Yes, we know that CPAs are not just accountants; you have to do more than that, as you have more responsibilities and duties to perform than regular chartered accountants.

Accounting automation is the future of accounting and this is the best time to switch all your manual accounting to automation. As a CPA, you can reduce all your clerical and repetitive work with the help of accounting automation software.

Accounting Automation Transforms the Role of CPAs

We understand that as a CPA, you have to be the trusted advisor for your clients that help businesses with all sorts of business matters. With the manual accounting process, the schedule becomes so hectic that you can not afford to spend more time on planning and advising. Let’s see how automation can change this whole process.

1. Get Rid of Manual Data Entries and Bookkeeping!

Current Scenario:

-

Generally, CPAs are in charge of tallying to check whether all the entries are done correctly and error-free.

-

CPAs spend so much time on this error correction that they can not focus on other things, such as making a business plan or financial plan for their clients or other services.

With Accounting Automation:

-

It brings the leverage of 100% error-free data entries, which saves 80% time for you to get focused on other things.

-

Suvit provides 100% error-free data entries direct from Excel, PDFs and Scanned PDFs to Tally.

-

It uses advanced technology OCR to capture data(text, numbers) to send entries in the Tally.

2. Get an Auto-generated Report and Help your Client with a Financial Advisory!

Current Scenario:

-

Manual accounting process does not generate any kind of report or analysis automatically.

-

Accountants must go through past records of some period to make a generalized report.

-

This report/analysis helps CPAs to plan the next financial or business plan for their clients.

With Accounting Automation:

-

Imagine getting this report generated all by itself based on your past records, such a relief, right? Accounting automation software can generate reports showing the analysis of different parameters over a given period.

-

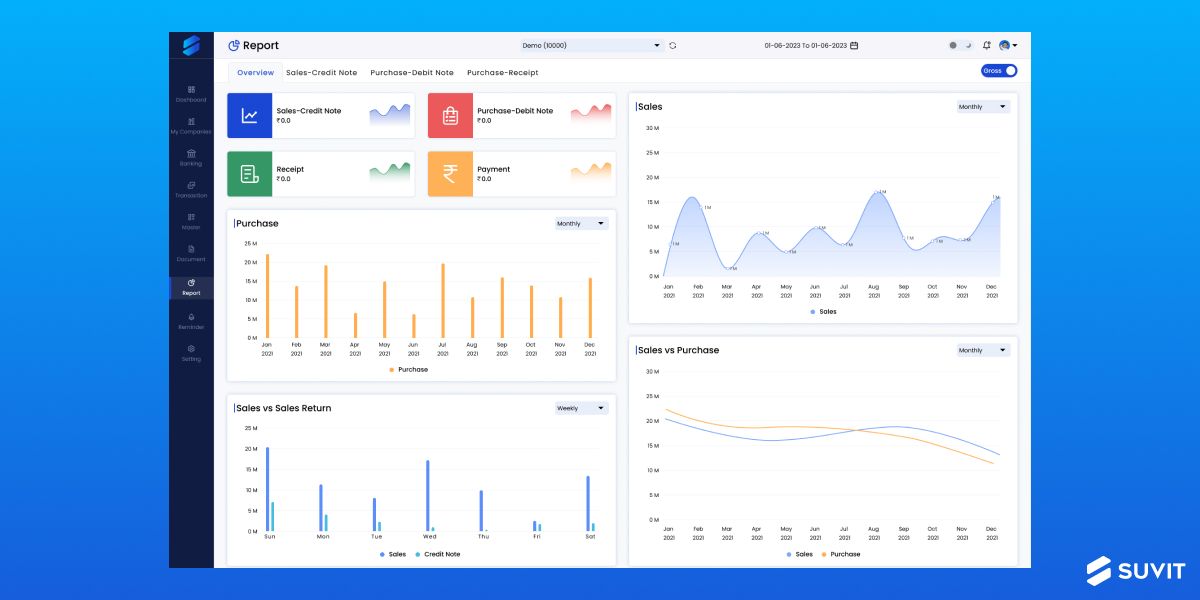

In Suvit, you will get reports & analytics charts and figures on the dashboard itself. Also, you can set the time periods for which you want to generate reports.

3. Be the Reason for Your and Your Staff’s Growth!

Current Scenario:

-

Bookkeeping staff and other members are just doing their regular work repeatedly.

-

Sometimes, there is no growth for them for a long time because of long repetitive tasks.

With Accounting Automation:

-

Reduce all the clerical work for your employees’ such as bookkeeping, entries, etc., and add new skills and value to them continuously.

-

With the saved time, their approaches and growth result can bring great value to you and your client’s business.

Read More: 11 Reasons You Should Invest In An Accounting Automation Software Also Read: The Ultimate Guide to Time-Saving in Accounting with Suvit

4. Streamline Client Communication and Collaboration!

Current Scenario:

-

CPAs often face challenges in efficiently communicating and collaborating with their clients.

-

Traditional methods such as phone calls, emails, and physical meetings can be time-consuming and less effective, leading to delays in obtaining necessary information and feedback.

