Ever caught yourself scratching your head over GST reconciliation in Tally? Fear not we have got your back! Here, we're unwrapping the mystery with 7 super-easy steps to flawless GSTR 2A reconciliation in Tally. No jargon, just cool tricks to sync your numbers act in tally.

Dive in, and by the end, you'll be a reconciliation rockstar—making your Tally game stronger than ever!

Let's turn those GST blues into a groovy financial tune!

Step-by-step process for GSTR 2A Reconciliation in TallyPrime

Let’s see how to do GSTR 2A reconciliation in Tally with just 7 steps!

Step 1: Grab the Latest GSTR 2A Data

Head to the GST portal, and download the freshest GSTR 2A data—your monthly GST transaction statements.

To get the accurate reconciliation, you have to use the latest GSTR 2A data.

Step 2: Slide it into TallyPrime

Navigate the Tally gateway like a boss to import the GSTR 2A data into TallyPrime.

- F11: Master

- Statutory

- GST Reconciliation

- Hit “Import” to slide that GSTR 2A data into TallyPrime.

Step 3: Reconcile Your GST Data with GSTR 2A

Back at the Tally gateway,

- F11: Master

- Statutory

- GST Reconciliation

Click "Reconcile" to ensure your activities sync up with the GSTR 2A data.

Step 4: Spot the Differences, Make it Right

If your GST transactions and GSTR 2A are not found in sync, no sweat. Identify the differences, reach out to suppliers or customers, and smooth out the kinks.

Step 5: Secure Your Reconciliation Report

After the fine-tuning, hit "Save." This reconciliation report is your golden ticket to GST compliance glory.

Keep it safe for an early heads-up on any bumps in the tax road. Step 6: Keep Tabs on GST Compliance

Your reconciliation report isn't just for show. Use it to track your GST compliance like a pro. Stay on top of the game by identifying and fixing issues promptly. Step 7: Repeat the Move Monthly

Don't be a one-hit wonder. Rinse and repeat these steps monthly to keep your GST compliance flawless. Stay in the groove, and tax time will always be a smooth jam!

Also read: GST Simplified: Suvit's Automated Solutions for SMEs Tax Compliance

Automate GSTR 2A Reconciliation in Tally With Suvit

Step-by-step procedure on how to reconcile GSTR 2A data utilizing Suvit:

