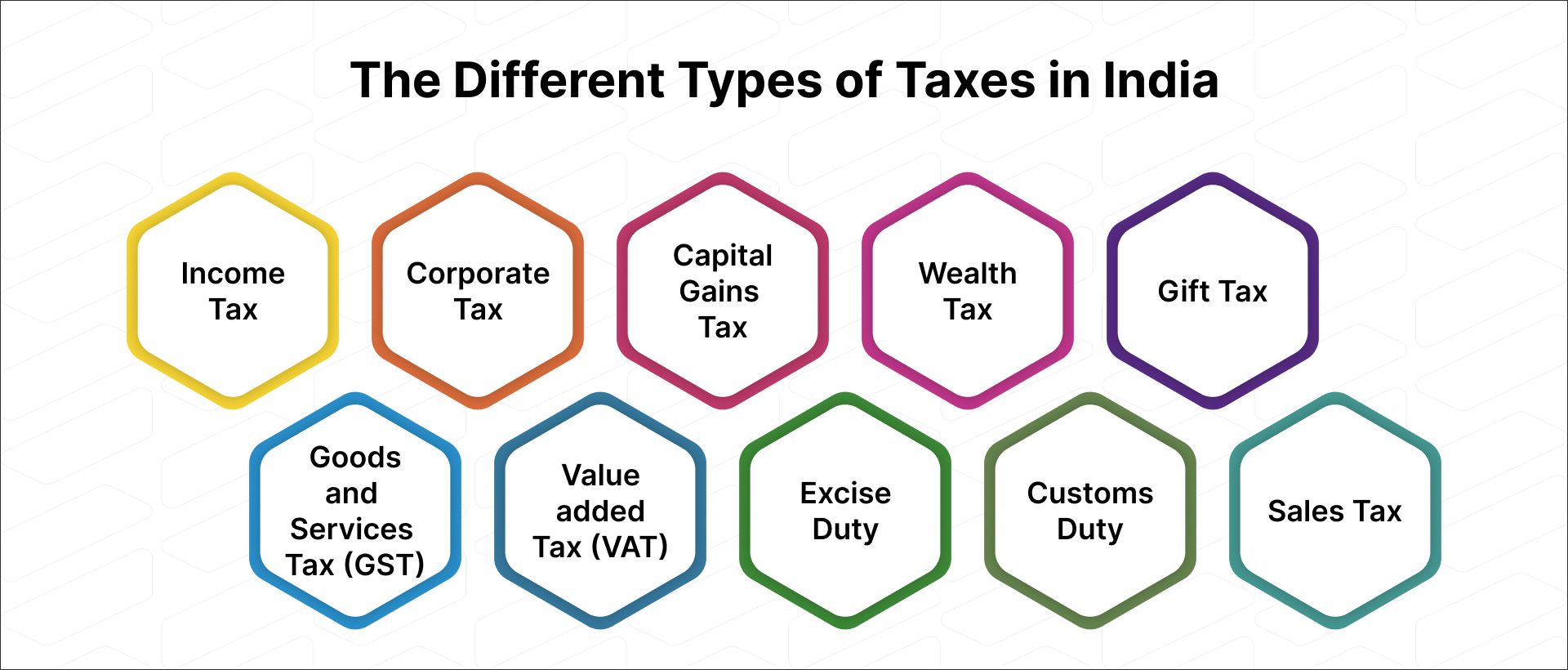

The Different Types of Taxes in India

The Indian tax system is a complex one, with a wide variety of taxes levied at the central, state, and local levels. However, all taxes in India can be broadly classified into two categories: direct taxes and indirect taxes.

Direct taxes are levied on the income of individuals and businesses. Some examples of direct taxes include:

- Income tax

- Corporate tax

- Capital gains tax

- Wealth tax

- Gift tax

Direct taxes are typically paid directly to the government by the taxpayer.

Indirect taxes are levied on the consumption of goods and services. Some examples of indirect taxes include:

- Goods and services tax (GST)

- Value added tax (VAT)

- Excise duty

- Customs duty

- Sales tax

Indirect taxes are typically paid by the consumer to the seller, who then remits the tax to the government.

GST is a relatively new tax in India, having been introduced in 2017. It is a comprehensive indirect tax that is levied on the supply of goods and services. GST has replaced a number of other indirect taxes, such as VAT, excise duty, and central sales tax.

GST is a major reform of the Indian tax system, and it has had a significant impact on businesses of all sizes. GST has made it easier for businesses to comply with tax regulations and to operate across state borders.

Why It Is Important to Pay Taxes Correctly

It is important to pay taxes correctly for a number of reasons. First, paying taxes correctly is a civic duty. It is the way that we all contribute to the common good. Second, paying taxes correctly helps to ensure that the government has the revenue it needs to fund essential services. Third, paying taxes correctly can help to avoid penalties and interest charges.

