The income tax department provides a unique 10-digit alphanumeric identifier known as the Permanent Account Number (PAN), which is mandatory for all taxpayers. In addition to receiving a physical PAN card at your registered address, you also have the option to download the e-PAN online.

What Is An E-PAN?

Think of an e-PAN as your physical PAN card's digital twin. It carries all the same essential information – your unique 10-digit alphanumeric code, name, father's name, gender, date of birth, photograph, signature, and even a secure QR code. But unlike its paper image, you can conveniently store your e-PAN on your digital devices, accessing it instantly anytime, anywhere. No more waiting for deliveries or fretting about lost cards!

Benefits Of Adopting E-PAN:

Unmatched Convenience: Ditch the worries of losing your card or waiting for postal deliveries. Your e-PAN is always readily available within your digital reach, streamlining transactions and saving time.

Enhanced Security: e-PANs have digital signatures and encryption, offering significantly higher security compared to physical cards, minimizing the risk of fraud or misuse. Opt for peace of mind with this secure, digital alternative.

Instant Verification: Use your e-PAN for seamless e-verification of your PAN details during various financial transactions, saving you time and hassle. No more submitting physical copies or waiting for verification delays.

Eligibility Criteria For E-PAN:

To be eligible for an e-PAN, you must meet the following requirements:

Indian Citizenship: This option is currently exclusive to Indian citizens.

Individual Taxpayer Status: Companies and other entities have different PAN application procedures.

Valid Aadhaar Card: Your Aadhaar card acts as a key element for e-PAN applications and should be linked to your registered mobile number. Ensure your information is accurate and up-to-date!

How to Download PAN Card : Three Avenues to Explore

Now, let's navigate the e-PAN download process! You have three convenient options, each with its specific interface and steps:

1. NSDL Website(Now Protean):

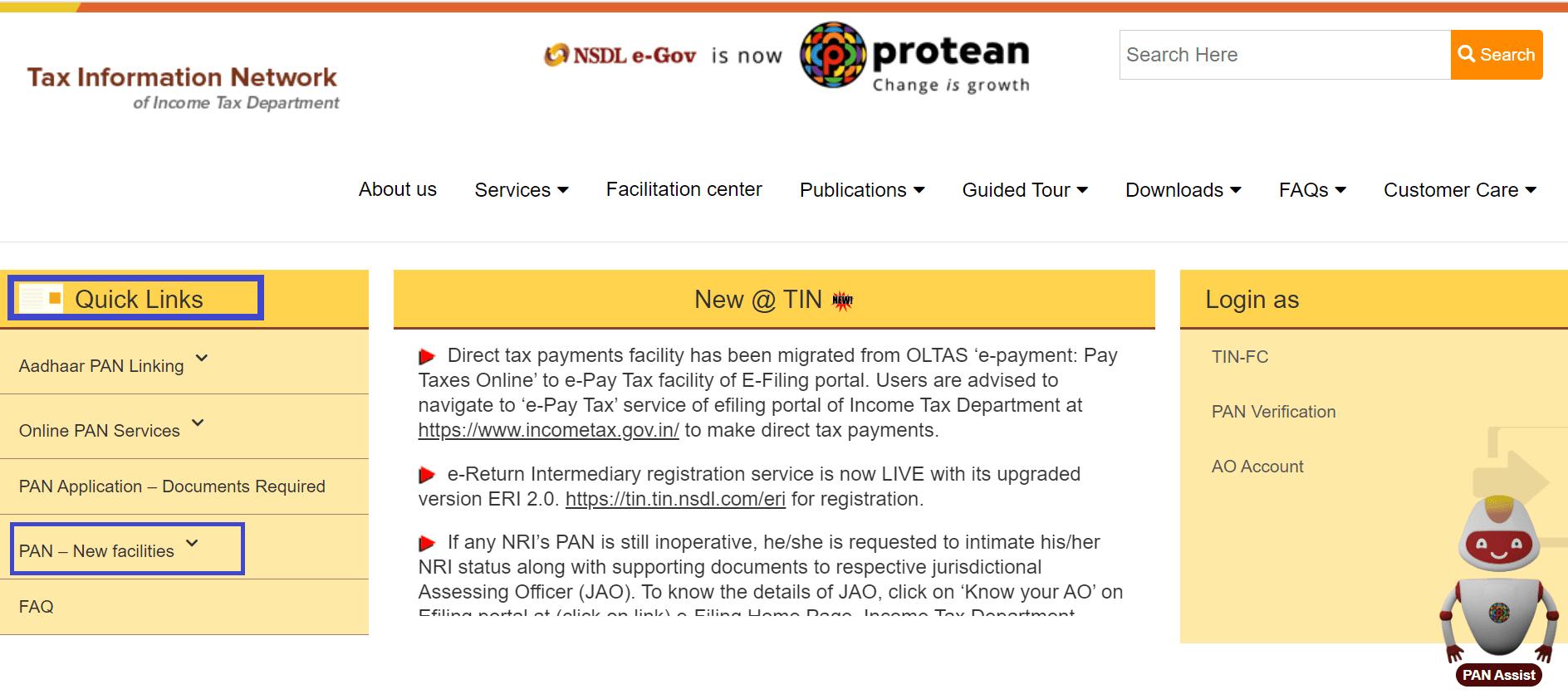

Step 1: Head to the NSDL website and navigate to "Quick Links" under "PAN Services."

Here, you'll encounter an important question:

FAQ: Will an e-PAN be considered valid proof of PAN?

Absolutely! An e-PAN holds the same legal value as your physical card. All the details are identical, so you can confidently use it as proof of identity and address during financial transactions.

