Think about assembling a puzzle with some pieces from a completely different set—getting anywhere would be nearly impossible. That’s exactly what accounting feels like without a proper pre-accounting process in place.

If you’ve ever spent hours chasing receipts, untangling transactions, or trying to make sense of mismatched financial data, you’re not alone. These pain points plague businesses of all sizes.

But here’s the good news: pre-accounting can eliminate much of this chaos and transform your accounting workflow into a smooth, stress-free process.

So, what exactly is pre-accounting, and how can it simplify your life? Let’s understand!

What is Pre-Accounting?

Think of pre-accounting as the prep work that ensures your accounting processes run smoothly. It involves collecting, organizing, and verifying financial data before it enters your main accounting system.

Pre-accounting creates a solid foundation for accurate bookkeeping and financial management.

Simply put, pre-accounting is like meal prepping: you gather ingredients, measure them out, and organize them before you start cooking.

Similarly, in pre-accounting, you categorize expenses, reconcile transactions, and prepare financial data for your accounting team or software.

Why is Pre-Accounting Important?

Pre-accounting isn’t just an optional step; it’s a vital part of maintaining an efficient and error-free financial process.

Here’s why:

| Benefit | Explanation |

|---|---|

| Improves Accuracy | Errors caught during pre-accounting prevent bigger issues later. |

| Saves Time | Organized data speeds up bookkeeping and reporting. |

| Enhances Decision-Making | Clean data provides clarity for better financial decisions. |

| Boosts Collaboration | Teams can work more efficiently with standardized processes. |

By embracing pre-accounting, you’re setting yourself up for smoother operations and fewer headaches down the road.

Key Tasks in Pre-Accounting

Pre-accounting involves several important tasks that lay the groundwork for accurate bookkeeping:

Transaction Categorization

Sorting expenses into appropriate categories (e.g., travel, office supplies). Categorization ensures every financial transaction aligns with the right account, making it easier to generate accurate reports and understand your spending patterns.

Receipt Management

Collecting, organizing, and digitizing receipts to ensure proper documentation. Tools like mobile apps can instantly scan and upload receipts, tagging them with relevant details such as date, vendor, and amount. This makes it easy to retrieve and verify data whenever needed, especially during audits.

Bank Reconciliation

Matching transactions in your records with your bank statements to detect discrepancies. Regular reconciliation prevents issues like duplicate entries or missed payments, ensuring your books remain balanced.

Data Preparation

Structuring financial information for seamless entry into your accounting system. This includes standardizing formats for invoices and categorizing income or expenses into specific accounts. Organized data helps accountants work more efficiently and reduces time spent on manual adjustments.

Pro Tip: Create a checklist for your pre-accounting process to ensure no step is missed. This ensures consistency and builds trust in the data’s accuracy.

How Pre-Accounting Simplifies Accounting Workflows?

1. Streamlining Data Collection

Gone are the days of flipping through paper receipts or scanning endless email threads. With modern pre-accounting tools, data collection becomes automated and centralized. For instance, apps can capture receipt data with a simple photo and sync it directly to your system.

2. Automation for Efficiency

Automation is the heart of pre-accounting. Tools like Vyapar TaxOne simplify complex tasks like mapping Excel data, creating ledgers, and reconciling accounts. Automation provides consistency and saves hours of manual effort.

3. Error Prevention

By addressing discrepancies early in the pre-accounting stage, you can prevent them from escalating into larger problems during bookkeeping or financial reporting.

4. Speeding Up the Workflow

Pre-accounting reduces bottlenecks in the accounting process. When data is clean and organized upfront, accountants can focus on more strategic tasks instead of fixing errors.

Pre-Accounting Best Practices

Want to optimize your pre-accounting process? Follow these tips:

- Leverage Technology: Use tools like Vyapar TaxOne for automation and seamless data management.

- Establish Clear Processes: Define standard operating procedures for tasks like categorization and reconciliation.

- Train Your Team: Ensure employees understand the importance of pre-accounting and how to execute it effectively.

