Goods and Services Tax (GST) is a comprehensive indirect tax levy on the manufacture, sale, and consumption of most goods and services in Bharat. It was introduced on July 1, 2017, to subsume multiple indirect taxes, such as excise duty, value-added tax (VAT), service tax, and central sales tax (CST).

GST ledgers in Tally are used to record all GST transactions, such as sales, purchases, and expenses. It is important to avoid mistakes in GST ledgers, as this can lead to penalties from the GST authorities.

In this blog post, we will discuss some of the common mistakes to avoid when managing GST ledgers in Tally. We will also provide tips on how to avoid these mistakes and ensure that your GST ledgers are accurate and compliant.

Lack of Understanding of GST Ledgers

Explanation of GST Ledgers and their Role in Tally

1. Definition and Purpose of GST Ledgers

GST ledgers serve as digital accounts within Tally designed specifically for recording transactions related to Goods and Services Tax (GST). They play a critical role in maintaining accurate and compliant financial records for businesses operating under the GST regime in Bharat.

These ledgers provide a structured framework for businesses to categorize and track the tax implications of their sales and purchases, ensuring seamless reconciliation with the GST portal.

Also Read: Simplify Your Tax Compliance: A Step-by-Step Guide to Filling All Types of GST Returns in India

2. Types of GST Ledgers

- Central GST (CGST)

- State GST (SGST)

- Integrated GST (IGST)

- Cess

Each type of GST ledger is associated with a specific type of GST, reflecting the tax amounts accrued and ensuring proper compliance with the respective tax authorities.

3. Role in Reconciliation with GST Portal

GST ledgers act as a bridge between Tally and the GST portal. They facilitate the smooth alignment of financial data, allowing businesses to cross-verify and rectify any discrepancies before filing GST returns.

Tracking input tax credit (ITC) and output tax liability is a crucial function of GST ledgers, ensuring that businesses are accurately reflecting their tax positions.

Importance of Correctly Categorizing Transactions under GST Heads

Correctly categorizing transactions under GST heads is important for a number of reasons, including:

- Compliance: GST is a complex tax system, and businesses have a responsibility to comply with all applicable laws and regulations. One way to do this is to ensure that all transactions are correctly categorized under the appropriate GST heads.

- Taxation: The tax rate applicable to a transaction will vary depending on the GST head under which it is categorized. For example, the tax rate on goods is generally lower than the tax rate on services. Therefore, it is important to correctly categorize transactions in order to ensure that the correct amount of tax is paid.

- Credits: Businesses can claim input tax credits on goods and services that are used for business purposes. However, input tax credits can only be claimed on goods and services that are taxed under the same GST head as the output tax payable by the business. Therefore, it is important to correctly categorize transactions in order to claim the maximum possible input tax credits.

- Reporting: Businesses are required to file GST returns on a regular basis. These returns must include details of all taxable transactions, along with the applicable GST rates and taxes paid. Therefore, it is important to correctly categorize transactions in order to file accurate GST returns.

In addition to the above, correctly categorizing transactions under GST heads is also important for the following reasons:

- To avoid penalties: The GST authorities may impose penalties on businesses that fail to correctly categorize transactions. The amount of the penalty will vary depending on the severity of the offence.

- To avoid audits: Businesses that incorrectly categorize transactions are more likely to be audited by the GST authorities. An audit can be a time-consuming and expensive process, and it may also result in additional penalties and taxes being imposed.

To maintain good business records: Correctly categorizing transactions helps businesses maintain accurate and up-to-date records of their financial transactions. This can be helpful for a number of purposes, such as making informed business decisions and complying with other tax and regulatory requirements.