Here are some tips for paying taxes correctly:

- File your tax returns on time and accurately.

- Pay your taxes in full and on time.

- Keep good records of your income and expenses.

- If you have any questions about your taxes, consult with a tax professional.

How GST Software Can Be Integrated with Other Business Management Software

GST software can be integrated with other business management software in a number of ways. One common approach is to use an API (application programming interface). An API allows two software applications to communicate with each other and share data.

Another approach to integrating GST software with other business management software is to use a third-party integration platform. A third-party integration platform is a software application that acts as a middleman between two or more software applications.

It allows the software applications to communicate with each other and share data, even if they are not directly compatible.

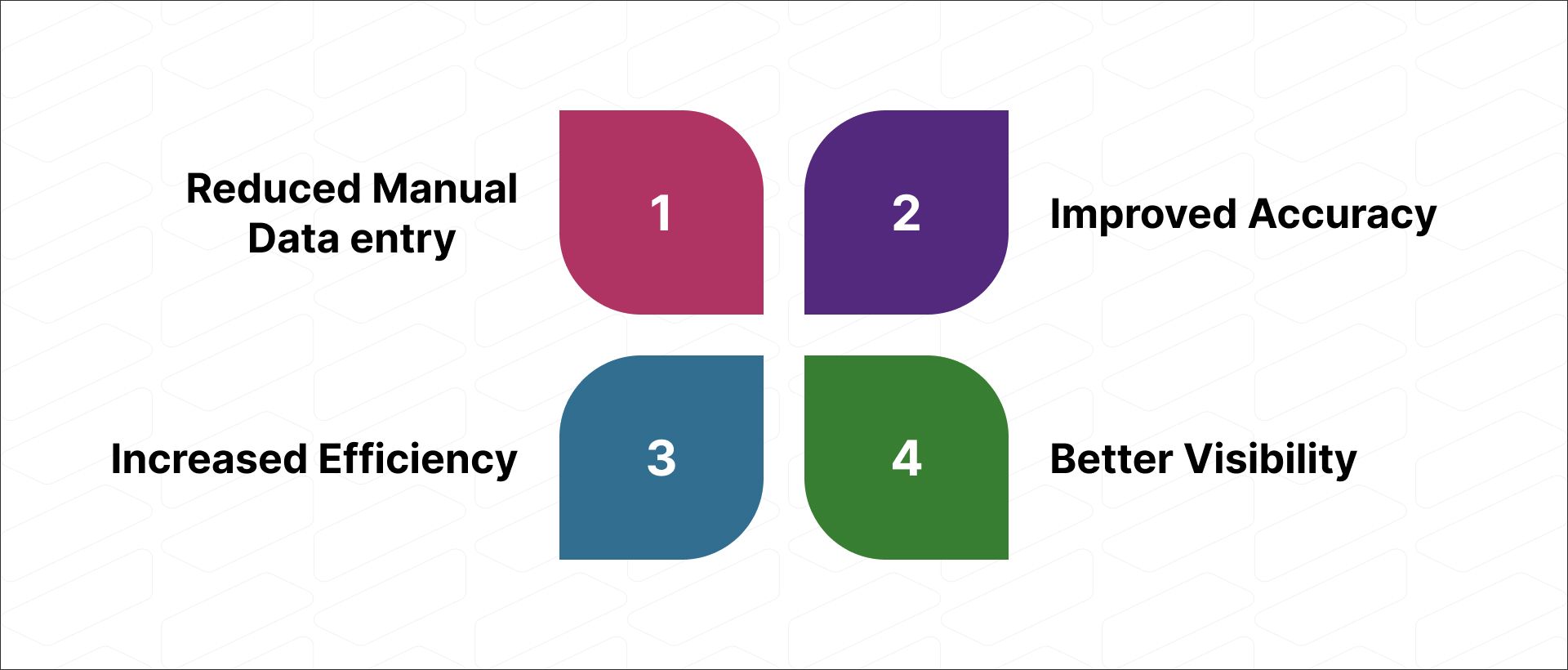

The Benefits of Integrating GST Software with Other Business Management Software

There are a number of benefits to integrating GST software with other business management software. Some of the key benefits include:

- Reduced manual data entry: When GST software is integrated with other business management software, data can flow seamlessly between the two systems. This reduces the need for manual data entry, which can save time and reduce the risk of errors.

- Improved accuracy: Integrating GST software with other business management software can help to improve the accuracy of GST compliance. This is because the data is automatically synchronized between the two systems, reducing the risk of human errors.

- Increased efficiency: Integrating GST software with other business management software can help to streamline GST compliance processes. This can free up your staff to focus on other tasks, such as growing your business.