Now, back to the download process:

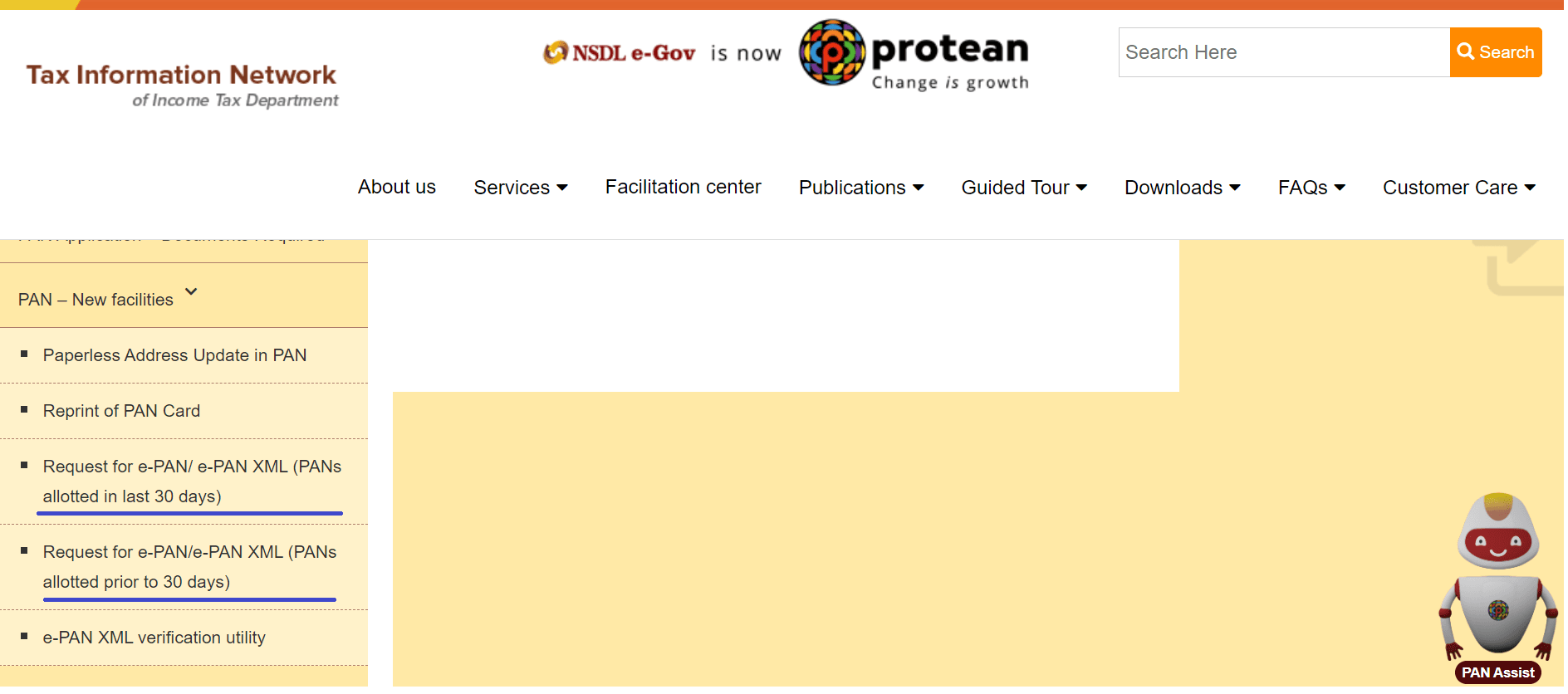

Step 2: Choose "Download e-PAN/e-PAN XML" based on whether your PAN was allotted within the last 30 days or prior to 30 days.

