When it comes to managing your finances, understanding where your business stands is super important. It's like taking a snapshot of your company's money matters at a specific time. In this blog, we're going to explore the Tally balance sheet - a key tool for figuring out how well your business is doing financially.

The Tally balance sheet is one of the most critical financial statements for any business. It provides a snapshot of a company's financial position at a given moment in time, showing its assets, liabilities, and shareholders' equity. The balance sheet is prepared using the fundamental accounting equation, which states that Assets = Liabilities + Shareholders' Equity.

Understanding Tally Balance Sheet

Tally is a popular accounting software in India, and it is widely used by businesses of all sizes to generate financial statements, including the balance sheet. To generate a balance sheet in Tally, you can navigate to Reports > Financial Statements > Balance Sheet.

The Tally balance sheet is divided into three main sections:

- Assets: This section lists all of the company's assets, which are resources that have economic value. Assets are further classified into current assets and fixed assets. Current assets are those that can be converted into cash within one year, such as cash, accounts receivable, and inventory. Fixed assets are those that have a lifespan of more than one year, such as land, buildings, and equipment.

- Liabilities: This section lists all of the company's liabilities, which are obligations that the company must repay in the future. Liabilities are also classified into current liabilities and long-term liabilities. Current liabilities are those that must be repaid within one year, such as accounts payable and short-term loans. Long-term liabilities are those that must be repaid over a period of more than one year, such as bank loans and debentures.

- Shareholders' Equity: This section represents the owners' investment in the business. It is calculated by subtracting the company's liabilities from its assets. Shareholders' equity includes components such as equity, share capital, retained earnings, and reserves.

Also Read: The ABCs of Balance Sheet Reconciliation: How to Streamline the Entire Process

Components of the Tally Balance Sheet

The Tally balance sheet is divided into three main sections:

Assets

Assets are resources that have economic value and are controlled by the company. They are classified into current assets and fixed assets.

Current assets are those that can be converted into cash within one year. Examples include:

- Cash

- Bank

- Accounts receivable

- Inventory

- Prepaid expenses

Fixed assets are those that have a lifespan of more than one year. Examples include:

- Land

- Buildings

- Furniture and fixtures

- Plant and machinery

- Intangible assets (such as patents, trademarks, and copyrights)

Liabilities

Liabilities are obligations that the company must repay in the future. They are classified into current liabilities and long-term liabilities.

Current liabilities are those that must be repaid within one year. Examples include:

- Accounts payable

- Short-term loans

- Accrued expenses

Also Read: A Comprehensive Guide to Accounting Terms for Business Owners - Simplify Your Finances

Long-term liabilities are those that must be repaid over a period of more than one year. Examples include:

- Bank loans

- Debentures

- Long-term borrowings

Shareholders' Equity

Shareholders' equity is the owners' investment in the business. It is calculated by subtracting the company's liabilities from its assets. Shareholders' equity includes components such as:

Equity: Share capital, retained earnings, and reserves.

Detailed Components of the Tally Balance Sheet

The following table provides a more detailed breakdown of the components of the Tally balance sheet:

Analyzing the Tally Balance Sheet

The Tally balance sheet can be analyzed to gain insights into a company's financial health and performance. Some key ratios that can be calculated from the balance sheet include:

- Current ratio: This ratio measures a company's ability to meet its short-term obligations. It is calculated by dividing current assets by current liabilities. A current ratio of 2:1 or higher is generally considered to be healthy.

- Quick ratio: This ratio is similar to the current ratio, but it excludes inventory from current assets. This is because inventory is the least liquid current asset, and it may take longer to convert into cash than other current assets. A quick ratio of 1:1 or higher is generally considered to be healthy.

- Debt-to-equity ratio: This ratio measures a company's financial leverage, i.e., the extent to which it is using debt to finance its operations. It is calculated by dividing total liabilities by shareholders' equity. A debt-to-equity ratio of less than 1:1 is generally considered to be healthy.

- Return on equity (ROE): This ratio measures how efficiently a company is using its shareholders' equity to generate profits. It is calculated by dividing net income by shareholders' equity. A higher ROE indicates that a company is using its shareholders' equity more efficiently to generate profits.