- Better visibility: Integrating GST software with other business management software can give you a better view of your overall financial performance. This is because you can see all of your financial data in one place, including your GST liability.

Examples of Specific Business Management Software That Can Be Integrated with GST Software

There are a number of different business management software solutions that can be integrated with GST software. Some examples include:

- Accounting software: Accounting software can be integrated with GST software to automate the process of generating GST invoices and returns, and to track GST payments.

- CRM software: CRM software can be integrated with GST software to track customer interactions and sales opportunities. This data can then be used to generate GST invoices and returns.

- ERP software: ERP software can be integrated with GST software to manage all aspects of a business, including inventory, manufacturing, and sales. This data can then be used to generate GST invoices and returns.

Which is the Best GST Software in India?

Tally

Tally is a popular GST software solution in India. It is a comprehensive accounting software that includes a variety of features to help businesses comply with GST regulations. Some of the key features of Tally include:

- GST invoice generation

- GST return filing

- GST payment tracking

- Inventory management

- Sales and expense tracking

- Financial reporting

Tally is available in a variety of editions, including a free version for small businesses.

Zoho Books

Zoho Books is another popular GST software solution in India. It is a cloud-based accounting software that is easy to use and affordable. Zoho Books includes a variety of features to help businesses comply with GST regulations, including:

- GST invoice generation

- GST return filing

- GST payment tracking

- Inventory management

- Sales and expense tracking

- Financial reporting

Zoho Books also offers a variety of integrations with other business management software, such as CRM software and e-commerce platforms.

ClearTax

ClearTax is a popular GST software solution in India that is known for its simplicity and ease of use. ClearTax offers a variety of features to help businesses comply with GST regulations, including:

- GST invoice generation

- GST return filing

- GST payment tracking

- GST compliance dashboard

- GST expert support

ClearTax is available in a variety of plans to suit the needs of businesses of all sizes.

How to Automate Tally With Accounting Automation tool Suvit

Suvit is an accounting automation tool that can help you automate Tally. It is a cloud-based solution that can be accessed from anywhere with an internet connection. Suvit offers a variety of features to help you automate your accounting tasks, including:

- Invoice processing: Suvit can automatically extract data from invoices and import it into Tally. This can save you a lot of time and effort, especially if you process a large number of invoices on a regular basis.

- Bank reconciliation: Suvit can automatically reconcile your bank statements with Tally. This can help you to identify and correct any errors in your accounting records.

- Journal entry automation: Suvit can automatically generate journal entries for common accounting transactions. This can save you a lot of time and effort, and help to reduce the risk of errors.

- GST compliance: Suvit can help you to comply with GST regulations by automatically generating GST invoices and returns.

How Suvit Can Automate Tally

Suvit can automate Tally in a number of ways. For example, you can use Suvit to:

- Automatically import invoices into Tally. Suvit can extract data from invoices in a variety of formats, including PDF, Excel, and CSV. Once the data has been extracted, Suvit can automatically import it into Tally.

- Automatically reconcile your bank statements with Tally. Suvit can download your bank statements and automatically reconcile them with Tally. This can help you to identify and correct any errors in your accounting records.

- Automatically generate journal entries for common accounting transactions. Suvit can automatically generate journal entries for common accounting transactions, such as sales, purchases, and payments. This can save you a lot of time and effort, and help to reduce the risk of errors.

- Automatically generate GST invoices and returns. Suvit can help you to comply with GST regulations by automatically generating GST invoices and returns.

The Benefits of Automating Tally with Suvit

There are a number of benefits to automating Tally with Suvit. Some of the key benefits include:

- Save time and money: Suvit can help you to save time and money by automating your accounting tasks. This will free up your time so that you can focus on other important aspects of your business.

- Reduce errors: Suvit can help to reduce the risk of errors in your accounting records. This is because Suvit automates many of the tasks that are prone to human error.

- Improve efficiency: Suvit can help you to improve the efficiency of your accounting operations. This is because Suvit can automate many of the tasks that are time-consuming and repetitive.

- Gain better insights: Suvit can help you to gain better insights into your financial performance. This is because Suvit provides a variety of reports that can help you to track your income, expenses, and cash flow.

Ready to Improvise Your GST Process?

GST software is an essential tool for businesses of all sizes in India. It can help businesses to comply with GST regulations, streamline their accounting processes, and save time and money.

If you are looking for a GST software solution that can automate Tally, I recommend that you consider Suvit. Suvit is a cloud-based accounting automation tool that offers a variety of features to help businesses automate their accounting tasks and comply with GST regulations.

To get started with Suvit, you can create a free account on the Suvit website. Once you have created an account, you can connect your Tally account to Suvit and start automating your accounting tasks!