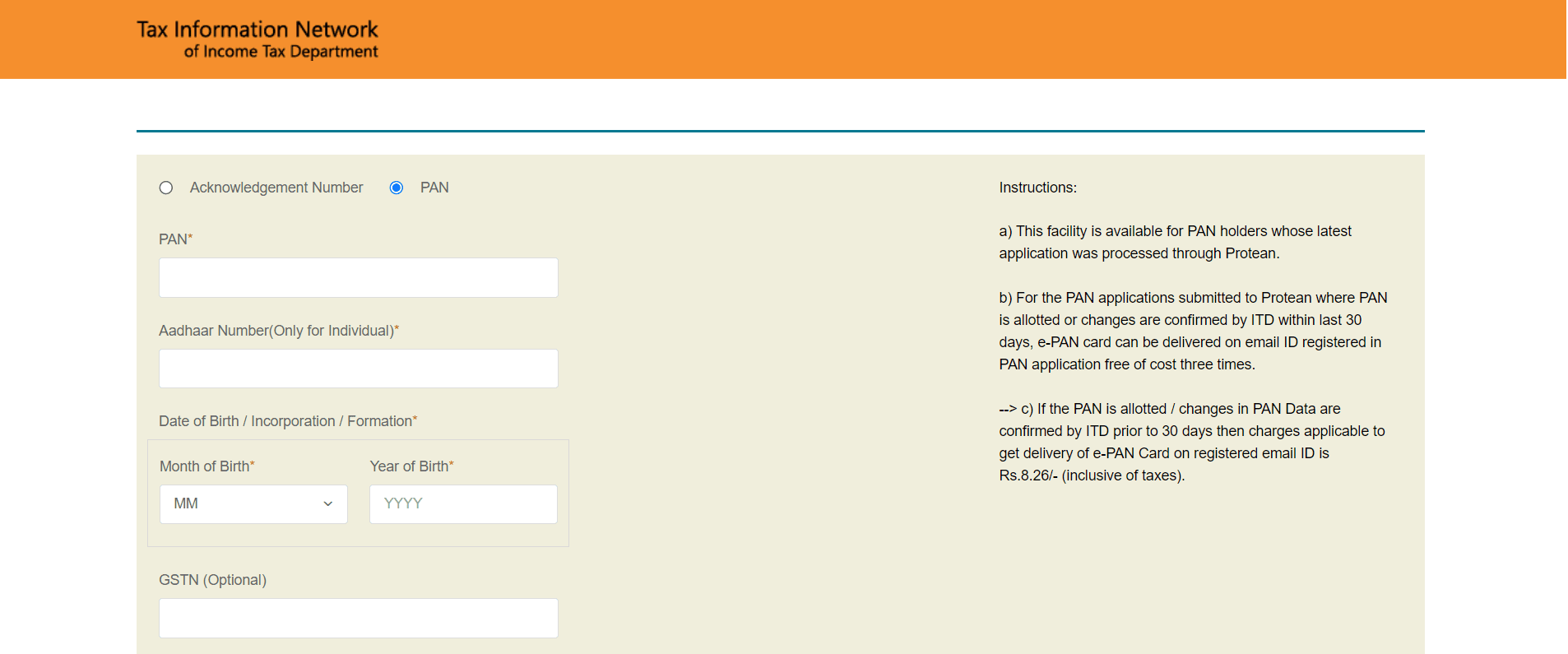

Step 3: On the next page, you can pick either 'Acknowledgment Number' or 'PAN.' If you choose 'PAN,' just type in your PAN number, Aadhaar number, birth date/registration date, GSTN (if you have one), and the captcha code. Then, click 'Submit.'

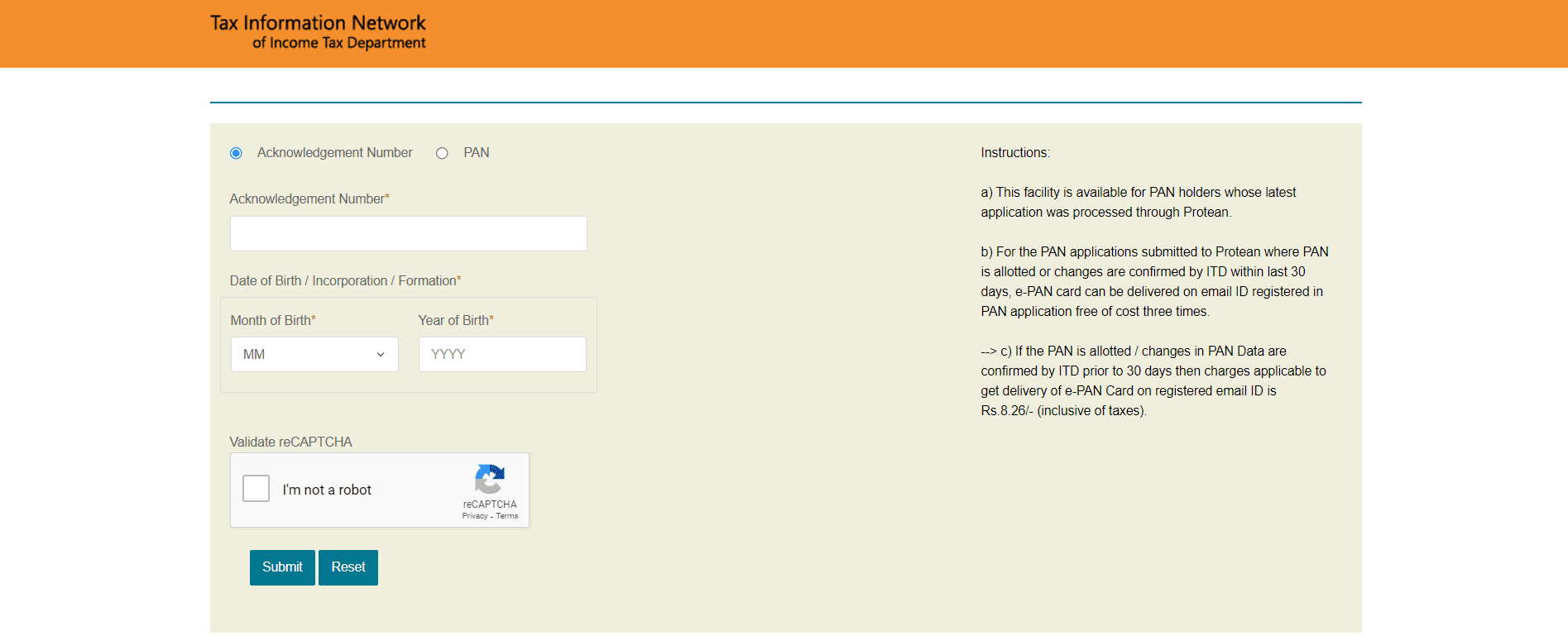

If you go for the 'Acknowledgement Number' option, put in the Acknowledgement number, your birth date/incorporation date, captcha code, and then click on 'Submit.'

Step 4: Enter your PAN number, Aadhaar number, and date of birth (or Acknowledgement number if applicable).

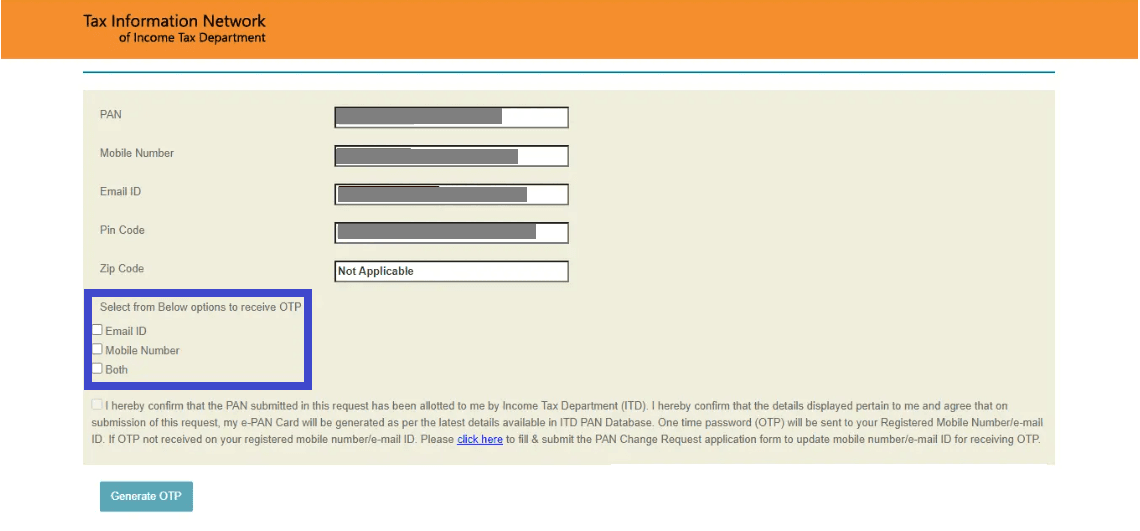

Step 5: Pick one option, mark the declaration, and press the 'Generate OTP' button.

