Digital accounting is the future of the accounting profession. The Institute of Chartered Accountants of India (ICAI) has recognized this and is taking a proactive approach to promote digitalization in the field.

The ICAI's digital push is centred around the Digital Competency Model for Management Professionals (DCMM). DCMM v2 is a framework that helps CA firms assess their digital maturity and develop strategies for improvement.

In this blog post, we will explore ICAI's digital push for new-age accounting and how it is reshaping the field. We will also discuss the benefits of digital accounting for CA firms and their clients, as well as the challenges and opportunities of this digital transformation.

Let’s get started!

What is DCMM?

The Digital Competency Model for Management Professionals (DCMM) is a framework developed by the ICAI to help CA firms assess their digital maturity and develop strategies for improvement. The DCMM v2 framework is based on the following five dimensions:

- Leadership: This dimension assesses the firm's commitment to digital transformation and its leadership's understanding of the digital landscape.

- Strategy: This dimension assesses the firm's digital strategy and its alignment with the overall business strategy.

- Processes: This dimension assesses the firm's digital processes and its ability to automate and streamline them.

- People: This dimension assesses the firm's digital workforce and its skills and knowledge.

- Technology: This dimension assesses the firm's digital infrastructure and its use of

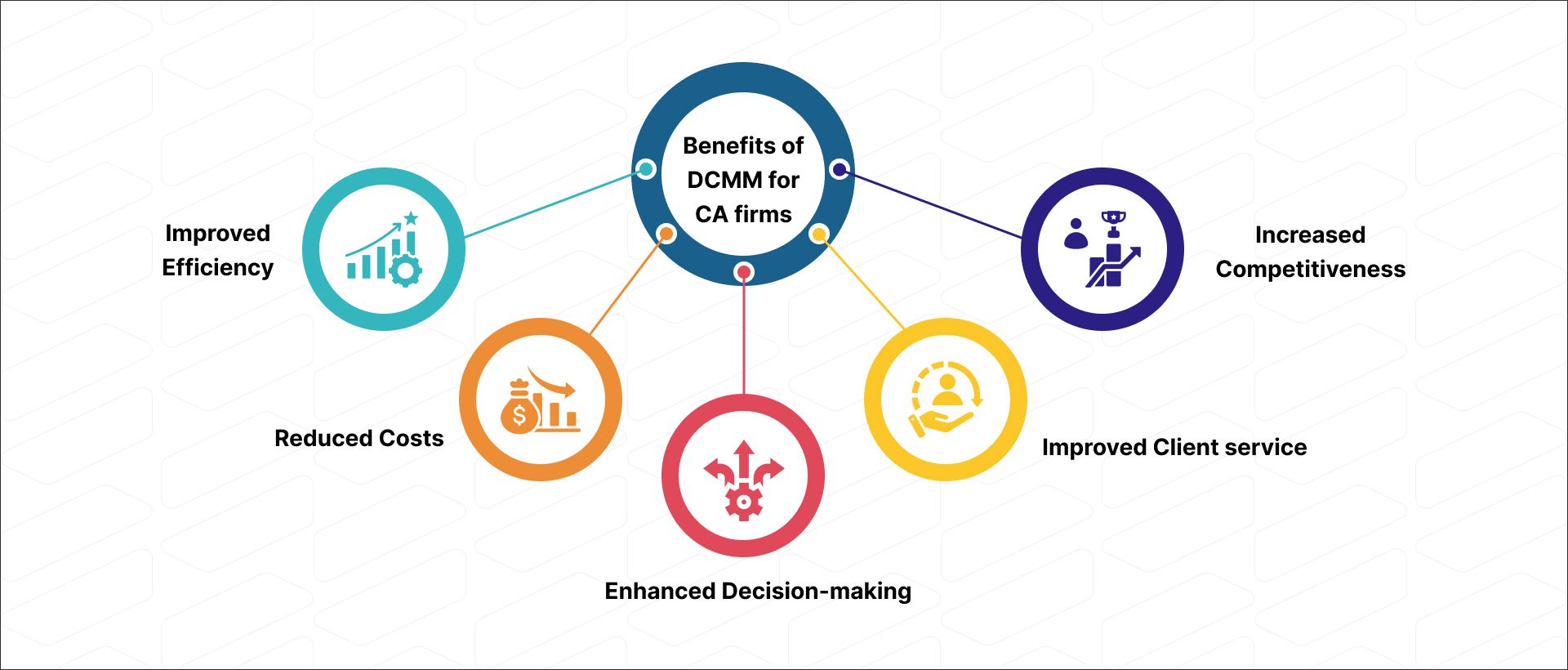

Benefits of DCMM for CA firms

There are several benefits for CA firms that adopt the DCMM v2 framework. These benefits include:

- Improved efficiency: DCMM v2 can help CA firms automate their accounting processes and improve their efficiency.

- Reduced costs: DCMM v2 can help CA firms reduce their costs by streamlining their operations and eliminating manual tasks.

- Enhanced decision-making: DCMM v2 can help CA firms make better decisions by providing them with insights into their digital performance.

