Accounting has become far more complex than simply balancing books with pen and paper in today’s business environment.

Gone are the days of manually inputting data and combating with spreadsheets. Now, accounting software is the backbone of a smooth, efficient, and accurate accounting process.

But with so many options available, how do accountants know which accounting software is best suited for their needs?

Whether you’re a fresh accountant looking to get the best tools in your toolkit or a business owner wondering how to make your finance team’s lives easier, choosing the right accounting software is essential.

Let’s see what accounting software accountants use, and how you can pick the best one for your needs.

Types of Accounting Software Used by Accountants

When it comes to accounting software, there’s no one-size-fits-all. Depending on your needs, there are a few different types of software that accountants use:

1. Cloud-based Accounting Software

This is the most popular choice for accountants today. Cloud-based software allows access from anywhere, making it easier to work remotely or from multiple locations. It’s typically more affordable, as it uses a subscription-based model, and it’s often more secure because the data is stored in a secure cloud environment.

2. Desktop-based Accounting Software

While less common today, desktop-based software still has a loyal following. It is typically used by businesses that prefer to store their data locally rather than in the cloud. These solutions often require a one-time purchase rather than a subscription fee.

3. Industry-Specific Accounting Software

Certain businesses, like retail, e-commerce, or manufacturing, may need industry-specific software. These solutions come with features tailored to the needs of those industries, such as inventory management or payroll support.

4. Customizable Accounting Software

Larger firms or businesses with specific needs may opt for customizable software. This type allows for tweaking and adding features to suit a company’s unique processes. Customizable options tend to be more expensive but offer unparalleled flexibility.

Popular Accounting Software Accountants Prefer

Now that we’ve covered the types of accounting software, let’s look at some of the most popular choices for accountants:

| Software | Key Features | Best For |

|---|---|---|

| QuickBooks | Invoicing, expense tracking, payroll, integration with third-party apps | Small to medium businesses |

| Tally ERP | GST support, stock management, payroll, reporting | Indian businesses, enterprises |

| Zoho Books | Multi-currency support, automation, project billing, tax compliance | Small businesses |

| Xero | Easy integration, real-time financial reporting, strong mobile app | Small businesses to large firms |

| FreshBooks | Time tracking, invoicing, expense management, cloud-based | Freelancers, service-based businesses |

| Suvit | Automation of data entry, GST reconciliation, and financial reporting | Accounting professionals, CAs |

Each of these tools brings something different to the table. For instance, QuickBooks is widely used for its simplicity and comprehensive features for small businesses.

Tally ERP is especially popular in India for handling GST compliance.