FAQ: What to do when I do not receive an OTP?

Don't worry! Simply reload the page and submit your details again to receive another OTP. If the issue persists, reach out to UIDAI for assistance.

Step 6: Enter the OTP received on your registered mobile number.

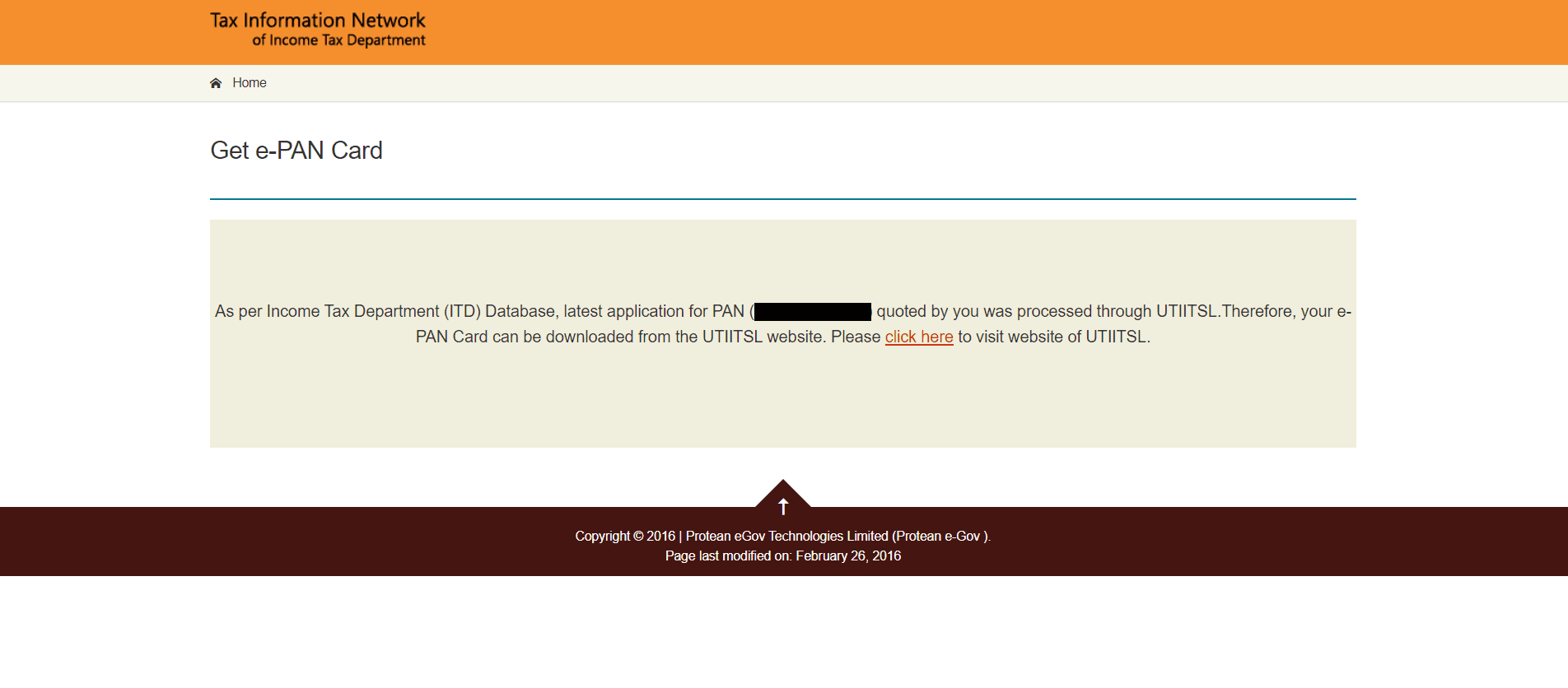

Alert: If your PAN card application was processed through UTIITSL, then you’ll see a message like this:

Step 7: Click "Validate" and then "Download PDF" to download your e-PAN.

If your free e-PAN downloads are used up, a message will appear on the screen. Click on 'Continue with paid e-PAN download facility.' Choose a payment option, make the payment, and then click 'Download PDF.'

Your e-PAN card will be downloaded in PDF format, secured with a password, which is your birth date.