- Schedule Regular Check-Ins: Reconcile and review data consistently to avoid last-minute scrambling.

How Vyapar TaxOne Can Help in Pre-Accounting

Vyapar TaxOne is a powerful ally in your pre-accounting journey. Here’s how it can make a difference:

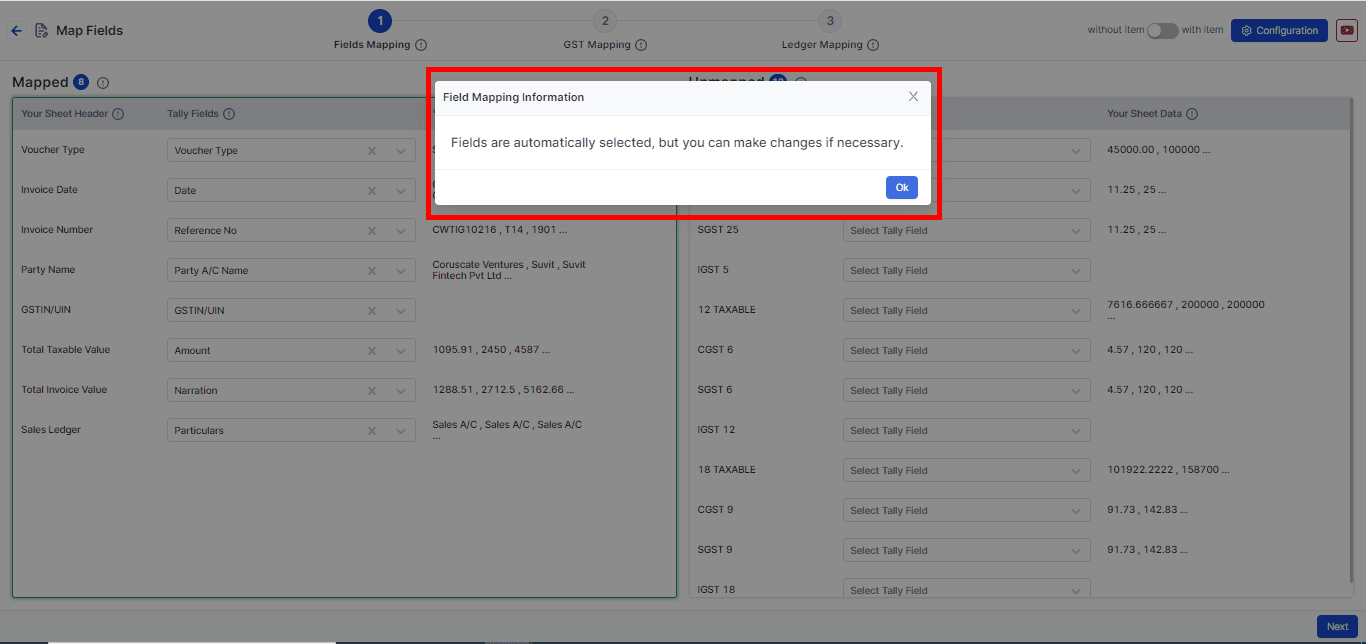

1. Automated Data Mapping

Vyapar TaxOne’s cutting-edge tools are designed to handle data from multiple sources with ease. Its automated mapping feature ensures transactions from bank statements, invoices, and Excel sheets are categorized accurately. No more manual sorting—Vyapar TaxOne does it all, saving valuable time and minimizing errors.

