The digital rupee, also known as e-rupee, is a central bank digital currency (CBDC) being developed by the Reserve Bank of India (RBI). It is a digital form of the fiat Indian rupee that is issued and regulated by the RBI.

The digital rupee is expected to be launched in two phases: wholesale and retail. The wholesale phase was launched in November 2022 and is currently being used by select banks to settle secondary market transactions in government securities.

The retail phase is expected to be launched in December 2023 and will be available to the general public.

Meaning of Digital Rupee

The digital rupee is a digital form of the Indian rupee that is issued and regulated by the RBI. It is a legal tender that can be used to make payments and settle transactions like the physical rupee. The digital rupee is stored in a digital wallet and can be transferred to other wallets or used to make payments to merchants who accept digital rupee payments.

Understanding the Impact of the Digital Rupee

The digital rupee is expected to impact the Indian economy and society significantly. It is likely to make payments faster, more efficient, and more secure. It can also help to reduce the cost of financial transactions and promote financial inclusion.

The digital rupee is expected to have a number of specific effects, implications, and impacts, including:

- Economic impact: The digital rupee is expected to boost economic growth by promoting financial inclusion and making it easier for businesses to operate. It is also expected to reduce the cost of financial transactions and make saving and investing easier.

- Impact on Indian businesses: The digital rupee is expected to make it easier and cheaper for businesses to make payments and receive payments from customers and suppliers. It is also expected to help businesses to reach new customers and expand their markets.

- Impact on individuals: The digital rupee is expected to make it easier and more convenient for individuals to make payments, save money, and invest. It is also expected to help individuals to protect their money from fraud and theft.

Economic Impact of the Digital Rupee in India

The digital rupee is expected to impact the Indian economy significantly. It is likely to boost economic growth by promoting financial inclusion and making it easier for businesses to operate. It is also expected to reduce the cost of financial transactions and make saving and investing easier.

