Artificial Intelligence (AI) is reforming industries worldwide, and accounting is no exception.

From automating regular tasks to providing deeper insights into financial data, AI has become an integral tool for accountants.

Ethical concerns, particularly around data privacy and compliance, are taking center stage as businesses integrate AI into their accounting workflows.

Let’s see what AI ethics in accounting means, why it matters, and how you can adopt best practices to navigate this critical area responsibly.

What is AI Ethics in Accounting?

AI ethics refers to the principles and guidelines that govern the development and use of AI systems, ensuring fairness, transparency, accountability, and respect for human rights.

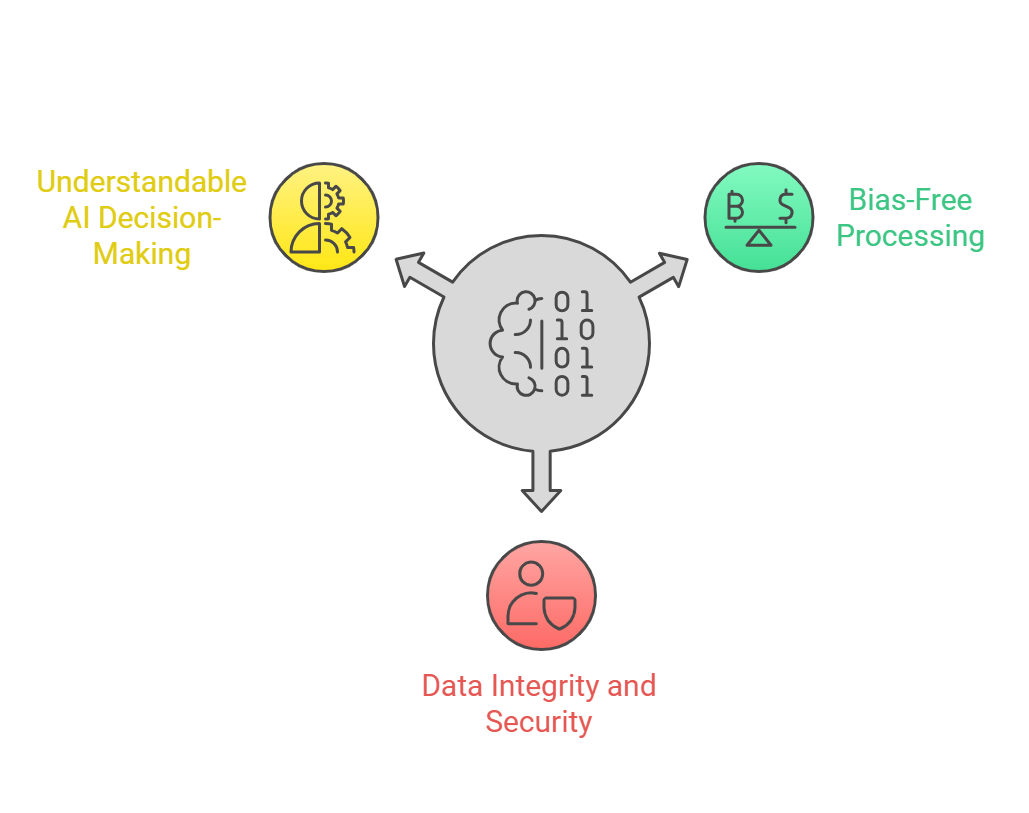

In accounting, these ethics focus on:

- Ensuring that AI-driven tools process financial data without bias.

- Preserving sensitive data's confidentiality and integrity.

- Making AI decision-making processes understandable to humans.

For example, imagine an AI tool used to assess loan eligibility. If the algorithm favors certain demographics over others due to biased training data, it’s not just unethical but also potentially illegal.

Such scenarios highlight the need for ethical frameworks in accounting AI.

Why Data Privacy and Compliance Matter in AI Accounting Tools

When dealing with financial data, the stakes are high. Data privacy and compliance are not just fancy words but legal and ethical obligations.

Regulations such as the General Data Protection Regulation (GDPR) in Europe, India’s Digital Personal Data Protection Act, and other global standards ensure that businesses handle data responsibly.

Here’s why these aspects are important:

- Safeguarding Client Trust: Clients entrust accountants with their most sensitive financial information. Any breach can erode trust and harm reputations.

- Avoiding Legal Penalties: Non-compliance with data protection laws can result in hefty fines and legal battles.

- Protecting Against Cyber Threats: Financial data is a prime target for cybercriminals, making robust privacy measures indispensable.

