Fintech is rapidly transforming the financial services industry, and the accounting profession is no exception. Accounting technology is automating tasks, improving efficiency, and providing accountants with new insights to help businesses make better decisions.

In this blog post, we will explore the impact of fintech innovations on the accounting industry. We will discuss how technology is changing the roles of accountants and bookkeepers, and we will highlight five technologies that are transforming the accounting profession.

Let’s get right into it!

How Is Fintech Changing The Financial Market Landscape?

Fintech is changing the financial market landscape in a number of ways, including:

- Increasing competition and innovation: Fintech companies are developing new products and services that are challenging traditional financial institutions. This is leading to increased competition and innovation in the financial sector, which is benefiting consumers.

- Expanding access to financial services: Fintech is making it easier for people to access financial services, especially those who were previously underserved by traditional financial institutions. For example, fintech companies are offering mobile banking and payment services to people in developing countries.

- Reducing costs: Fintech companies are often able to offer financial services at lower costs than traditional financial institutions. This is due to their use of technology to automate processes and reduce overhead costs.

- Improving security: Fintech innovations are also improving the security of financial transactions. For example, fintech companies are using blockchain technology to create secure and transparent financial records.

Overall, fintech is having a positive impact on the financial market landscape by increasing competition, innovation, access, and security.

Here are some specific examples of how fintech is changing the financial market landscape:

- Peer-to-peer lending platforms: Peer-to-peer lending platforms allow individuals to borrow money directly from other individuals, without the need for a traditional bank. This has made it easier for people to access loans, especially those who have poor credit or who are trying to start a business.

- Online investing platforms: Online investing platforms make it easy for individuals to invest in stocks, bonds, and other financial assets. This has made it easier for people to save for retirement and other financial goals.

- Mobile payment apps: Mobile payment apps allow people to make payments using their smartphones. This has made it more convenient and efficient for people to make purchases.

- Blockchain technology: Blockchain technology is being used to develop new financial products and services, such as cryptocurrencies and decentralised finance applications. Blockchain has the potential to revolutionize the way we think about and use money.

Influence Of Accounting Technology On Business Decisions

Accounting technology has a significant impact on business decisions. By automating tasks, improving efficiency, and providing accountants with new insights, accounting technology can help businesses make better decisions in a number of ways:

- Improved financial reporting and analysis: Accounting technology can help businesses to generate more accurate and timely financial reports. This can help businesses identify trends and patterns in their financial data, which can then be used to make better decisions about budgeting, forecasting, and investment.

- Increased visibility into financial performance: Accounting technology can help businesses gain greater visibility into their financial performance. This can help businesses to identify areas where they can improve their efficiency and profitability.

- Reduced risk: Accounting technology can help businesses to reduce risk by automating tasks such as compliance and fraud detection. This can free up accountants to focus on more strategic tasks, such as advising businesses on how to achieve their financial goals.

- Enhanced decision-making: Accounting technology can help businesses make better decisions by providing them with real-time data and insights into their financial performance. This can help businesses to make more informed decisions about pricing, marketing, and product development.

Here are some specific examples of how accounting technology can influence business decisions:

- Budgeting and forecasting: Accounting technology can help businesses to create more accurate and realistic budgets and forecasts. This can help businesses avoid overspending and make sure that they have the resources they need to achieve their goals.

- Investment decisions: Accounting technology can help businesses to make more informed investment decisions. By analyzing financial data, accounting technology can help businesses identify investment opportunities that have the potential to generate high returns.

- Pricing decisions: Accounting technology can help businesses to set prices that are both profitable and competitive. By understanding their costs and margins, businesses can use accounting technology to set prices that will maximize their profits.

- Marketing decisions: Accounting technology can help businesses to track the effectiveness of their marketing campaigns. By analyzing financial data, businesses can identify which marketing channels are generating the most leads and sales.

- Product development decisions: Accounting technology can help businesses to make better product development decisions. By understanding their customers' needs and preferences, businesses can use accounting technology to identify new product opportunities and develop products that are likely to be successful.

Technology's Impact On The Evolving Roles Of Accountants And Bookkeepers

Technology is having a significant impact on the evolving roles of accountants and bookkeepers. As technology automates more and more tasks, accountants and bookkeepers are being freed up to focus on more strategic and value-added activities.

Here are some specific ways in which technology is impacting the roles of accountants and bookkeepers:

- Automation of routine tasks: Technology is automating many of the routine tasks that accountants and bookkeepers traditionally performed, such as data entry, bank reconciliation, and payroll processing. This frees up accountants and bookkeepers to focus on more complex tasks, such as financial analysis, tax planning, and business advisory services.