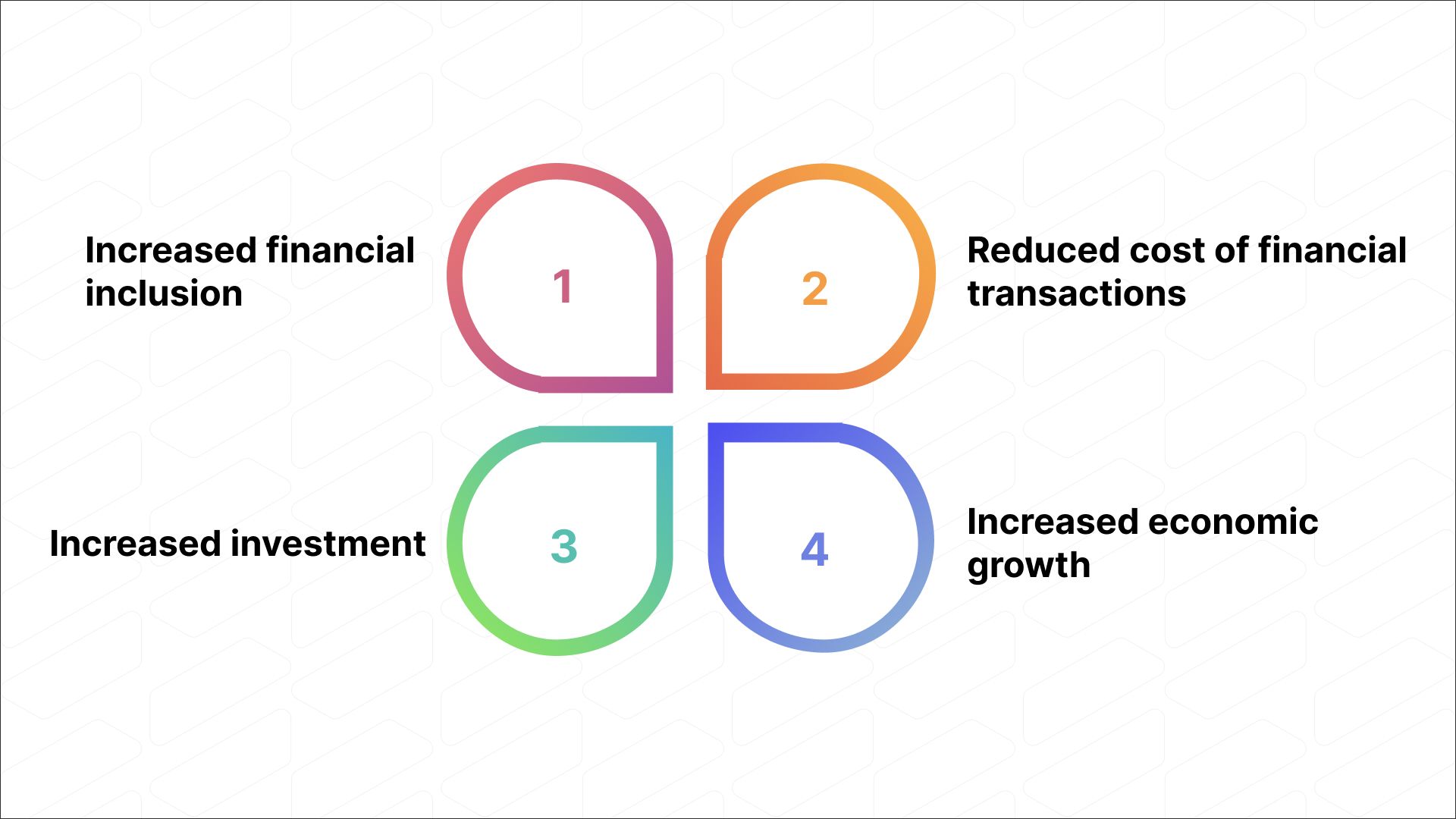

Here are some specific ways in which the digital rupee is expected to impact the Indian economy:

- Increased financial inclusion: The digital rupee is expected to make it easier for people in rural and underserved areas to access financial services. This is because digital rupee wallets can be accessed on mobile phones without a bank account.

- Reduced cost of financial transactions: The digital rupee is expected to reduce the cost of financial transactions, such as remittances and cross-border payments. This is because digital rupee transactions are processed directly between wallets without the need for intermediaries.

- Increased investment: The digital rupee is expected to make it easier for people to invest in financial markets. This is because digital rupee wallets can be used to purchase and sell securities directly without the need for a broker.

- Increased economic growth: The digital rupee is expected to boost economic growth by making it easier for businesses to operate and by promoting financial inclusion.

Recommended Read: Tally Solutions vs. Traditional Accounting: Why Tally is the Future

Impact of the Digital Rupee on Indian Businesses

The digital rupee is expected to have a positive impact on Indian businesses. It is likely to make it easier and cheaper for businesses to make payments and receive payments from customers and suppliers. It is also expected to help businesses to reach new customers and expand their markets.

Here are some specific ways in which the digital rupee is expected to impact Indian businesses:

- Reduced cost of payments: The digital rupee is expected to reduce the cost of payments for businesses. This is because digital rupee transactions are processed directly between wallets without the need for intermediaries.

- Increased efficiency: The digital rupee is expected to make payments more efficient for businesses. This is because digital rupee transactions are processed in real-time, 24/7.

Expanded markets: The digital rupee is expected to help businesses to reach new customers and expand their markets. This is because digital rupee payments can be accepted from anywhere in the world.

Impact of the Digital Rupee on Individuals

The digital rupee is expected to have a positive impact on individuals. It is likely to make it easier and more convenient for individuals to make payments, save money, and invest. It is also expected to help individuals to protect their money from fraud and theft.

Here are some specific ways in which the digital rupee is expected to impact individuals:

- Convenient payments: The digital rupee will make it easier and more convenient for individuals to make payments. This is because digital rupee payments can be made using a smartphone or other mobile device without the need for cash or a credit card. Digital rupee payments can also be made online or in stores, wherever the digital rupee is accepted.

- Reduced risk of fraud and theft: The digital rupee is expected to help individuals protect their money from fraud and theft. This is because digital rupee wallets are protected by strong security features, such as encryption and two-factor authentication. Additionally, digital rupee transactions are recorded on a blockchain, which makes them very difficult to counterfeit.

