Does the phrase “month-end close” fill your finance team with dread? You’re not alone.

Most accountants find that closing the books is the stressful part of their job. With deadlines approaching and accuracy being non-negotiable, having a foolproof system is critical.

Enter the month-end close checklist—your go-to guide to ensure nothing slips through the cracks. Let’s break it down into actionable steps peppered with tips to make it easy for you and your team.

1. Pre-Close Preparation

Think of this as warming up before a marathon. Pre-close preparation lays the foundation for an error-free close.

Checklist:

| Task | Objective | Deadline |

|---|---|---|

| Gather Documentation | Collect invoices, receipts, and expense reports. | 3-5 days before close |

| Review Transactions | Check for missing or duplicate entries. | 3 days before close |

| Team Communication | Ensure all departments submit inputs on time. | 2 days before close |

Pro Tip: Use shared folders or accounting software to centralize documents and improve visibility.

Why this step matters:

- Missing documentation can delay reconciliations and reporting.

- Early communication prevents last-minute scrambling, saving time and reducing stress.

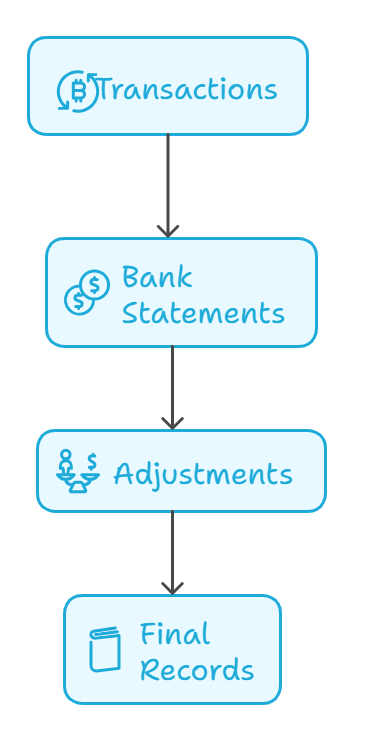

2. Reconciliation of Accounts

Reconciliation ensures your records match reality. Missing this step can lead to costly errors.

Bank Reconciliation

- Match bank statements with recorded transactions.

- Investigate discrepancies and resolve them promptly.

Accounts Payable & Receivable

- Verify all outstanding invoices are accounted for.

- Identify overdue receivables and follow up with clients.

Fixed Assets

- Update fixed asset registers.

- Calculate depreciation for the month.

Common Pitfalls:

- Overlooking small discrepancies can compound into significant issues.

- Failing to follow up on overdue payments can impact cash flow.

3. Review and Adjust Entries

This step ensures your books reflect the actual financial health of the organization.

Adjust for Accruals and Prepayments

- Record accrued expenses and prepayments.

- Allocate revenues and expenses to the correct periods.

Check for Currency Adjustments

- Adjust for foreign exchange rate changes if you deal with multiple currencies.

Benefits of Accuracy:

- Accurate adjustments ensure compliance with accounting standards.

- They also provide a clearer financial picture for decision-making.

Quick Tip: Using accounting automation tools can significantly reduce manual errors here.

Also Read: 90% Fewer Errors in Accounting with Suvit's Precision

4. Generate and Analyze Reports

This is where all your hard work comes together.

Reports to Prepare:

- Trial Balance: Ensure credits and debits match.

- Financial Statements: Generate P&L statements, balance sheets, and cash flow reports.

- Budget vs. Actual Analysis: Compare actuals against forecasts and document variances.

Example Table:

| Report Type | Purpose | Key Insights |

|---|---|---|

| Profit & Loss Statement | Understand revenue and expenses for the month. | Profitability trends |

| Balance Sheet | Snapshot of financial position. | Asset & liability ratio |

| Cash Flow Statement | Monitor cash movement. | Liquidity insights |

Why Analysis Matters:

- Highlighting trends in financial statements can inform strategic decisions.

- Comparing budget vs. actuals helps identify areas of improvement for future months.

Additional Tip: Use visualization tools like graphs to make data interpretation easier for stakeholders.

