Accountants are the gatekeepers of money flow and play a crucial role in ensuring that companies remain financially stable. With the advent of AI in various industries, the accounting industry is also undergoing a significant transformation through AI-powered accounting.

AI is not merely a part of the accounting game; it is revolutionizing the entire accounting landscape, transforming the way businesses operate and manage their finances.

AI and Accounting: A Big Change

Hold on tight for a game-changing future! The AI integration into accounting software, especially Tally, will gear up to drive a new era of automation. It will streamline manual processes, help boost accuracy, and allow accountants to focus on more strategic and value-packed tasks. With AI-powered capabilities on the horizon, Tally is poised to transform the accounting profession, bringing about four transformative changes that will redefine how accountants work. Get ready for a paradigm shift in the making!

1. Futuristic Data Handling: A Leap Beyond Manual Input

Bid farewell to the tedious world of manual data entry! In the future, AI will be the unsung hero in Tally, flying in to rescue accountants from the cage of time-consuming and error-prone data input tasks. This automation promises to be a game-changer by:

- Importing data effortlessly: No more manual headaches. AI will seamlessly import data from various sources like Excel, PDFs, and even scanned documents, giving accountants a break from the tiresome task of data conversion.

- Extracting insights from invoices: The AI magic doesn't stop there. It'll dig into invoices, extract the juicy details like vendor info, item descriptions, and amounts, and then effortlessly populate the fields in Tally. Talk about a hands-free experience!

- Becoming the data detective: AI isn't just here to do the heavy lifting; it's also your vigilant data guardian. Its validation skills will identify inconsistencies and anomalies, waving the red flag for potential errors. It's like having a superhero for data accuracy!

By automating the data entry game, Tally will gear up to be a powerhouse in error prevention. The result? Accountants will have more time to dive into strategic tasks like financial analysis, reporting, and providing top-notch advice. The future of data handling in Tally? Efficient, accurate, and oh-so-smooth!

Also Read: How Suvit’s AI-Powered Features Can Turn Around Your Accounting Practice

2. Bulletproof Accounting: AI's Guardian Angel

Let's talk real talk, my friends. Tally is stepping into the future, and it's not playing around. AI is taking the stage, and guess what? It's not only about a sidekick; it is about becoming the guardian angel of your accounting game.

Here's the exclusive scoop:

- Real-time Error Alerts: Forget waiting for the auditing nightmare. AI is on the scene, keeping a hawk's eye on your financial data. No more slipping through the cracks – it catches those errors in real-time.

- Transaction Detective: AI algorithms? They're like your personal Sherlock Holmes for transactions. They dive into the nitty-gritty, compare sources, and wave a red flag when things don't add up. Your data guardian, right there.

- Fraud-Busting Superhero: AI doesn't just stop at errors; it's your superhero against fraud. It crunches historical data, spots funky patterns, and says, "Not on my watch!"

- Formula Guru: Worried about miscalculations? Fear not. AI algorithms are here to double-check every calculation and formula in your financial statements. Your numbers? They're going to be as solid as a rock.

With AI as your accounting guardian, errors don't stand a chance. It's not just about crunching numbers; it's about having a financial superhero by your side. Welcome to the future where accounting is bulletproof!

3. Future-Proofing Tally with AI Predictive Analytics

Alright, buckle up for this one! Tally is about to get a serious upgrade, my friends. We're talking about tossing the old-school ways out the window and welcoming the future with AI's predictive analytics. No more dwelling on past numbers; Tally is your ticket to becoming a financial fortune teller, navigating risks like a boss.

Here's the whole story:

- Cash Flow Crystal Ball: AI algorithms, fueled by historical data, are gearing up to predict future cash flows. Imagine having the power to peek into the financial future, deciding where to splurge and tighten the belt.

- Risk Radar Activated: AI isn't just about making predictions; it's your financial risk radar. Market trends, customer traits, economic indicators – AI dives into the data pool and spots potential risks and opportunities.

- Strategic Advisor Mode: Forget the old-school accountant vibes. With AI insights, accountants won't just hit the keyboard keys; they'll make moves that align perfectly with long-term business goals. It's like going from playing checkers to chess.

Imagine you, with Tally and AI, at the front of business growth. It's not just accounting; it's a financial adventure, and Tally is your trusty sidekick!

4. Instant Intel: Unleashing Decision-Making Power

Let's dive into the hustle, where real-time insights meet business brilliance. In today's unbelievable world of business, having the 411 on your financial game is like having a superpower. Armed with AI, Tally is about to drop the mic with real-time insights that'll make your head spin.