In addition to calculating these ratios, you can also analyze the Tally balance sheet by looking at trends over time and comparing the company's performance to its peers in the same industry.

Here are some specific things to look for when analyzing the Tally balance sheet:

- Is the company's current ratio healthy? A low current ratio could indicate that the company is at risk of not being able to meet its short-term obligations.

- Is the company's debt-to-equity ratio healthy? A high debt-to-equity ratio could indicate that the company is too leveraged and could be at risk of financial distress if the economy were to downturn.

- Is the company's ROE healthy? A low ROE could indicate that the company is not using its shareholders' equity efficiently to generate profits.

- Are the company's accounts receivable increasing over time? This could indicate that the company is having difficulty collecting payments from its customers.

- Is the company's inventory increasing over time? This could indicate that the company is not selling its products or services quickly enough.

- Is the company's debt increasing over time? This could indicate that the company is taking on too much debt, which could increase its financial risk.

By carefully analyzing the Tally balance sheet, you can gain valuable insights into a company's financial health and performance. This information can be used to make informed business decisions, such as whether to invest in the company, lend money to the company, or do business with the company.

Interpreting Tally Balance Sheet Figures

When interpreting the Tally balance sheet figures, it is important to consider the following factors:

- Industry: The financial performance of a company can vary significantly depending on the industry in which it operates. For example, a company in the retail industry may have a lower current ratio than a company in the manufacturing industry.

- Company size: Smaller companies may have more difficulty accessing financing, which can lead to a higher debt-to-equity ratio.

- Company stage: Companies in the early stages of growth may have a lower ROE than more established companies.

Here are some examples of how to interpret the Tally balance sheet figures:

- A company with a high current ratio and a low debt-to-equity ratio is generally considered to be financially healthy. It has enough current assets to meet its short-term obligations and is not too leveraged.

- A company with a low current ratio and a high debt-to-equity ratio is generally considered to be at risk of financial distress. It does not have enough current assets to meet its short-term obligations and is too leveraged.

- A company with a low ROE could be experiencing financial difficulties or it may be investing heavily in its future growth. It is important to consider the company's industry and stage of growth when interpreting its ROE.

- A company with a low accounts receivable turnover ratio could be having difficulty collecting payments from its customers. This could be due to a number of factors, such as a poor credit approval process or a weak economy.

- A company with a low inventory turnover ratio could be overstocked or it may be selling slow-moving products. This could lead to increased inventory costs and reduced profitability.

Utilizing Tally Balance Sheet for Decision-Making

The Tally balance sheet can be used to make a variety of business decisions, such as:

- Credit decisions: Lenders use the balance sheet to assess a company's creditworthiness before granting a loan. The lender will look at the company's current ratio, debt-to-equity ratio, and other financial ratios to determine whether the company is able to repay the loan.

- Investment decisions: Investors use the balance sheet to evaluate a company's financial health before investing in it. The investor will look at the company's ROE, asset turnover ratios, and other financial ratios to determine whether the company is a good investment.

- Pricing decisions: Businesses use the balance sheet to determine their pricing strategy. For example, a company with a strong balance sheet may be able to offer lower prices to its customers.

- Budgeting decisions: Businesses use the balance sheet to prepare their budget. The budget will be based on the company's expected revenue and expenses. The balance sheet can help the business to identify any potential financial risks and to make sure that it has enough cash to meet its obligations.

In addition to these specific decisions, the Tally balance sheet can also be used to make more general business decisions, such as whether to expand the business, enter a new market, or acquire another company. By carefully analyzing the balance sheet, businesses can identify their strengths and weaknesses, assess their financial risks, and make better decisions about how to allocate resources.

Here are some specific examples of how the Tally balance sheet can be used to make business decisions:

- A lender may use the balance sheet to determine whether to grant a loan to a company that is seeking to expand its operations. The lender would look at the company's current ratio and debt-to-equity ratio to make sure that the company is able to repay the loan.

- An investor may use the balance sheet to evaluate a company that is planning to launch a new product. The investor would look at the company's ROE and asset turnover ratios to determine whether the company has the financial resources to successfully launch the new product.

- A company may use its balance sheet to determine whether to offer a discount to its customers. The company would look at its cash reserves and its current ratio to make sure that it can afford to offer the discount.