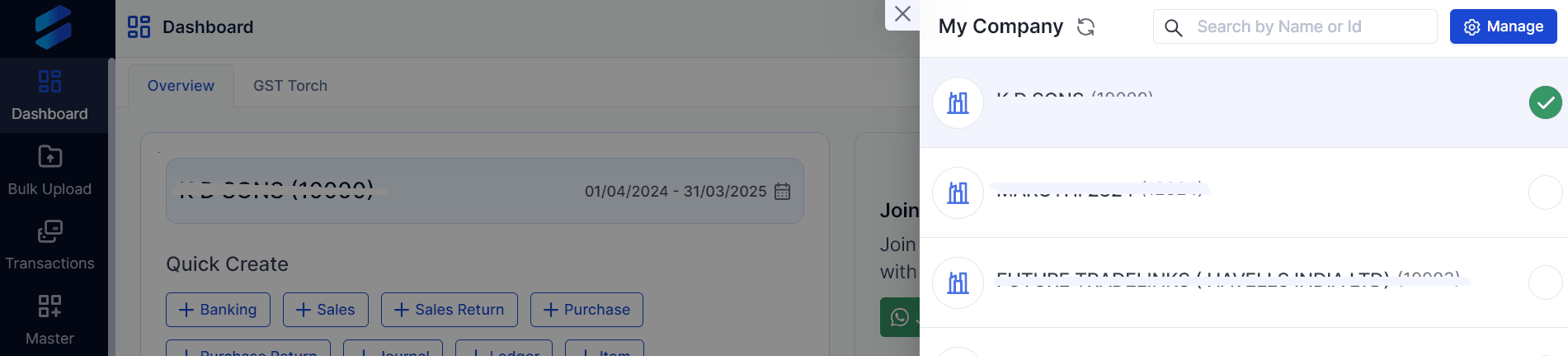

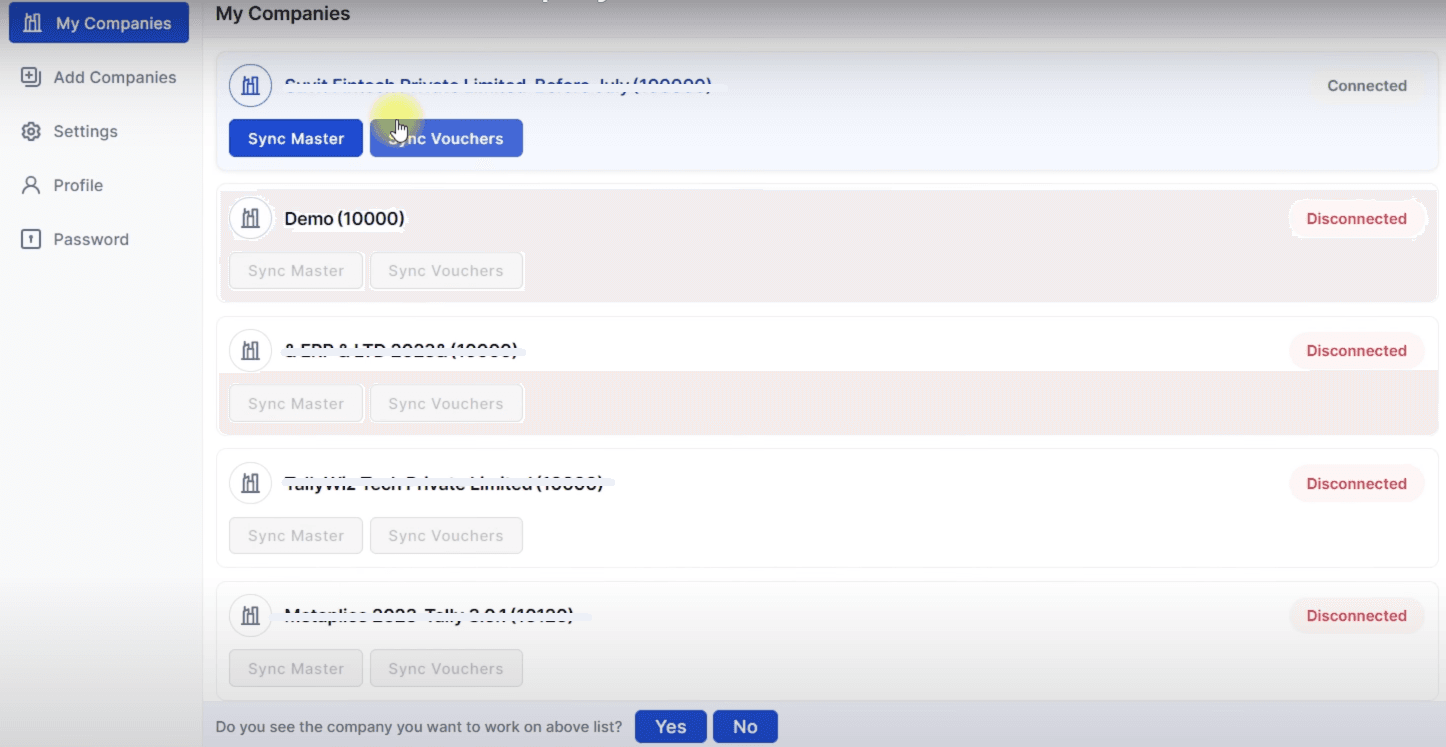

Step 1: Select the Company

First, choose the company of which you want to perform GSTR 2A Reconciliation, like shown in the image:

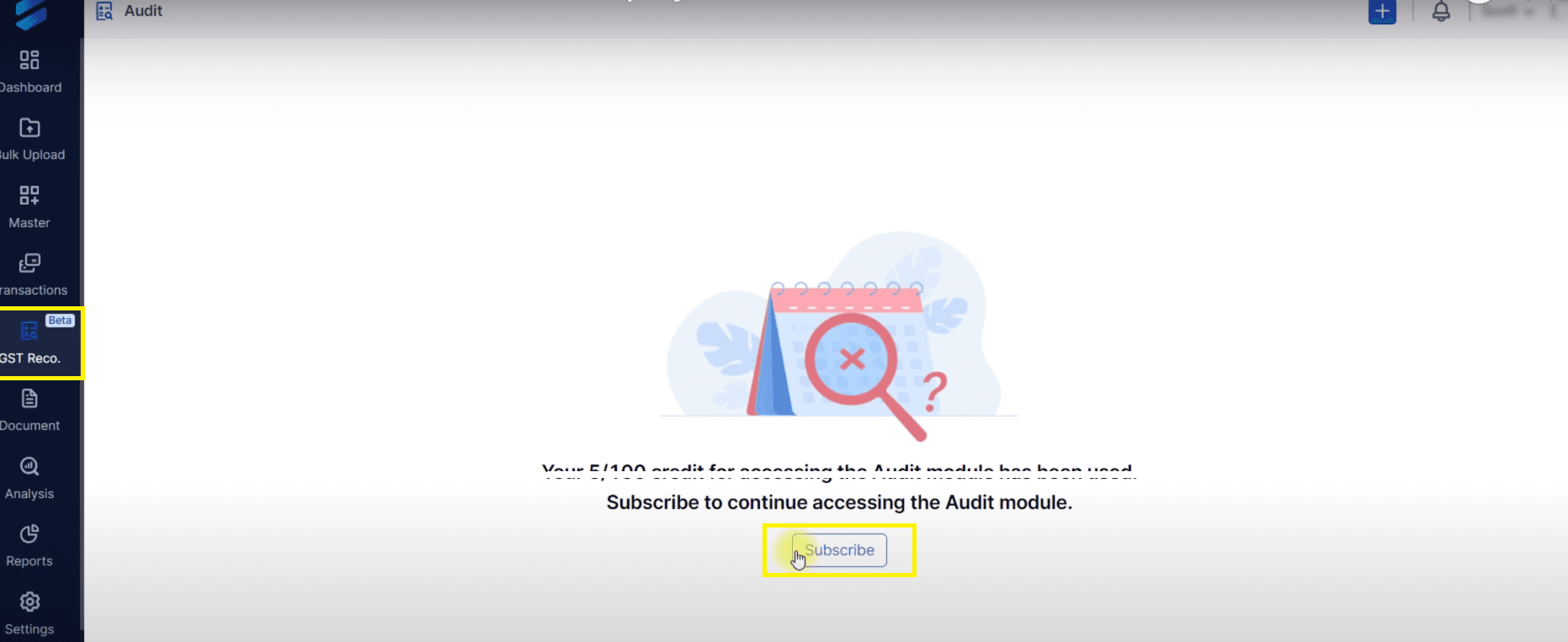

Step 2: Subscribe the Company

After selecting the company, go to GST Reco. Module and subscribe to the company.

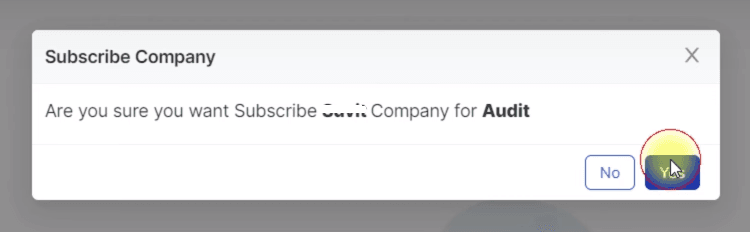

A pop will appear, click yes to move further.

On clicking yes, a blank dashboard will be opened, like this:

Step 3: Sync Vouchers

You have to click on ‘Sync Vouchers’ from the desired company from the Suvit desktop app.

A pop will appear, simply click on yes and go to the website.