- Improved client service: DCMM v2 can help CA firms provide their clients with better service by offering them real-time access to their financial data and insights.

- Increased competitiveness: CA firms that adopt DCMM v2 will be more competitive in the market because they will be able to offer their clients more efficient and innovative services.

Also Read: How Section 194N and 194NF Affect Your Cash Withdrawals and Income Distribution

How DCMM v2 can help CA firms automate their accounting processes

DCMM v2 can help CA firms automate their accounting processes in a number of ways. For example, CA firms can use DCMM v2 to:

- Implement cloud-based accounting software: A cloud-based accounting software can automate many of the manual tasks involved in accounting, such as data entry, reconciliation, and reporting. One such example is Suvit, which helps automate all these tasks seamlessly.

- Use automated workflows: Automated workflows can be used to streamline and automate accounting processes, such as invoice processing and expense reporting.

- Implement robotic process automation (RPA): RPA can be used to automate even more complex accounting tasks, such as tax preparation and financial analysis.

By automating their accounting processes, CA firms can save time and money, improve efficiency, and reduce errors. This can lead to improved profitability and better client service.

Here are some specific examples of how CA firms can use DCMM v2 to automate their accounting processes:

- Internal processes: CA firms can use DCMM v2 to automate tasks such as time tracking, expense reporting, and payroll processing. This can free up CAs to focus on more strategic and value-added work.

- Audit processes: CA firms can use DCMM v2 to automate audit tasks such as data collection, analysis, and reporting. This can help CA firms to complete audits more efficiently and accurately.

- Tax and compliance services: CA firms can use DCMM v2 to automate tax and compliance tasks such as tax preparation and filing. This can help CA firms to save their clients time and money.

- Accounting function: CA firms can use DCMM v2 to automate tasks such as financial statement preparation and reporting. This can help CA firms to provide their clients with more timely and accurate insights into their financial performance.

Also Read: GST Rules for Small Businesses and Start-ups in India

How the digital push by the ICAI aims to facilitate seamless collaboration between accountants and their clients

The ICAI's digital push aims to facilitate seamless collaboration between accountants and their clients by enabling real-time access to financial data, cloud-based accounting software and platforms, and automated chatbots.

Real-time access to financial data

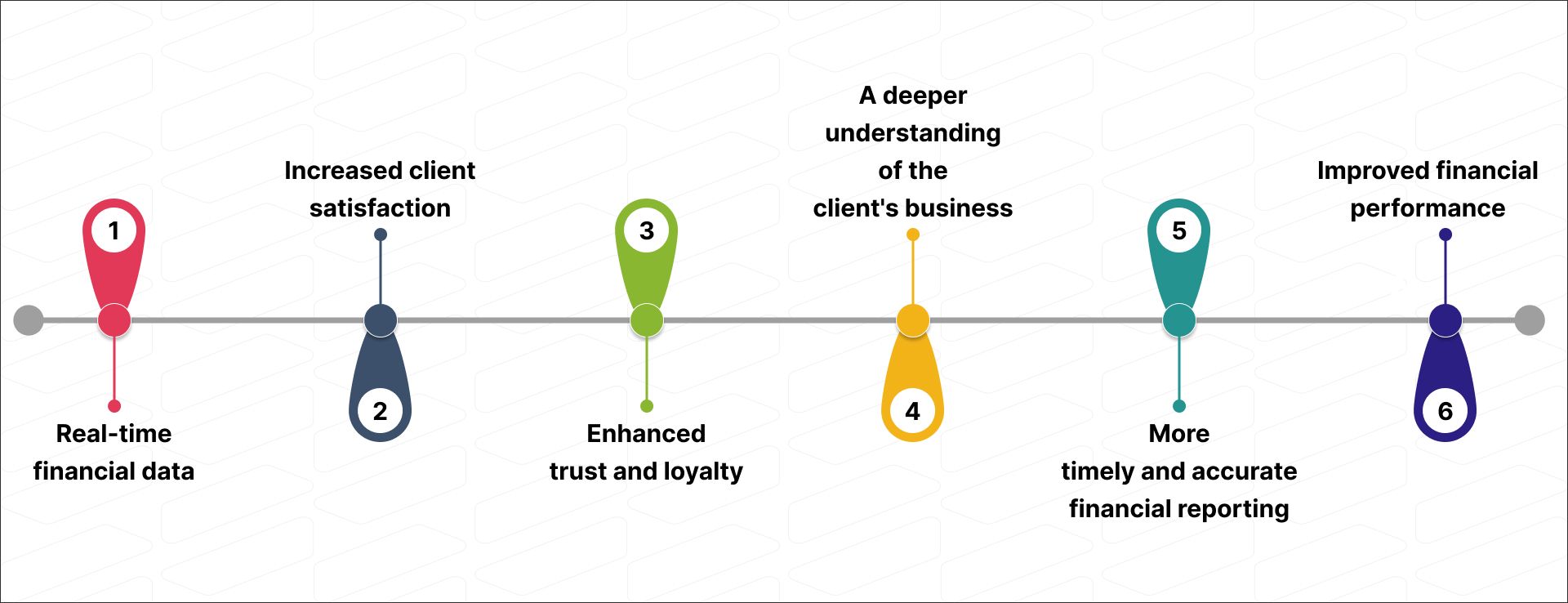

Real-time access to financial data allows accountants and clients to collaborate more effectively and efficiently. For example, accountants can use real-time data to provide their clients with more timely and accurate insights into their financial performance. Clients can also use real-time data to make better decisions about their business.

