Navigating employee welfare can often feel overwhelming, but that’s where the Employees’ State Insurance Corporation (ESIC) portal steps in. Operated by the Ministry of Labour and Employment, this portal is more than just a tool—it's a lifeline for millions of workers across India.

With the Employees’ State Insurance (ESI) scheme, the government goes above and beyond regular medical insurance. It ensures financial security in times of illness, maternity, workplace injuries, and even during unemployment, offering a safety net for workers and their families.

Currently, over 13 crore employees and their loved ones benefit from this robust social security system. In this blog, we’ll guide you through the ESIC employee login and employer login processes while also explaining the hassle-free ESIC registration procedure. Whether you're an employer looking to fulfill compliance requirements or an employee seeking support, this guide has you covered.

Let’s see how the ESIC portal makes accessing these benefits simpler, smarter, and more effective for everyone involved!

What is the ESIC Portal, and How Does It Work?

The ESIC portal is the backbone of the Employees’ State Insurance Corporation (ESIC), operating independently under the Ministry of Labour and Employment. Think of it as the central hub where employees and employers connect to access and manage benefits under the Employees’ State Insurance (ESI) scheme.

Originally designed to support factory workers, the ESI scheme has expanded its reach to include the entire organized sector in India, ensuring a safety net for millions of employees. The ESIC portal plays a pivotal role in managing the member login panel, streamlining contributions, and funding the scheme to deliver its promised benefits.

How Does It Work?

The ESI scheme runs on a simple contribution model:

- Employers contribute 3.25% of an employee’s wages.

- Employees contribute 0.75%, making it a total of 4% of the wages paid.

These contributions are governed by the ESIC portal, strictly adhering to the provisions of the Employees’ State Insurance Act of 1948.

Here’s a thoughtful feature: employees earning a daily average wage of up to ₹137 are exempt from contributing to the scheme. However, employers are still required to contribute on their behalf, ensuring everyone, regardless of income level, gets access to essential medical and financial support.

From ensuring compliance to facilitating seamless contributions, the ESIC portal ensures that this welfare system operates smoothly for all.

What Are the Eligibility Criteria for using the ESIC Portal?

The ESIC portal isn’t just for everyone—it has specific eligibility criteria to ensure the benefits are accessible to those who qualify. Here’s a breakdown:

For Employers

If your organization has 10 or more employees, registering on the ESIC portal is mandatory. This rule applies across most industries, ensuring compliance with labor laws and providing employee benefits.

For Employees

The eligibility for employees is tied to specific conditions:

- The scheme covers employees working in non-seasonal factories with 10 or more workers.

- The wage limit for eligibility is ₹21,000 per month. However, for employees with disabilities, the wage limit is relaxed to ₹25,000 per month.

- These criteria have been in effect since January 1, 2017.

By meeting these requirements, employees and employers can unlock a comprehensive safety net that ensures support during challenging times.

What Advantages Does the ESIC Portal Offer?

The ESIC portal isn’t just a registration tool—it’s a gateway to a host of benefits that go beyond traditional medical insurance. Here are some of the key advantages for employees and their families:

- Comprehensive Medical Coverage: Not only does the insured receive complete medical care, but their family is also covered, ensuring peace of mind in times of need.

- Support During Sickness: Employees can avail themselves of financial and medical assistance during periods of illness or physical distress, helping them recover without additional stress.

- Employment Injury Benefits: If an employee faces a loss of earning capacity due to an occupational hazard, workplace injury, or accident, they receive compensation to safeguard their livelihood.

- Dependent Benefits: In unfortunate cases where the insured suffers death due to workplace injury, their dependents are eligible for a monthly pension, offering financial security in difficult times.

With such wide-ranging benefits, the ESIC portal ensures employees and their families have a safety net that’s there when they need it most.

Also Read: Top Government Business Loan Schemes in India

What Services Does the ESIC Portal Offer?

The ESIC portal offers a wide range of services designed to cater to both employers and employees, making it an essential platform for managing ESI benefits. Let’s break it down:

Services for Employers

The portal provides tools to simplify compliance, streamline reporting, and manage employee data:

Employer Portal:

Employers can efficiently:

- Update employee details.

- Maintain and submit wage contributory reports.

- Respond to absenteeism verifications.

- This portal helps employers stay compliant while ensuring transparency.

Shram Suvidha Portal:

Designed to simplify adherence to labor laws, this portal allows organizations to:

- Streamline compliance reporting using a single unified form.

- Monitor performance through key indicators, making compliance hassle-free and efficient.

