2025 is knocking on the door, and with it comes a fresh set of challenges and opportunities for accounting teams.

As businesses navigate a rapidly changing economic and technological landscape, it’s time for accounting teams to level up.

Did you know that by 2025, over 75% of finance processes are expected to be automated? While this statistic signals exciting times ahead, it also underscores the need to focus on the right objectives to ensure success.

Here are five essential accounting team objectives to keep your team ahead of the curve in 2025.

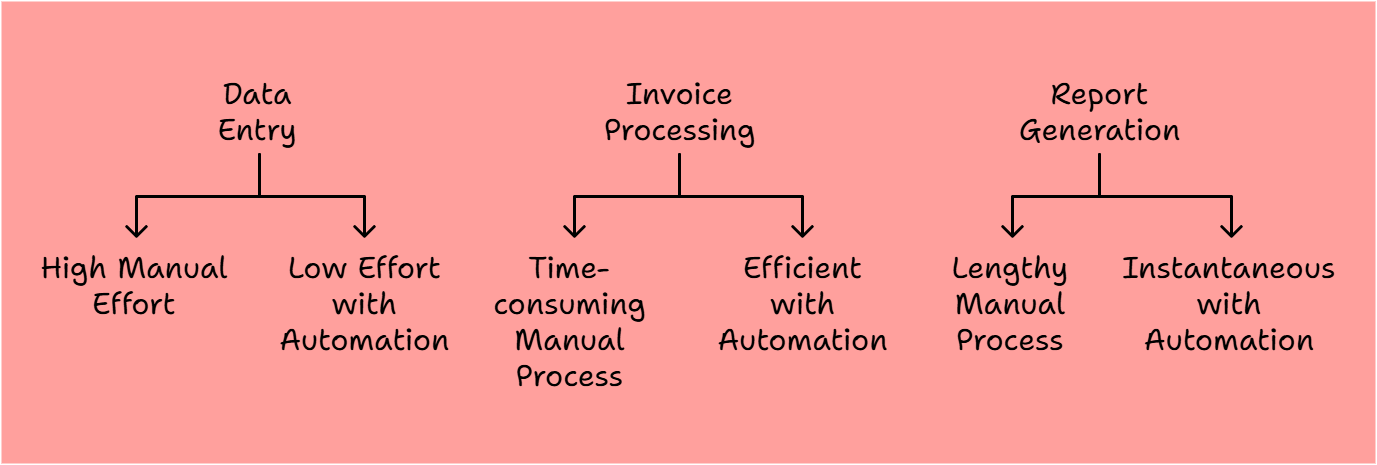

1. Leverage Technology for Efficiency

Why it Matters:

- Manual processes waste time and increase error rates.

- Automation improves productivity and accuracy.

What to Do:

- Use tools like QuickBooks, Xero, and Suvit to automate tasks like reconciliation and invoice processing.

- Train your team to effectively use these platforms.

At a Glance:

By using automation, your team can reclaim valuable hours each week, allowing them to focus on strategic tasks that add real value to the organization.

Real-Life Impact: Imagine spending 40% less time on routine tasks and reallocating that time to revenue-generating activities. With tools like Suvit, this dream becomes reality.

Pro Tip: Technology can’t work its magic unless your team knows how to maximize its potential. Make training a priority.

