Aadhaar and PAN are two important documents for Indian citizens. Aadhaar is a 12-digit unique identification number issued by the Unique Identification Authority of India (UIDAI), while PAN is a 10-digit alphanumeric code issued by the Income Tax Department. Both Aadhaar and PAN serve as identity proofs and are required for various purposes such as opening bank accounts, filing income tax returns, applying for loans, etc.

The government has made it mandatory for taxpayers to link their Aadhaar with their PAN cards. But how can you check whether your Aadhaar and PAN cards are already linked? There are two ways to check the Aadhaar PAN card link status online, which are as follows.

Also Read: UAN: Portal Registration, Activating Your Universal Account Number, And Linking It To Aadhar

Check the Aadhaar PAN Card Link Status without Logging into the Income Tax Portal

You can check the Aadhaar PAN card link status without logging into the Income Tax portal by following these steps:

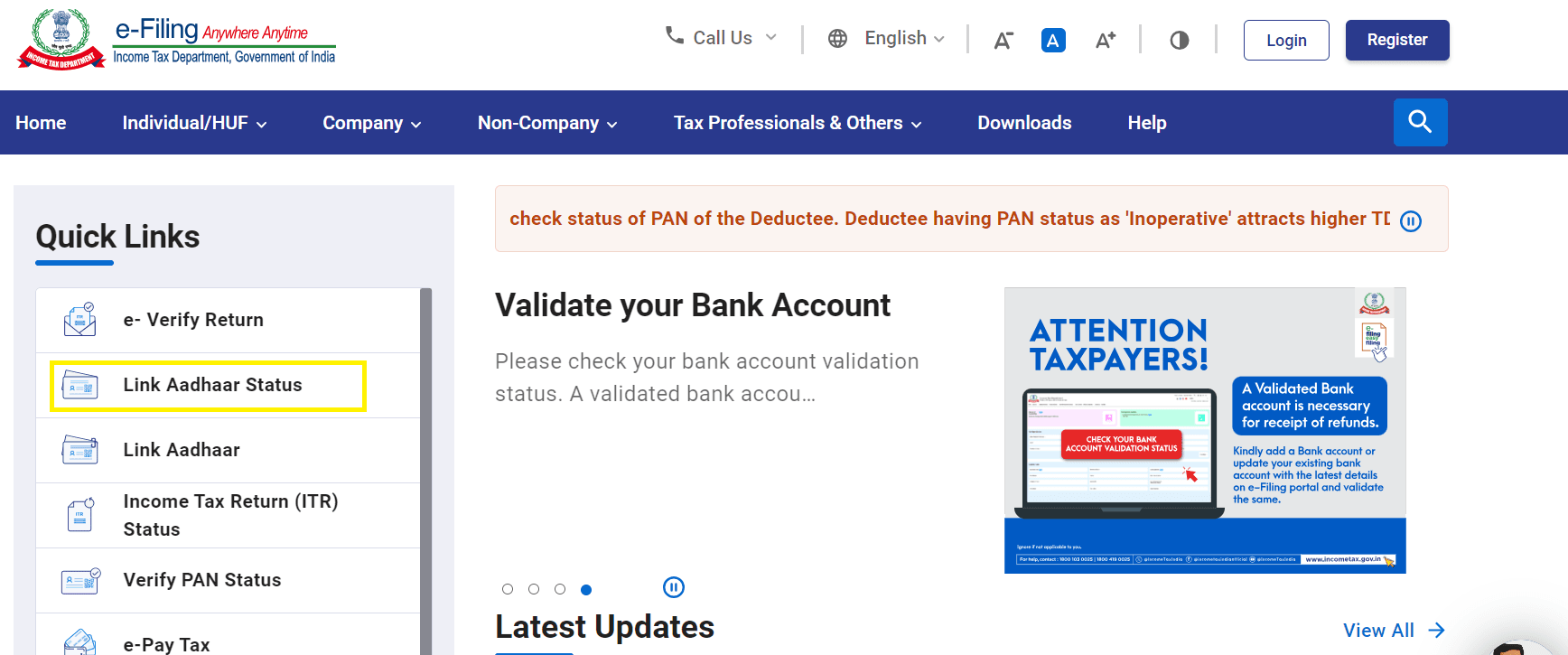

Step 1: Visit the Income Tax e-filing portal by using this link: https://www.incometax.gov.in/iec/foportal/

Step 2: Under the ‘Quick Links’ option, select the ‘Link Aadhaar Status’ tab.