Services for Employees

Employees benefit from services that enhance accessibility and ensure they can make the most of the ESI scheme:

IP Portal (Insured Person Portal):

Employees can log in at http://www.esic.in/employeeportal/login.aspx using their insurance number (also their username). Here, they can:

- Check the contributions made on their behalf.

- View their entitlement to various benefits.

- Access important information about their insurance status.

Tie-Up Hospitals:

Insured individuals and their families can visit affiliated hospitals for medical needs, including emergencies and routine treatments.

During the Covid-19 pandemic, the portal ensured access to private chemists and affiliated hospitals for insured persons while many ESIC hospitals were allocated for Covid-19 care.

Scale of Medical Benefits:

This feature outlines the guidelines and procedures for insured persons and their family members to access medical benefits, ensuring clarity and transparency in the process.

With these services, the ESIC portal empowers both employers and employees to manage their responsibilities and benefits with ease.

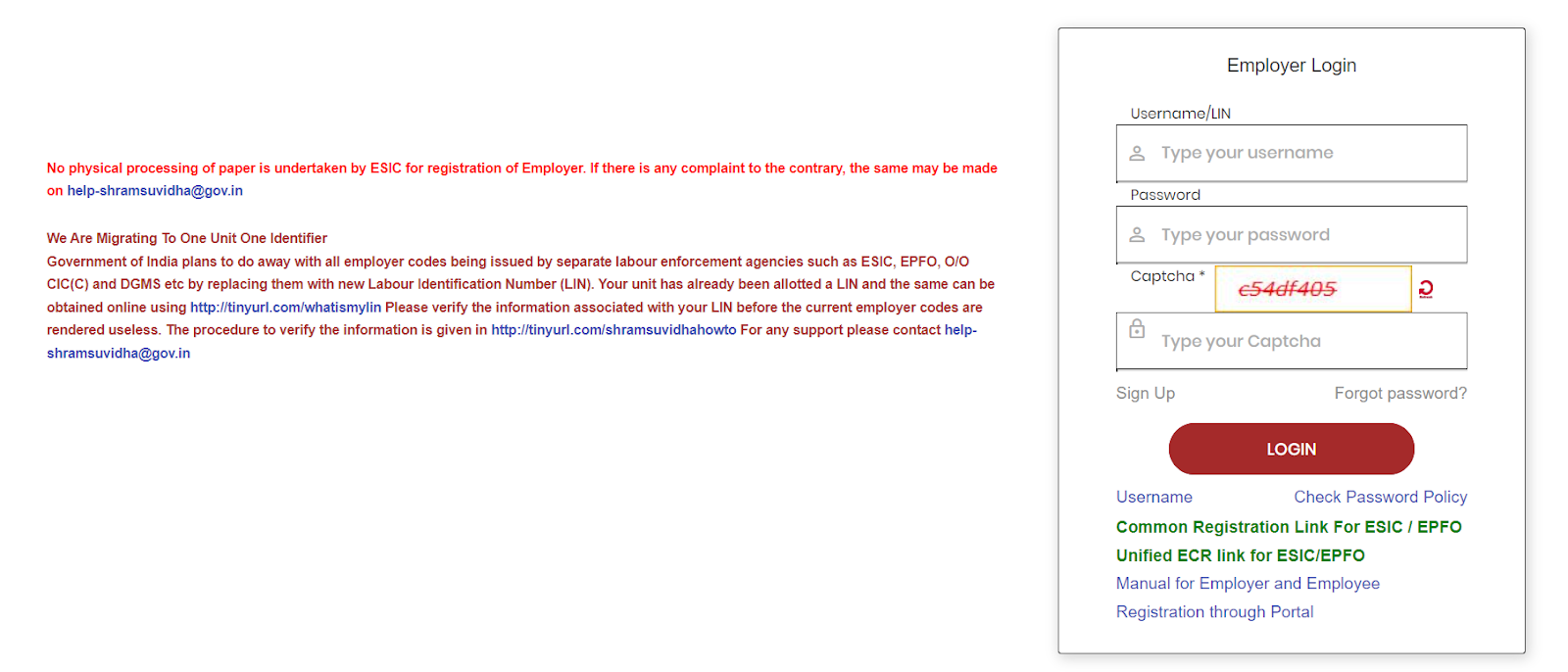

ESIC Employer Login Process

Employers with more than ten employees must register within 15 days at the Employees’ State Insurance Corporation.