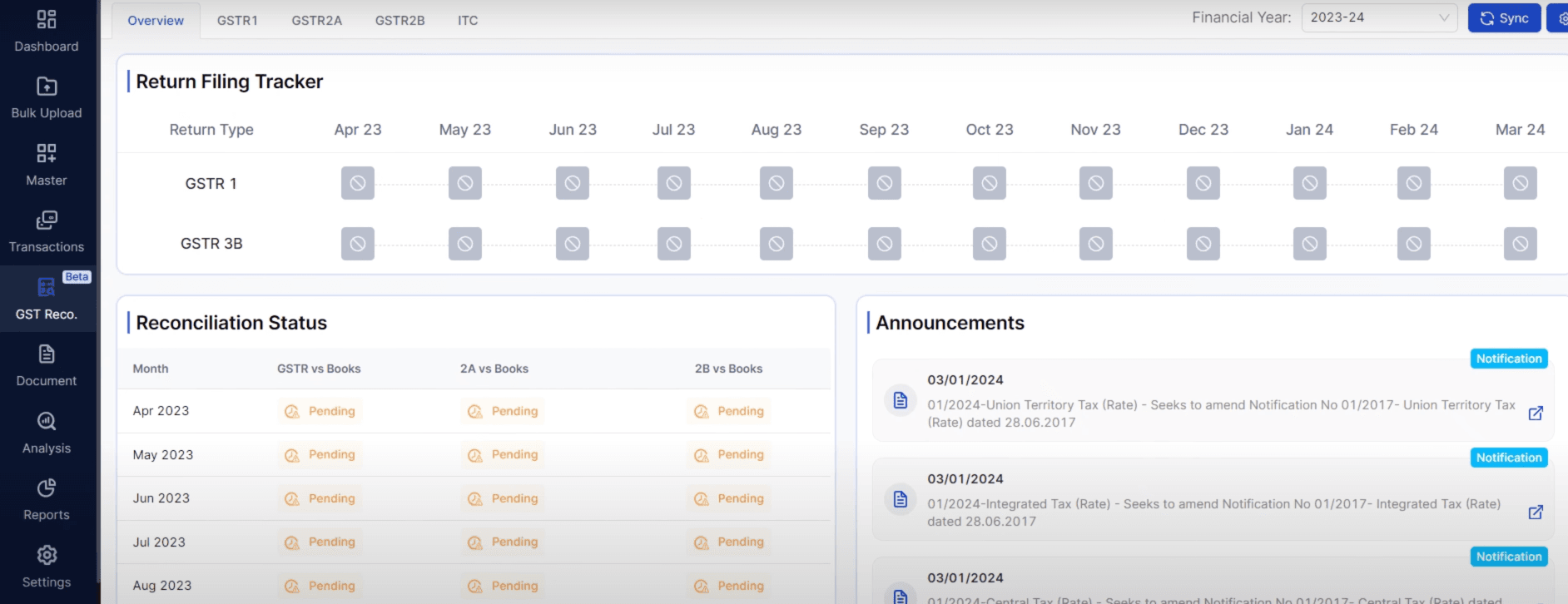

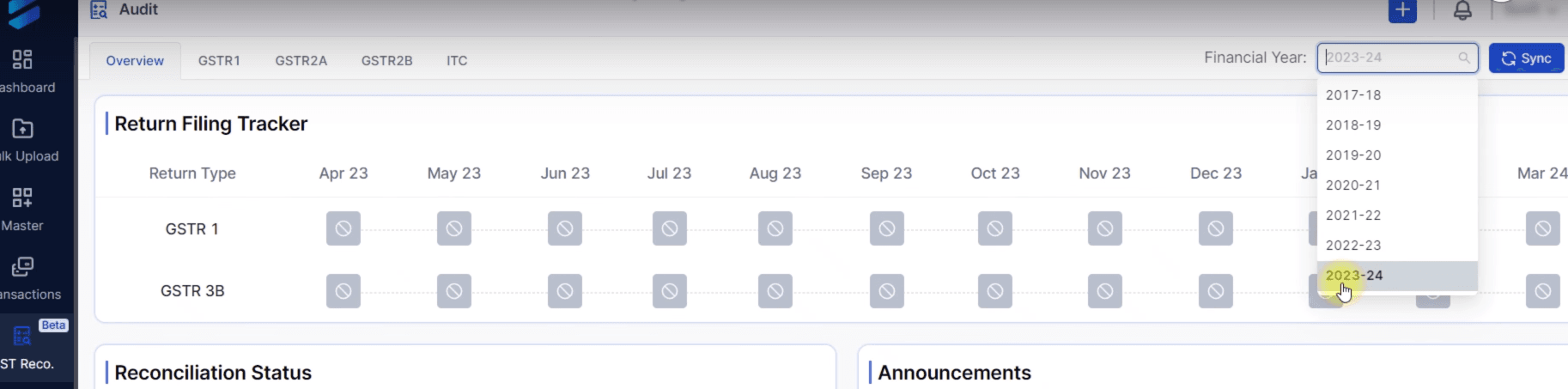

Step 4: Select the Financial Year

On the website module, choose the financial year for which you want to perform GSTR 2A reconciliation.