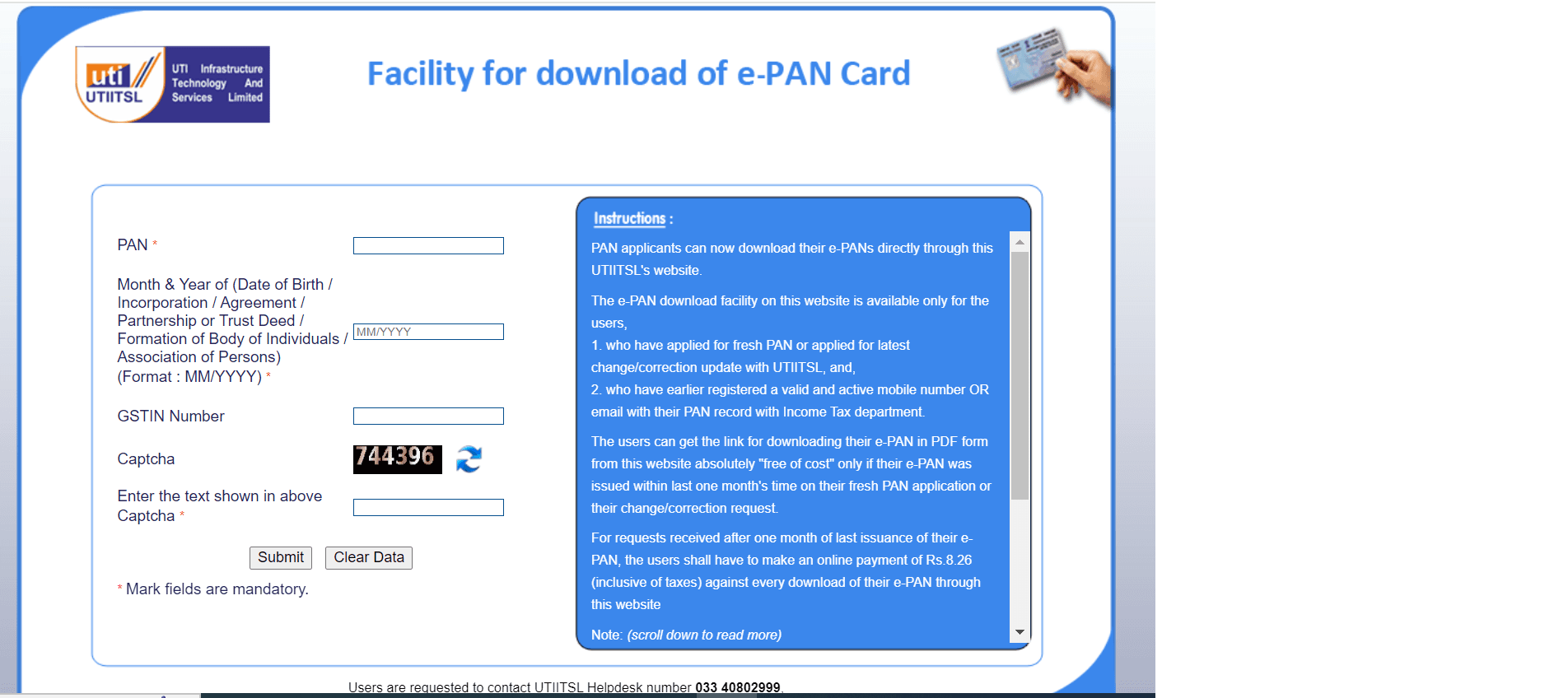

2. UTIITSL Website:

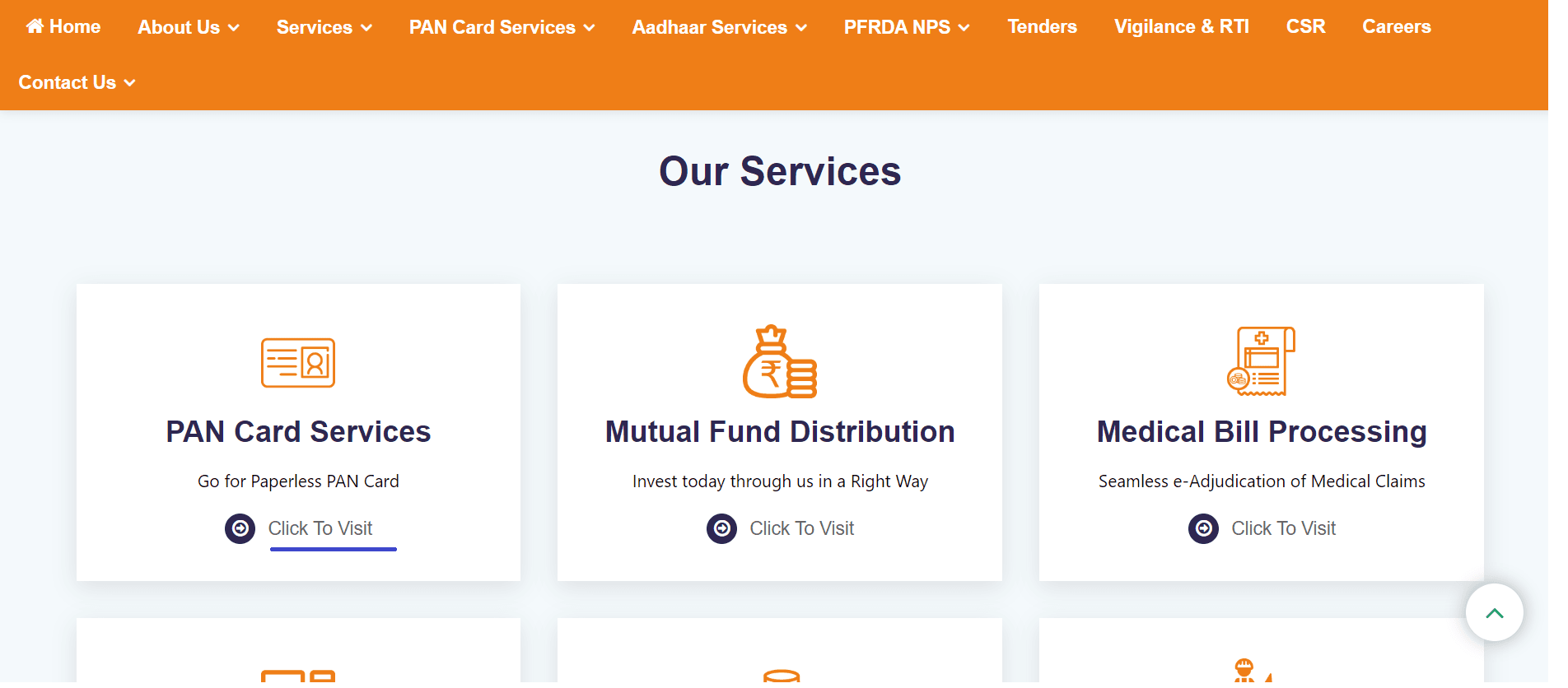

Step 1: Visit the UTIITSL website and Select ‘Click to visit’ button on Pan Card Services.