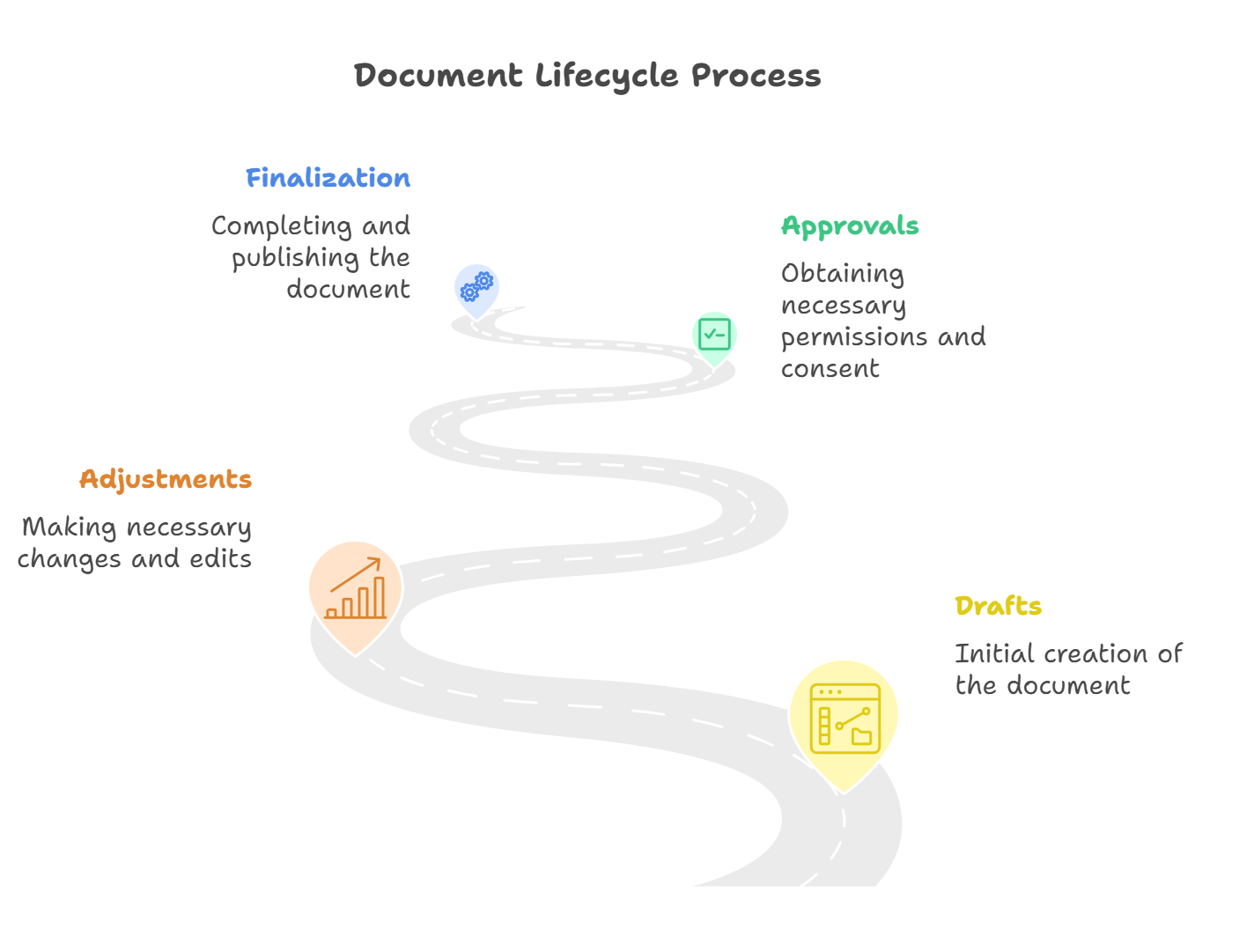

5. Documentation and Finalization

Documentation isn’t just a compliance step; it’s a lifesaver when auditors knock.

Checklist:

- Maintain detailed work papers for adjustments.

- Secure approvals from stakeholders before finalizing.

Why This Step is Essential:

- Detailed documentation ensures transparency and audit readiness.

- It also minimizes the risk of errors being overlooked.

Hypothetical Example: Imagine an audit where you’re asked to explain a large adjustment. Clear work papers can save hours of backtracking and provide immediate clarity.

6. Post-Close Activities

Once the dust settles, there’s still a bit left to do.

Share Financial Reports

- Distribute finalized reports to key stakeholders.

- Highlight key findings during presentations or team meetings.

Review the Process

- Conduct a debrief with the team.

- Identify bottlenecks or inefficiencies to improve next month’s close.

Archive Records

- Securely store all relevant documents.

- Ensure easy retrieval for audits or reference.

Pro Tip: Many accounting software platforms offer cloud storage for safe archiving. You can take advantage of it.

Continuous Improvement:

- Use team feedback to refine the checklist.

- Incorporate lessons learned into training for new team members.

Bringing It All Together: A Stress-Free Month-End Close

The month-end close process doesn’t have to be a source of stress. With a detailed checklist in hand, you can transform chaos into a well-oiled operation. Remember, consistency and preparation are your best allies.

Looking to make things even smoother? Consider adopting accounting automation tools that can handle repetitive tasks, leaving you free to focus on strategic insights.

With the right tools and this checklist, you’ll be closing the books with confidence every month.