Also Read: All About Goods Transport Agency (GTA) Under GST

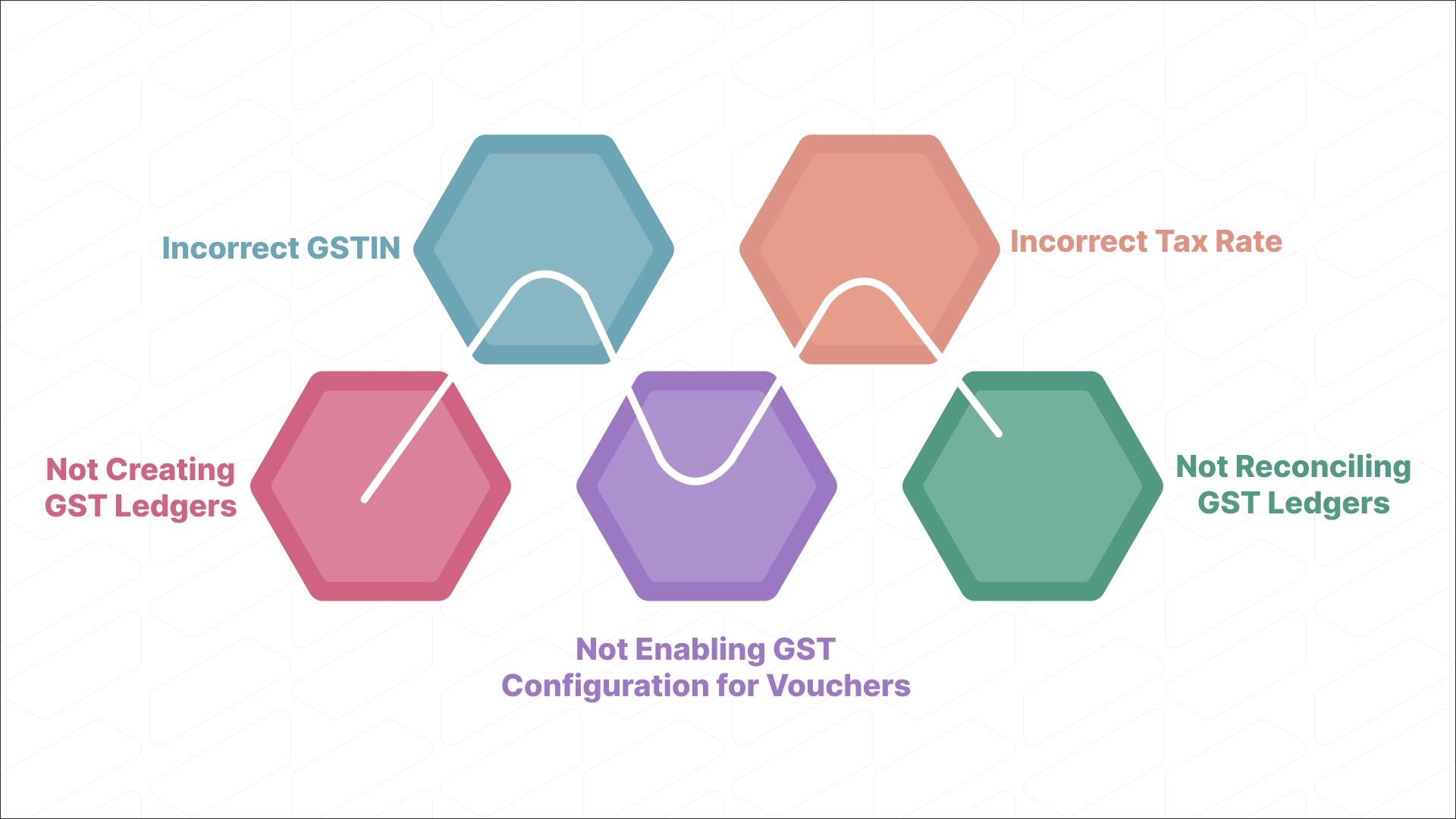

Types of Mistakes to Avoid When Managing GST Ledgers in Tally

1. Incorrect GSTIN

When you create a new party master in Tally, you need to enter the GSTIN of the party. If you enter the GSTIN incorrectly, Tally will not be able to calculate the tax correctly and the transaction will be listed as incomplete in the Return summary.

To avoid this mistake, make sure to double-check the GSTIN of the party before entering it into Tally. You can use the GSTIN Validation Tool on the GST portal to verify the GSTIN.

