In the world of taxation, precision isn’t just a nicety; it’s a necessity.

For businesses navigating the complex landscape of Tax Deducted at Source (TDS), one critical component often overlooked is the Book Identification Number (BIN).

This unique identifier, integral to the Form 24G filing process, holds significant importance for government deductors.

Let’s dive into what BIN is, how to verify it, the consequences of not using it correctly, and everything else you need to know to stay compliant.

What is the Book Identification Number (BIN)?

The Book Identification Number (BIN) is a distinctive identifier assigned to deductors during the monthly filing of Form 24G.

If you’re a government deductor who reports TDS without making payments through bank challans, quoting your BIN on your quarterly TDS statements is not just recommended—it’s required.

The BIN ensures that your tax reporting aligns with government expectations, minimizing discrepancies and potential issues down the line.

Why BIN Matters: The Compliance Connection

Accurate reporting is crucial in tax compliance. If the amounts reported in Form 24G don’t match the BIN details, you may face serious repercussions.

For instance, if there’s a mismatch, the credit might not appear in the Form 26AS of the respective deductee. This could lead to confusion and delays in tax credit claims, creating unnecessary headaches for both you and your clients.

Step-by-Step Guide to BIN Verification

Verifying your BIN details is a straightforward process that ensures everything is in order. Here’s how to do it:

