The Institute of Chartered Accountants of India (ICAI) is essential for the accounting profession in India. They make sure Chartered Accountants (CAs) follow high ethical standards and have strong technical skills.

In recent times, the world of finance has been changing a lot, especially with the introduction of Artificial Intelligence (AI). AI is making big changes in many fields, including accounting.

Seeing these changes, ICAI created the ICAI CA GPT List. This isn't just any accounting software; it's a collection of AI tools developed specifically for CAs. Let's explore how this helps CAs and changes the accounting experience.

What is the ICAI CA GPT List?

The ICAI CA GPT List isn't a single program, but a toolbox filled with smart AI assistants! Each tool tackles a specific area of a CA's work.

Imagine having an AI expert for accounting standards, another for regulations, and even one for auditing. That's the power of the CA GPT List!

Supercharge Your Skills: Exploring the ICAI CA GPT List

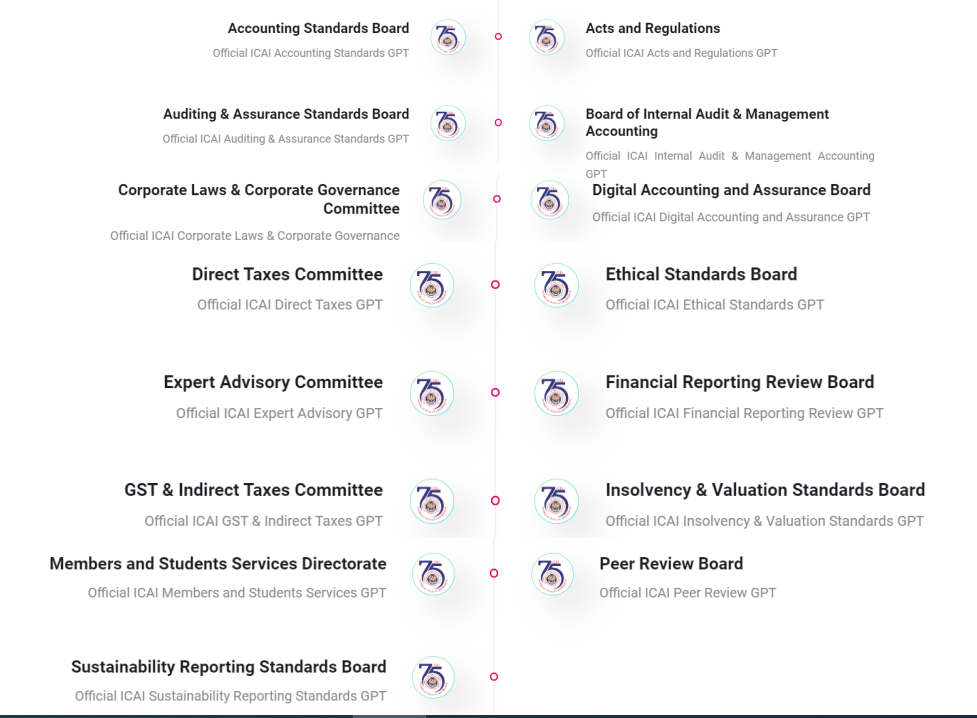

The CA GPT List is your one-stop shop for AI-powered assistance across various aspects of CA work. Here's a breakdown of the 15 tools and what they can do for you:

-

Accounting Standards: Stuck on a complex accounting standard? The Accounting Standards GPT can help you navigate the intricacies and ensure your work adheres to the latest regulations.

-

Acts & Regulations: Stay on top of the ever-changing legal landscape with the Acts and Regulations GPT. This tool provides quick access to relevant acts and helps you stay compliant.

-

Auditing & Assurance: The Auditing & Assurance Standards GPT acts as your AI audit buddy, offering guidance on best practices and ensuring the accuracy of your audits.

-

Internal Audit & Management Accounting: Get valuable insights on internal controls and risk management with the Internal Audit & Management Accounting GPT.

-

Digital Accounting & Assurance: Embrace the digital future with the Digital Accounting and Assurance GPT. This tool assists with leveraging technology for efficient accounting processes.

-

Corporate Laws & Governance: The Corporate Laws & Corporate Governance GPT ensures you're well-versed in corporate law and best practices for ethical governance.

-

Direct Taxes: Streamline your tax calculations and stay updated on the latest tax laws with the Direct Taxes GPT.

-

Ethical Standards: Maintaining the highest ethical standards is paramount. The Ethical Standards GPT helps you navigate ethical dilemmas and make sound decisions.

-

Expert Advisory Committee: Seeking guidance on complex accounting, auditing, and allied matters? The Expert Advisory Committee GPT provides insights based on the expertise of the committee members.

-

Financial Reporting Review: Ensure the accuracy and transparency of your financial reports with the assistance of the Financial Reporting Review GPT.

-

GST & Indirect Taxes: The GST & Indirect Taxes GPT simplifies navigating the complexities of India's Goods and Services Tax and other indirect taxes.

-

Member & Student Services: This GPT acts as a helpful resource for ICAI members and students, providing information on various services and support offered by the institute.

-

Insolvency & Valuation Standards: The Insolvency & Valuation Standards GPT equips you with the knowledge to handle insolvency and valuation procedures effectively.

