People say, 'Communication is the key'.

But to what?

We will tell you the answer.

It is the key to convincing, collaborating, connecting, and drawing conclusions!

Success requires effective communication, especially for chartered accountants (CAs).

To build trust & keep things transparent, communicating well with clients is necessary.

The small and mid-sized firms involved in CA practice should use smart AI tools for quick updates and reminders to clients in the growing digital world to communicate efficiently.

What is Client communication in the CA World?

When you think about client communication in the CA world, it’s more than just emails or phone calls. It’s about creating a bridge of trust, understanding, and collaboration.

For Chartered Accountants, significantly those managing multiple clients, effective communication isn’t optional—it’s the backbone of their practice.

Here’s why it matters and how you can ace it.

Importance of client communication for Chartered Accountants

Effective client communication is at the heart of a successful CA practice. Beyond checking the accuracy of deliverables, it plays a vital role in promoting trust, transparency, and satisfaction. Let’s see why client communication is essential for Chartered Accountants.

Builds Trust and Credibility

Clients trust their CAs with sensitive financial data and critical business decisions. Transparent and consistent communication assures them their finances are in capable hands. For instance:

| Scenario | Outcome with Clear Communication | Outcome with Poor Communication |

|---|---|---|

| Explaining tax-saving strategies | Client feels confident and proactive | Client feels uncertain and stressed |

| Notifying compliance deadlines | Tasks completed on time | Risk of penalties and disputes |

Reduces Errors and Misunderstandings

Financial terms and regulations can be confusing for clients. Simplifying these and addressing questions early helps avoid costly errors.

Example: If a client misunderstands their GST filing obligations, they might underreport or overpay taxes. Clear communication prevents such scenarios.

Strengthens Client Relationships

Strong communication is the foundation of long-term client relationships. Personalized updates, regular check-ins, and addressing concerns promptly show clients that you value their partnership.

🗨️ Pro Tip: Use AI tools for personalized reminders and updates, assuring no client feels overlooked.

Drives Client Retention and Referrals

Satisfied customers are more likely to stick with you and refer you to others.

Regular, meaningful communication assures they think of you as a reliable advisor rather than just a service provider.

Aligns with Digital Transformation

In the tech-driven world, timely communication has become a client expectation. Leveraging AI-powered solutions allows CAs to keep pace with these expectations while focusing on their core work.

📌 Example Tools: Automated client reminders, chatbots for quick responses, and digital dashboards for real-time updates.

Client Communication Best Practices for Chartered Accountants

1. Keep It Simple and Clear

Financial topics can be complex, and clients often struggle with technical jargon. The secret is to make things understandable and simple. Avoid complicating them with too much detail and focus on what they need to know.

See how you can make it clear:

| Before | After |

|---|---|

| You need to comply with Section 194J of the Income Tax Act for TDS deductions. | You must deduct tax on payments to consultants as per the current laws. |

| Your financial statements show non-compliance with AS-22 for deferred tax liabilities. | There’s an issue with how deferred taxes are accounted for in your financial statements. Let me simplify the corrections for you. |

| You haven’t filed GSTR-1 for this quarter, which violates GST provisions under Section 37. | Your quarterly GST return (GSTR-1) is pending. Filing it soon will help avoid penalties. |

2. Be Proactive, Not Reactive

Waiting for clients to reach out with questions or concerns often leads to missed opportunities. Proactive communication—such as providing updates before they ask or informing them of upcoming deadlines—helps maintain trust and shows you’re always ahead of the game.

Example: Sending reminders before tax filing deadlines or notifying clients of potential deductions they may have missed.

🗨️ Pro Tip: Leverage AI-based tools to send timely reminders and keep clients informed without manually reaching out each time.