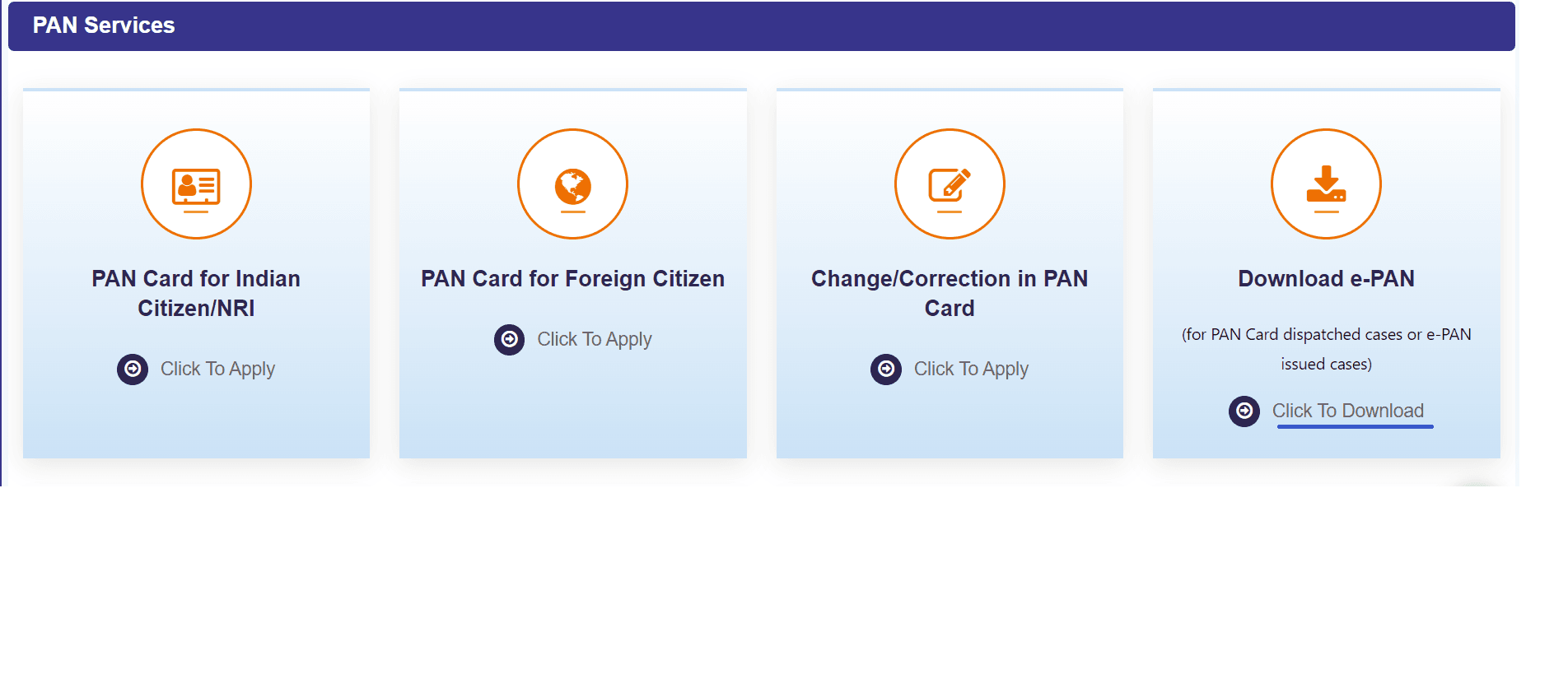

Step 2: Now, select "Click to Download" under "Download e-PAN."

Step 3: Enter your PAN number, date of birth, and GSTIN (optional).