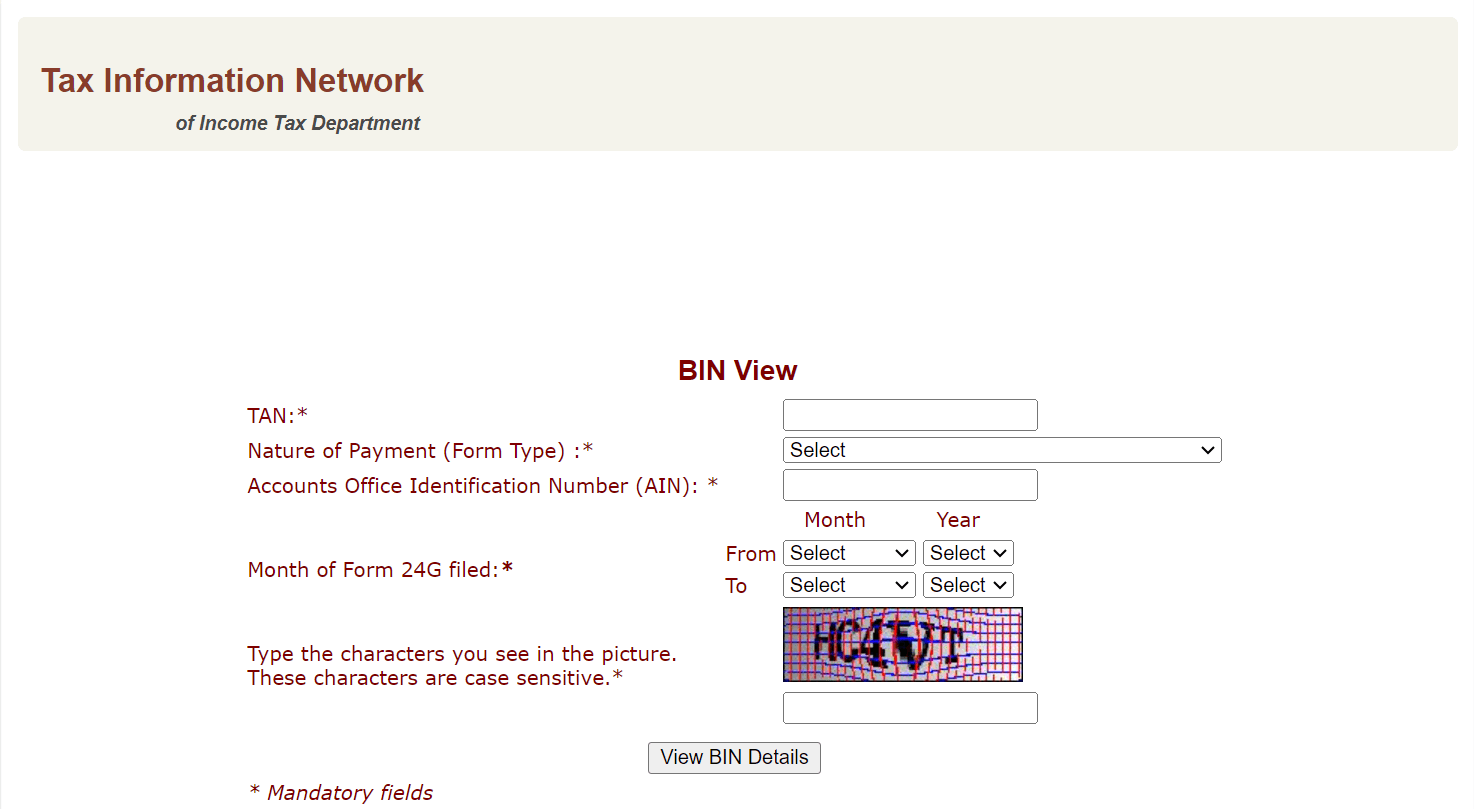

Step 1: Access the NSDL Tax Information Network Portal

Start by visiting the official NSDL portal dedicated to tax information. This is your gateway to verifying your BIN.

Step 2: Enter Your Details

You’ll need to input the following information:

- Tax Deduction and Collection Account Number (TAN) of the deductor.

- Nature of Payment: Choose from options like TDS - Salary, TDS - Non-Salary, TCS, etc.

- Accounts Office Identification Number (AIN).

- The month of Form 24G filed.

Step 3: Click on 'View BIN Details'

Once you’ve entered the necessary details, click on this option to proceed.

Step 4: Verify the Amounts

On the redirected page, enter the amounts as per the different forms, and tick the checkbox next to the column. Click on 'Verify Amount' to check for discrepancies.

Step 5: Check the Verification Alert

Look at the Verification Alert column. If it says 'Amount Matched,' your BIN details are valid. If it states 'Amount Not Matched,' your BIN details are invalid, indicating a need for immediate attention.

Also Read: 3 Easy And Simple Ways On How To Download E-Pan Card Through NSDL, UTIITSL, And E-Filing Website

Consequences of Not Quoting BIN

Quoting the BIN correctly is critical. Discrepancies can lead to significant issues. For example, if the amounts in Form 24G do not align with the BIN details, you’ll receive an alert that says 'Amount Not Matched.'

This mismatch can prevent credits from being reflected in the Form 26AS for the respective deductee, potentially causing confusion and disputes during tax assessments.

Essential Clarifications About BIN

Here are some important points to keep in mind regarding BIN:

- Valid TAN Requirement: You need a valid TAN to access DDO records and generate a BIN.

- Tax Remittance Verification: Users can verify the amount of tax remitted to the government.

- Request Validity: BIN view/download requests remain valid for a maximum period of 12 months.

- File Security: Downloaded BIN files come compressed in a password-protected zip folder.

- AIN Requirement: To extract the contents of the BIN file, an AIN (seven-digit) is necessary. The file may be split into multiple files if it contains many records.

Key Points to Remember About BIN

Here are crucial takeaways regarding BIN that every deductor should be aware of:

-

Details Needed for BIN Access: Always provide your TAN, nature of payment, and the month/year range of Form 24G.

-

Additional Information for Specific AOs: If you are targeting a specific Accounts Office (AO), include the AIN in addition to the mandatory details.

-

Quoting BIN in Statements: Ensure you quote your BIN in the transfer voucher details for quarterly TDS/TCS statements.

-

Time Frame for Selection: Your selected period should fall within 15 months.

-

Filing Period for BIN Access: The BIN view is available for Form 24G filed for financial years from 2010-11 onwards.

-

Contacting Authorities: If you cannot find BIN details for the specified AIN and period, reach out to your respective Pay and Accounts Office (PAO) or District Treasury Office (DTO) for assistance.

Also Read: Beyond Just Tax Filing: Unlocking the Full Potential of Your Tax Identification Number

The Importance of BIN in Taxation Compliance

In the realm of taxation, the Book Identification Number (BIN) is more than just a number; it’s a linchpin for seamless compliance. By adhering to the verification process and understanding its implications, deductors can ensure accuracy in their TDS reporting. Remember, compliance is not merely about avoiding penalties; it's about fostering trust and transparency in your financial dealings.

At Suvit, we strive to make tax compliance easier for you. Understanding and effectively managing your TDS obligations, including the proper use of BIN, can save you time, prevent costly mistakes, and enhance your business reputation. So, keep your BIN details accurate, stay informed, and enjoy peace of mind as you navigate the complexities of taxation!