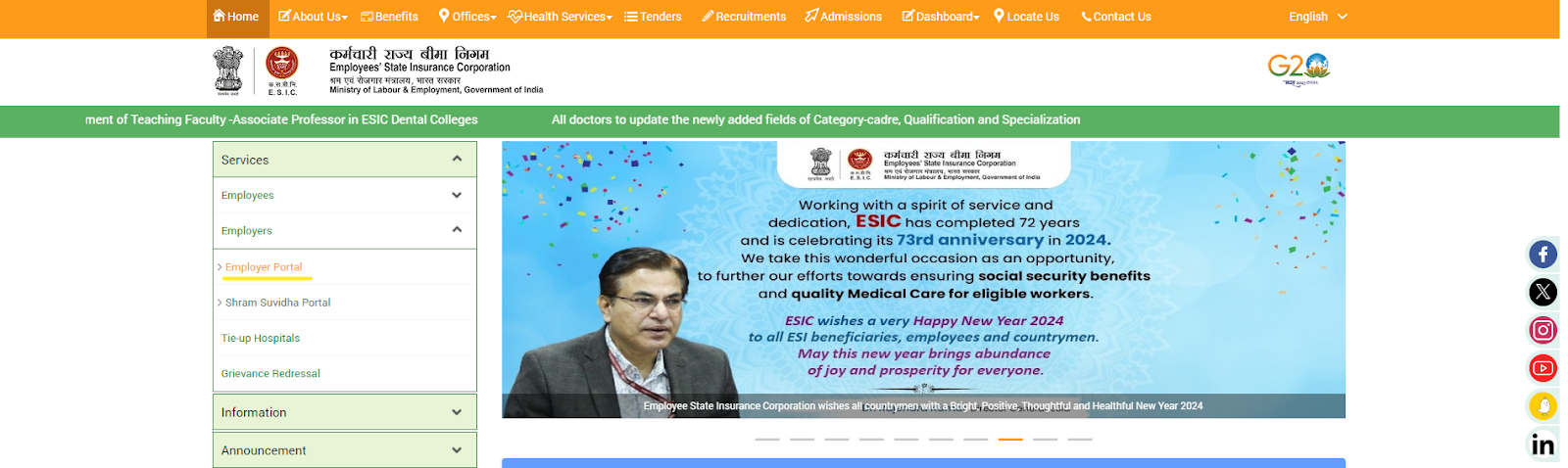

Step 1: To begin, visit the online employer portal at www.esic.in and log in with the ESIC Employer credentials.

Once registered, the employer will receive a 17-digit code and login details. If not registered, find the process here.

For Employers:

- Employers with more than 10 employees must fill out Form-01 and submit it to ESIC.

- Within 15 days, the company should receive a 17-digit unique Identification number from the Regional office, used for all scheme-related correspondence.

- This unique number is crucial for scheme-related communication. Along with Form-01, a declaration in Form 3 must also be submitted.

For Employees:

- When joining a Private Limited Company, employees need to complete Form-1 and provide a family photo to the employer.

- Under ESI, employees get a permanent photo ID and insurance number within 3 months for identification.

- If an employee switches companies, the registration can be transferred later on.

Step 2: Make sure the ESIC 'employer portal' is compatible with your browser – it works with Internet Explorer or Mozilla Firefox.

Visit the page by clicking on this link: https://www.esic.nic.in/.

Or else,

On the left side of the page, find 'Services.' Click 'Employer' and then 'Employer Portal.' Your browser may ask for permission to redirect you; grant it to access the Employer Portal.

Step 3: Click 'Click here to log in' on the right side.

Step 4: After receiving credentials, log in to submit employee details, including family members, residence address, and preferred clinic for medical treatment.

Benefits for Employers through the ESIC Portal include:

-

Employers covered under the ESI scheme enjoy exemptions from the ‘Maternity Benefit Act and Employees’ Compensation Act for their employees.

-

Employers are relieved from the responsibilities arising from the physical distress of workers, like employment injury or physical disablement resulting in wage loss. The ESIC portal offers financial assistance in such situations for insured employees.

-

Any contribution made under the ESI Act is deductible when calculating 'Income' under the Income Tax Act.