Best Practices for AI Ethics in Accounting

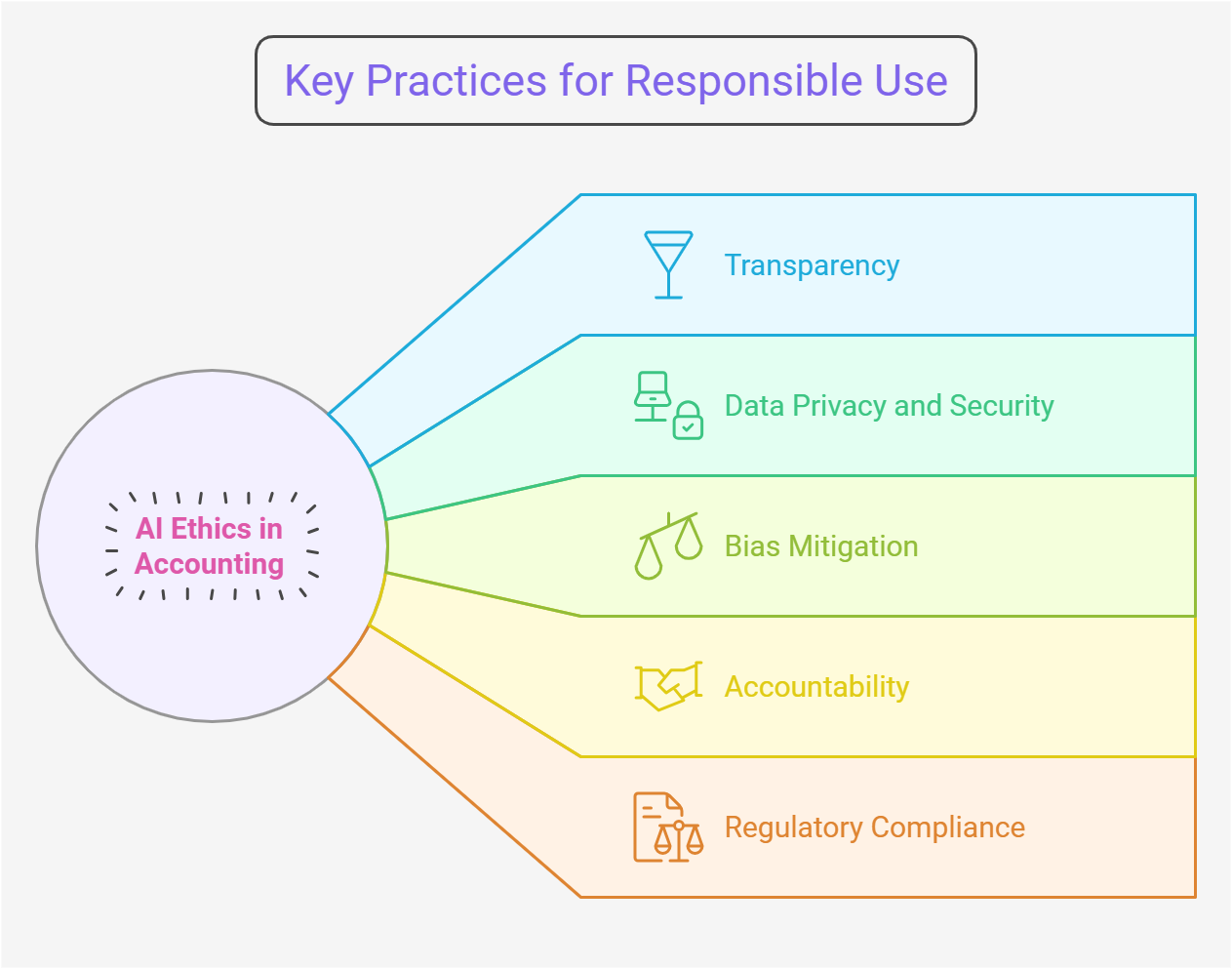

Adopting ethical AI practices doesn’t just protect your clients; it also strengthens your credibility.

This is how to do it:

Transparency

Transparency is the cornerstone of ethical AI. Accountants and clients should understand how AI tools arrive at decisions.

- Use explainable AI models that break down decision-making processes into clear, human-understandable terms.

- Regularly communicate with clients about the role AI plays in their financial management.

- Document AI processes clearly so that stakeholders can review and assess them as needed.

Data Privacy and Security

Handling sensitive financial data comes with immense responsibility.

- Encrypt all data at rest and in transit to protect against breaches.

- Conduct regular security audits and implement strict access controls to identify vulnerabilities.

- Use anonymization techniques to ensure that sensitive data cannot be traced back to individuals during AI analysis.

- Establish a robust incident response plan to address any data breaches or security threats quickly.

Bias Mitigation

AI tools are only as unbiased as the data they are trained on. Accounting professionals must:

- Ensure datasets are diverse and representative, covering a wide range of scenarios and demographics.

- Implement continuous bias testing protocols to identify and rectify any algorithmic biases over time.

- Collaborate with diverse teams to develop and evaluate AI tools from multiple perspectives.

- For sure and equitable results, incorporate fairness metrics into AI performance assessments.