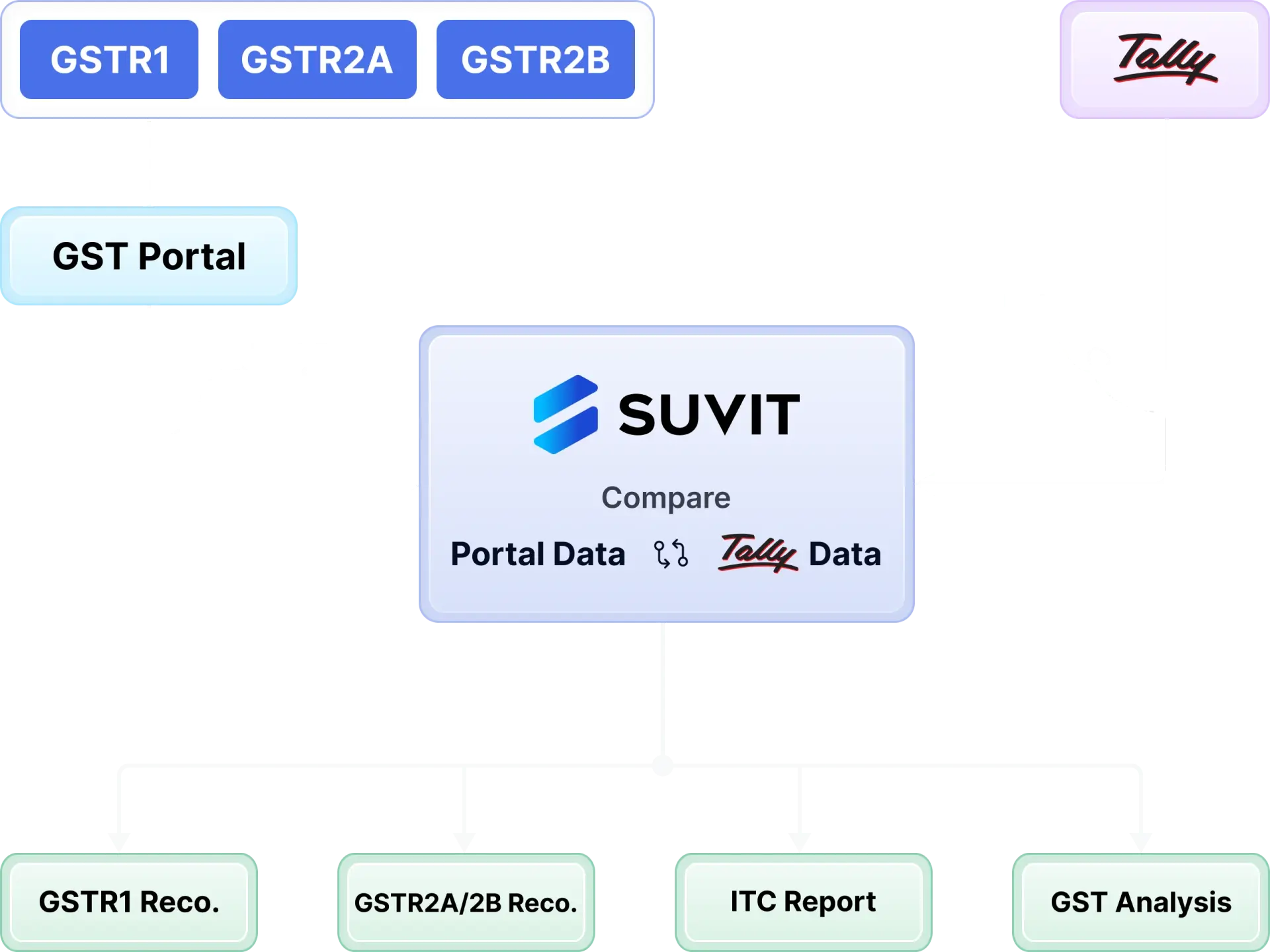

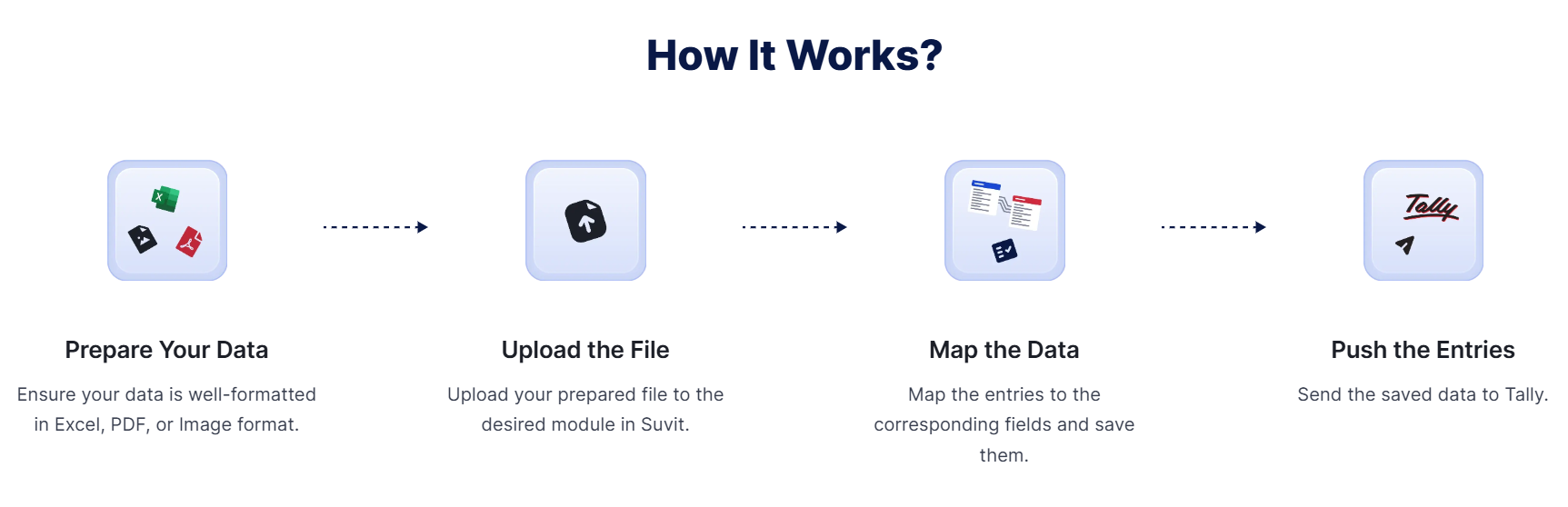

Meanwhile, Suvit offers excellent automation, streamlining workflows and reducing errors, especially for CAs involved in GST reconciliation. Suvit can be integrated with Tally, that’s its added benefits!

See how you can do it:

Key Features Accountants Look For in Accounting Software

When choosing the right software, accountants usually look for the following features:

- User-friendly interface: The software should be easy to navigate, even for those who may not be tech-savvy.