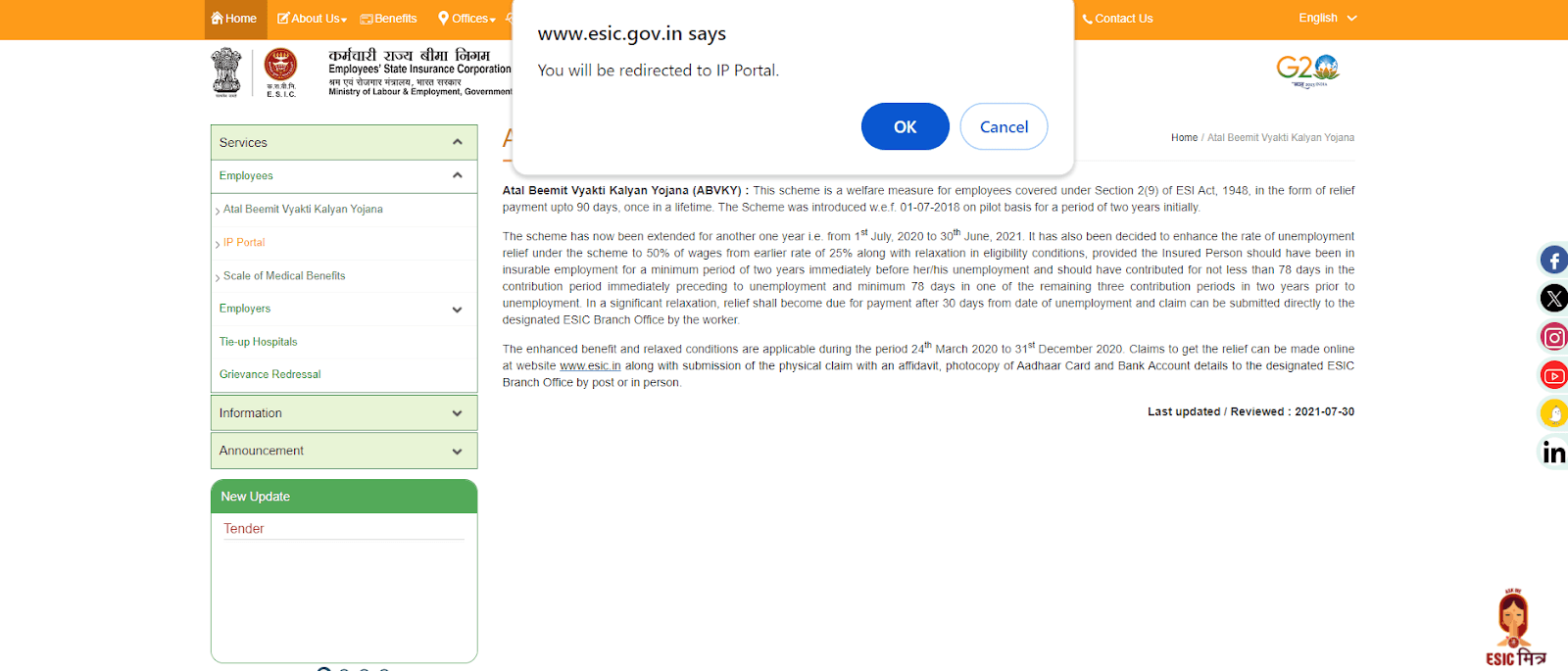

ESIC Employee Login Process

Once an employee is registered by the employer, they become an 'Insured person.' The Insured person or employee can visit the employee portal to check their contributions to the ESI scheme and the benefits they're entitled to.