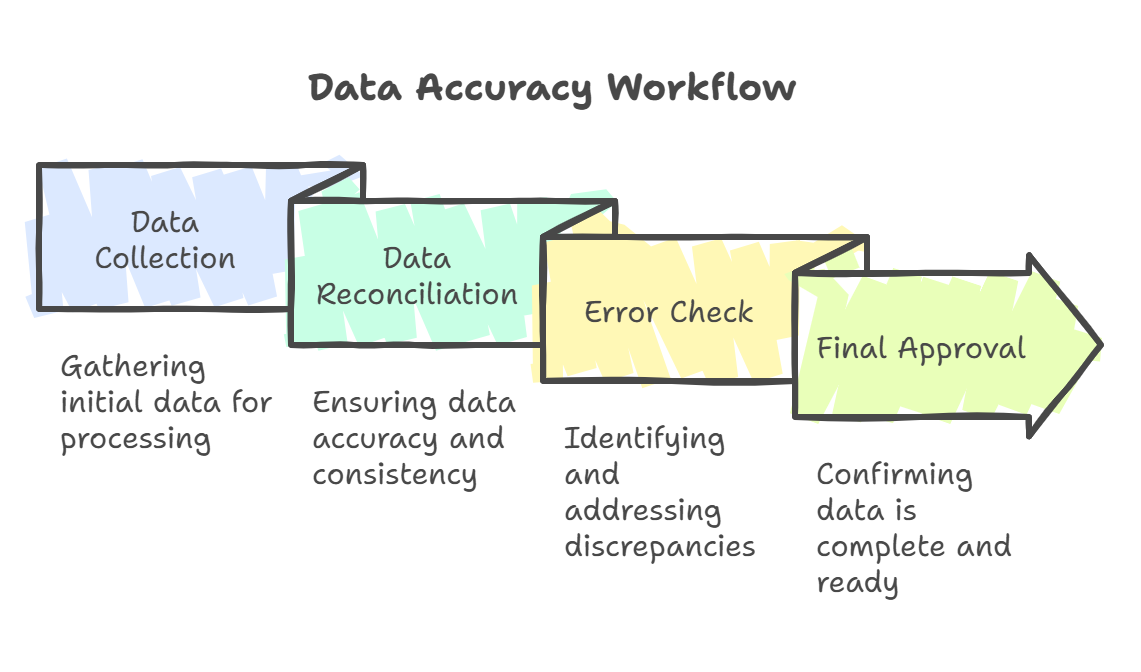

2. Strengthen Data Accuracy and Integrity

What’s at Stake: Errors in financial data can lead to missed deadlines, penalties, and lost trust.

Key Actions:

- Implement real-time reconciliation to catch discrepancies early.

- Standardize workflows across the team.

- Use tools with built-in compliance checks and error detection features.

Visual Workflow for Data Accuracy:

Checklist for Maintaining Data Integrity:

- Ensure all data sources are integrated.

- Conduct weekly audits of critical financial entries.

- Use version control to manage changes effectively.

Pro Tip: Clean and reliable data isn’t just a necessity; it’s the foundation for strategic decision-making.

