During a tea break, two of our team members were chatting about how India’s export business has been booming lately.

Did you know that India’s overall exports (including both merchandise and services) reached an impressive $776.68 billion in FY 2024, marking a slight increase from the previous FY?

With the government pushing for more global trade, businesses are seizing the opportunity to export goods like never before.

Naturally, this led to a conversation about Export-Oriented Units (EOUs) and how registering under the IGCR scheme can be a game-changer for businesses looking to reduce costs and boost profits.

As EOUs become more popular in India’s growing export market, understanding the procedure for registering under the IGCR has become critical.

That’s why we decided to walk you through it. If you're considering exporting your products, knowing how to register your business as an EOU under IGCR is a must to take full advantage of the benefits and exemptions available. Let’s break it down for you.

What is an Export-Oriented Unit (EOU)?

Before jumping into the process, let’s first understand what an Export-Oriented Unit is. An EOU is a business unit dedicated to manufacturing goods that are mostly meant for export.

These units get several perks like tax exemptions and duty-free imports under the IGCR scheme, which can significantly reduce operating costs.

If you're running an EOU, you can import goods at concessional rates, provided that you follow the regulations set by the government.

One of the primary steps to avail of these benefits is registering under the IGCR.

Why Register Under IGCR?

So, why is registering under the IGCR scheme necessary? Well, the government offers some great incentives to EOUs. By registering under the scheme, you’re allowed to import inputs, capital goods, and even spare parts at a lower cost.

These benefits can help you save on duties and taxes, which can then improve your profitability. But with great benefits come a few steps of compliance, and registration is the first big one.

Step-by-Step Procedure for Registration of EOU under IGCR

Let’s dive into the heart of the topic—how exactly do you go about registering an EOU under the IGCR scheme? Don’t worry; I’ll break it down for you, nice and easy.

Step 1: Apply Online on the ICEGATE Portal

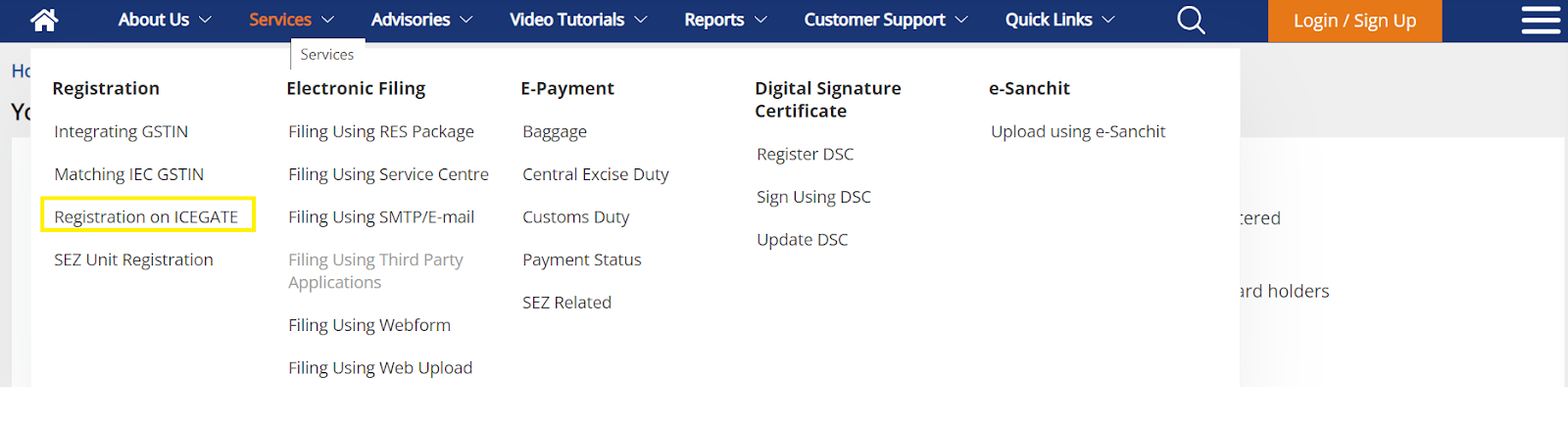

The very first step is to head over to the ICEGATE Portal, the Indian Customs EDI Gateway.

Here’s where all the online filings happen. If you don’t have an account on ICEGATE, you’ll need to register by providing your business details, PAN, GSTIN, etc.

This is like setting up the basics of your compliance journey. Once registered, the portal will give you access to several forms and applications needed to complete your EOU registration.

Step 2: Fill out the IGCR Declaration Form

The next step is filling out the IGCR Declaration Form on ICEGATE. This form asks for details about the goods you plan to import under the concessional rate, along with information about your business.

Make sure you’re meticulous about this step—incorrect or incomplete information can cause delays in your registration.

Double-check the details related to your raw materials, capital goods, and other inputs you plan to import duty-free.

Step 3: Submitting the Bond and Bank Guarantee

Once the IGCR Declaration Form is completed, the next big step is submitting a bond. This bond acts as a guarantee to the government, ensuring that the imported goods will be used for their intended purpose (i.e., manufacturing goods for export).

Along with the bond, you’ll need to submit a bank guarantee. This is essentially a financial security that ensures your business will comply with the terms of the IGCR scheme.

The bond and bank guarantee vary based on the value of the goods you intend to import, so you’ll want to consult with a financial expert to determine the correct amounts.

Step 4: Examination and Verification by Customs

Once your bond and guarantee are submitted, customs officials will take over to verify your application.

They will cross-check all the information provided in the IGCR Declaration Form, bond, and other documents. This process may also involve a physical verification of your premises.

This step ensures that the imported goods will indeed be used for export manufacturing, preventing misuse of the concessional rates.

Step 5: Approval and Issue of Registration Certificate

Once customs are satisfied with your application and the verification process is complete, they will approve your registration and issue a Registration Certificate.

This certificate is your gateway to importing goods under the IGCR scheme.

Congratulations—you’re now officially registered as an EOU under the IGCR!

But don’t relax just yet—there are still a few compliance requirements you’ll need to keep up with regularly.

Post-Registration Compliance for EOUs under IGCR

Getting registered is only half the journey. Once you’ve got your certificate, you’ll need to comply with ongoing requirements to maintain your status as an EOU.

Maintain Detailed Records

It’s important to keep meticulous records of all goods imported and how they’re used. The government will periodically check that the imported goods are being used strictly for manufacturing products meant for export.

Submit Regular Returns

As an EOU, you’ll be required to submit periodic returns, detailing your imports and exports. This includes filing quarterly returns and possibly even annual audits, depending on the volume of goods you import.

Ensure that your accounting is precise—errors in returns can lead to penalties or even cancellation of your registration.

Re-export Obligations

If for any reason you’re unable to use the imported goods for manufacturing and export, you’ll need to re-export them. This ensures that the concessional rate isn’t misused. Non-compliance in this area can result in penalties or loss of benefits under the IGCR.

Stay Smart, Stay Compliant

At Suvit, we’re always looking for ways to help businesses simplify their compliance processes. While Suvit doesn’t handle IGCR directly, our accounting automation software is designed to ease the burden of managing compliance, record-keeping, and filing taxes for your business.

Whether you're handling EOU-related financial records or just keeping track of your day-to-day transactions, Suvit ensures your data is accurate, organized, and ready when you need it.

If you're tired of juggling manual accounting tasks, why not give Suvit a try? Automate your accounting processes and experience stress-free compliance management.

You can try Suvit free for a week and see how our automation solutions can streamline your business operations!