- Improved data access and analytics: Technology is providing accountants and bookkeepers with better access to data and analytics tools. This allows them to gain deeper insights into their client's financial performance and identify trends and opportunities that may not have been visible in the past.

- Increased focus on strategic and advisory services: With technology automating more and more routine tasks, accountants and bookkeepers are able to focus on providing more strategic and advisory services to their clients. This may include helping clients to develop financial plans, improve their operational efficiency, and make better investment decisions.

Below are some examples of the new roles and responsibilities that accountants and bookkeepers may take on in the future:

- Data analyst: Accountants and bookkeepers with strong analytical skills will be in high demand to help businesses make sense of their data and identify insights that can help them improve their performance.

- Financial advisor: Accountants and bookkeepers can use their expertise to provide financial advice to businesses and individuals on a range of topics, such as tax planning, investment strategy, and retirement planning.

- Business consultant: Accountants and bookkeepers can use their knowledge of business and finance to help businesses improve their operations, grow their revenue, and achieve their financial goals.

5 Technologies Transforming The Accounting And Bookkeeping

Artificial intelligence (AI)

AI is a broad term that refers to machines that can perform tasks that typically require human intelligence. AI is being used to develop new accounting automation solutions that can perform complex tasks such as invoice processing, bank reconciliation, and fraud detection.

For example, AI-powered accounting software can automatically extract data from invoices and bank statements, and then match it to accounting data. This can save businesses a significant amount of time and effort, and it can also help to improve the accuracy of financial data.

Machine learning (ML)

ML is a type of AI that allows machines to learn from data and improve their performance over time. ML is being used to develop new accounting automation solutions that can learn from historical data to identify patterns and anomalies.

For example, ML-powered accounting software can be used to detect fraudulent transactions and anomalies in accounting data. This can help businesses to prevent fraud and other financial irregularities.

Robotic process automation (RPA)

RPA is a type of software that can automate repetitive tasks. RPA is being used to develop new accounting automation solutions that can automate a wide range of tasks, such as data entry, invoice processing, and payroll processing.

For example, RPA-powered accounting software can be used to automatically enter data from invoices into an accounting system. This can save businesses a significant amount of time and effort, and it can also help to improve the accuracy of financial data.

Blockchain

Blockchain is a distributed ledger technology that can be used to create secure and transparent records. Blockchain is being used to develop new accounting automation solutions that can create secure and transparent financial records.

For example, blockchain-based accounting software can be used to track the movement of assets and liabilities in a secure and transparent manner. This can help businesses to improve their financial compliance and reduce the risk of fraud.

Cloud computing

Cloud computing is the delivery of computing services over the Internet. Cloud computing is being used to develop new accounting automation solutions that are accessible from anywhere with an internet connection.

For example, cloud-based accounting software can be accessed from any device with an internet connection, such as a laptop, tablet, or smartphone. This makes it easier for businesses to manage their finances on the go.

Role of Accounting Automation in Fintech Innovations

Accounting automation plays a significant role in fintech innovations, and Suvit is a leading accounting automation company that is developing innovative accounting automation solutions.

Role of accounting automation in fintech innovations

Fintech companies are using accounting automation to develop new products and services that are helping businesses save time and money, improve efficiency, and reduce risk. For example, fintech companies are developing cloud-based accounting software, AI-powered accounting automation solutions, and blockchain-based accounting automation solutions.