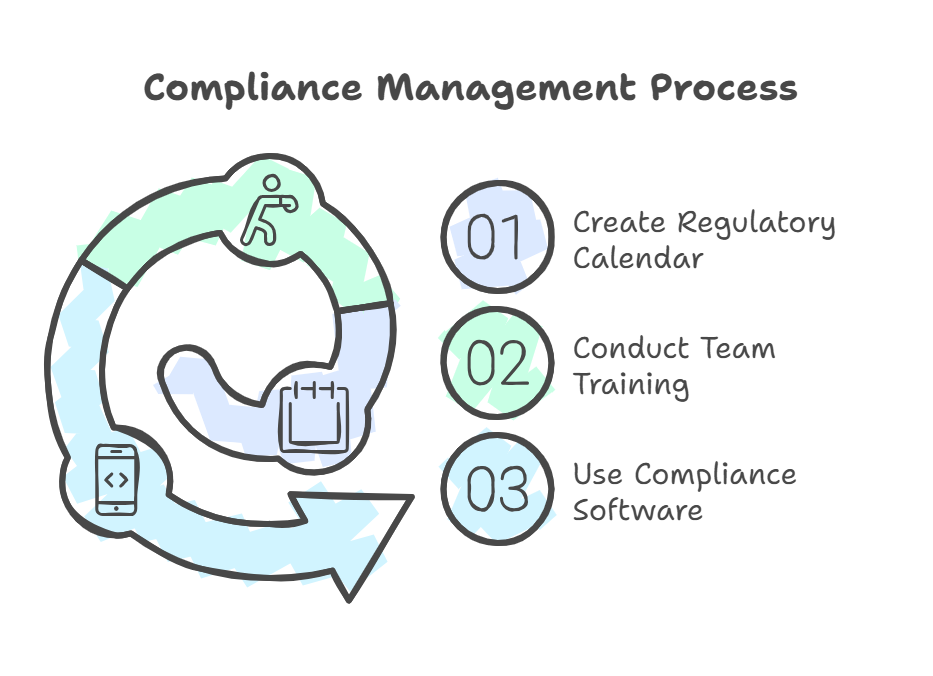

3. Prioritize Compliance and Regulatory Awareness

Why It’s Important: The regulatory landscape is constantly changing, and staying compliant is important for avoiding penalties and maintaining trust.

Steps to Stay Ahead:

Example Calendar for Compliance:

| Month | Regulation Update | Action Needed |

|---|---|---|

| January | GST Filing Deadline | File GST returns |

| April | New Tax Policy Implementation | Update processes and software |

| July | Annual Financial Audits | Schedule and prepar |

Scenario: Your company is notified of a new tax regulation set to take effect in March 2025. By proactively updating your processes and tools in January, you avoid last-minute stress and ensure seamless compliance.

Pro Tip: A little preparation goes a long way. Keeping everyone informed reduces last-minute scrambles.

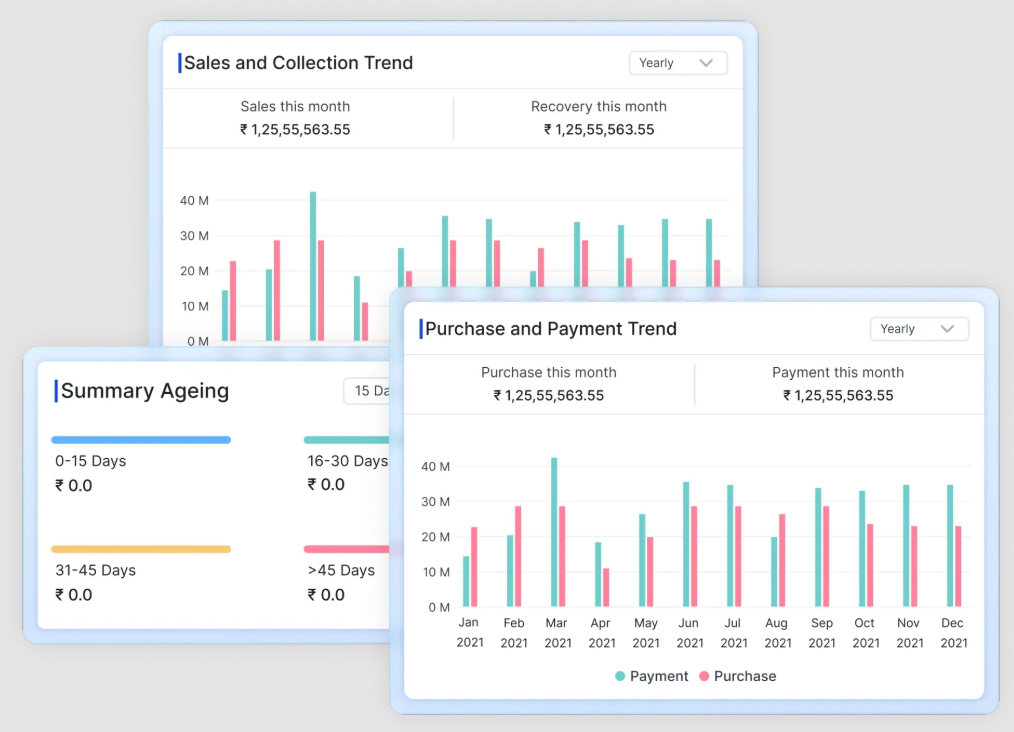

4. Focus on Strategic Insights and Decision Support

From Numbers to Insights: Accounting teams in 2025 must act as strategic partners, offering actionable insights rather than just crunching numbers.