Here's the juice:

- Continuous Financial Analysis: AI isn't taking a break; it's on a constant grind. As transactions happen, it's crunching numbers in real-time, updating your cash flow, profitability, and inventory levels.

- Early Warning System: Forget about waking up to financial surprises. AI's real-time monitoring is like an advanced alarm system. It spots issues before they become problems, giving you the heads up on things like profitability going south or cash flow taking a detour.

- Resource Allocation Wizardry: Ever wish you had a guide on where to park your funds for maximum returns? AI-driven insights have got you covered. They're like the GPS for your resources, making sure your money lands where it multiplies.

- Opportunity Spotter: AI isn't just about fixing issues; it's about spotting opportunities. Real-time data on market trends and customer vibes? It's your secret weapon to identify and seize those golden opportunities, propelling your business forward.

With AI as your real-time sidekick, accountants aren't just number players; they're the strategic partners every business dreams of. It's not just about surviving in the game but about owning it. Get ready for the future, where real-time insights aren't just an amenity but a business necessity!

What might interest you the most with Suvit?

Hold on to your hats because though the integration of AI into Tally has not yet happened, with Suvit, it's a full-blown revolution in the accounting game in India.

We are not talking about minor adjustments; we are discussing a massive transformation revolutionizing how accountants operate.

Also Read: The Impact of Artificial Intelligence on Cloud Accounting Services

Suvit is:

Beyond Tech Advancement: This isn't your typical tech upgrade; it's a revolution. With Suvit, AI isn't just stepping in; it's taking the lead. Mundane and error-prone tasks? That's old news. Suvit is here to handle the nitty-gritty, while accountants get to focus on the strategic and value-packed stuff.

Future-Proof Profession: Suvit is not slowing down; it's revving up. As it develops, its impact on accounting will be felt even more powerful. It's not just about keeping up; it's about leading the way. Accountants who board the Suvit train will be the profession's rockstars.

Intelligent Accounting's Arrival: Suvit is the guide and analyzer, generating insights and making real-time decisions. It's not a dream; it's the future of accounting. Believe it by taking the 7-day free trial!

How Does Suvit Work?

Download Suvit and get the benefits of automation. Suvit is an AI-powered automation tool that eliminates all clerical work while maintaining 100% data accuracy. Upload documents with a few clicks, and you'll never have to manually enter data from Excel to Tally again.

Suvit allows you to move data from Excel to Tally in only three steps.

Check that Suvit is connected to Tally and the Internet.