- Increased financial inclusion: The digital rupee is expected to make it easier for people in rural and underserved areas to access financial services. This is because digital rupee wallets can be accessed on mobile phones without a bank account. The digital rupee is also expected to reduce the cost of financial transactions, such as remittances and cross-border payments, which will make it easier for people to send and receive money from abroad.

- Enhanced privacy: The digital rupee is expected to offer enhanced privacy to users. This is because digital rupee transactions are not linked to personal identities, such as bank account numbers or credit card numbers. Users can choose to remain anonymous when making digital rupee payments.

Impact of Digital Rupee on Accountants

The digital rupee is expected to impact the role of accountants significantly. It is likely to automate many of the tasks that accountants currently perform, such as reconciling accounts, processing payments, and preparing financial statements. This will free up accountants to focus on more strategic tasks, such as financial planning and analysis.

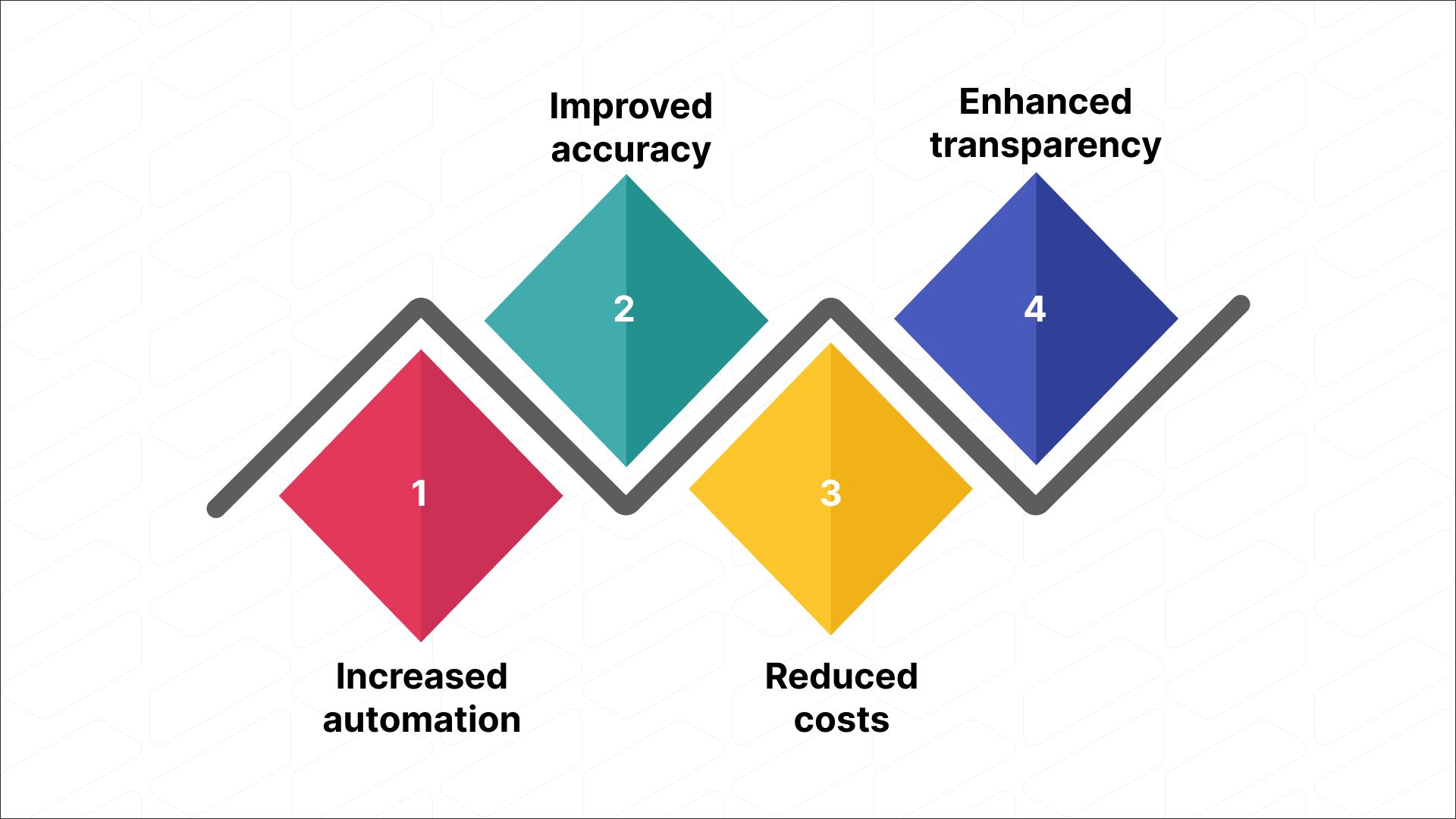

Here are some specific ways in which the digital rupee is expected to impact accountants:

- Increased automation: The digital rupee is expected to automate many of the tasks that accountants currently perform, such as reconciling accounts, processing payments, and preparing financial statements. The use of accounting automation tools will free up accountants to focus on more strategic tasks, such as financial planning and analysis.

- Improved accuracy: The digital rupee is expected to improve the accuracy of accounting records. This is because digital rupee transactions are recorded on a blockchain, which is a distributed ledger that cannot be tampered with.

- Reduced costs: The digital rupee is expected to reduce the cost of accounting services. This is because the automation of many accounting tasks will reduce the need for manual labour.

- Enhanced transparency: The digital rupee is expected to enhance the transparency of financial transactions. This is because digital rupee transactions are recorded on a blockchain, which is a public ledger that can be viewed by anyone.

The digital rupee is still in its early stages of development, but it has the potential to revolutionize the way that accountants work. Accountants who are prepared for the digital rupee will be well-positioned to succeed in the future.

Here are some specific things that accountants can do to prepare for the digital rupee:

- Learn about the digital rupee: Accountants should learn about the digital rupee and its potential impact on their profession. This will help them to identify opportunities and to mitigate risks.

- Invest in new skills: Accountants should invest in new skills, such as accounting automation, blockchain technology, and data analytics. These skills will be in high demand as the digital rupee becomes more widely adopted.

- Network with other accountants: Accountants should network with other accountants and professionals who are working in the digital rupee space. This will help them to stay up-to-date on the latest developments and to get advice from others.

The Blend of the Digital Rupee and Suvit

Suvit is an AI-powered accounting platform that helps businesses automate their accounting tasks. It can automatically reconcile accounts, process payments, prepare financial statements, and generate tax reports. Suvit integrates with the popular accounting software Tally, which makes it the perfect tool for Indian businesses.

The digital rupee and Suvit can work well together to make money tasks faster and easier. The digital rupee will make payments faster and more efficient, while Suvit can automate many of the mundane tasks that accountants currently perform, such as transferring banking data from Excel to tally, data entry, and preparing financial statements.

Here is an example of how a business could use the digital rupee and Suvit together:

A business owner could use the digital rupee to accept payments from customers. Suvit could then automatically import these transactions into its accounting software. Suvit could then use this data to generate financial reports, such as an income statement and balance sheet, as well as tax reports and GST reports.

This would save the business owner a lot of time and hassle. They would not have to worry about manually entering transactions or reconciling accounts. Suvit would do all of that for them.

The main features of Suvit include:

- Data entry automation: Suvit can automatically extract data from invoices, receipts, and other documents and enter it into Tally. This can save businesses a lot of time and effort, and help to reduce errors.

- Client management: Suvit can help businesses to manage their clients more effectively. Businesses can give their clients access to Suvit so that they can upload their own documents and track the status of their data entry.

- User management: Suvit can help businesses to manage their teams more efficiently. Businesses can create users and assign them access to specific companies and tasks.

Ready to Accept the Future Approach?

The digital rupee is a new and innovative form of currency that has the potential to revolutionize the way we make payments and manage our finances. It is expected to have a significant impact on the Indian economy and society, both in the short and long term.

The digital rupee is still in its early stages of development, but it can potentially change how we live and work. It is important to stay informed about the digital rupee and to understand its potential benefits and risks.

The digital rupee is coming, and Suvit is ready. With Suvit's AI-powered accounting platform, you can automate your Tally accounting and data entry processes and focus on more important things, like growing your business.

Start your 7-day free trial today and see for yourself how Suvit can help you take your accounting to the next level.

Recommended Read: How To Identify and Close Skills Gaps Among Your Accounting Staff