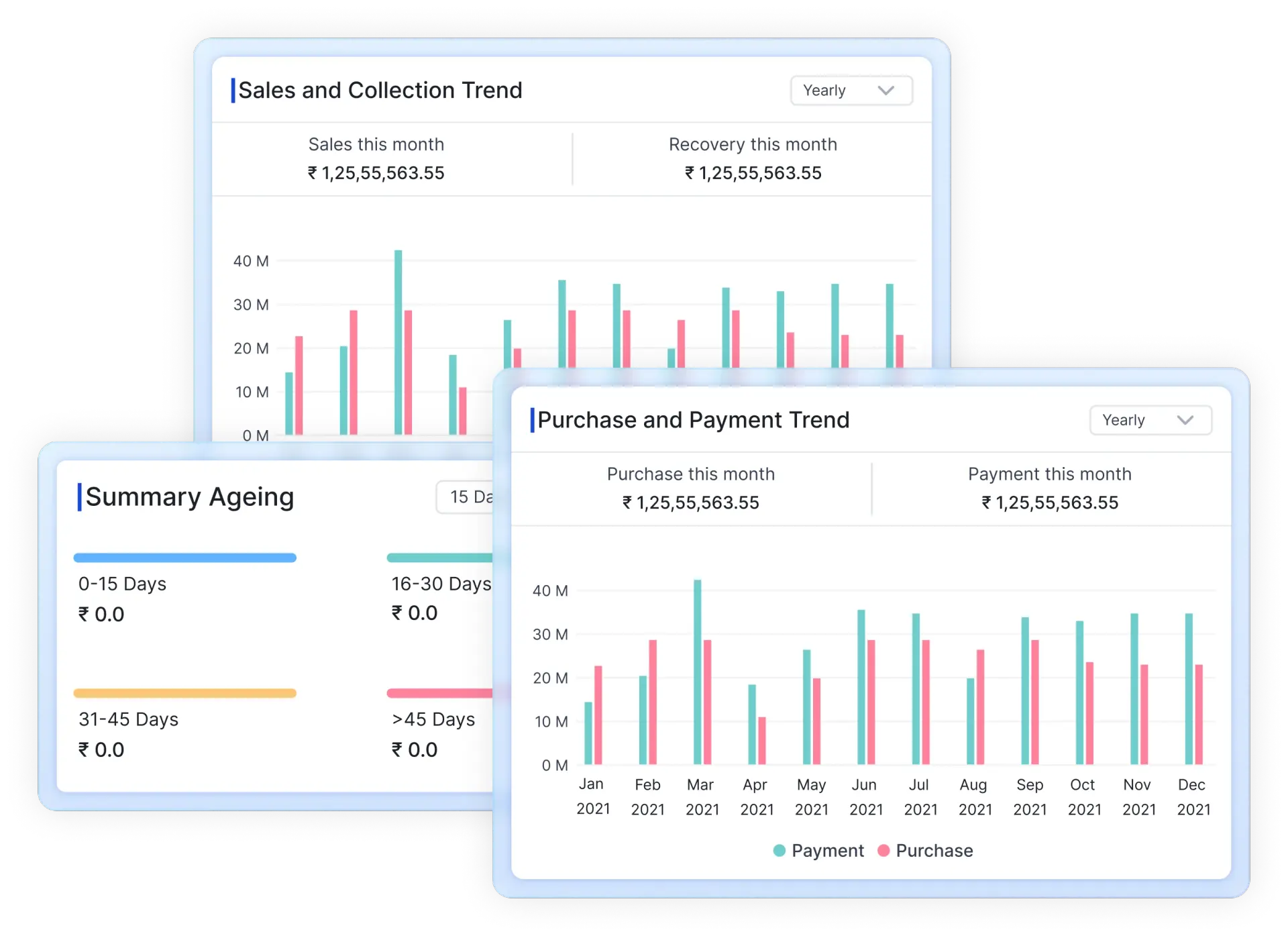

- Automation capabilities: Features like data entry automation, tax calculations, and report generation can save a lot of time.

- Integration: The software should integrate seamlessly with other tools used by the business, such as payroll or invoicing software.

- Robust reporting & analytics: The ability to generate accurate and insightful reports for decision-making is a must-have.

- Scalability: As businesses grow, so do their accounting needs. It’s important to choose software that can handle increasing transactions.

- Security & compliance: Data privacy is paramount. The software should adhere to local compliance standards, especially regarding tax filings.

Factors That Influence Software Choice

The right software depends on various factors that accountants and businesses should consider:

1. Size of the Business or Firm

Larger organizations or firms with complex accounting needs may opt for solutions like Suvit, which offers custom features and integrations. Small businesses might choose a simpler solution like FreshBooks or Zoho Books.

2. Budget

For small businesses, budgeting is key. Cloud-based options like Xero, Suvit or Zoho Books offer cost-effective solutions compared to high-end customizable software.

3. Business Needs

Consider your specific accounting needs. Are you handling payroll? Do you need multi-currency support or advanced reporting? Make sure the software aligns with your requirements.

4. Local Compliance

In regions like India, choosing software that integrates with local compliance standards, such as Tally ERP or Suvit for GST Reconciliation, Tracking GST filing, etc. is vital.

Emerging Trends in Accounting Software

As technology evolves, so do accounting tools. Here are some trends shaping the future of accounting software:

- Artificial Intelligence: AI-powered tools automate tasks such as data entry, invoice processing, and tax calculations, making the entire accounting process faster and more accurate.

-

Mobile Access: Accountants can now work from anywhere, anytime, with mobile-compatible software.

-

Real-time Reporting: Many accounting platforms now offer real-time reporting, allowing businesses to make more informed decisions on the fly.

- Blockchain: Some advanced solutions are integrating blockchain for secure and transparent transaction tracking.

How to Choose the Right Accounting Software

With so many options out there, it can be confusing to choose the ideal accounting software. Here’s a simple process to guide you:

- Assess Your Needs: What do you need the software to do? Do you need basic bookkeeping, or do you need advanced features like payroll and tax filing?

- Try Free Trials: Most software offers a free trial. Take advantage of this to test the platform before committing. (Here’s the link to try Suvit for free!)

- Consider Future Growth: Choose software that can grow with your business. Don’t pick something too basic that you’ll soon outgrow.

- Check for Support: Ensure that customer support is accessible and helpful. Always read the google reviews to know how they respond to their clients.

How to Choose the Best Accounting Software for Your Business or Practice

Choosing the right accounting software can make a world of difference in your daily operations. It not only streamlines accounting tasks but also helps reduce errors and improve overall efficiency.

By assessing your needs, considering key features, and exploring the options available, you can select the best software for your practice or business.

Whether you’re using Tally ERP or Suvit, the right tool will give you the power to manage your financial tasks with ease and precision.

Also Read: