If you run a business in India, you’re probably well-acquainted with the Goods and Services Tax (GST). While GST has streamlined tax compliance, some business documents still cause confusion—one of them being the Proforma Invoice.

So, what exactly is a proforma invoice?

Think of it as a sneak peek into a potential transaction. Unlike a standard invoice issued after a sale, a proforma invoice is a preliminary bill shared before the actual supply of goods or services. It provides an estimate, including key details like pricing, product description, and terms of sale.

In this guide, we’ll explore everything about proforma invoices, their role in GST, and how they can streamline your business transactions.

When is a Proforma Invoice Used?

Proforma invoices come in handy in several business scenarios. Here’s when you should use one: A handy flowchart to help you navigate:

Start -> Customer Inquiry

At the heart of it all, a customer might reach out for a quote or ask about your offerings. This is a prime opportunity to whip out a proforma invoice. It gives them a clear picture of what they'll be getting and for how much.

From Customer Inquiry:

-

Yes - Quote Requested? -> Proforma Invoice Issued

-

This provides a transparent breakdown of costs, fostering trust and potentially leading to a confirmed order.

-

No - Different Inquiry? (Here, the path splits depending on the inquiry)

-

Import/Export Transaction? -> Proforma Invoice Issued

-

Especially helpful for customs clearance, a proforma invoice helps estimate duties and taxes beforehand.

-

Advance Payment Needed? -> Proforma Invoice Issued

-

If you require upfront payment to secure the deal, a proforma invoice ensures clarity on what the customer is paying for.

-

End -> Clear Understanding & Potential Sale

As you can see, proforma invoices play a key role in various situations, setting expectations and smoothing the path towards a successful transaction. We'll delve deeper into their specific purposes in the next section!

Purpose of Issuing a Proforma Invoice

A proforma invoice isn’t just a preliminary estimate—it serves critical purposes, such as:

🔹 Transparent Pricing & Detailed Estimates – Helps customers understand costs, features, and specifications before committing to a purchase.

🔹 Securing Advance Payments – Functions as a formal agreement that outlines payment expectations before work begins.

🔹 Facilitating International Trade & Customs Clearance – Customs officials rely on proforma invoices to assess import/export duties accurately.

Proforma invoices bridge the gap between initial discussions and confirmed orders, ensuring clarity for both buyers and sellers.

As you can see, proforma invoices are more than just fancy estimates. They are powerful tools for clear communication, securing finances, and streamlining international trade.

What Goes into a Proforma Invoice?

| Key Factors | Why It Matters |

|---|---|

| Heading "Pro Forma Invoice" | Distinguishes it from a final invoice. |

| Seller & Buyer Details | Includes names, addresses, and GSTIN (if applicable). |

| Invoice Number & Date | Helps track and reference transactions easily. |

| Description of Goods/Services | Lists product quantity, unit price, and total cost. |

| Applicable Tax Rate | Mention "Not Applicable" as GST doesn’t apply to proforma invoices. |

| Total Invoice Value (Excluding GST) | Provides a clear cost breakdown. |

| Payment Terms & Conditions | Specifies accepted payment methods, deadlines, and refund policies. |

| Validity Period | Indicates how long the estimate remains valid. |

A well-structured proforma invoice should contain the following key details:

By ensuring these components are included, you create a proforma invoice that is professional, clear, and legally sound.

Formatting Your Proforma Invoice: Best Practices

Now that you know the essential components, let's talk about how to put them together into a winning proforma invoice. While there's no single rigid format, a professional layout goes a long way in building trust and making a good impression.

Think of your proforma invoice like a well-designed business card. It should be clear, concise, and visually appealing.

Here are some general formatting tips:

- Use a professional font and consistent formatting: Opt for a clean and easy-to-read font like Arial or Times New Roman. Maintain consistent font size and spacing throughout the document.

- Clear Headings and Sections: Bold headings like "Seller Information," "Description of Goods/Services," and "Payment Terms" will help guide your customer's eye and make the information easy to find.

- Company Logo (Optional): Adding your company logo can add a touch of professionalism and brand recognition.

Remember, the goal is to create a document that is informative, easy to understand, and reflects well on your business.

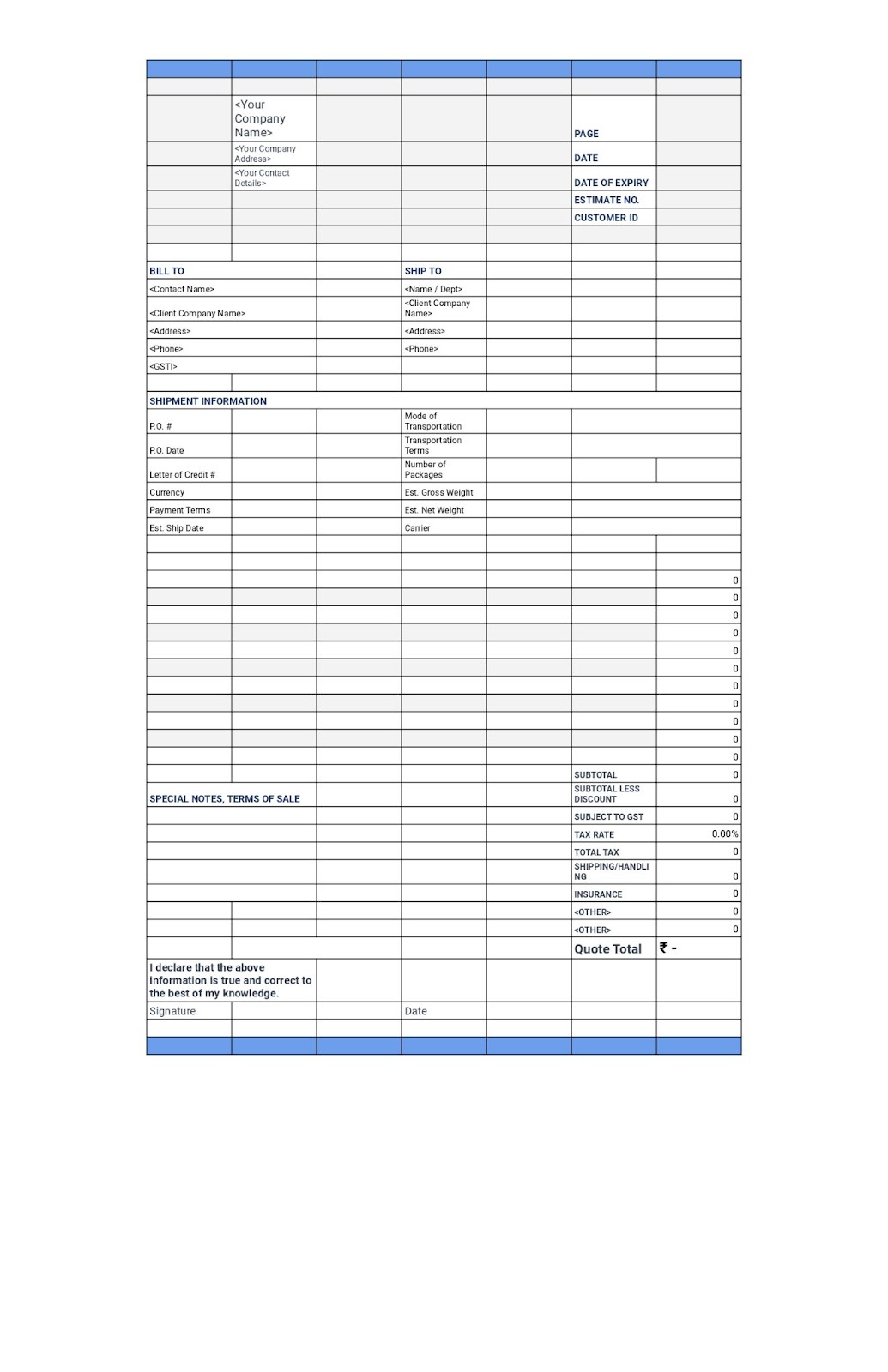

Sample Proforma Invoice Under GST

Note: This is just a sample format, and you may need to adjust it based on your specific business needs.

Proforma Invoice vs. Invoice, Estimates & Purchase Orders

Many businesses confuse proforma invoices with similar documents. Here’s a simple comparison:

| Document | Purpose | Binding Agreement? | GST Included? | Issued By |

|---|---|---|---|---|

| Invoice | Official record of a sale | Yes | Yes (final price) | Seller |

| Pro-forma Invoice | Estimate before a sale | No | Depends on Seller | Seller |

| Estimate | Informal cost approximation | No | No | Seller |

| Purchase Order | Formal confirmation of intent to buy | Yes | No (may reference proforma invoice) | Buyer |

Let's unpack this table further:

🔹 Invoice: The final document issued after a confirmed sale, legally binding, and includes GST.

🔹 Proforma Invoice: A non-binding estimate before a sale, useful for clarity and negotiations.

🔹 Estimate: The most informal document, often used for rough pricing.

🔹 Purchase Order: A buyer-issued document confirming their intent to purchase goods/services.

Understanding these distinctions helps businesses avoid confusion and ensures smooth transactions.

Bonus Tips & Remember This!

Here are some additional tips to keep in mind when dealing with proforma invoices:

- Clearly label it "Pro Forma Invoice" to avoid confusion with a final invoice.

- Proofread carefully before sending it out. Typos or errors can create misunderstandings.

- Consider using a numbering system for easy tracking and reference.

Remember: A proforma invoice cannot be used for claiming Input Tax Credit (ITC) under GST. ITC can only be claimed on a regular invoice issued after the actual supply of goods or services.

For any specific questions or clarifications regarding proforma invoices and GST, it's always recommended to consult a tax professional. They can provide tailored advice based on your specific business needs.

Also Read:

- Understanding e-Invoicing Under GST: Applicability, Limits & Implementation Date

- Invoice Extraction - A Simple Way to Do It

- Why It’s Important for Your Invoicing to Be on the Cloud for AP Efficiency

- Dynamic QR Codes in B2C Invoices: Simplifying Payments in India

- A Guide to Different Types of Invoices & Their Uses