GST is a landmark tax reform that was introduced in India in 2017. It has simplified the tax structure, reduced the tax burden, and increased the revenue for the government. According to a report by the World Bank, GST has the potential to increase India’s GDP growth by up to 4.2% in the long run.

By registering and filing your GST returns online, you can save time and money, avoid errors and penalties, track your transactions and refunds, and comply with the tax laws in India. The GST portal is the one-stop destination for all your GST-related needs.

You can register, file, pay, and claim your GST online using this portal. Do you want to know how to register and file your GST returns online in a few simple steps? If yes, then you are at the right place. In this post, we will guide you on how to log into the GST portal and access its various features and functions.

Also Read: How to Fix an Emsigner GST Portal Error?

How to log into the GST portal

To log into the GST portal, you need to have the following prerequisites:

- A valid GSTIN (Goods and Services Tax Identification Number), which is a 15-digit alphanumeric code assigned to you after registering for GST.

- A username and password that were created by you during the registration process.

- A working internet connection and a compatible web browser.

Once you have these prerequisites, you can follow these steps to log in to the GST portal:

Step 1: Go to the GST portal homepage

- Open your web browser and type in the address bar gst.gov.in, or click on this link to go to the GST portal homepage.

- Click on the Login button at the top right corner of the screen

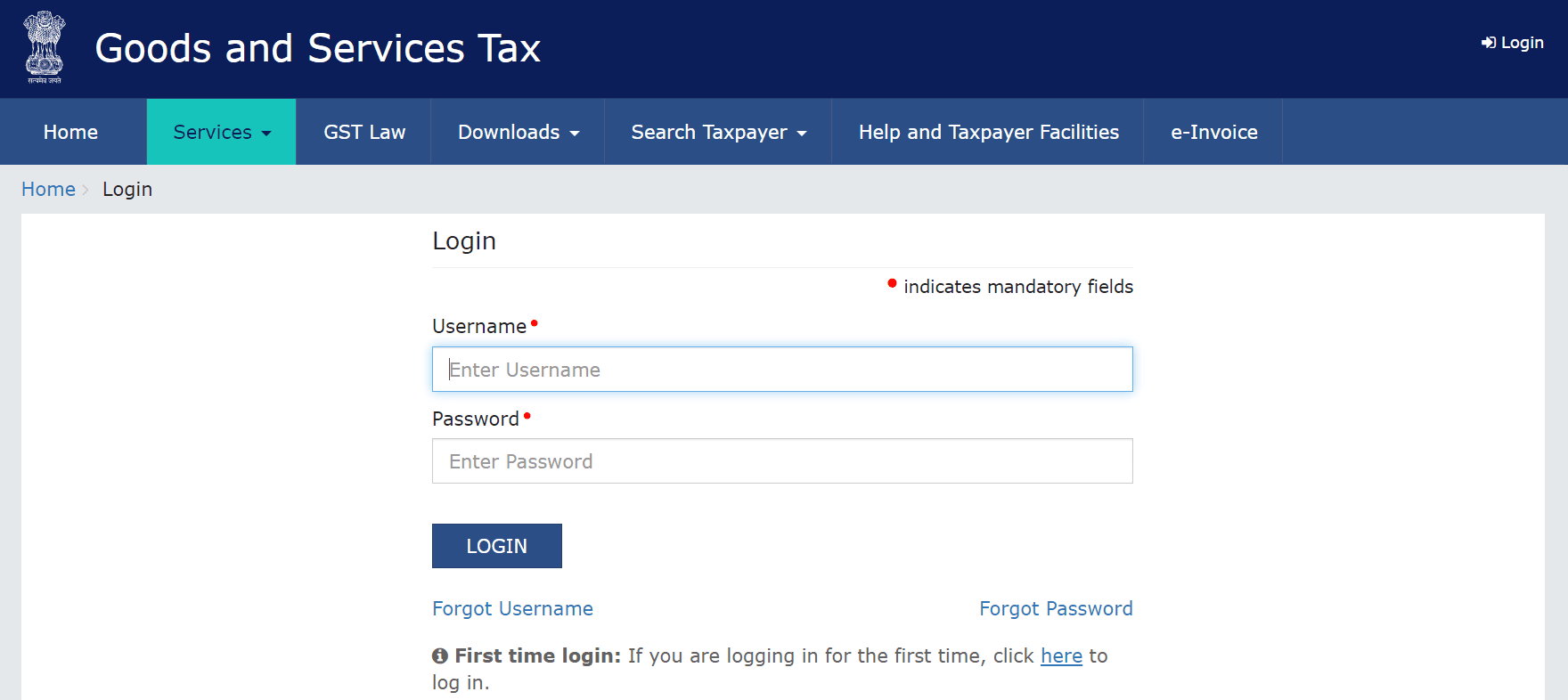

Step 2: Enter your username and password

Enter your username and password in the respective fields and click on the LOGIN button. You can also use the Forgot Username or Forgot Password links if you need to reset them.

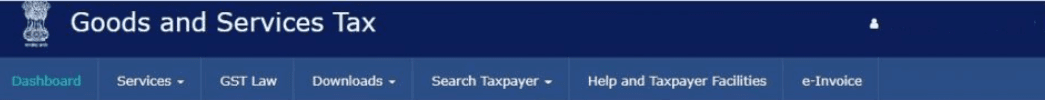

- You will be redirected to the GST portal dashboard, where you can access various services and functions related to GST. You can also view your profile, notifications, and messages by clicking on the icons at the top right corner of the screen.

Step 3: Explore the GST portal dashboard

- The GST portal dashboard is the main interface where you can manage your GST-related activities online. You can use the menu bar on the left side of the screen to navigate to different sections, such as Services, User Services, Downloads, Help, etc.

-

Some of the features and functions you can access from the GST portal dashboard are:

- Viewing your profile: You can view and edit your personal and business details, such as your name, address, contact information, bank account, etc. You can also change your password, add or remove authorized signatories, and manage your digital signature certificates.

