Special Economic Zones (SEZs) have become a powerhouse for economic growth in India.

They offer businesses attractive benefits like tax exemptions, duty-free imports, and simplified compliance procedures.

But when it comes to taxation and logistics, things can get a little complicated. That’s where understanding SEZ GST & E-Way Bill regulations becomes necessary.

If you're a business operating in an SEZ or planning to set up one, this guide will break down everything you need to know about GST and e-Way Bills in a friendly, easy-to-understand manner.

What is a Special Economic Zone (SEZ)?

Think of an SEZ as a special trade zone within India that operates almost like a separate country for taxation and customs purposes.

The government creates these zones to attract investments, boost exports, and promote economic activity.

Key Benefits of SEZs:

✅ Tax Exemptions: Businesses enjoy income tax benefits, GST exemptions, and reduced customs duties.

✅ Duty-Free Imports: SEZs allow companies to import raw materials and machinery without paying customs duties.

✅ Simplified Compliance: Businesses in SEZs deal with less regulatory red tape, making operations smoother.

In short, SEZs provide a highly business-friendly environment, particularly for companies involved in manufacturing, IT services, and exports.

Understanding Export & Import in SEZs

Before diving deeper into SEZs and their specific rules, let's clarify two key terms: exports and imports.

-

Export: This refers to the outward movement of goods and services from one country to another. When a company in India manufactures shirts and sells them to a buyer in the United States, that's considered an export.

-

Import: On the other hand, import refers to the inward movement of goods and services from a foreign country. If a clothing store in India purchases those same shirts from a US manufacturer, that's considered an import.

These terms become particularly relevant when discussing SEZs because a core function of SEZs is to promote exports.

The tax breaks and duty-free benefits offered in SEZs are designed to incentivize businesses to manufacture goods within the zone and then export them to other countries.

GST Rules for SEZ Units

GST can get a bit confusing when it comes to SEZs, but here’s the simple version:

Zero-Rated Supplies to SEZs

Supplies made to SEZ units are zero-rated under GST. This means they are taxed at 0%, similar to exports.