Accountability

Accountability ensures that someone is always responsible for AI decisions.

- Maintain detailed logs of AI processes for audit purposes.

- Assign clear roles and responsibilities within your team to oversee AI operations and ethical compliance.

- Develop a governance framework that includes checks and balances for AI decision-making.

- Encourage a culture of ethical responsibility where employees feel empowered to report potential AI-related issues.

Regulatory Compliance

Staying compliant with data protection laws is non-negotiable.

- Keep updated on local and international data regulations, including emerging legislation that may impact AI use in accounting.

- During inspections, keep thorough audit trails to prove compliance.

- Leverage AI tools designed to monitor and ensure compliance with applicable financial and data protection regulations.

- Partner with legal experts to routinely review your AI systems to ensure they align with regulatory requirements.

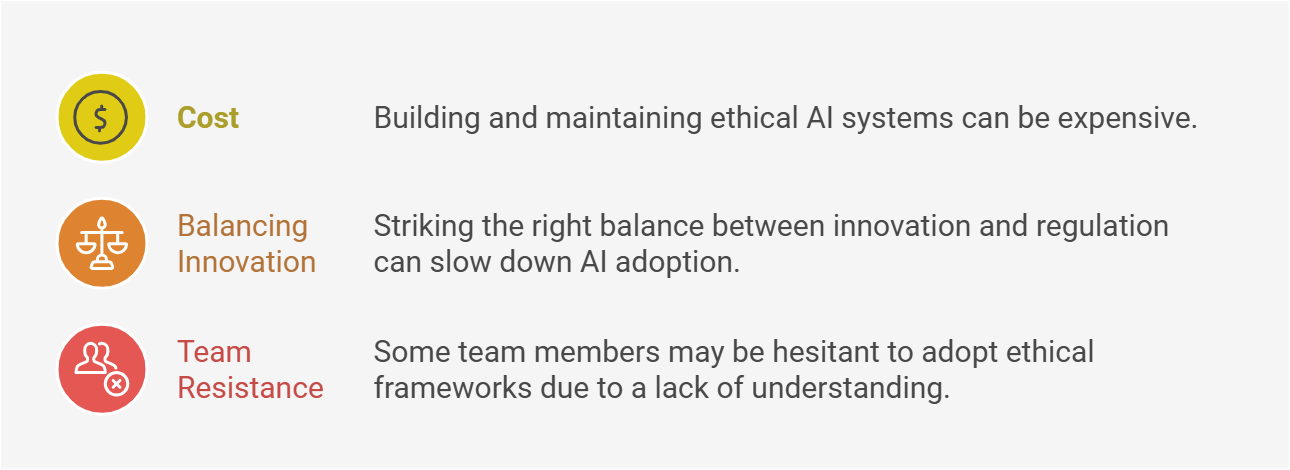

Challenges in Implementing AI Ethics

While the benefits are clear, implementing AI ethics is not without challenges:

How AI Can Aid Compliance in Accounting

Ironically, while AI introduces ethical challenges, it also serves as a powerful ally in addressing them. For example, AI-driven systems excel in monitoring transactions, quickly identifying irregularities, and flagging potential instances of non-compliance.

These automated checks ensure that businesses stay ahead of regulatory pitfalls without relying solely on manual oversight.

In addition to compliance monitoring, AI tools equipped with predictive analysis are transforming how accountants manage data. By analyzing patterns and trends, these tools help preempt compliance issues before they arise, offering a proactive approach rather than a reactive one.

This capability not only safeguards businesses but also builds confidence among clients who trust their accountants to stay ahead of the curve.

Another significant advantage of AI lies in its ability to streamline audits. Organizing and analyzing large volumes of financial data can be a daunting task for humans, but AI accomplishes it with remarkable speed and accuracy.

This efficiency allows accountants to focus on higher-value tasks, ensuring that audits are both thorough and timely.

By bridging the gap between compliance requirements and operational efficiency, AI is proving to be an essential tool for modern accounting practices, reinforcing its role as a solution rather than a challenge.

Also Read: Cultural Shifts in Accounting Firms Due to AI Adoption

Future of AI Ethics in Accounting

The future of AI ethics in accounting looks promising but requires ongoing effort:

- Emerging Trends: From advanced bias detection to AI tools tailored for specific compliance needs, innovation continues to shape ethical AI.

- Education: Accountants need continuous training to stay updated on ethical AI practices.

- Collaboration: Regulators, AI developers, and accountants must work together to build systems that are both innovative and ethical.

As AI becomes more integral to accounting, the need for ethical practices around data privacy and compliance cannot be overstated.

By embracing transparency, securing data, mitigating biases, and staying compliant with regulations, accountants can use AI responsibly while maintaining client trust.

Remember, ethical AI is not just a technical requirement but a commitment to fairness and integrity in every financial decision.