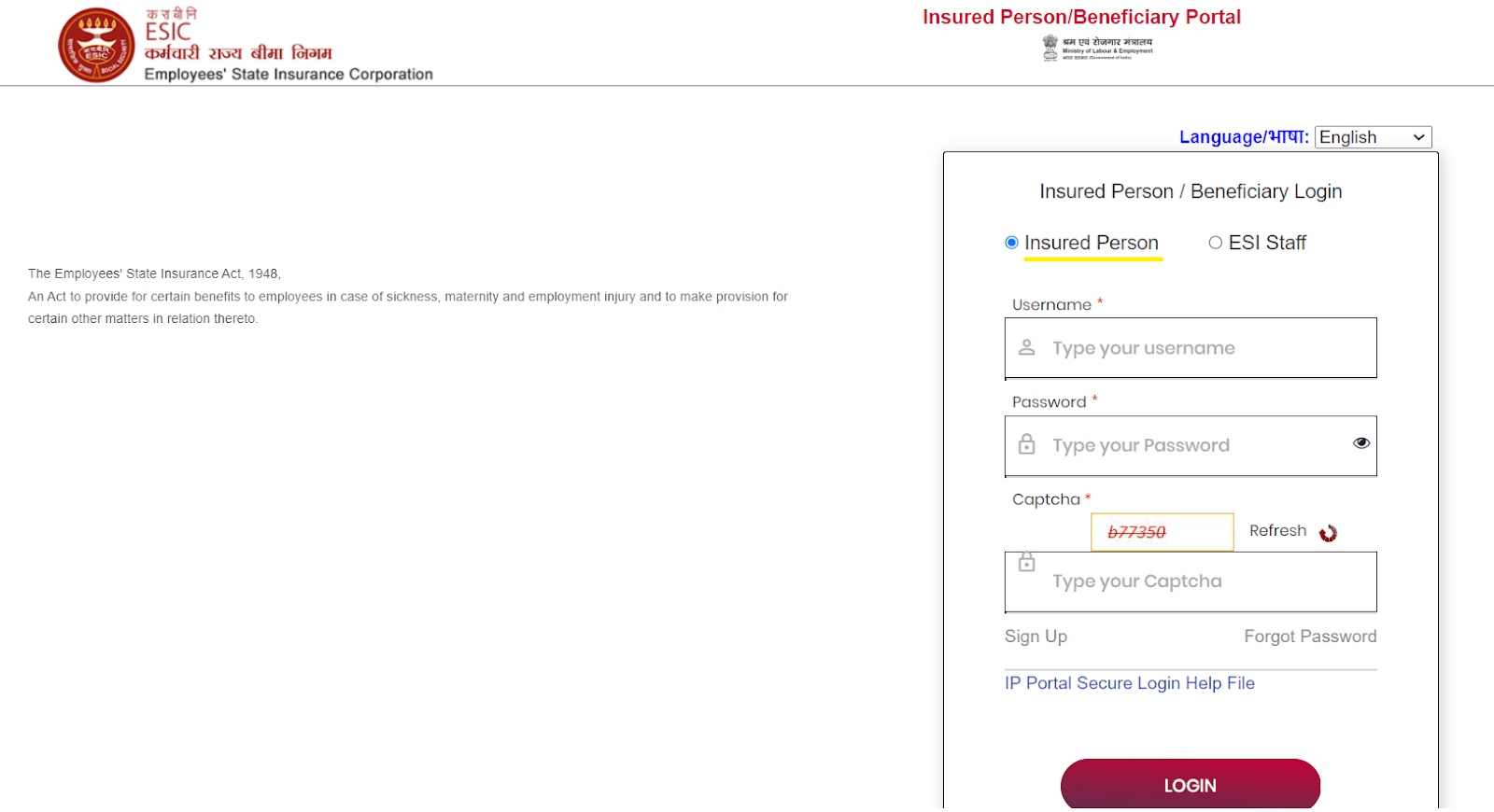

Step 1: To access the employee portal, click on the link provided: https://www.esic.nic.in/insured-person-employer-login. This ESIC Employee login portal is compatible with most web browsers.

Step 2: Click 'Services' located on the left side of the screen. Inside it, choose 'Employee,' and then click on 'IP Portal.'

Since the Employee Portal is an external page, your browser might request permission to redirect. Allow the redirection to continue.

Step 3: Use your 'Insurance number' as your username, enter the Captcha, and log in. Make sure to choose 'Insured Person.'

Once logged in, you can view the contributions made by both you and your employer to the scheme. Additionally, you'll find updates and details about other benefits that you can claim and are entitled to.

Benefits for Employees through the ESIC Portal include:

-

Medical Benefits: Full medical support is provided to the employee and their family from the day they enter insurable employment. There is no limit set on treatment expenditure for both the individual and their family.

-

Sickness Benefit: A cash compensation benefit equivalent to 70% of the total wages is payable to insured workers during certified sickness, lasting at least 91 days in a year.

-

Maternity Benefit: Maternity benefit for confinement/pregnancy spans twenty-six weeks. It can be extended for an additional month on medical advice, with full wages, subject to contribution for 70 days in the preceding two Contribution Periods.

-

Disablement Benefit:

-

a. Temporary Disablement Benefit (TDB): From the first day of entering insurable employment, and regardless of paid contributions in case of employment injury, 90% of the wage is payable as long as the disability continues under temporary disablement benefits.

-

b. Permanent Disablement Benefit (PDB): Paid at a rate of 90% of the wage in monthly payments, depending on the extent of loss of earning capacity as certified by a Medical Board.

-

Dependents Benefit: Dependents Benefit (DB) is paid at a rate of 90% of the wage in monthly payments to the dependents of a deceased Insured person in cases where death occurs due to employment injury or occupational hazards.

-

Other Benefits:

-

a. Funeral Expenses: An amount of Rs. 15,000/- is payable to the dependents or the person performing last rites from day one of entering insurable employment.

-

b. Confinement Expenses: For an Insured Woman or an I.P. in respect of his wife, if confinement occurs where necessary medical facilities under the ESI Scheme are not available.