-

Peer Review: Seeking feedback from peers is crucial for growth. The Peer Review GPT facilitates a smooth and efficient peer review process.

-

Sustainability Reporting: The Sustainability Reporting Standards GPT empowers you to integrate sustainability best practices into your reporting processes.

Also Read: Digital Push for New-Age Accounting by the ICAI

Level Up Your Practice: How CA GPT Benefits CAs

The CA GPT tools are more than just advanced technology – they're a game-changer for Chartered Accountants. Here's how they can boost your practice:

- Enhance Accuracy: These AI tools never get tired, ensuring your work is always accurate, especially for compliance checks and data analysis.

- Make Better Decisions: They turn complex data into clear insights, helping you make smart decisions that benefit your clients.

- Stay Updated: The accounting world changes fast. CA GPT tools keep you informed about the latest standards, regulations, and best practices, so you're always ahead.

How to Access Your ICAI CA GPT Tools

Ready to experience the power of AI in your CA practice? Accessing the ICAI CA GPT List is a breeze! Here's a simple guide:

Step-1: Head to the ICAI AI Website: First things first, visit the official ICAI AI website at https://ai.icai.org/.

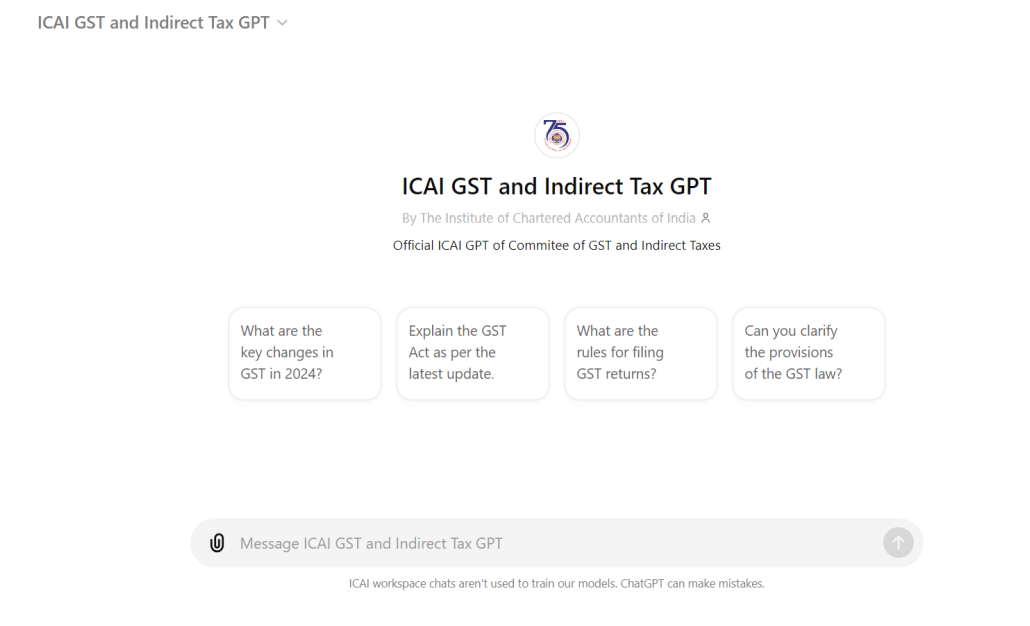

Step-2: Find Your CA GPT Tools: On the website, look for "CAGPT" or navigate directly to https://ai.icai.org/cagpt/

Step-3: Login with Your Credentials: If you're a registered CA member, enter your Membership ID. An OTP (one-time password) will be sent to your mobile number linked to the Self Service Portal (SSP). Enter the OTP to access the CA GPT home screen.

Step-4: New User? Sign Up! Not using ChatGPT yet? No problem! The website offers a sign-up option. You can also use your Gmail ID and password for easy login.

Step-5: Explore Your AI Assistants: Once logged in, you'll see a range of ICAI CA GPT tools available. Simply click on any tool to access its specific functionalities.

Step-6: Ask Away! Each tool has a prompt section where you can pose your questions or provide instructions. The AI will then assist you based on your chosen tool's area of expertise.

So, what are you waiting for? Start exploring the ICAI CA GPT List today and discover a world of possibilities for your CA practice!

Also Read: AI and Cloud-Based Tools Recognized by ICAI—A Chartered Accountant’s Guide to Efficiency

Important Information About ICAI CA GPT

The ICAI CA GPT List is currently in beta testing, which means it's still under development. It's like having a really smart apprentice – it's constantly learning and improving based on your feedback!

Here are some key things to keep in mind:

- Not Professional Advice: The information you get from the CA GPT tools is for learning purposes only. It's not a replacement for consulting a qualified professional like a lawyer, accountant, or tax advisor for specific business decisions.

- Double-Check for Accuracy: Since it's still under development, there's a chance the information might not be the absolute latest. It's always a good idea to double-check things with other reliable sources.

- Use Responsibly: This powerful tool is meant to help you, so use the information ethically and avoid spreading misinformation.

- Respect Copyrights: The information and tools within CA GPT are protected by intellectual property laws.

- Be a Good User: Don't use the CA GPT tools for anything harmful or to spread spam.

We encourage you to explore the CA GPT List responsibly and provide feedback to help them continue learning and improving!