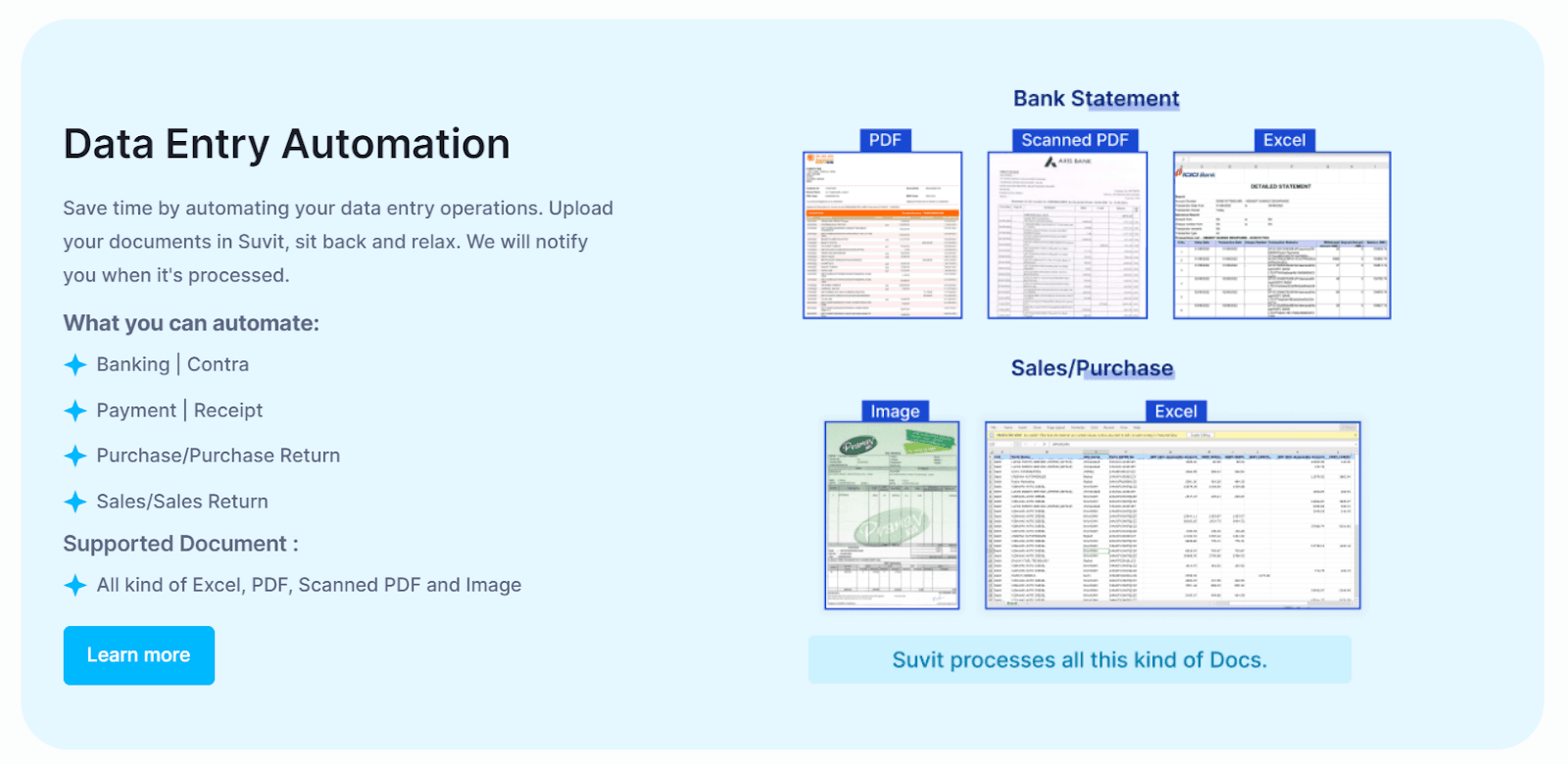

Suvit's accounting automation features

Suvit is a cloud-based accounting automation software that offers a variety of features, including:

- Invoice processing: Suvit can automatically process invoices from a variety of sources, including email, PDF, and Excel and automate data entry to Tally.

- Bank reconciliation: Suvit can automatically reconcile bank statements with accounting data.

- Financial reporting: Suvit can generate a variety of financial reports, such as balance sheets, income statements, and cash flow statements.

- Tax preparation: Suvit can help businesses prepare for tax season by automating tasks such as tax calculation and tax form preparation.

Benefits of using Suvit's accounting automation features

Businesses that use Suvit's accounting automation features can benefit from a number of advantages, including:

- Improved efficiency: Suvit can automate many of the time-consuming tasks involved in accounting, which can free up businesses to focus on more strategic activities.

- Reduced costs: Suvit can help businesses reduce their accounting costs by automating tasks that would otherwise be performed by humans.

- Improved accuracy: Suvit can help to improve the accuracy of financial data by reducing the risk of human error.

- Reduced risk: Suvit can help businesses reduce their risk of fraud and other financial irregularities by automating tasks such as fraud detection and compliance.

- Enhanced decision-making: Suvit can provide businesses with real-time data and insights into their financial performance, which can help them make better decisions about budgeting, forecasting, and investment.

Ready to Embrace Fintech Innovations?

The accounting and bookkeeping industry is undergoing a rapid transformation due to the advent of new technologies such as artificial intelligence (AI), machine learning (ML), robotic process automation (RPA), blockchain, and cloud computing. These technologies are automating tasks, improving efficiency, and reducing risk.

Businesses that adopt these technologies can benefit from a number of advantages, including improved financial performance and reduced costs.

Accountants and bookkeepers need to adapt to the changing landscape and develop their skills in these areas to stay ahead of the curve and remain competitive. They should also be familiar with the latest accounting technologies and trends. By doing so, accountants and bookkeepers can position themselves for success in the future.

Suvit is a powerful accounting automation software that can help businesses improve their efficiency, accuracy, and security. To get started with Suvit, you can create a free account on the Suvit website. Once you have created an account, you can connect your Tally account to Suvit and start automating your accounting tasks!