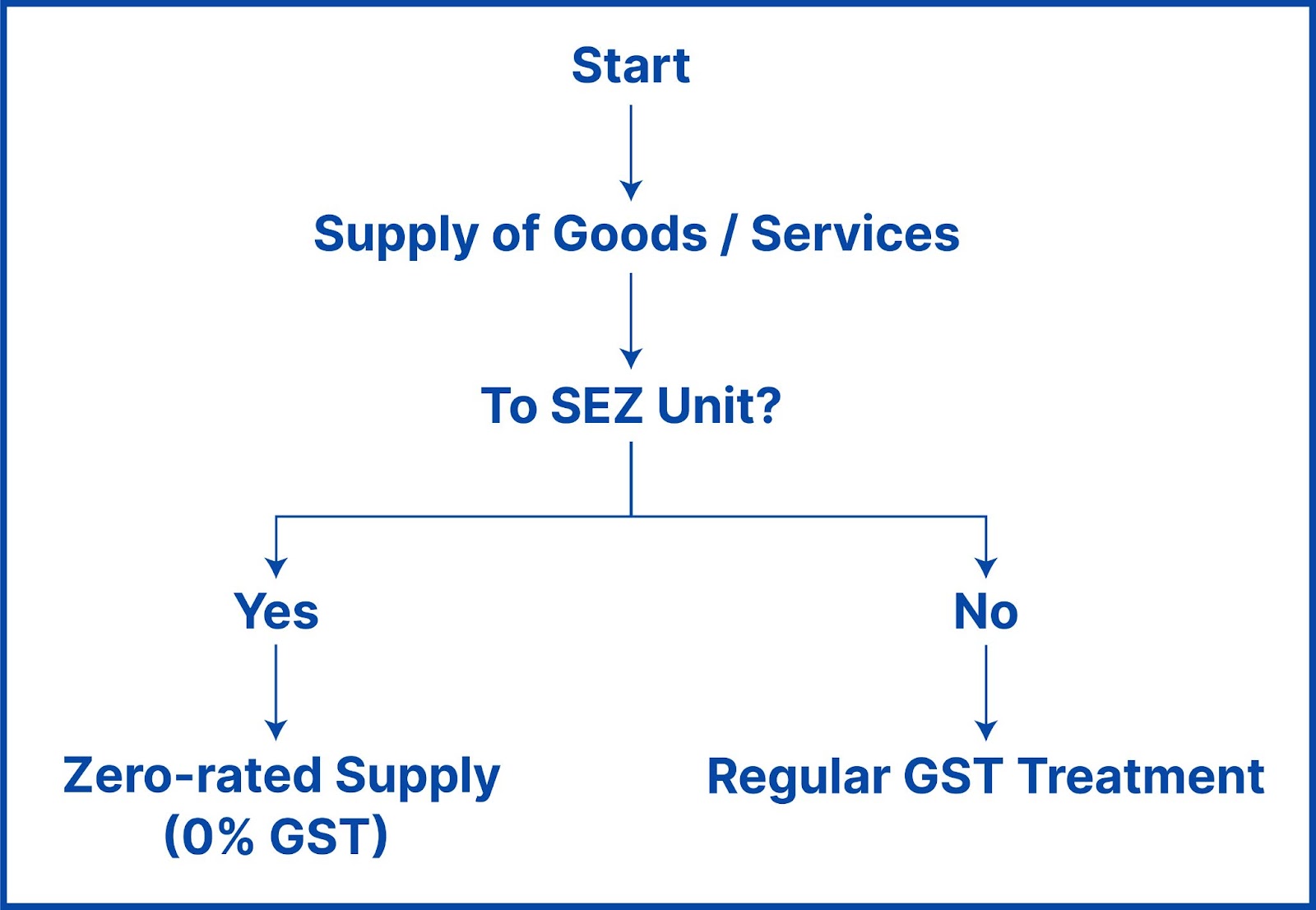

Here's a flowchart to illustrate this concept:

As you can see, if your supply (sale of goods or services) is going to an SEZ unit, it qualifies as a zero-rated supply with no GST charged. However, if the supply is not going to an SEZ unit, then the regular GST rules and tax rates apply.

Important Note: Even though the supply itself is zero-rated, there are two options available to suppliers for claiming credit on taxes paid on inputs used for these zero-rated supplies to SEZs:

-

Supply under bond or Letter of Undertaking (LUT): Under this option, you can supply goods/services to the SEZ unit without paying Integrated GST (IGST) upfront. However, you'll need to provide a bond or LUT guaranteeing payment of IGST if you fail to meet certain conditions. This allows you to claim the Input Tax Credit (ITC) on the taxes you paid for the inputs used in the supplies to the SEZ unit.

-

Supply on payment of IGST and claim a refund: You can also choose to pay the IGST upfront when supplying to the SEZ unit. However, you can then claim a refund of this IGST paid.

E-Way Bill Rules for SEZ

Now that we've covered GST, let's explore how the e-Way Bill system applies to SEZs. This system, which tracks the movement of goods within India, has specific considerations for SEZs.

Here's the key takeaway: the e-Way Bill requirement applies only when goods are moving from an SEZ unit to other locations within India. In simpler terms, if you're sending goods out of the SEZ, you'll likely need an e-Way Bill.