- Filing your returns: You can file your monthly, quarterly, or annual GST returns online using the GST portal. You can also track the status of your returns, view your ledger balances, and download your return forms and acknowledgments.

- Making payments: You can make GST payments online using the GST portal. You can also generate challans, view your payment history, and claim refunds.

- Applying for registration: You can apply for a new GST registration or cancel your existing registration online using the GST portal. You can also track the status of your application, upload supporting documents, and respond to queries from the tax authorities.

- Seeking help: You can access the help center, FAQs, user manuals, videos, webinars, and other resources to get assistance and guidance on using the GST portal. You can also contact the GST helpdesk via phone, email, or chat.

Also Read: A Guide to GSTR 2A, GSTR 2B, and GSTR 3B for GST Compliance

Step 4: Log out after use

-

After you have completed your tasks on the GST portal, you should log out of your account to ensure the security and privacy of your data. To do this, click on the Logout button at the top right corner of the screen.

-

You will see a confirmation message asking you to log out. Click on the Yes button to confirm.

Tips and best practices for using the GST portal

Here are some tips and best practices for using the GST portal effectively and efficiently:

- Change your password regularly and keep it confidential. Do not share your username and password with anyone else.

- Check your notifications and messages regularly for any updates or alerts from the GST portal or the tax authorities.

- Verify your GSTIN and other details before filing your returns or making your payments. Ensure that you file your returns and pay your taxes on time to avoid penalties and interest.

- Use the online tools and calculators available on the GST portal to check your tax liability, input tax credit, refund amount, etc.

- Keep a backup of your data and documents related to GST. Download and save your return forms, acknowledgments, challans, receipts, etc., for future reference.

- If you face any issues or difficulties while using the GST portal, seek help from the GST helpdesk or your tax consultant. Do not rely on unverified sources or third-party websites for GST-related information or services.

Conclusion

Logging in to the GST portal is easy and convenient, allowing you to manage your GST-related activities online. You can view your profile, file your returns, make payments, claim refunds, and more. By logging in to the GST portal, you can enjoy the benefits of GST and comply with the tax laws in India. We hope you found this post helpful and informative.