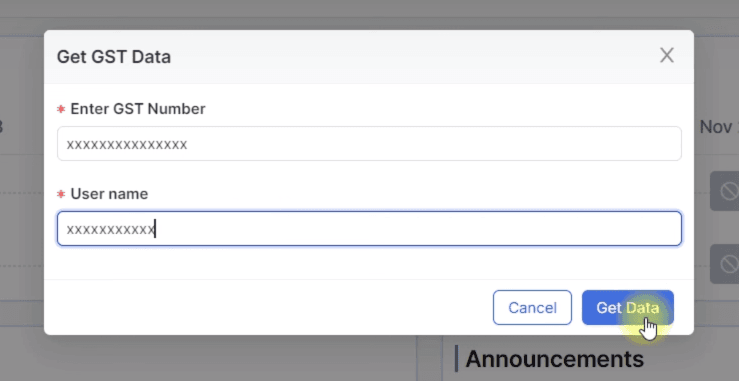

Step 5: Add GST Data

After selecting FY, now click on the Sync button next to it.

A pop will appear.

You have to enter the company's GST number and user name of the GST portal.

Then click on the Get Data button.

Step 6: Enter the OTP Code

A new window will ask for an OTP (One-Time Password) – the code you receive on your phone or email.

This is for fetching data of selected financial year from the GST portal.

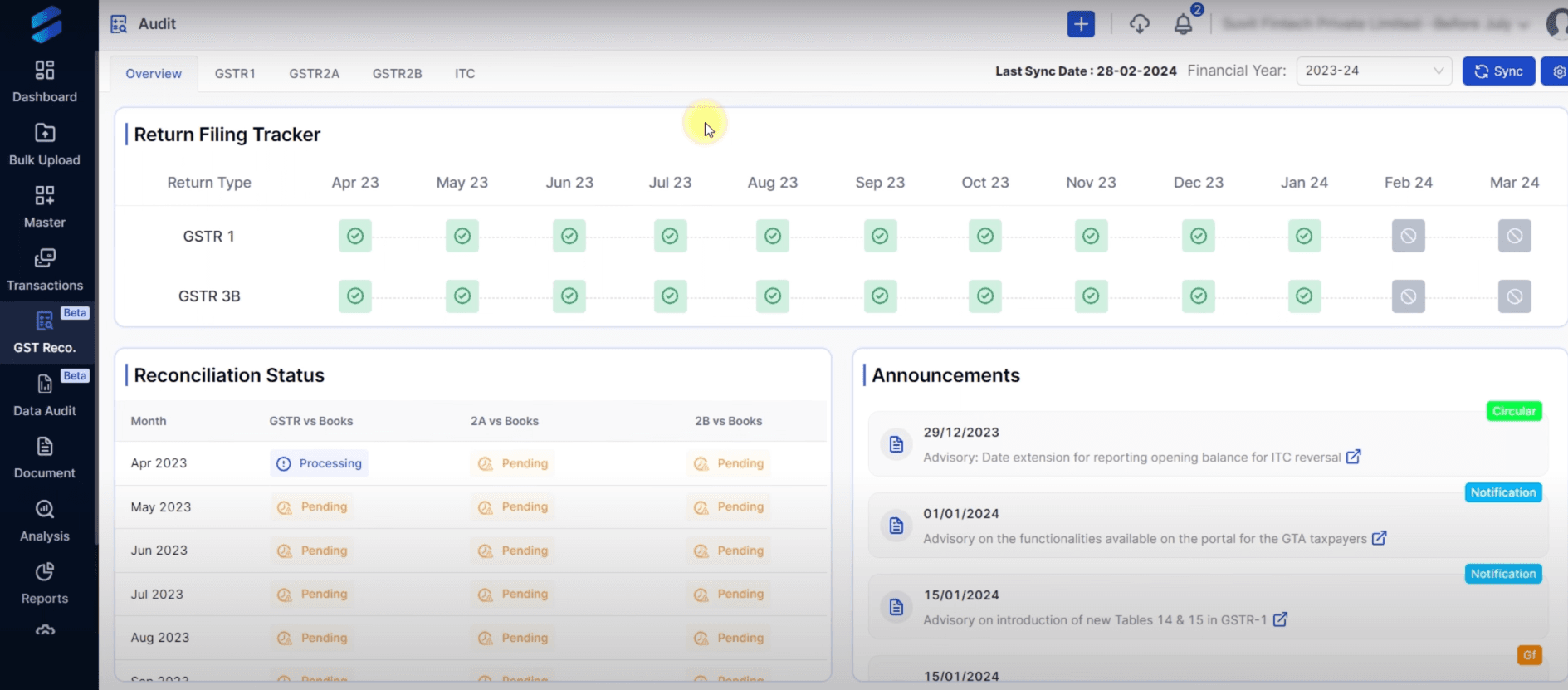

After that, portal data will start syncing data.