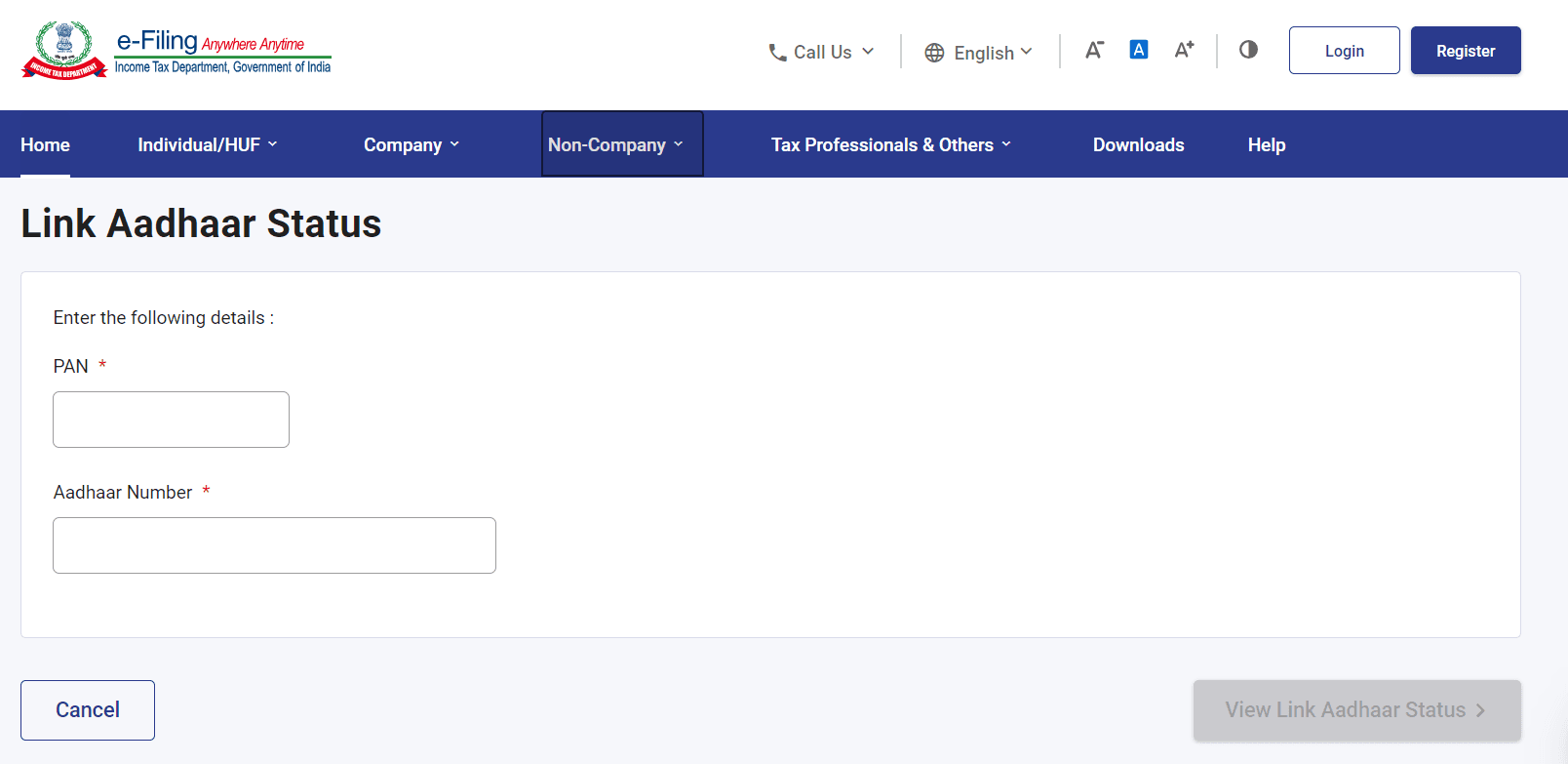

Step 3: Enter your ‘PAN number’ and ‘Aadhaar Number’ and then click the ‘View Link Aadhaar Status’ button.

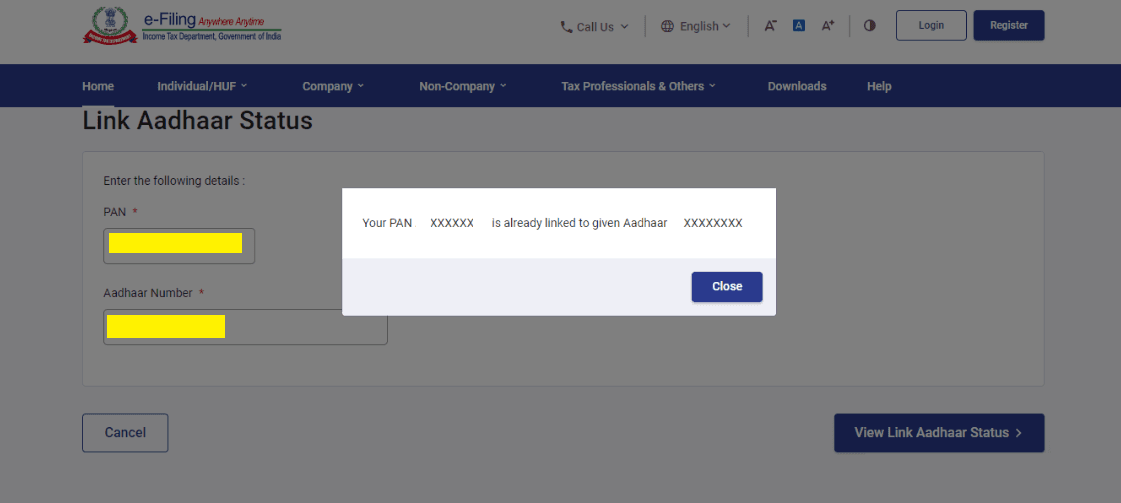

Step 4: A pop-up message regarding your Link Aadhaar status will be displayed on successful validation.