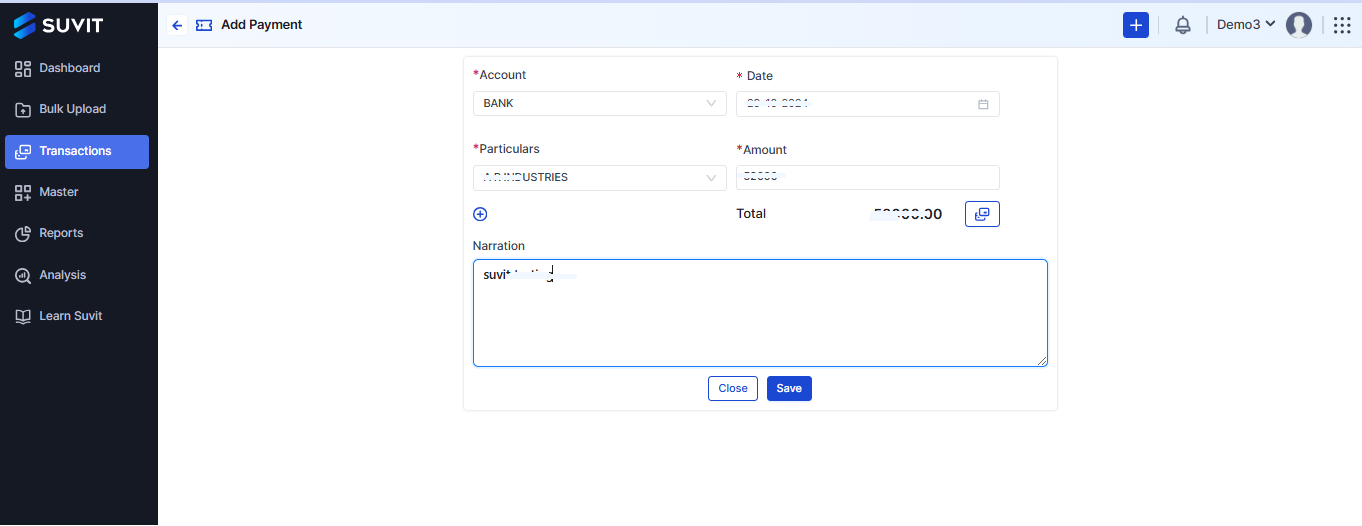

2. Voucher Management and Creation

Managing vouchers efficiently is a cornerstone of pre-accounting. This process involves creating, organizing, and maintaining vouchers for every financial transaction, ensuring proper documentation and traceability.

For instance, each payment made or received should be accompanied by a corresponding voucher—whether it’s a cash payment, journal entry, or bank transaction.

Digitized voucher systems can simplify this process, allowing you to generate customized vouchers automatically while ensuring compliance with legal and financial standards.

Vyapar TaxOne can help you:

- Auto-generate vouchers with key transaction details such as date, amount, and category.

- Maintain a structured voucher numbering system to avoid duplication.

- Store and retrieve vouchers digitally for easy access during audits or reconciliations.