On completion, you will see a screen something like this:

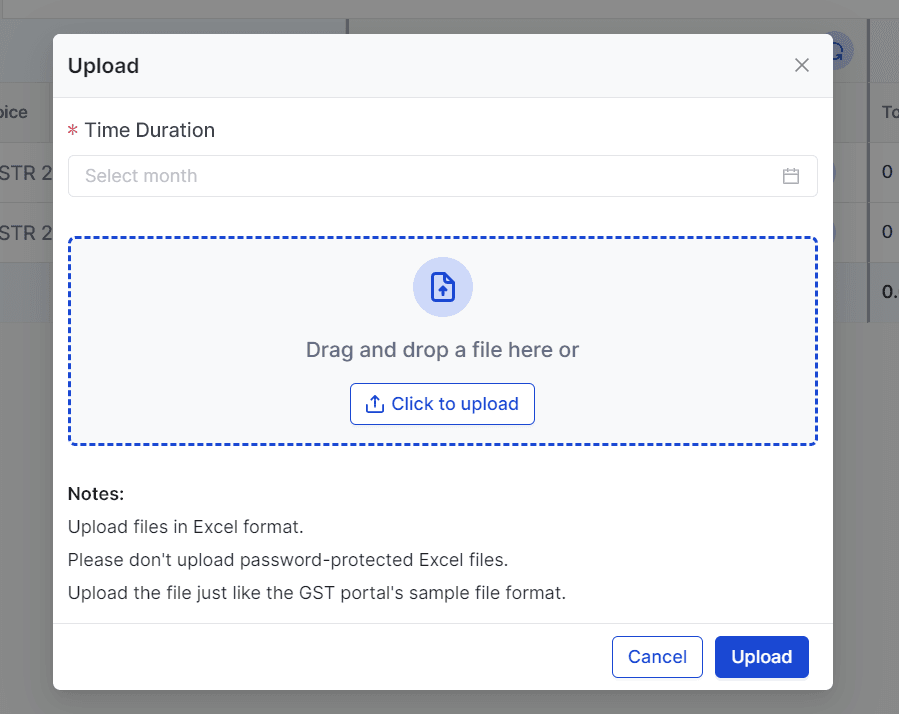

Step 7: Upload Excel

If you have a GST excel file, you can simply upload it by selecting the Upload button. A pop will appear:

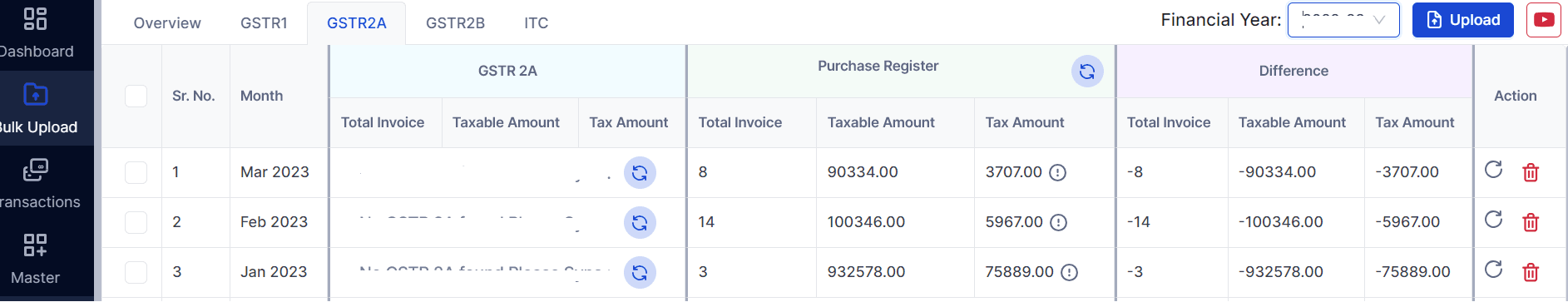

Step 8: Time for Main Action!