With Accounting Automation:

-

Utilizing accounting automation tools can facilitate seamless communication and collaboration with clients.

-

Many automation software offers built-in messaging systems, document-sharing capabilities, and real-time updates, making it easier for CPAs to interact with clients, seek clarifications, and provide instant assistance.

5. Ensure Compliance and Accuracy with Automated Regulatory Updates!

Current Scenario:

- CPAs bear the responsibility of staying updated with ever-changing tax laws, financial regulations, and compliance requirements. Manual tracking of these updates can be challenging and can lead to the risk of errors and non-compliance.

With Accounting Automation:

-

Modern accounting automation software often comes equipped with automatic regulatory updates.

-

These tools can monitor and incorporate changes in tax laws, accounting standards, and compliance regulations, ensuring that your accounting practices are always up-to-date and accurate.

6. Enhance Data Security and Confidentiality Measures!

Current Scenario:

-

CPAs handle sensitive financial data and confidential information of their clients.

-

Traditional manual record-keeping and data management processes can leave room for data breaches, accidental leaks, or unauthorized access.

With Accounting Automation:

-

Accounting automation tools often incorporate robust security measures, such as data encryption, access controls, and secure cloud storage.

-

These measures ensure that client data remains protected from cyber threats and unauthorized access.

7. Optimize Time Management and Workload Distribution!

Current Scenario:

-

CPAs often struggle with managing their time effectively and distributing their workload efficiently.

-

They may find themselves overloaded with repetitive tasks, leading to burnout and reduced productivity.

-

Additionally, managing multiple clients and their diverse accounting needs can be a challenging juggling act.

With Accounting Automation:

-

Accounting automation tools can help CPAs streamline their workflow and optimize time management.

-

By automating repetitive tasks such as data entry, reconciliation, and report generation, CPAs can free up valuable time to focus on more strategic and high-value activities.

-

As a result, CPAs can deliver superior services to their clients while maintaining a healthy work-life balance for themselves and their team. This improved efficiency also translates to higher profitability for the CPA firm.

Read More: Best Accounting & Auditing Automation Tool for Indian Tax Professionals

How Can Suvit Benefit You?

Suvit is an AI-powered automation technology that reduces all your clerical work with 100% data accuracy.

Benefits you get from using Suvit:

1. Streamlined Data Management and Error-Free Entries!

-

With Suvit's advanced technology, you can directly import data from various sources such as Excel sheets, PDFs, and scanned documents into your accounting software.

-

This automation ensures 100% accuracy in data entries, reducing the time spent on error correction and data verification.

-

By freeing up valuable time that would otherwise be consumed by manual data entry, CPAs can focus on more critical tasks like financial analysis, strategic planning, and client advisory services.

-

Suvit streamlines your data management process, providing you with the confidence that your accounting records are error-free and up-to-date.

2. Instant Access to Real-Time Analytics and Reports!

-

Suvit empowers CPAs with instant access to comprehensive analytics and reports. It generates auto-generated reports that provide a clear analysis of various financial parameters over specific time periods.

-

These reports enable CPAs to quickly identify trends, financial health, and potential opportunities or risks for their clients.

-

With Suvit's user-friendly dashboard, you can visualize financial data through charts and figures, simplifying complex information for better decision-making.

-

The ability to generate real-time reports saves valuable time and allows CPAs to deliver more timely and relevant financial advice to their clients, fostering stronger client relationships.

3. Ensured Compliance and Updated Regulatory Practices!

-

Suvit takes the burden off your shoulders by providing automatic regulatory updates. Our software monitors changes in financial regulations and incorporates them into its functionalities, ensuring that your accounting practices remain compliant at all times.

-

By leveraging Suvit's automated regulatory updates, CPAs can avoid costly compliance errors, penalties, and reputational damage.

-

This feature lets you focus on offering proactive advice to clients, confident that your accounting processes align with the latest regulatory requirements.

4. Optimized Workload and Time Management!

-

Suvit optimizes workload and time management for CPAs by automating repetitive and time-consuming tasks. This streamlining of tasks allows CPAs to handle a higher volume of clients efficiently and deliver better-quality services.

-

With Suvit taking care of manual data entry and bookkeeping, CPAs can dedicate more time to strategic planning, financial analysis, and providing value-added services to clients.

-

Optimized workload distribution not only improves productivity but also contributes to better work-life balance for CPAs and their team members.

-

Our software enables you to achieve higher efficiency and profitability for your firm while also ensuring that your clients receive the attention and service they deserve.

Start your Free Trial Today and Experience all the Advantages of CPA

Suvit offers a wide range of benefits for CPAs, helping them transform their accounting practice and deliver exceptional service to their clients. By leveraging the power of automation and real-time data access, Suvit empowers CPAs to take on new challenges, enhance client relationships, and stay ahead in the dynamic world of accounting and finance.

Now you know that automation is worth giving a shot!

So, go ahead and take the 7-day free trial of Suvit to experience the magic!