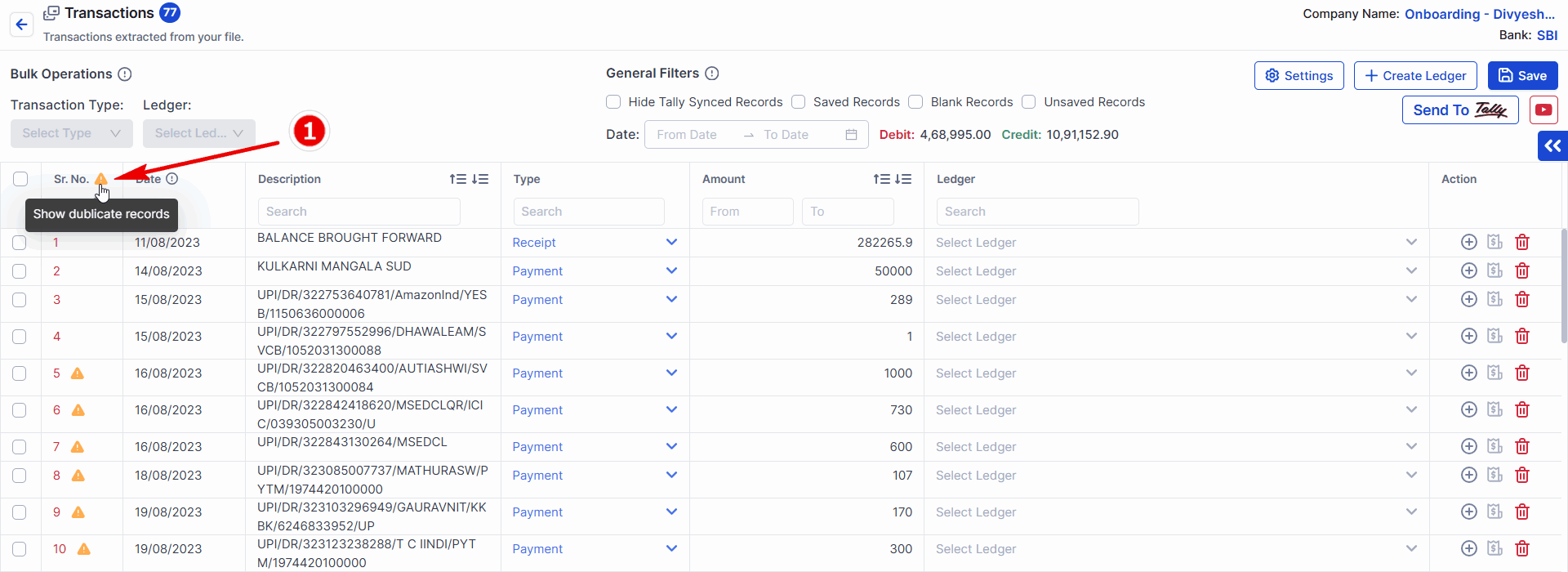

3. Bank Integration and Reconciliation

Vyapar TaxOne connects directly to your bank accounts for real-time transaction updates. This seamless integration enables faster and more accurate reconciliation.

Transactions are automatically matched, and any discrepancies are flagged instantly, giving you peace of mind.

4. Customizable Reporting

With Vyapar TaxOne, pre-accounting doesn’t stop at the organization; it extends into actionable insights.

Customizable reporting features allow you to analyze spending trends, identify cost-saving opportunities, and prepare for audits effortlessly.

5. Integration-Friendly

Vyapar TaxOne integrates seamlessly with the popular accounting software Tally. This ensures a smooth transition from pre-accounting to bookkeeping without needing manual uploads or data reformatting.

Example: Imagine a small retail business using Vyapar TaxOne to manage daily sales and expenses. By automating data categorization and integrating with their accounting software, the business can reduce its monthly accounting workload by 40% and save countless hours during tax season.

Benefits of Pre-Accounting

The advantages of pre-accounting go beyond just saving time. Here’s what you gain:

| Benefit | Explanation |

|---|---|

| Improved Accuracy | Reliable data leads to better financial insights. |

| Faster Processes | Streamlined workflows reduce turnaround times. |

| Cost Savings | Automation cuts down on manual labor costs. |

| Better Compliance | Organized records make tax filing stress-free. |

Real-World Applications

Consider a small business owner who previously struggled with mismatched receipts and manual data entry. After adopting pre-accounting tools like Vyapar TaxOne, they:

- Minimized errors in tax filing, avoiding penalties.

- Gained real-time visibility into their financial health.

- Saved time for strategic tasks.

Pre-accounting isn’t just a theoretical concept; it delivers tangible results.

Organized Workflows For The Win

Pre-accounting may sound like an extra step, but it’s a game-changer for simplifying your accounting workflow. By organizing data, leveraging automation, and following best practices, you’ll save time, reduce errors, and make better financial decisions.

Ready to take the next step? Explore tools like Vyapar TaxOne to streamline your pre-accounting process and experience the difference firsthand.

Remember: Simplifying your workflow starts with mastering the basics—and pre-accounting is the perfect place to begin.

Also Read:

- Leading Bookkeeping Trends in the Artificial Intelligence Era

- How Data Input Automation Can Change The Way CA or Tax Firms Work

- Why Should Accounting Software Security be the Number One Concern?

- What Every Freelancer CA Should Know About Artificial Intelligence in Accounting

- What is Quishing or QRshing? How to Avoid and Prevent Phishing Scams via QR Codes?