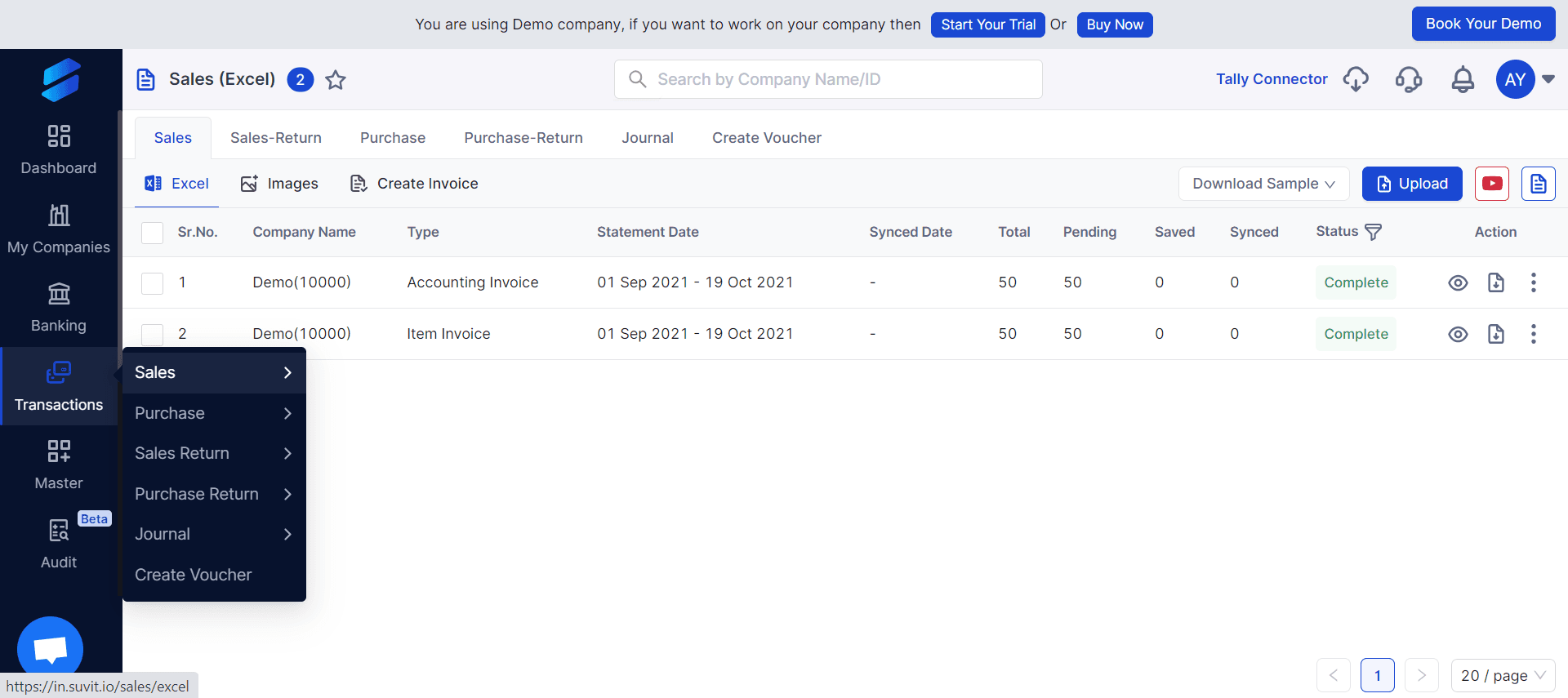

Step 1: Upload your Excel sheets based on the modules of Banking, Sales, or Purchase.