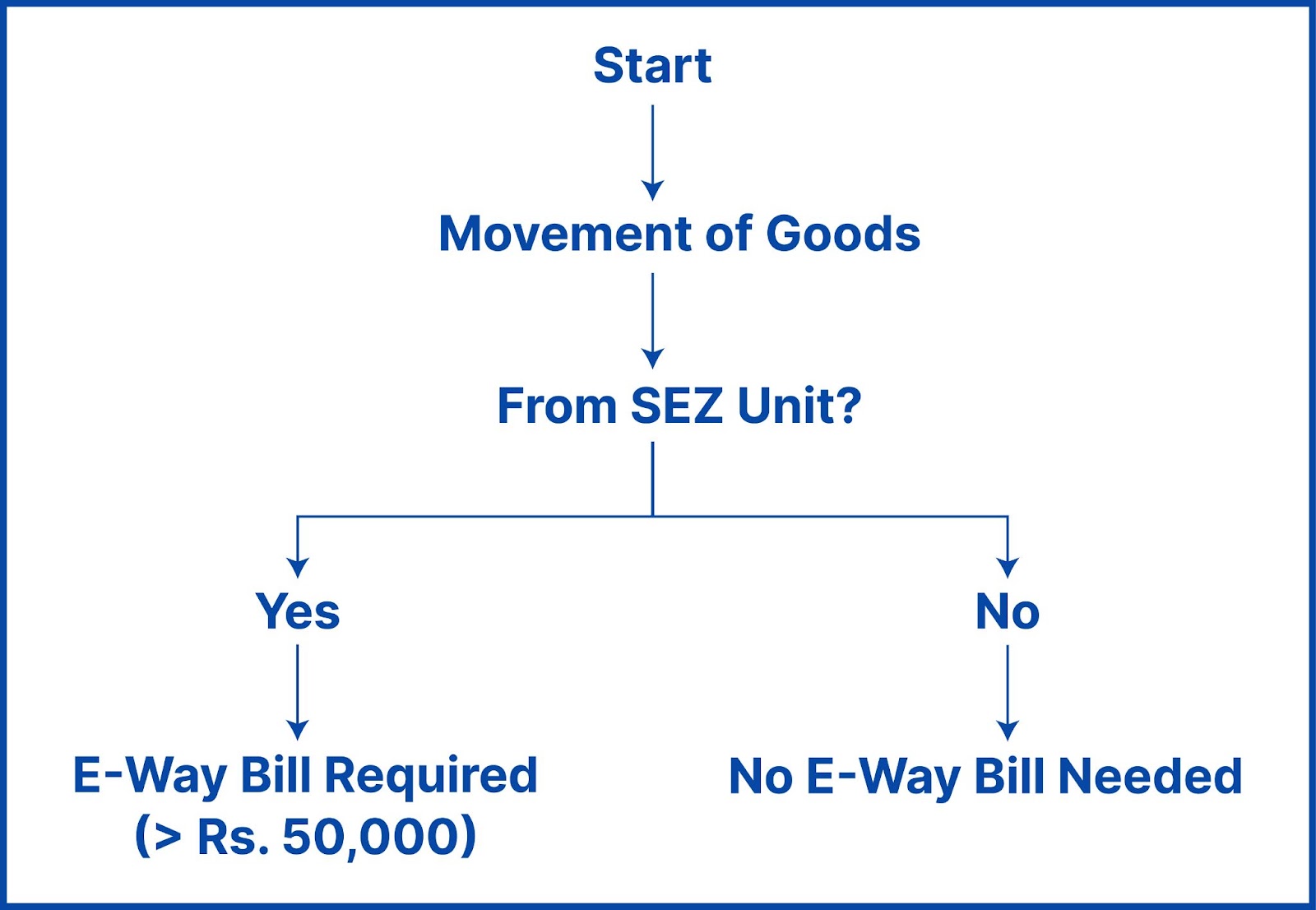

This concept is visualized in the following flowchart:

As you can see, if the movement of goods originates from an SEZ unit, an e-Way Bill is mandatory, provided the value of the consignment exceeds Rs. 50,000. However, if the movement doesn't involve an SEZ unit as the starting point, there's no need for an e-Way Bill.

Validity of e-Way Bills for SEZ Movements:

Here's an additional point to remember: the validity period of e-Way Bills for movements originating from SEZs differs slightly:

- One day for movement up to 200 kilometers.

- Two days for movement exceeding 200 kilometers.

It's important to note that these validity periods can be extended as per regulations. Make sure to stay updated on any changes to ensure compliance.

Remember: It's always best to stay updated on the latest regulations and consult with a tax professional for specific guidance related to your SEZ operations.

FAQs on SEZ GST & E-Way Bill Compliance

1. Do intra-SEZ transfers require GST compliance?

No, intra-SEZ transactions are typically exempt from GST since SEZs are treated as separate economic territories.

2. What documents are needed to move goods from an SEZ?

Depending on the type of goods and destination, the required documents may include:

✔ Invoice or Purchase Order

✔ Bill of Lading (for sea or air transport)

✔ Packing List

✔ Declaration from the SEZ Unit

✔ Export Declaration (if applicable)

3. What happens if I don’t generate an e-Way Bill for SEZ goods?

Non-compliance with e-Way Bill rules can result in:

❌ Penalties & Fines – Depending on the distance and tax amount.

❌ Goods Seizure – Authorities can detain shipments until compliance is met.

Also Read:

- Mastering Multi-Branch GST Registration in India: A Definitive Guide for Businesses Navigating Multiple GSTINs

- Step-by-Step Guide to the QRMP Scheme: Making GST Filing Easier

- Dormant Company & Dormant Account: Keep Costs Low, Options High

- What is MSME Procurement and Marketing Support (PMS) Scheme

- Municipal Accounting And Auditing: A Must-Know for CAs