After all the things get sync, you will see a screen like this for GSTR 2A:

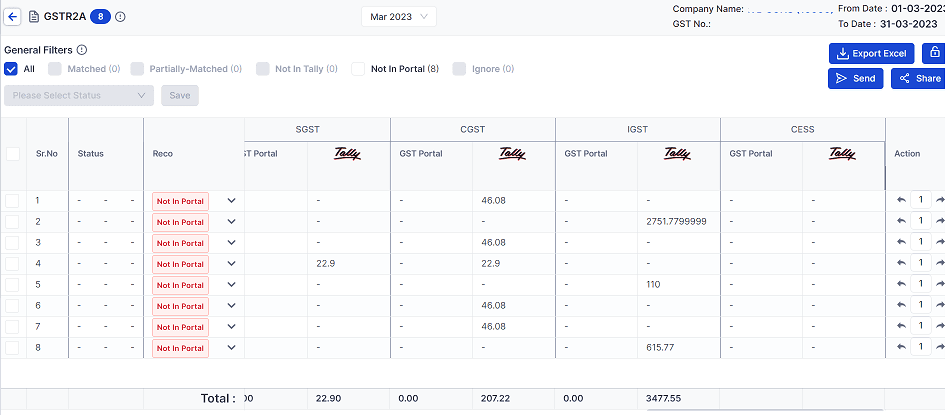

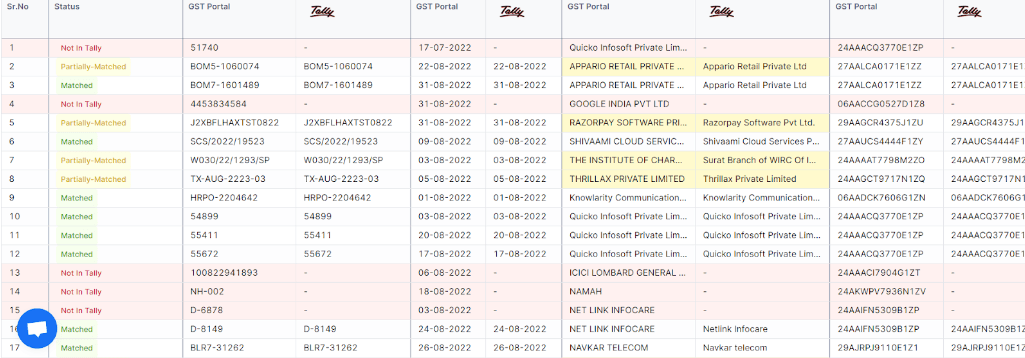

On clicking further on anywhere here, a detailed version of that will open.

Here, you can clearly see the reasons what’s the error in your recorded data and Tally.

Step 9: Understand Data Status

You will see your data is sorted into categories like "Not in Tally," "Not in Portal," "Partially Matched," and "Matched."

Look at these to find any differences in your GST data.

Also read: What Role GST Software Plays For Your Business?

Challenges arise while GST reconciliation

Invoice Number Trouble: Parties use invoice numbers differently, making it tricky for the reconciliation process to find the right match.

State-wise Business Complexity: Purchaser operates in multiple states, and the seller issues invoices using a GSTIN different from the actual purchaser's, turning reconciliation into a puzzle.

Mismatched Return Periods: Both the purchaser and supplier record invoices in different return periods, causing a time-traveling mismatch.

Date Dilemma: The buyer and seller's invoices don’t sync up because they play with dates differently. The buyer needs to follow the date on the sales invoice for a smooth function.

Value Twister: Invoice values play a game of Twister, with minor differences because both parties round off differently. It’s like a math riddle.

GSTR-2A and Purchaser Invoice Number Mismatch: The purchaser's recorded transaction invoice numbers do not fit with the seller's invoices received in GSTR-2A, often due to practicing different patterns.

Also read: 4 Common Challenges In Using Paper Invoices

What’s Next?

It's required to keep up the move of regularly sorting out your GST Reconciliations. This not only helps you spot any needed changes right on time but also acts as a shield against those tax authority spotlight moments.

Use automated accounting software to get rid of these manual processes of GST reconciliation.

Sign up for a 7 day free trial of Suvit and watch the magic yourself.

Stay cool and compliant!