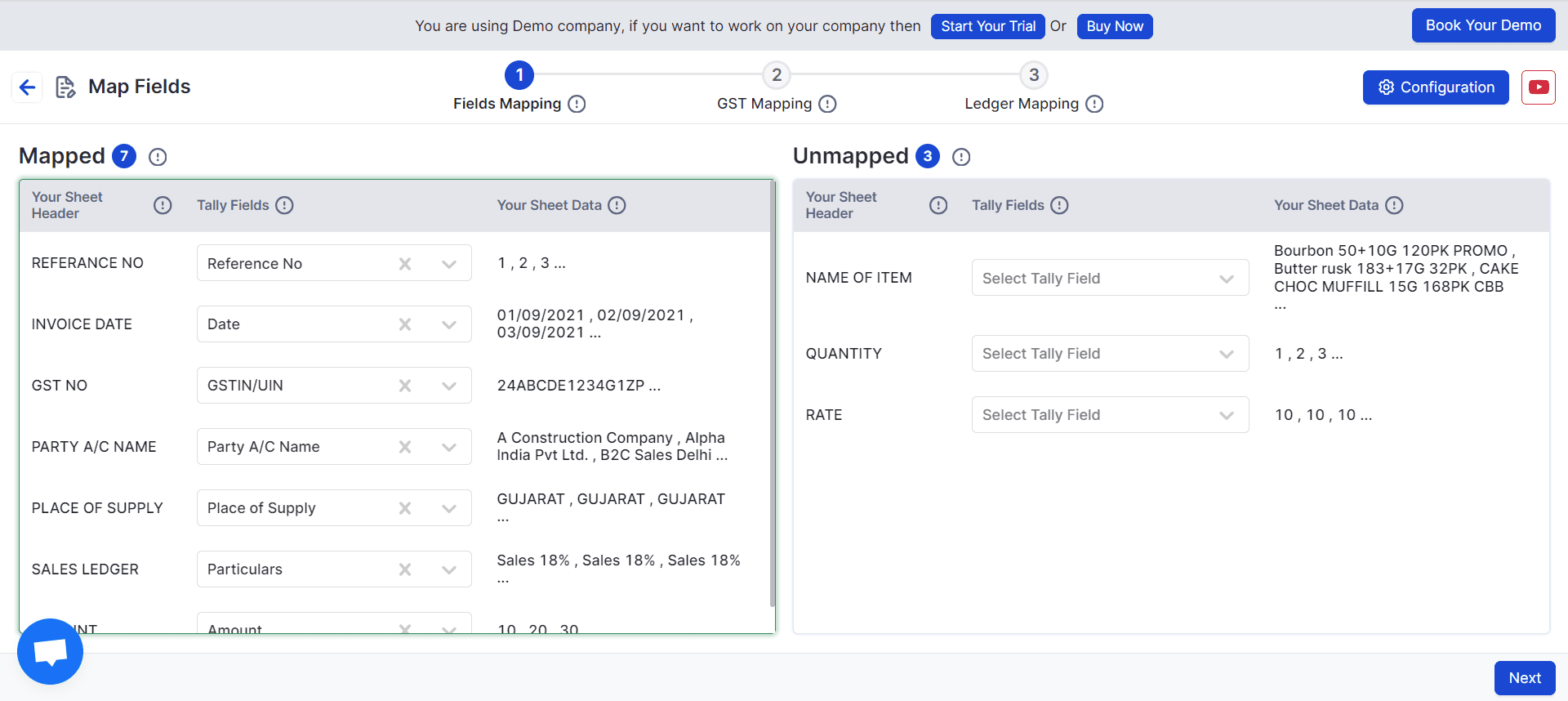

Step 2: Enter the required information and complete the mapping stage.

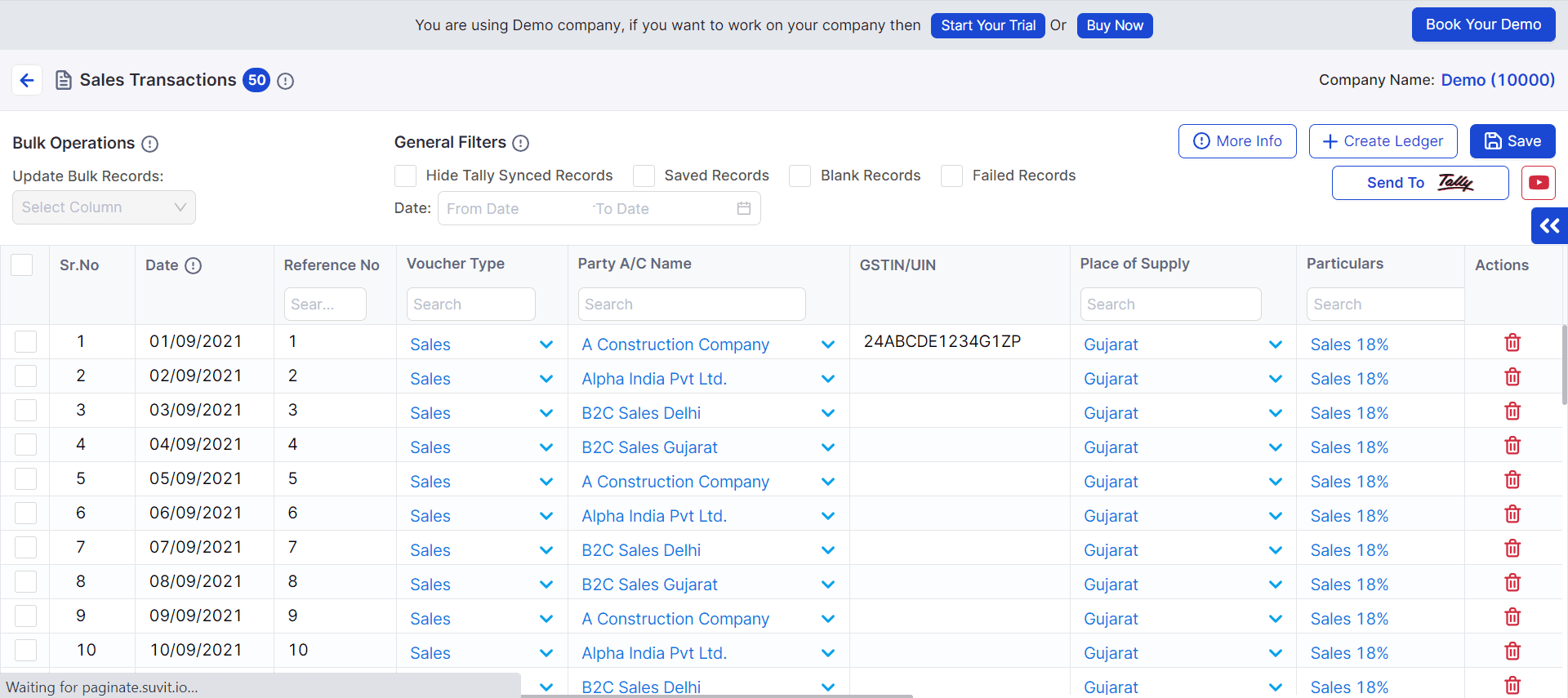

Step 3: Click Send to Tally to complete the data transfer from Excel to Tally.

When your entries are pushed into Tally, you will be notified.