How to Excel:

- Use real-time analytics to track trends and forecast outcomes.

- Collaborate with other departments to understand challenges and align financial insights with business goals.

Dashboard Sample:

| Month | Regulation Update | Action Needed |

|---|---|---|

| Revenue Growth | Positive | Allocate more resources to top-performing products. |

| Operating Expenses | Rising | Identify areas for cost-cutting. |

| Cash Flow Forecast | Stable | Plan for investments in Q3. |

Pro Tip: Present insights in a way that’s easy for non-accounting teams to understand. Simple visuals and clear language can make all the difference.

Pro Tip: Present insights in a way that’s easy for non-accounting teams to understand. Simple visuals and clear language can make all the difference.

5. Enhance Collaboration and Communication

Why Collaboration Matters: Silos hinder efficiency. Seamless communication ensures alignment across departments.

Practical Steps:

- Use tools like Slack, Microsoft Teams, or Trello for better communication and task tracking.

- Conduct monthly review meetings with key stakeholders.

- Share clear and simplified financial insights with non-finance teams.

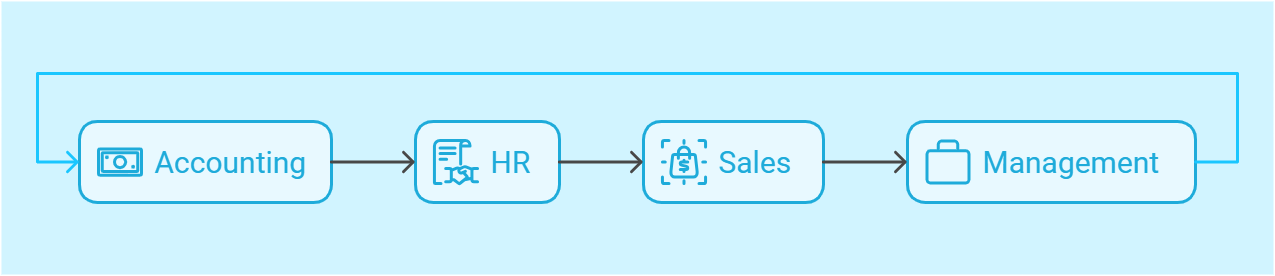

Collaboration Flowchart:

Team Activity: Introduce a monthly “Finance Friday” where team members from various departments gather to discuss financial progress, challenges, and upcoming goals.

These meetings foster transparency and encourage cross-departmental collaboration.

Pro Tip: Set up monthly cross-departmental sessions to review financial progress and ensure alignment on objectives.

Bonus Objective: Build Resilience Through Continuous Learning

Why It’s Key: In a rapidly evolving field like accounting, staying updated is half the battle.

How to Implement:

- Encourage certifications like CPA or CMA for team members.

- Host quarterly workshops on emerging trends in accounting.

- Create a shared resource library for articles, courses, and tools.

Learning Roadmap Example:

| Quarter | Focus Area | Training Method |

|---|---|---|

| Q1 | Advanced Excel Techniques | Online course |

| Q2 | AI in Accounting Practices | In-house workshop |

| Q3 | Regulatory Updates | External expert session |

| Q4 | Leadership Skills | Team coaching |

Pro Tip: Learning isn’t just an individual effort—create a culture where growth is celebrated and supported across the team.

Charting the Road Ahead for Your Accounting Team

Success in accounting isn’t a destination—it’s a journey. And like any journey, having a clear map makes all the difference.

Use these objectives as your compass. Embrace technology, champion data accuracy, stay compliant, provide actionable insights, and foster collaboration.

But don’t stop there. Reflect on your team’s unique strengths and challenges. What’s one action you can take today to get closer to these goals?

Setting the stage now will prepare your team for 2025 and ensure they shine as strategic partners in your organization’s success story.

Let’s rewrite the narrative of accounting teams—one objective at a time!

Also Read: Calendar vs. Fiscal Year: A Guide to Choosing the Right Accounting Period for Your Business