3. Be Consistent and Regular

Consistency is key to building a strong rapport with clients. Set a routine for communication—whether it's monthly check-ins or quarterly financial reviews—and stick to it. It will help clients feel confident that they are always in the loop.

| Communication Frequency | Impact on Client Relationships |

|---|---|

| Monthly updates on financial health | Clients feel informed and in control |

| Quarterly meetings for tax planning | Clients stay ahead of their financial obligations |

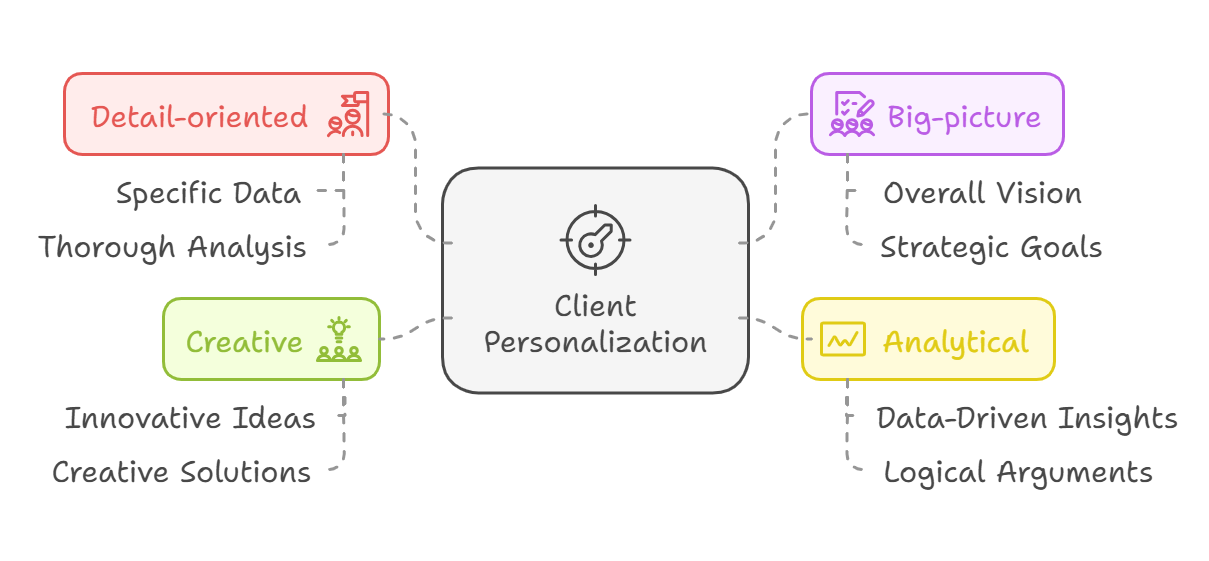

4. Personalize Your Approach

No two clients are the same. Understanding their unique needs and tailoring your communication accordingly is essential. Some clients may prefer a more formal approach, while others might appreciate a casual check-in.

Example: Offering detailed reports to more analytical clients and high-level summaries for clients who prefer a broad overview.

5. Utilize Technology to Your Advantage

Blending technology can make your communication more efficient and effective. Use tools that simplify communication, like client portals, digital reports, and cloud-based file sharing.

| Tools for Improved Communication | Benefits |

|---|---|

| Client portals | Centralized access to documents and updates |

| Digital reports | Real-time access to financials and progress |

| Secure file sharing systems | Easy document exchange with full security |

Secret Tip🤫: You can have all these facilities in Suvit’s automated accounting tool!

6. Listen Actively and Respond Promptly

Client communication isn’t a one-way lane. Listening to your client’s concerns and needs is just as important as delivering your message.

Respond promptly to queries and demonstrate that you value their time.

Tip: Active listening involves asking follow-up questions to make sure you fully understand your client’s issue or request before offering solutions.

7. Set Expectations and Be Transparent

Clear expectations prevent confusion. Let your clients know when they can expect updates, the costs involved, or the time required for certain tasks. If an issue arises, be upfront about it and communicate the solution.

See this example:

| Instead of This: | Say This: |

|---|---|

| I will get back to you about this soon. | I’ll have an update for you by Friday. |

| Let me know if you have any questions. | Feel free to reach out if you have questions—I’m available between 3 PM and 5 PM tomorrow. |

Build Stronger Client Relationships Through Communication

By adopting these client communication best practices, being Chartered Accountants you can not only enhance your service delivery but also build long-lasting, trustworthy relationships with clients.

In a field where precision and transparency are paramount, strong communication can set you apart and create loyal advocates for your practice.