The following message will be displayed when your Aadhaar is linked to your PAN card: "Your PAN is already linked to the given Aadhaar”

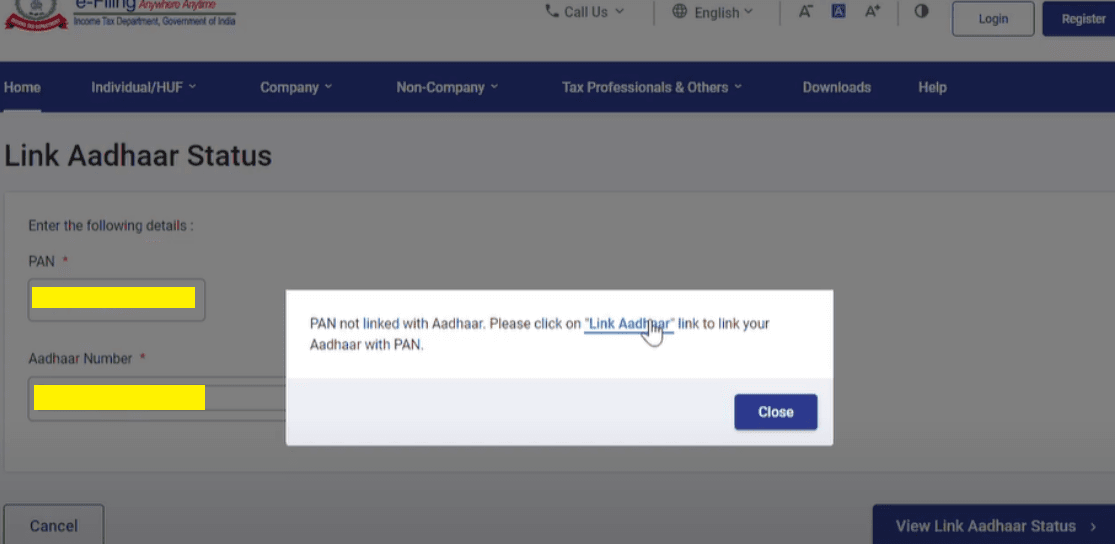

The following message will be displayed when your Aadhaar is not linked with your PAN card:

"PAN not linked with Aadhaar. Please click on ‘Link Aadhaar’ to link your Aadhaar with your PAN”

Check the Aadhaar PAN Card Link Status by Logging into the Income Tax Portal

You can also check the Aadhaar PAN card link status by logging into the Income Tax portal by following these steps:

Step 1: Login into the Income Tax e-filing portal by using this link: https://eportal.incometax.gov.in/iec/foservices/#/login

Step 2: Go to ‘Dashboard’ on the homepage and click the ‘Link Aadhaar Status’ option.

Step 3: Otherwise, go to ‘My Profile’ and click on the ‘Link Aadhaar Status’ option.

Step 4: When your Aadhaar is linked to your PAN card, the Aadhaar number will be displayed.

Step 5: When your Aadhaar is not linked with your PAN card, ‘Link Aadhaar Status’ will be displayed.

How do you Link your Aadhaar with your PAN Card Online?

If you find that your Aadhar is not linked with your PAN card, you can link them online by following these steps:

Step 1: Visit the Income Tax e-filing portal by using this link: https://eportal.incometax.gov.in/iec/foservices/#/login

Step 2: Under the ‘Quick Links’ heading, click on the ‘Link Aadhaar’.

Step 3: Enter your ‘PAN number’, ‘Aadhaar Number’, and ‘Name as per Aadhaar’ and click the ‘Link Aadhaar’ button.

Step 4: A message regarding your Link Aadhaar request will be displayed on successful submission.

You can also link your Aadhaar with your PAN card by sending an SMS to 567678 or 56161 in the following format:

UIDPAN<space><12 digit Aadhaar><space><10 digit PAN>

For example, UIDPAN 123456789012 ABCDE1234F

Also Read: Blue Aadhaar Card: A Must-Have for Children Below the Age of Five

Benefits of Linking your Aadhaar with your PAN Card

Linking your Aadhaar with your PAN card has several benefits, such as:

- It helps in verifying your identity and avoiding duplication of PAN cards.

- It helps simplify the process of filing income tax returns and claiming tax refunds.

- It helps prevent tax evasion and fraud by ensuring that all your financial transactions are recorded under your PAN card.

- It helps availing of various government schemes and subsidies requiring Aadhaar authentication.

Upon Final Consideration on Aadhaar PAN Card Link

Linking your Aadhaar with your PAN card is a mandatory requirement for taxpayers in India. You can check the status of your Aadhar PAN card link online by visiting the Income Tax e-filing portal or by sending an SMS. If your Aadhar is not linked with your PAN card, you can link them online by following some simple steps. Linking your Aadhaar with your PAN card has many benefits for your financial and tax-related matters.