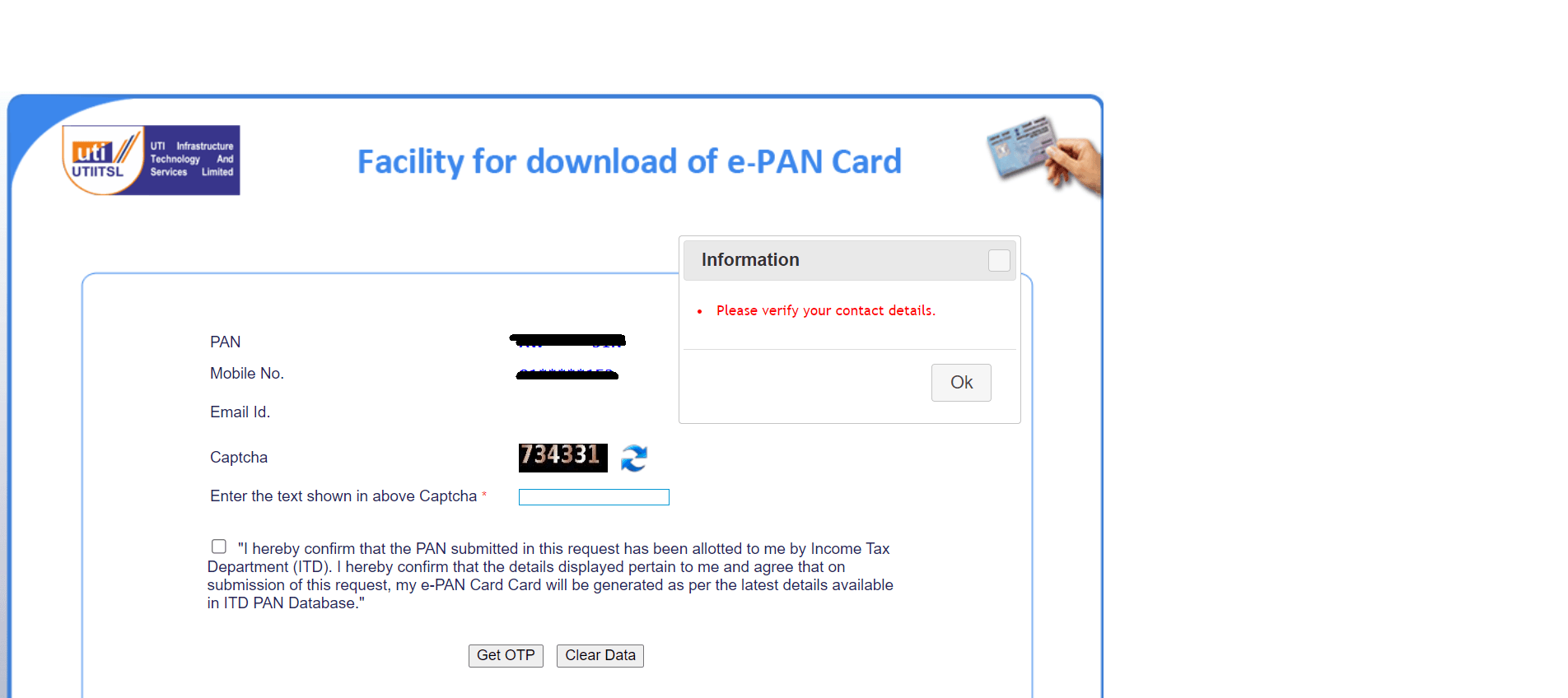

Step 4: Click "Submit" and you will be required to verify your contact details.

Step 5: You will receive a link to your e-PAN via SMS or email. Click the link and enter the OTP received on your registered mobile number. Download your e-PAN in PDF format.

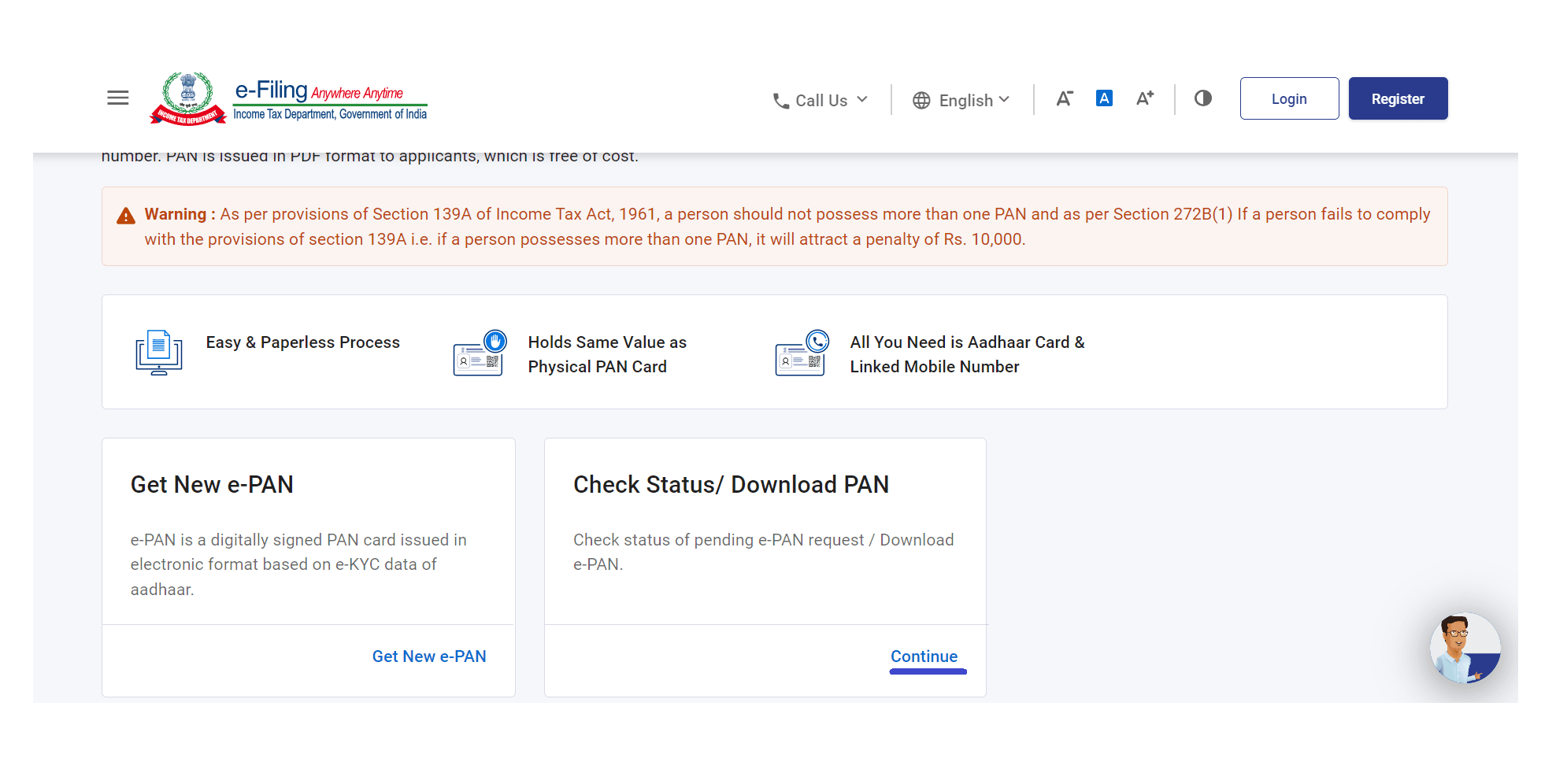

3. Income Tax e-Filing Website:

This option is only available if you applied for an instant e-PAN using your Aadhaar number on the e-filing website.