Cloud-based accounting software and platforms

Cloud-based accounting software and platforms make it easy for accountants and clients to collaborate on financial data. Accountants can access their clients' financial data from anywhere in the world, and clients can view their financial data in real-time. This makes it easier for accountants and clients to communicate and collaborate on financial matters.

Automated chatbots

Automated chatbots can be used to provide clients with 24/7 support on financial matters. Chatbots can answer clients' questions about their financial data, provide them with insights into their financial performance, and help them resolve financial issues. This can free up accountants to focus on more complex and strategic tasks.

Here are some specific examples:

- Real-time access to financial data: CA firms are using cloud-based accounting software to provide their clients with real-time access to their financial data. This allows clients to view their financial data anytime, anywhere, and to collaborate with their accountants on financial matters more effectively.

- Cloud-based accounting software and platforms: CA firms are also using cloud-based accounting software and platforms to collaborate with their clients on financial matters. For example, CA firms can use cloud-based software to share financial reports with their clients, discuss financial strategies, and resolve financial issues.

- Automated chatbots: CA firms are also using automated chatbots to provide their clients with 24/7 support on financial matters. For example, clients can use chatbots to ask questions about their financial data, get insights into their financial performance, and resolve financial issues.

The ICAI's digital push is making it easier for accountants and their clients to collaborate on financial matters. This is leading to improved communication, efficiency, and decision-making.

In addition to the benefits mentioned above, seamless collaboration between accountants and their clients can also lead to:

The impact of digital accounting on the accounting profession

Digital accounting is having a major impact on the accounting profession. It is changing the way that accountants work, the services that they offer, and the skills that they need.

One of the biggest impacts of accounting automation is that it automates many of the manual tasks that accountants used to perform. This is freeing up accountants to focus on more strategic and value-added work.

For example, accountants can now use cloud-based accounting software like Suvit to automate tasks such as data entry, reconciliation, and reporting. This allows accountants to spend more time on tasks such as financial analysis, financial planning, and tax compliance.

Another impact of digital accounting is that it enables accountants to offer new and innovative services to their clients. For example, accountants can now use data analytics to help their clients make better financial decisions. They can also use artificial intelligence (AI) to automate complex tasks such as tax preparation and financial modelling.

The impact of digital accounting on the accounting profession is still evolving. However, it is clear that digital accounting is transforming the way that accountants work and the services that they offer.

The challenges of implementing digital accounting

There are a number of challenges that CA firms face when implementing digital accounting. These challenges include:

- Cost: Implementing digital accounting can be expensive, especially for smaller CA firms.

- Complexity: Digital accounting can be complex to implement and manage.

- Skills gap: CA firms need to have the skills and knowledge to implement and use digital accounting systems effectively.

- Cultural change: Implementing digital accounting requires a cultural change within CA firms. CAs need to be willing to adopt new technologies and new ways of working.

Despite these challenges, the benefits of implementing digital accounting outweigh the costs. CA firms that implement digital accounting can improve their efficiency, reduce their costs, and offer their clients more innovative services.

Here are some specific tips for CA firms that are implementing digital accounting:

- Start small: Don't try to implement all of the latest digital accounting technologies at once. Start with a few key technologies and then gradually add more over time.

- Get the right training: Make sure that your staff has the training they need to use the new digital accounting systems effectively.

- Change your culture: Create a culture that is supportive of digital transformation. Encourage your staff to embrace new technologies and new ways of working.

By following these tips, CA firms can overcome the challenges of implementing digital accounting and reap the many benefits that it offers.

Ready to Incorporate Digital Accounting in Your Firm?

The future of accounting is digital. CA firms that embrace digital accounting will be the ones that thrive in the years to come.

So, if you’re ready to embrace the new-age digital accounting, try out Suvit! Here are some specific features of Suvit.io that make it a great tool for accounting automation:

- Document processing: Suvit can automatically process documents such as invoices, receipts, and bank statements. This saves you time and effort, and it also helps to ensure that your data is accurate.

- Bank reconciliation: It can automatically reconcile your bank statements. This ensures that your records are up-to-date and that your bank balance is accurate.

- Financial reporting: Suvit can generate financial reports such as balance sheets, income statements, and cash flow statements. This can help you to track your financial performance and make better business decisions.

- Client management: Suvit can help you to manage your clients' data. This includes storing their contact information, invoices, and payments.

- Collaboration: It allows you to collaborate with your team members on accounting tasks. This can help to improve efficiency and accuracy.

Automate your accounting with Suvit, a free trial is available for 7 days with no need to enter your credit card information. Simply sign up and get started!