- A company may use its balance sheet to prepare its budget for the next fiscal year. The company would use the balance sheet to estimate its revenue and expenses for the year. The budget would help the company to identify any potential financial risks and to make sure that it has enough cash to meet its obligations.

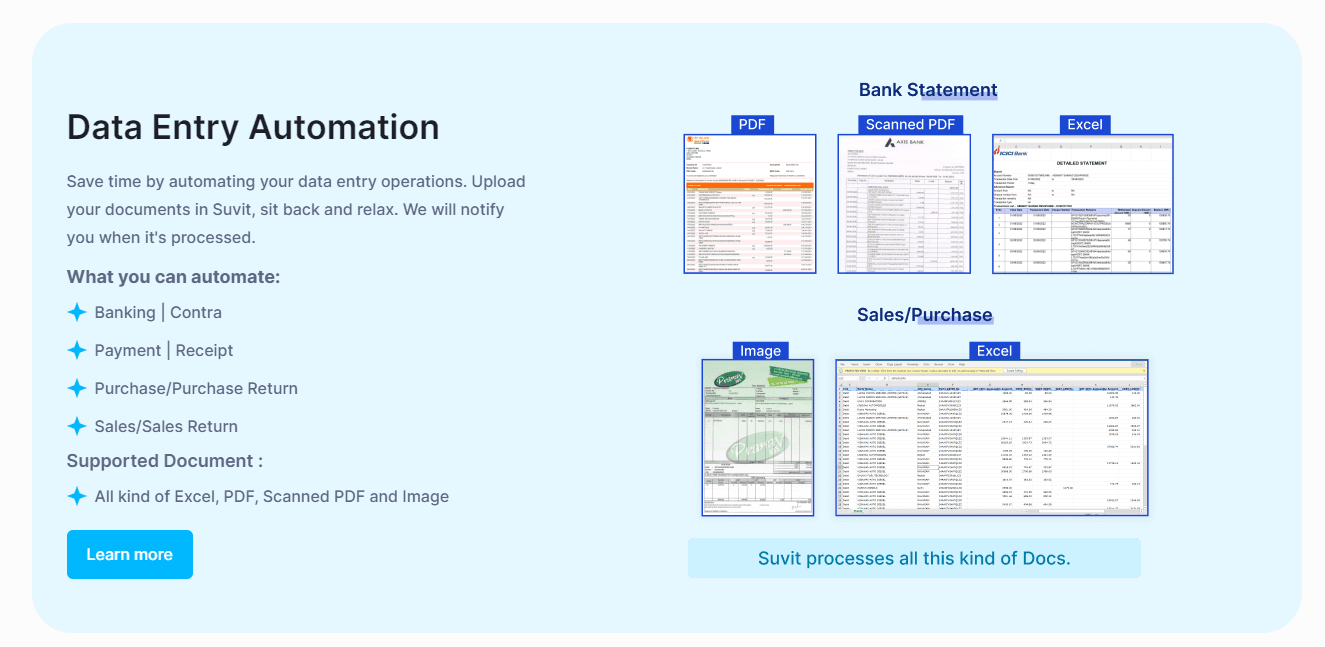

Automate Your Tally Banking With Suvit

Suvit is an AI-powered accounting automation software that helps accountants, tax consultants, and other finance professionals save time and improve accuracy. It can automate a variety of tasks, such as data entry, reconciliation, and reporting. Suvit also integrates with Tally and helps import transactions from Excel or PDF files into Tally, generate reports from Tally data, manage customers and suppliers, track inventory, and generate invoices and bills!

It eliminates the need to even put entries manually into Tally. As soon as you upload your Excel or PDF files, it will fetch all the data and make the transactions ready to be copied to Tally. In this case, you won’t be required to extensively learn about Tally, just basic knowledge would help!

Here are some of the key features of Suvit:

- Automates data entry, reconciliation, and reporting

- Integrates with Tally

- Supports multiple languages

- Provides real-time insights into financial data

- Cloud-based for easy access from anywhere

- Affordable and easy to use

Suvit is a powerful tool that can help businesses of all sizes improve their accounting processes. If you are looking for a way to save time and improve accuracy, Suvit is a great option to consider. Sign up today.