Step 1: Visit the Income Tax e-Filing website.

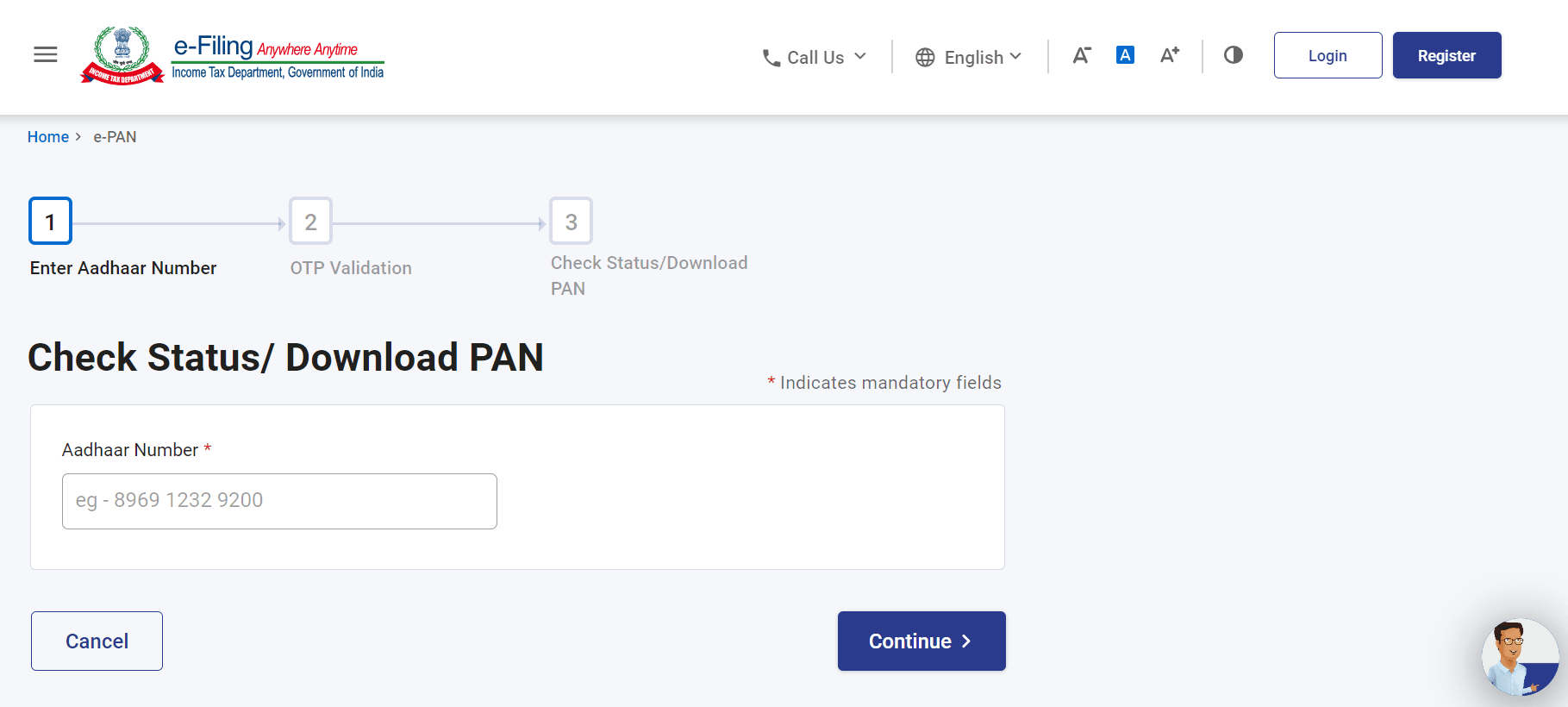

Step 2: Go to "Check Status/ Download PAN" and click on ‘Continue’ button.

Step 3: Input your 'Aadhaar Number' and press the 'Continue' button. After that, provide the 'Aadhaar OTP' sent to your Aadhaar-registered mobile number, then click 'Continue'.

Step 4: The status of your e-PAN will be presented. Once the new e-PAN is assigned, click 'Download e-PAN' to acquire a copy of your e-PAN.

Important Customer Care Numbers For PAN Card

By utilizing any of these three convenient methods, you can seamlessly download your e-PAN and experience the benefits of this digital alternative. Remember, if you encounter any difficulties, the PAN Card customer care representatives are just a phone call away!

- INCOME TAX DEPARTMENT: 1800-103-0025, 1800-419-0025, +91-80-46122000, +91-80-61464700

- UTIITSL: +91-33-40802999, 033-40802999

- NSDL: 020-27218080

- PAN CARD: Protean eGov Technologies Limited Toll Free Number- 020-27218081

FAQS

FAQ: Should I submit a physical copy of my KYC application or Aadhaar card as proof?

No, this is an entirely online process. No paperwork is required, making it convenient and paperless.

FAQ: Is it mandatory to complete in-person verification (IPV) for e-KYC?

No, the e-KYC process relies on your Aadhaar information, making IPV unnecessary. Enjoy a fully online and hassle-free experience!

FAQ: How to know if my e-PAN generation request has been submitted successfully?

A success message along with an Acknowledgement ID will be displayed, so keep a note of it for future reference. You'll also receive a copy on your registered mobile number linked to Aadhaar.

FAQ: Can I apply for a PAN if my Aadhaar Card is inactive?

Unfortunately not. Your Aadhaar card needs to be active for applying for a PAN. Ensure your Aadhaar details are up-to-date before proceeding.

FAQ: Do I need to pay any fee to apply for e-PAN?

No, it's completely free! Enjoy the benefits of digital convenience at no cost. If your e-PAN is ready, click "Download e-PAN" to download it and store it securely. Remember, downloading your e-PAN within 30 days of allotment is free. After that, a nominal fee applies. Keep your e-PAN password, which is your date of birth, confidential for optimal security.