2. Incorrect Tax Rate

When you record a GST transaction in Tally, you need to select the appropriate tax rate. If you select the wrong tax rate, Tally will not calculate the tax correctly.

To avoid this mistake, make sure to double-check the tax rate before recording the transaction. You can find the latest GST rates on the GST portal.

3. Not Enabling GST Configuration for Vouchers

For Tally to calculate the tax correctly, you need to enable GST configuration for all vouchers that involve GST transactions.

To do this, go to Gateway of Tally > Accounting Features > GST > GST Configuration. In the GST Configuration screen, select the "Enable GST configuration for vouchers" checkbox.

4. Not Creating GST Ledgers for All GST Transactions

You need to create GST ledgers for all types of GST transactions that your business undertakes. If you do not create a GST ledger for a particular type of transaction, Tally will not be able to track your GST liability accurately.

To create a GST ledger, go to Gateway of Tally > Accounting Info > Ledgers > Create. In the Create Ledger screen, select the "GST" option from the Type of Duty/Tax drop-down list. Then, select the appropriate tax type (e.g., Central Tax, State Tax, Integrated Tax) from the Tax Type drop-down list.

5. Not Reconciling GST Ledgers Regularly

You should regularly reconcile your GST ledgers with your GST returns to ensure that all transactions are recorded correctly.

To reconcile your GST ledgers, go to Gateway of Tally > Accounting Features > GST > GST Reconciliation. In the GST Reconciliation screen, select the appropriate period and click on the "Reconcile" button.

By avoiding these common mistakes, you can ensure that your GST ledgers are accurate and compliant with the GST laws. This will help you to avoid penalties from the GST authorities and save money in the long run.

How to Avoid Mistakes in GST Ledgers

Here are some tips on how to avoid common mistakes in GST ledgers:

- Use a GST accounting software: A GST accounting software such as Tally can help you to automate many of the tasks involved in managing GST ledgers, such as calculating tax, generating reports, and reconciling GST ledgers. This can help to reduce the risk of human error.

- Get professional help: If you are not sure about how to record GST transactions in Tally, it is advisable to get professional help from a qualified accountant. They can help you to set up your GST accounting system correctly and train you on how to use it.

- Keep your Tally software up-to-date: Tally regularly releases updates to its software to ensure that it is compliant with the latest GST laws and regulations. Make sure to install these updates as soon as they are available.

- Regularly review your GST ledgers: It is important to regularly review your GST ledgers to identify and correct any errors. You can do this by comparing your GST ledgers to your GST returns.

- Reconcile your GST ledgers regularly: You should regularly reconcile your GST ledgers with your GST returns to ensure that all transactions are recorded correctly. To reconcile your GST ledgers in Tally, go to Gateway of Tally > Accounting Features > GST > GST Reconciliation.

Bonus: Automate Your Tally Accounts With Suvit

Suvit is an amazing tool that can transform the way you manage your Tally accounts overall.

Suvit is an AI-powered accounting automation platform that can help businesses of all sizes automate their Tally accounting and data entry processes. This can save businesses a lot of time and effort, and help to improve the accuracy and efficiency of their accounting processes.

Here are some of the key features of Suvit:

- Data entry automation: Suvit can automatically extract data from invoices, receipts, and other documents and enter it into Tally. This can save businesses a lot of time and effort, and help to reduce errors.

- Client management: Suvit can help businesses to manage their clients more effectively. Businesses can give their clients access to Suvit so that they can upload their own documents and track the status of their data entry.

- User management: Suvit can help businesses to manage their teams more efficiently. Businesses can create users and assign them access to specific companies and tasks.

Tally Mastery: Ready to Level Up?

Understanding and managing GST ledgers in Tally is a cornerstone of seamless GST compliance. By avoiding mistakes in GST ledgers, you can ensure that your GST liability is calculated correctly and that you are compliant with the GST laws. This will help you to avoid penalties from the GST authorities and save money in the long run.

And, if you are looking for a way to automate your Tally accounting and data entry processes, we encourage you to try Suvit! Start your 7-day free trial today and see for yourself how Suvit can help you take your accounting to the next level.